Has your credit card suddenly been charged for purchases you didn't make? You're not aloneâcredit card fraud affects countless individuals each year, leaving many feeling anxious and overwhelmed. In this article, we'll help guide you through the credit card fraud investigation process, providing clear steps to follow and tips on protecting yourself in the future. So, grab a cup of coffee and join us as we dive into this crucial topicâyou'll want to read on!

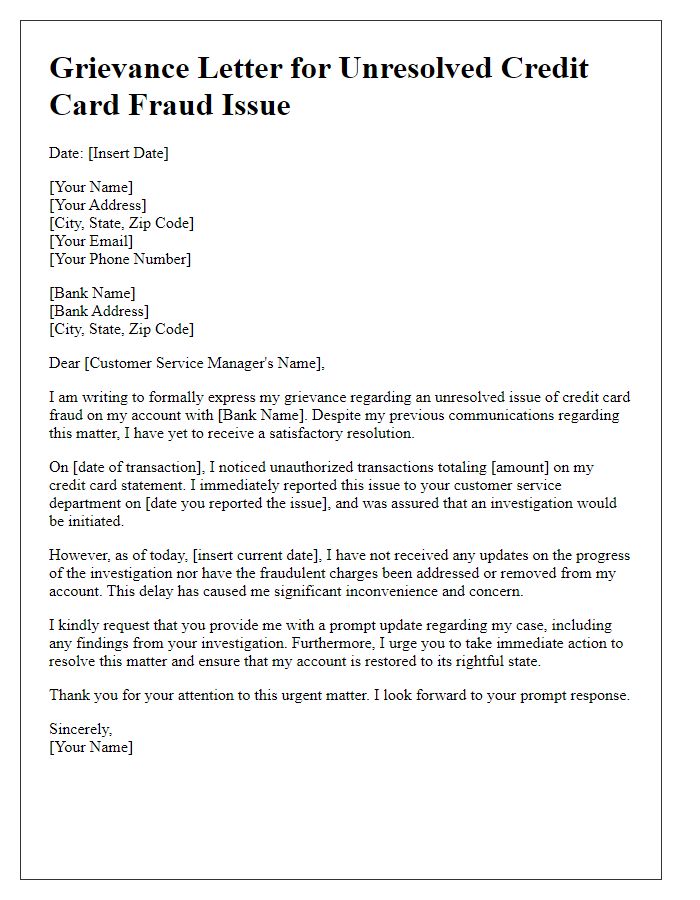

Clear Incident Description

A credit card fraud incident typically begins with unauthorized transactions appearing on bank statements. For instance, on August 15, 2023, a consumer noticed charges totaling $2,500 from various online retailers, including Amazon and Best Buy, which were not initiated by them. The consumer's credit card, issued by XYZ Bank, experienced these fraudulent activities within a 24-hour period. Furthermore, the consumer had their card in possession, indicating that their card information may have been compromised through a data breach at a merchant or online phishing scam. The affected individual immediately reported the discrepancies to the fraud department at XYZ Bank, providing detailed account information and requesting a thorough investigation into the fraudulent charges.

Account Details

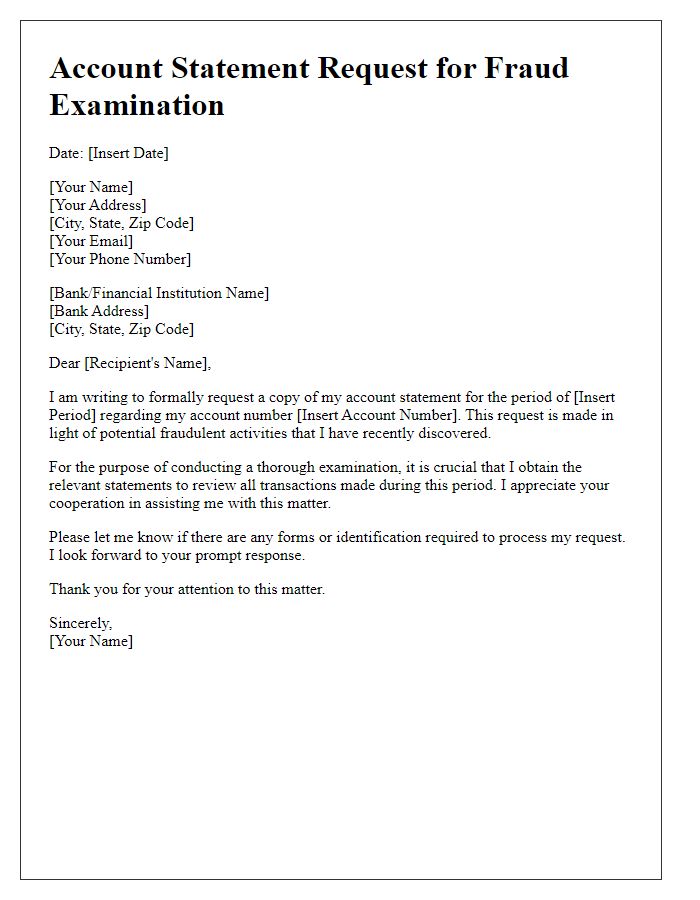

Credit card fraud investigations often focus on specific account details to ensure a thorough review. Essential information includes the credit card number (typically 16 digits), which must be reported safely to avoid further fraud. The transaction date and time provide context for suspicious activities, while the merchant name and location (for example, an online retailer like Amazon or a local store in New York City) clarify where unauthorized charges occurred. The amount charged is critical, as differences from typical spending patterns can indicate fraud. Additionally, account holders should include their contact information and any recent changes in billing addresses or personal details, as these elements may correlate with unauthorized access. Finally, the reporting date of the suspicious activity is vital for the investigative timeline.

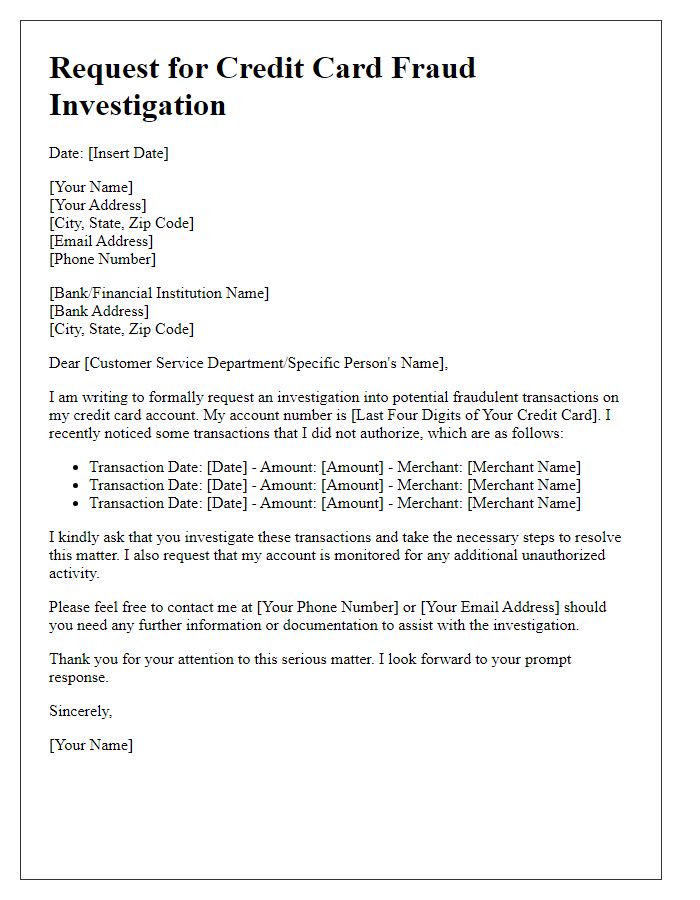

Fraudulent Transactions List

Fraudulent transactions can severely impact credit card holders, manifesting as unauthorized purchases reported by consumers. A fraudulent transaction list typically includes specific details such as transaction dates, merchant names, transaction amounts, and locations. For example, an unauthorized charge on October 5, 2023, for $120 at an online retailer XYZ.com could be listed, raising red flags for the cardholder. Contextual elements like location, such as transactions originating from foreign countries (e.g., Singapore or Nigeria), can further indicate potential fraud. Cardholders must monitor their accounts consistently to identify these suspicious activities promptly and initiate investigations with their financial institutions. Quick reporting is crucial, as federal regulations protect consumers against losses due to credit card fraud, generally limiting liability to $50 when promptly reported.

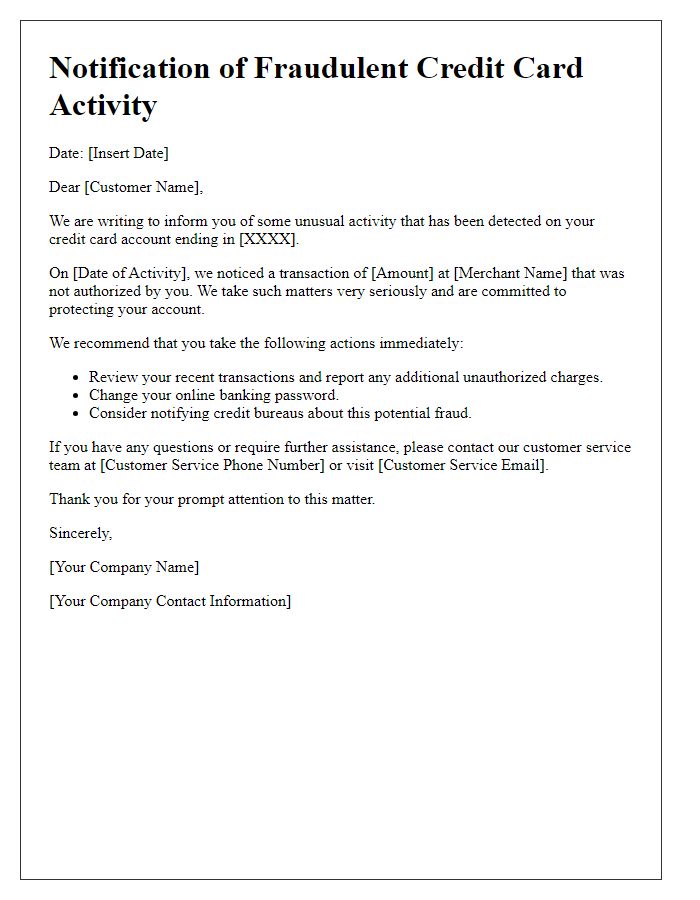

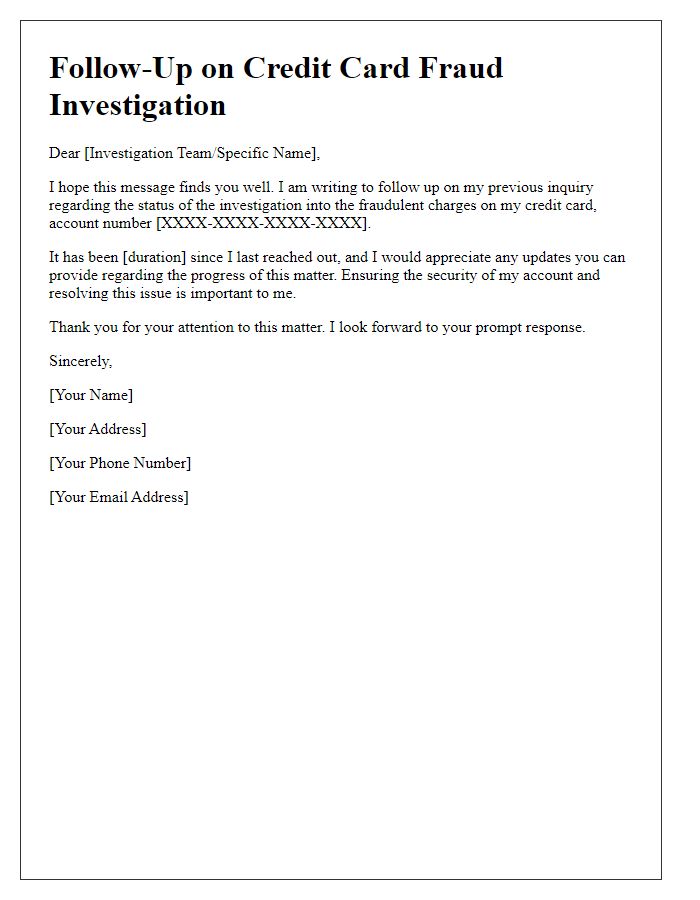

Contact Information for Follow-up

Credit card fraud investigations require immediate attention to ensure financial security and recovery of funds. Contacting the fraud department of the issuing bank or credit card issuer is crucial. Maintain a record of the calling customer service number, typically found on the back of the credit card. Use official websites to avoid phishing scams. Provide personal identification information such as name, address, and account number during the call. Follow-up communication through email should include a clear subject line indicating the purpose of the inquiry, along with detailed incident descriptions, transaction dates, and amounts. Document any reference numbers provided for future correspondence. Prompt reporting is essential, ideally within 60 days of the unauthorized transactions to minimize liability exposure to up to $50 in most cases. Regularly monitor financial statements to track ongoing suspicious activities. Secure all communications by using encrypted email services or documented letters sent via certified mail to establish a trail.

Declaration of Non-Authorization

Credit card fraud investigation requires a detailed declaration of non-authorization from the account holder. A comprehensive document should include the account number, date of the unauthorized transaction, and the exact amount charged. Provide a note on the transaction details like merchant name and location, to help pinpoint the fraudulent activity. Include personal identification information such as name, address, and contact number for fraud department communication. Emphasize the urgency of the investigation due to potential identity theft risks, outlining any steps already taken, like reporting to local authorities or placing a fraud alert with credit bureaus. Documenting these elements aids in streamlining the resolution process and recovering lost funds.

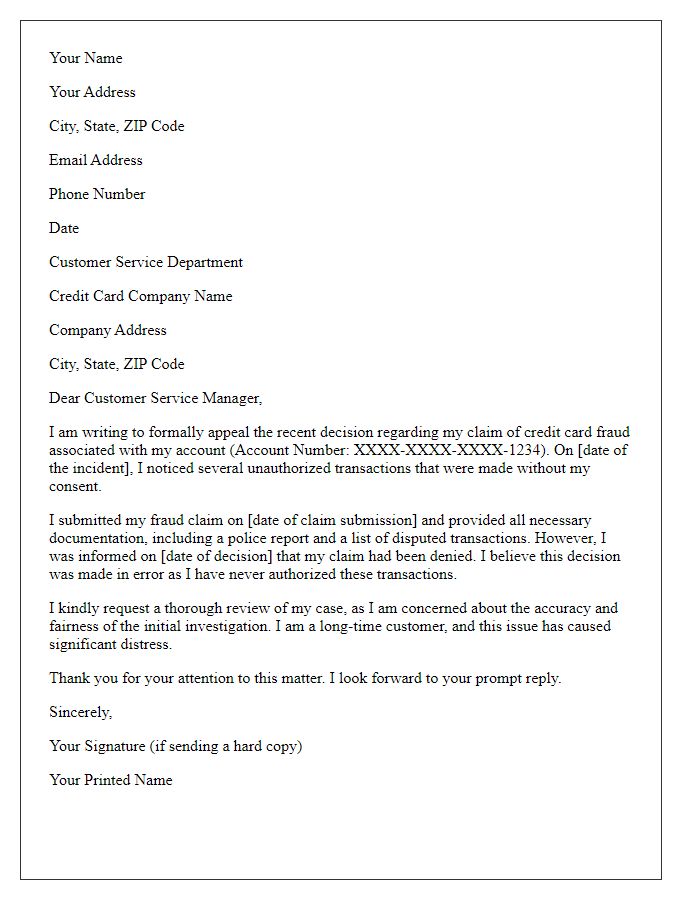

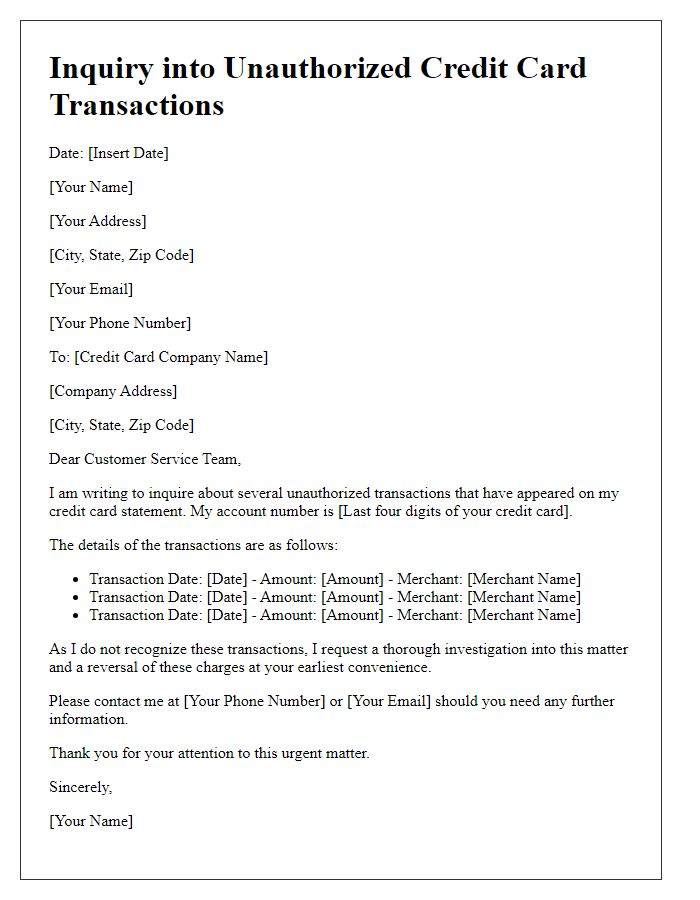

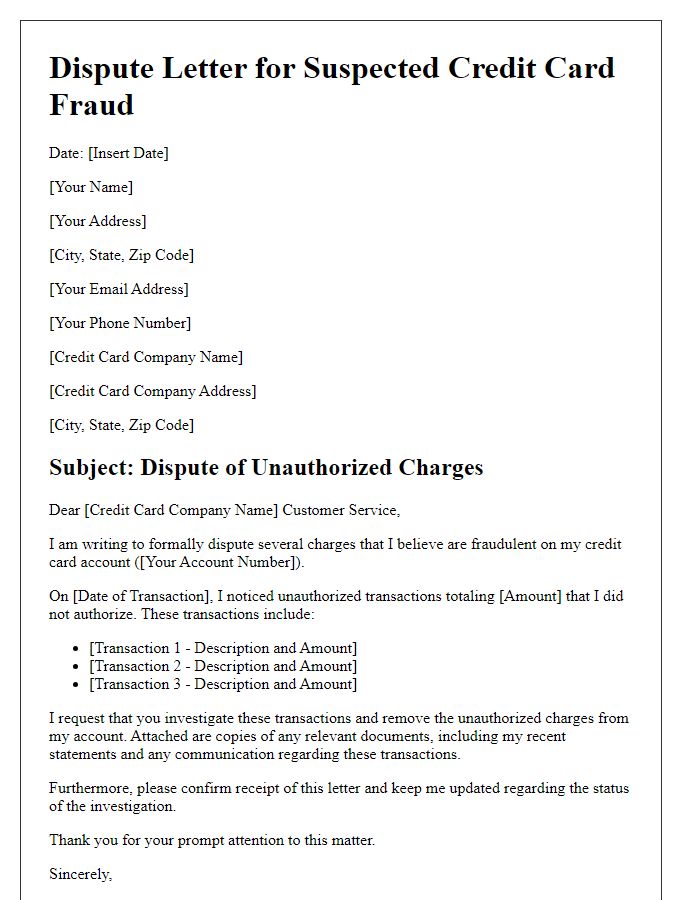

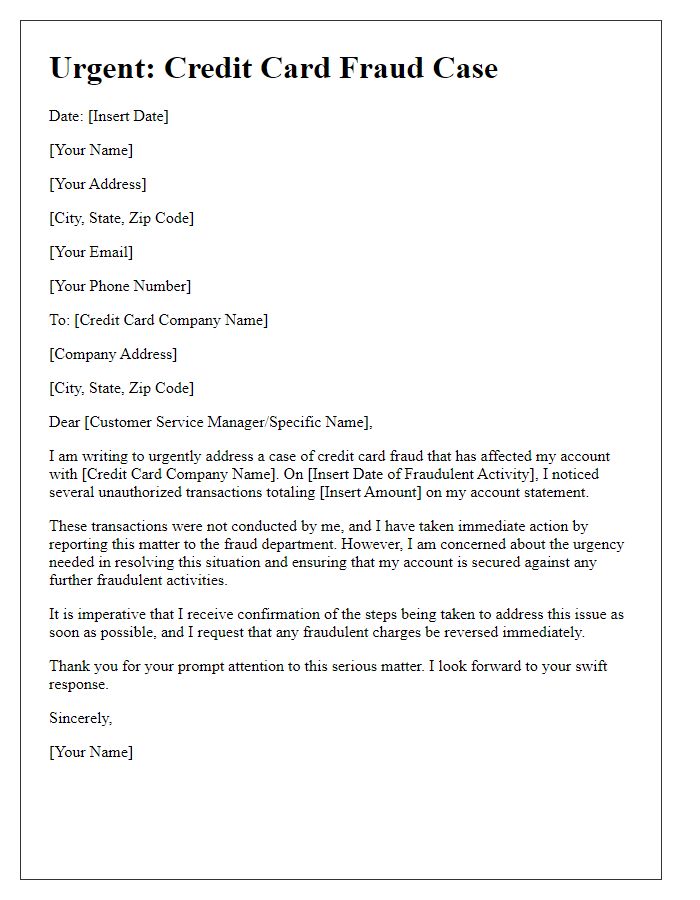

Letter Template For Credit Card Fraud Investigation Samples

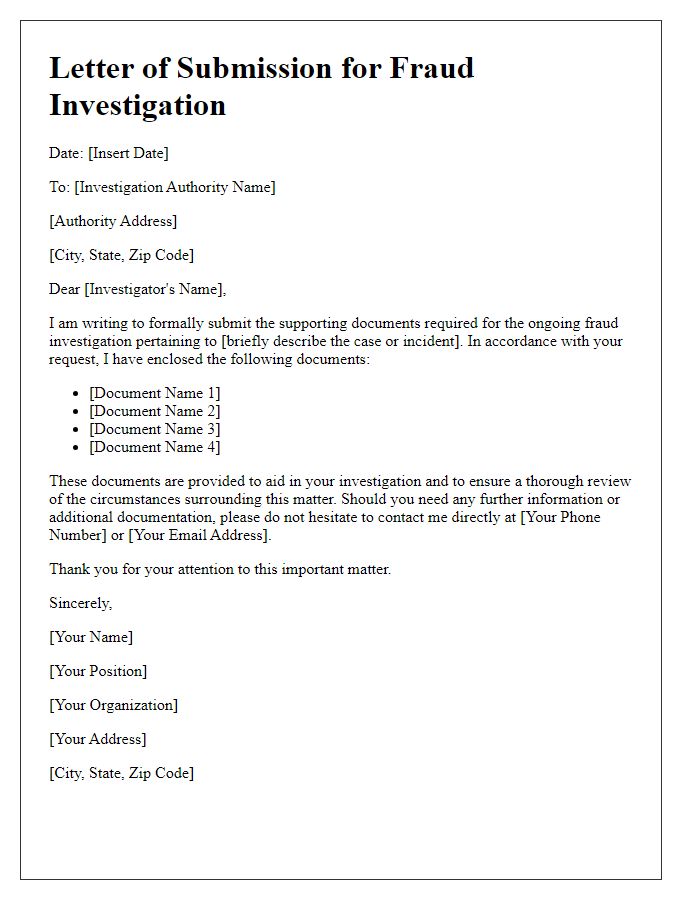

Letter template of supporting documents submission for fraud investigation

Comments