Navigating the world of credit card transactions can sometimes feel like solving a complex puzzle, especially when you find yourself facing a pending charge that raises questions. If you've ever stared at your statement, wondering what that mysterious amount refers to, you're not alone. Understanding these pending transactions is crucial for managing your finances and ensuring accuracy in your accounts. Join us as we delve deeper into the ins and outs of credit card pending transactions and clarify any confusions you may have!

Accurate transaction details

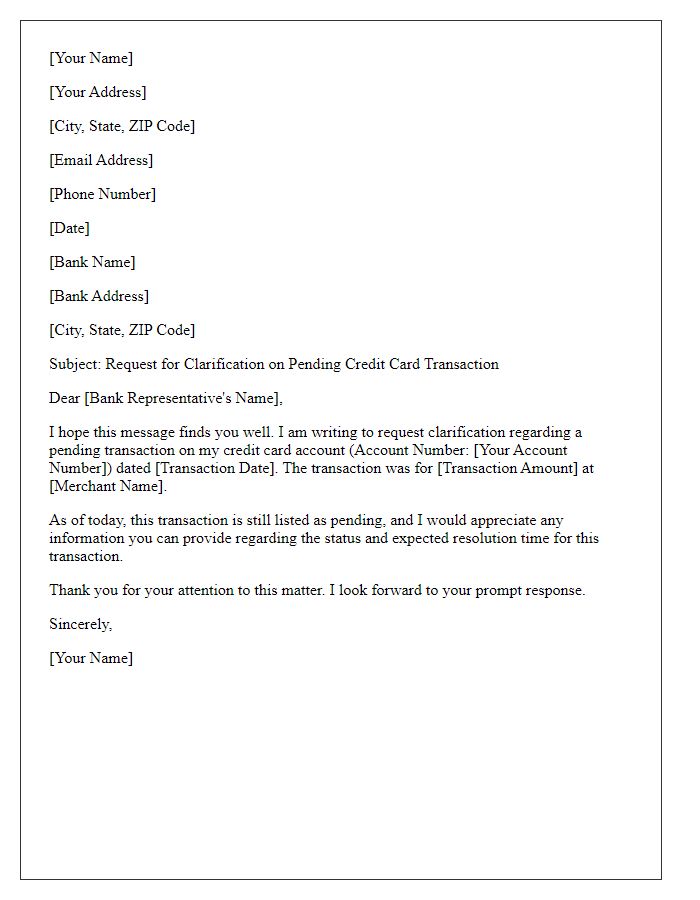

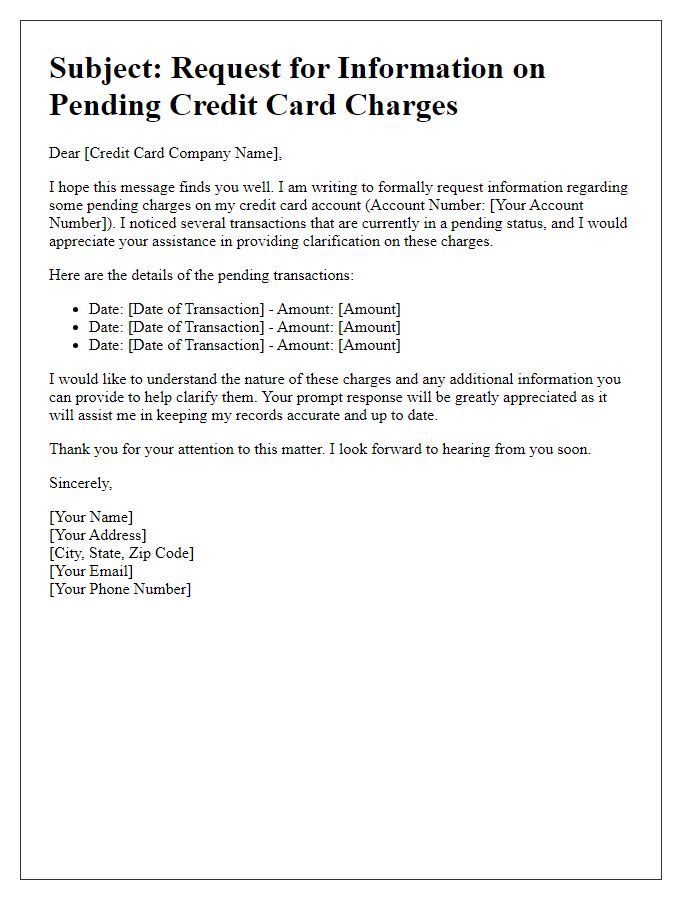

Pending transactions on credit cards can lead to confusion if details are unclear. Accurate transaction details include date of transaction, merchant name (such as Walmart, Amazon, or Target), transaction amount (often featuring specific currency denominations), and any associated reference numbers. For instance, a pending charge from Starbucks might appear on a customer's credit card statement within 1-3 days of original purchase. Additionally, specific payment information, such as initial authorization hold amounts differing from final billed amounts, may complicate understanding. Addressing these discrepancies promptly with the credit card issuer helps clarify status and ensures accurate financial records.

Clear account information

Pending transactions on credit card accounts can cause confusion and concern for consumers. Transactions that remain "pending" for an extended time, often 3 to 5 business days, may indicate a delay in processing by merchant systems or banking institutions. Credit card companies like Visa or MasterCard regularly use merchant identification numbers (MIDs) to track these transactions. Verification may include the transaction amount, date, and merchant name, which provides a clearer picture of the pending status. Consumers should contact customer service departments, typically available 24/7, to resolve any discrepancies or obtain detailed explanations regarding the pending transaction.

Specific transaction date

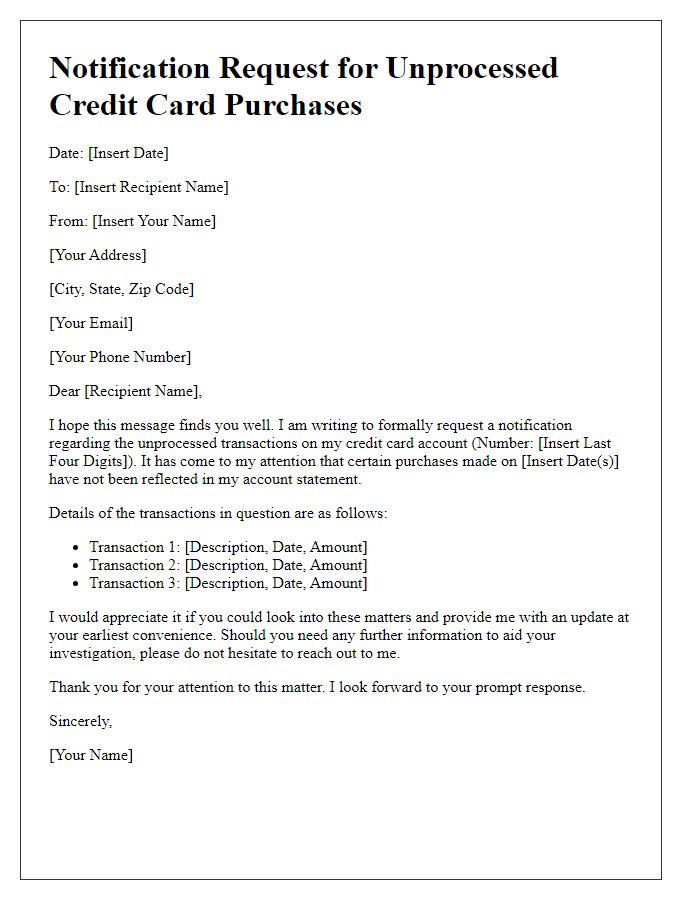

Pending transactions on credit cards can cause confusion and concern for consumers. For example, a transaction dated October 15, 2023, for a purchase at ABC Electronics in New York City, may appear as 'pending' on the account statement for several days, delaying the finalization of the payment process. During this pending period, the transaction amount is temporarily deducted from the available credit limit, impacting spending power. Credit card issuers typically hold pending transactions for up to five business days before processing them as completed or cancelling them upon merchant confirmation. Understanding the timeline can alleviate anxiety regarding potential charges or billing errors while waiting for the transaction to finalize.

Contact information for follow-up

Pending transactions can cause confusion for account holders. For instance, a cardholder may observe a pending charge, such as $75 from an online retailer, highlighted on their bank statement. This occurrence can stem from various reasons like authorization holds for services, e-commerce purchases, or subscription renewals. It's crucial to contact the financial institution, such as Capital One or Chase, for clarification regarding the transaction. During the follow-up, essential contact details include the transaction date (e.g., October 10, 2023), transaction amount ($75), merchant name (e.g., Amazon), and the last four digits of the credit card number. This information enables swift resolution and accurate identification of the pending charge.

Request for prompt resolution

Pending transactions on credit cards can lead to misunderstandings and inconvenience for cardholders. A pending transaction occurs when a purchase is authorized but not yet finalized, often seen on statements as an amount that has not cleared. This situation can last several days depending on the merchant and bank processing times. For instance, restaurants may take longer to finalize transactions compared to retail stores. Delays in processing can affect available credit limits and may cause unintentional overdrafts. Ensuring that banks provide timely updates on pending transactions is crucial for maintaining customer trust and financial accuracy. Prompt resolution of these pending transactions can help alleviate confusion and restore the confidence of cardholders in their banking services.

Letter Template For Credit Card Pending Transaction Clarification Samples

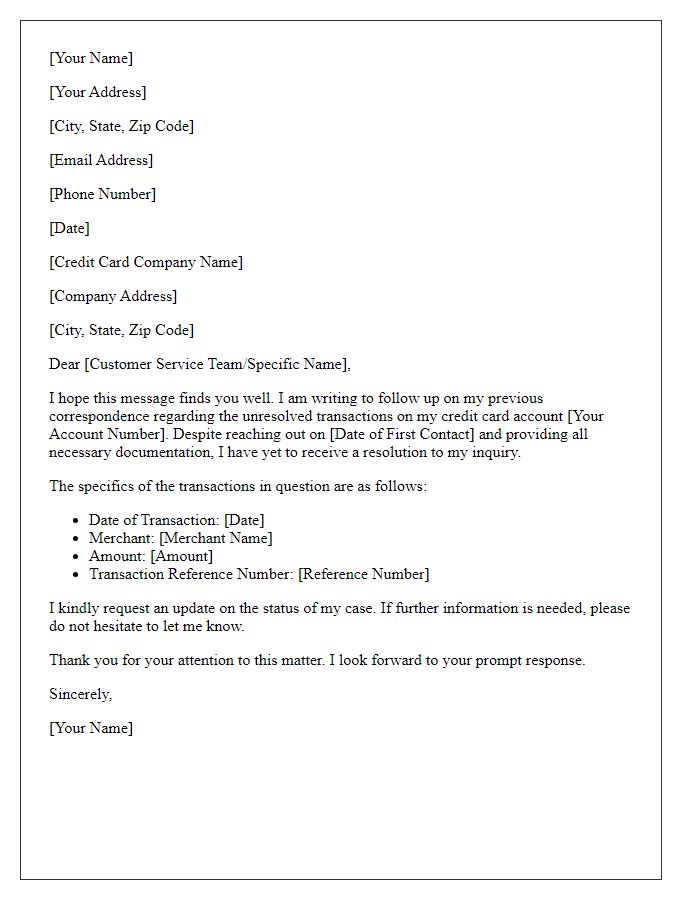

Letter template of request for clarification on pending credit card transaction

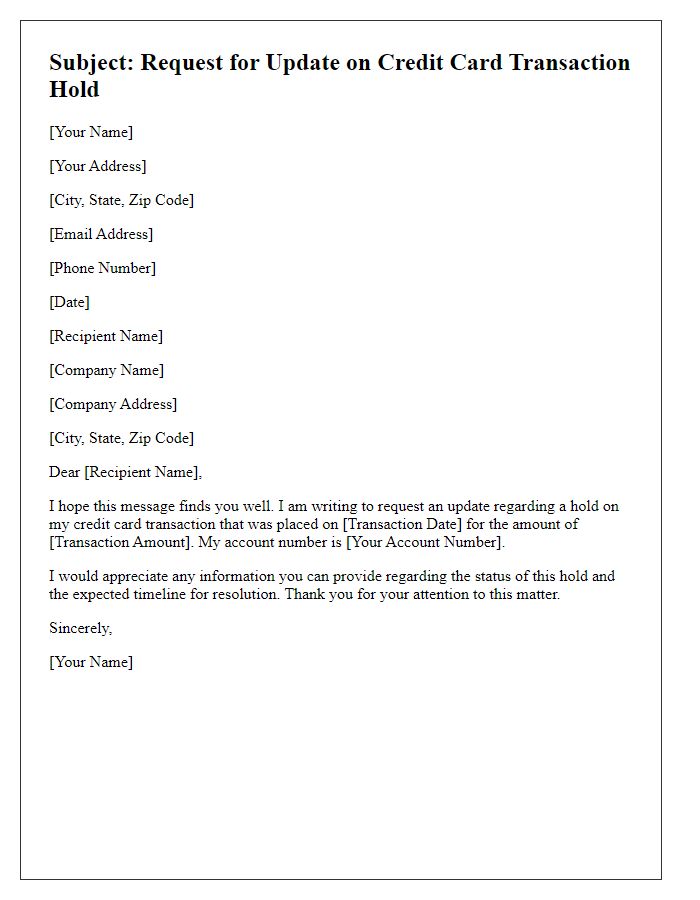

Letter template of appeal for information on pending credit card charges

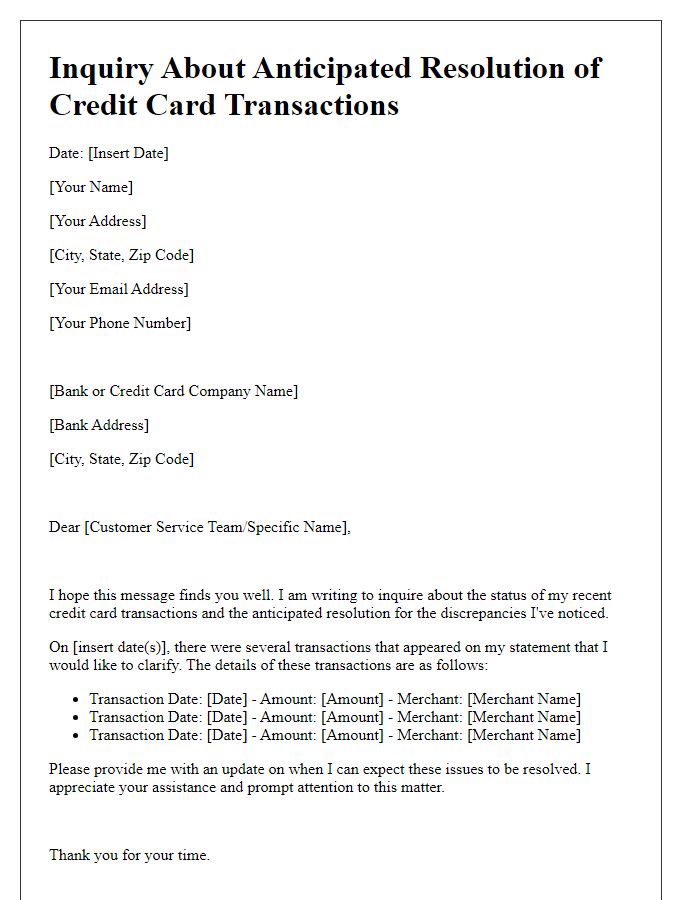

Letter template of notification request for unprocessed credit card purchases

Letter template of clarification needed for outstanding credit card payments

Letter template of demand for explanation on delayed credit card charges

Letter template of request for details on credit card transaction pending status

Comments