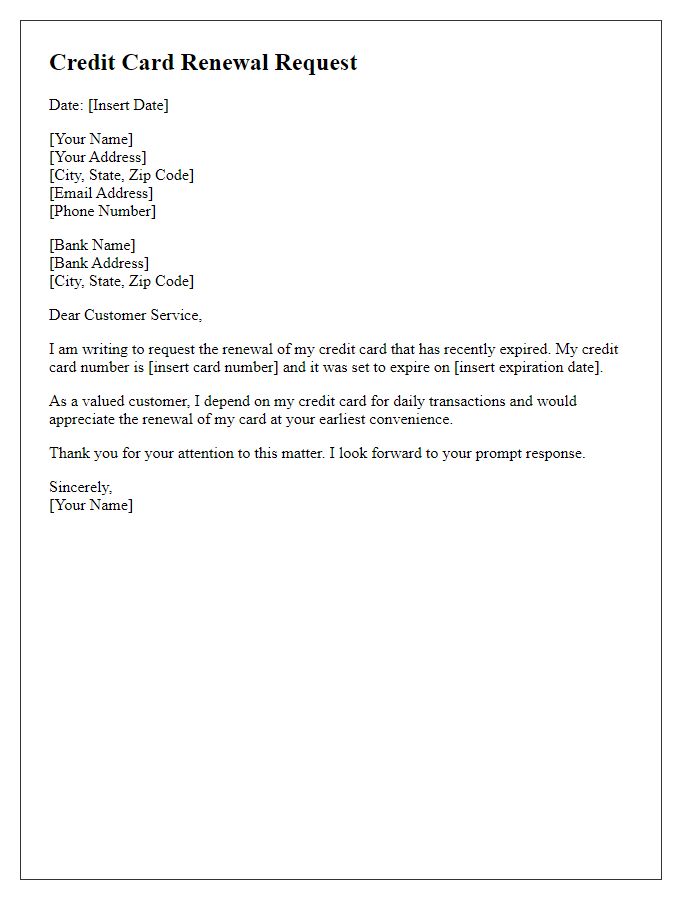

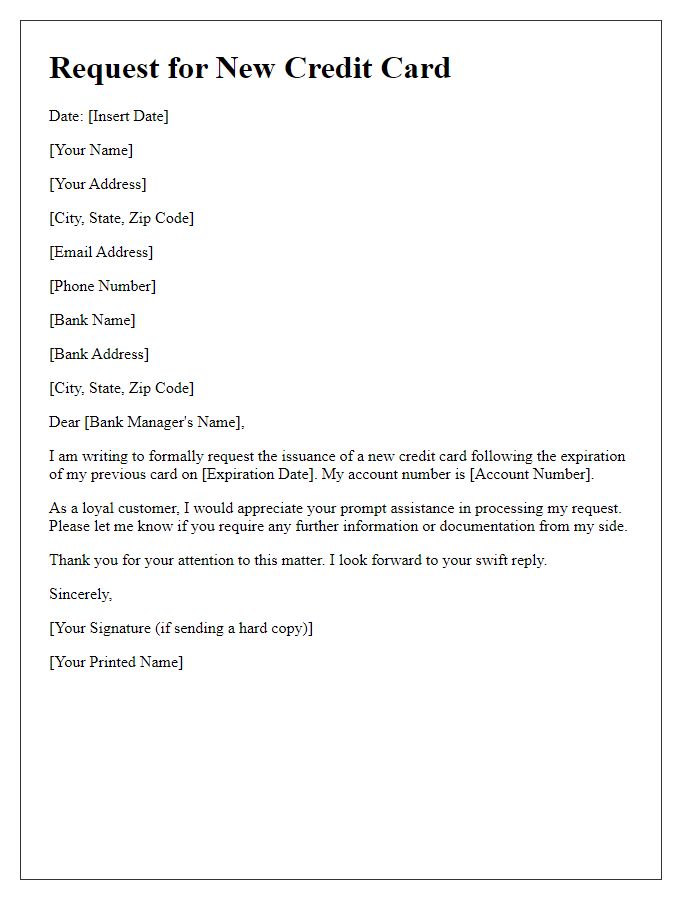

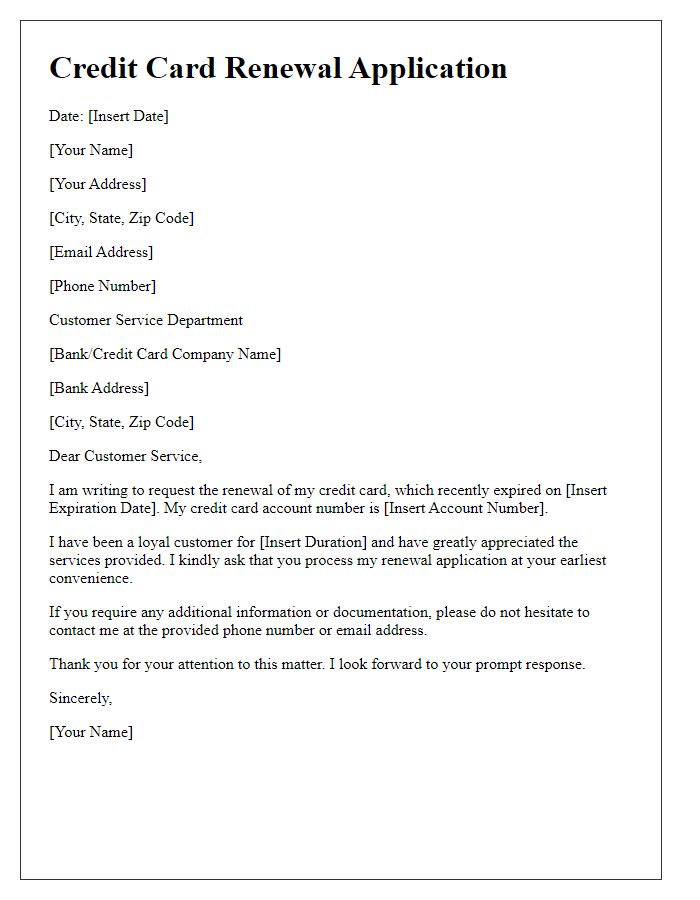

Are you tired of dealing with expired credit cards and the hassle that comes with renewal? It can be a bit overwhelming, but understanding the process can make it much simpler. In this article, we'll break down the essential steps for renewing your credit card, ensuring you're always equipped with an active card for your transactions. So, let's dive in and simplify your credit card renewal experienceâread on to discover more!

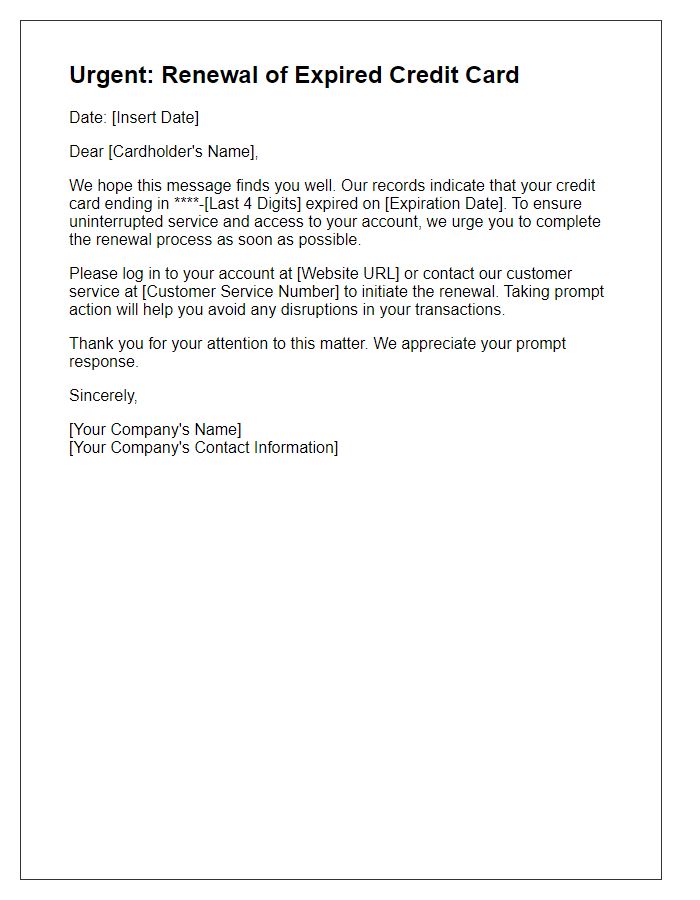

Subject Line Optimization

Expired credit cards can hinder purchasing power and access to financial resources. Timely renewal (typically within a month before expiration) ensures uninterrupted service. Institutions like Visa or MasterCard often send notifications via email or mail, prompting users to update their information. User experience may suffer if renewal is overlooked, leading to frustration at checkout, especially during significant sales events like Black Friday or Cyber Monday. Maintaining an active card is crucial for online subscriptions (such as Netflix or Amazon Prime) that require valid payment methods. A seamless renewal process can enhance customer loyalty and satisfaction while reducing the risk of declined transactions.

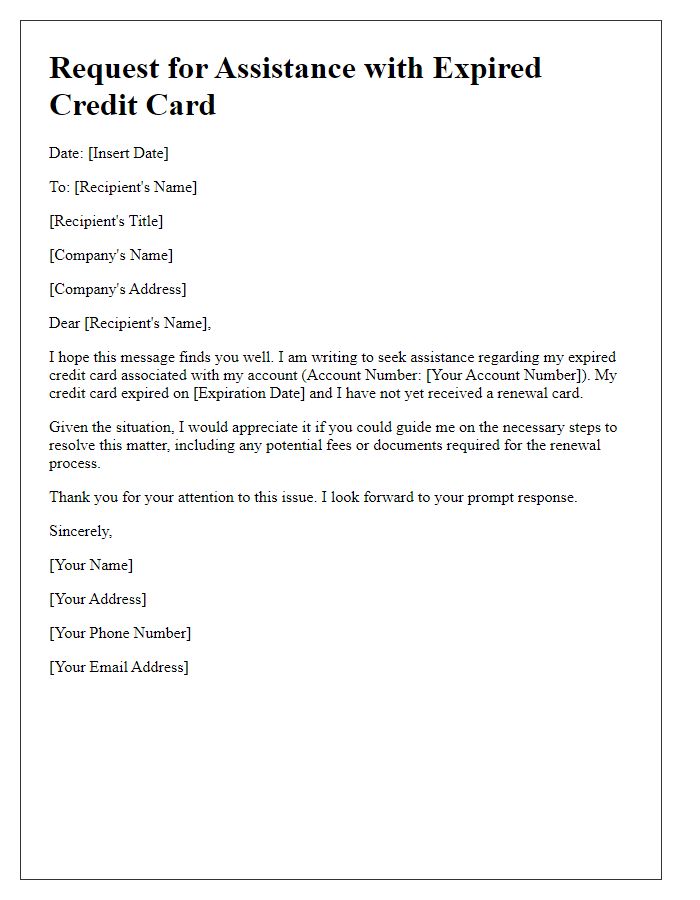

Personalization Techniques

Renewing an expired credit card involves several critical personalization techniques to enhance customer experience. Addressing customers by their first names in communications showcases familiarity and builds trust. Utilizing transaction history data can tailor renewal messages, highlighting recent purchases or rewards earned, which encourages loyalty. Acknowledging customer preferences, such as preferred communication channels (email, SMS, or app notifications), ensures messages reach the intended audience effectively. Timely reminders well ahead of the expiration date (at least 30 days) provide customers with ample opportunity to act, thereby minimizing any disruption in their financial activities. Additionally, offering personalized incentives like bonus points or a limited-time reduced interest rate for renewing can significantly improve renewal rates. Ensuring that renewal instructions are straightforward and include customer-specific links (like account management portals) can further enhance convenience and prompt action.

Clear Call-to-Action

The expiration of your credit card signifies an important transition in your financial management, especially for cards issued by major institutions like Visa or Mastercard. Expired cards can disrupt seamless transactions, from online shopping to in-person payments, resulting in declined purchases. For instance, businesses often implement advanced security protocols, necessitating the use of valid cards to prevent fraud. The renewal process is straightforward; simply log into your online banking account, navigate to the 'Card Services' section, and select 'Renew Card'. This action will initiate the issuing of a new card, typically delivered within 5-7 business days. Ensure your personal information is up-to-date to avoid delays in processing.

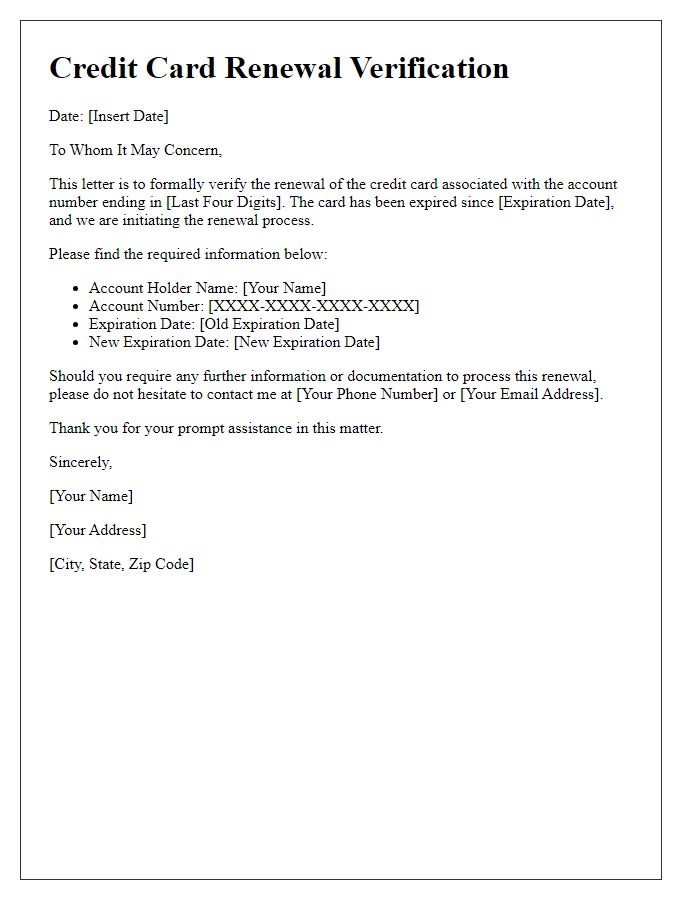

Security Assurance Language

Expired credit cards often compromise user security and convenience. Renewal processes typically begin 30 days prior to expiration, ensuring uninterrupted access. Financial institutions prioritize security by implementing encryption technologies like AES (Advanced Encryption Standard), safeguarding sensitive information during online transactions. Identity verification methods, such as two-factor authentication, provide additional protection against unauthorized access. Customers receive notifications through multiple channels, including email and SMS alerts, regarding the impending expiration and renewal of their cards. Regular monitoring of accounts for unusual activities enhances security, fostering trust in the financial institution's commitment to consumer protection.

Contact Information

Credit card expiration can significantly impact financial transactions. Cardholders should promptly check the expiration date, usually stamped on the front of the card, typically valid for three to five years from the issue date. When a credit card expires, users may experience declined transactions at merchants due to invalid account information. Issuing banks, for example, Chase and Bank of America, often initiate the renewal process automatically, sending a new card several weeks before expiration. Cardholders should verify their contact information, including address and phone number, to ensure seamless delivery of the new card. Failure to receive the new card may lead to potential delays, forcing customers to contact their bank's customer service for resolution.

Comments