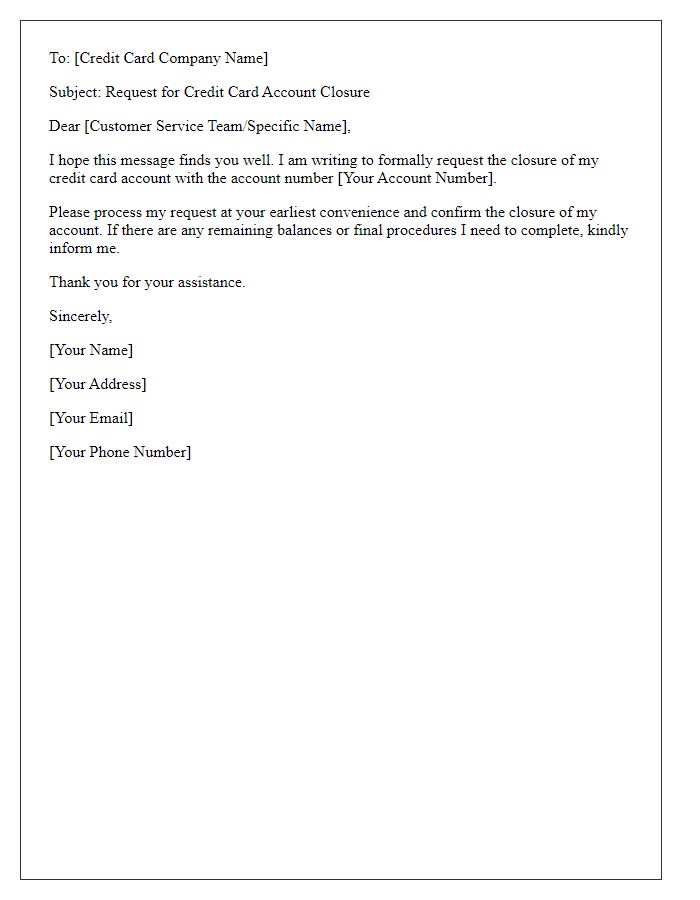

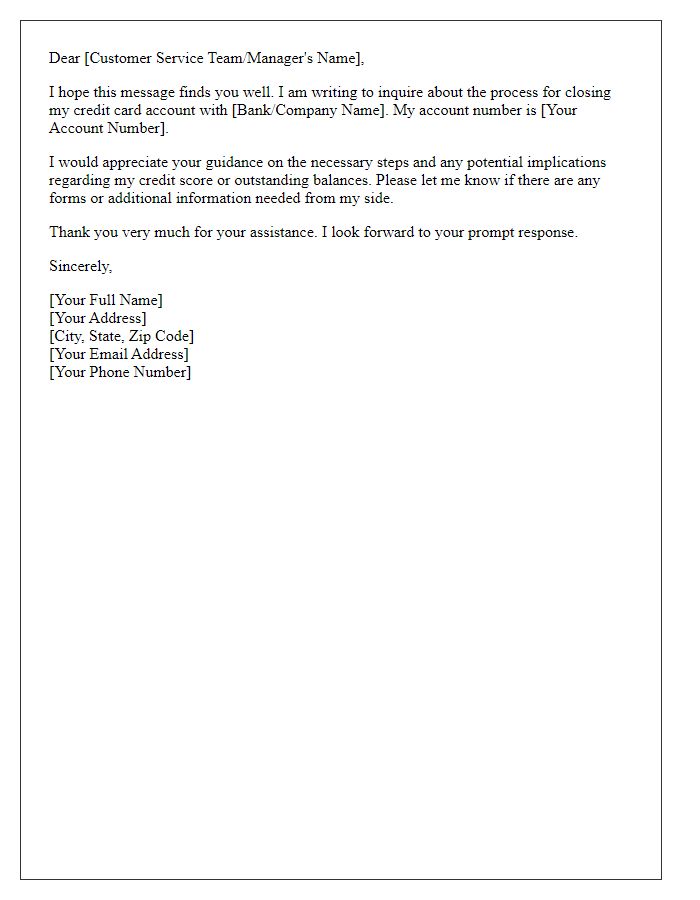

Are you thinking about closing your credit card account but unsure how to approach it? It's essential to communicate your request clearly and professionally to ensure a smooth process. In this article, we'll provide you with a handy letter template that will guide you through the closure process, making it as effortless as possible. So, if you're ready to take the next step, keep reading to discover all the details!

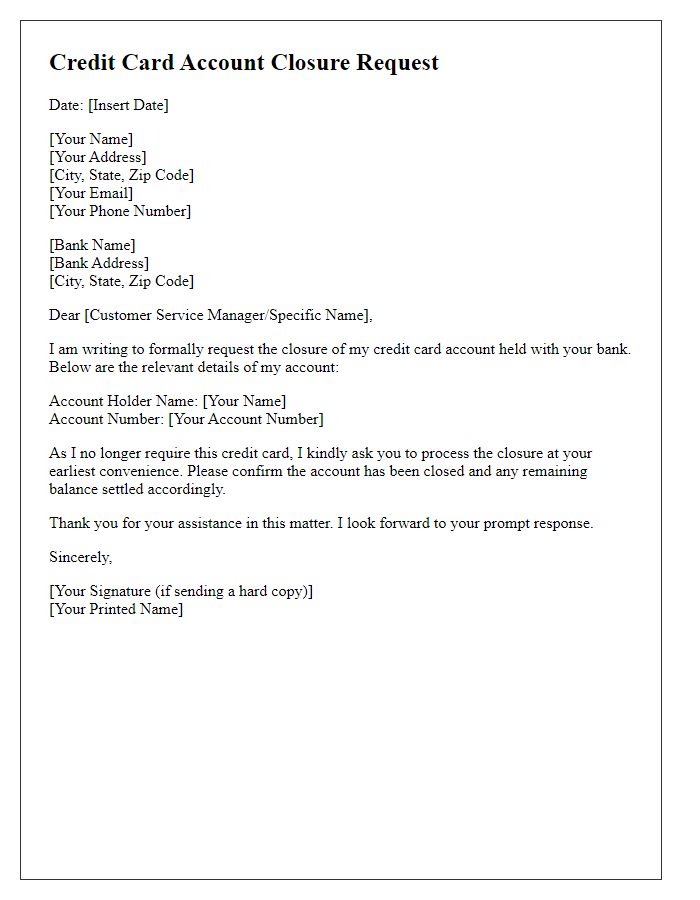

Account Holder's Full Name and Contact Information

To close a credit card account, an account holder must submit a formal request. This request includes the account holder's full name, ensuring identification with the financial institution. Additionally, contact information such as a phone number and email (to facilitate communication regarding the closure process) is essential. Including the credit card number, specific account details, and any outstanding balances enables the bank to process the request efficiently, ensuring all obligations are met. Clear communication helps prevent future charges or account issues, confirming the intent to close the account permanently.

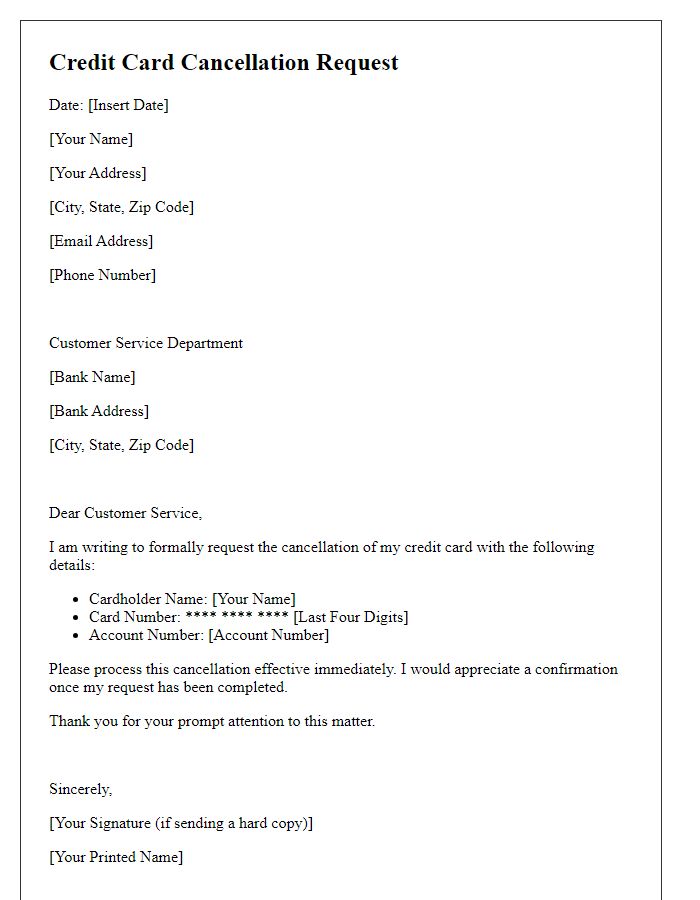

Credit Card Account Number

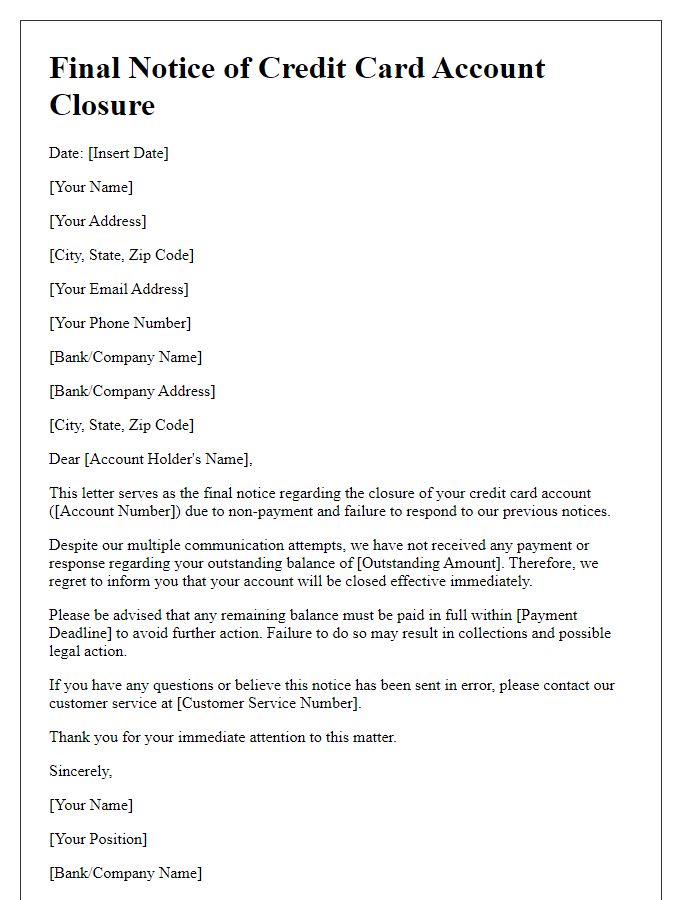

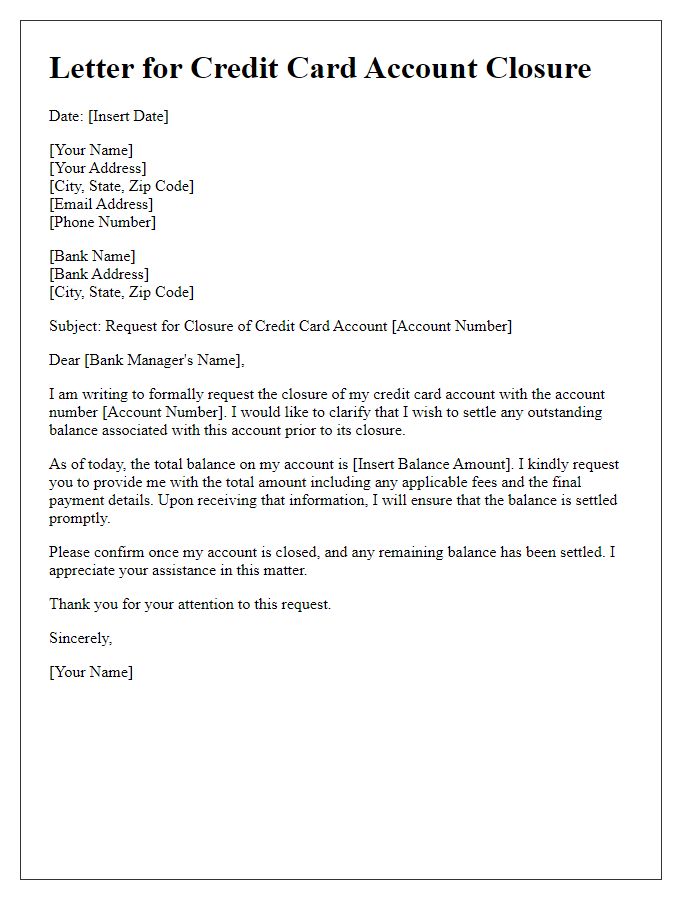

Credit card account closure requests should include specific details to ensure smooth processing. The closing of a credit card account, such as a Visa or Mastercard, requires the account number (for example, 1234-5678-9012-3456) for identification. Customers should also mention the reason for closure, whether related to financial management, interest rates, or dissatisfaction with services. Additionally, it is advisable to inquire about the final balance statement and the potential impact on the credit score, since closing accounts can affect credit utilization ratios. Customers should confirm that no remaining fees or rewards will be forfeited upon closure, ensuring a clear understanding of the process.

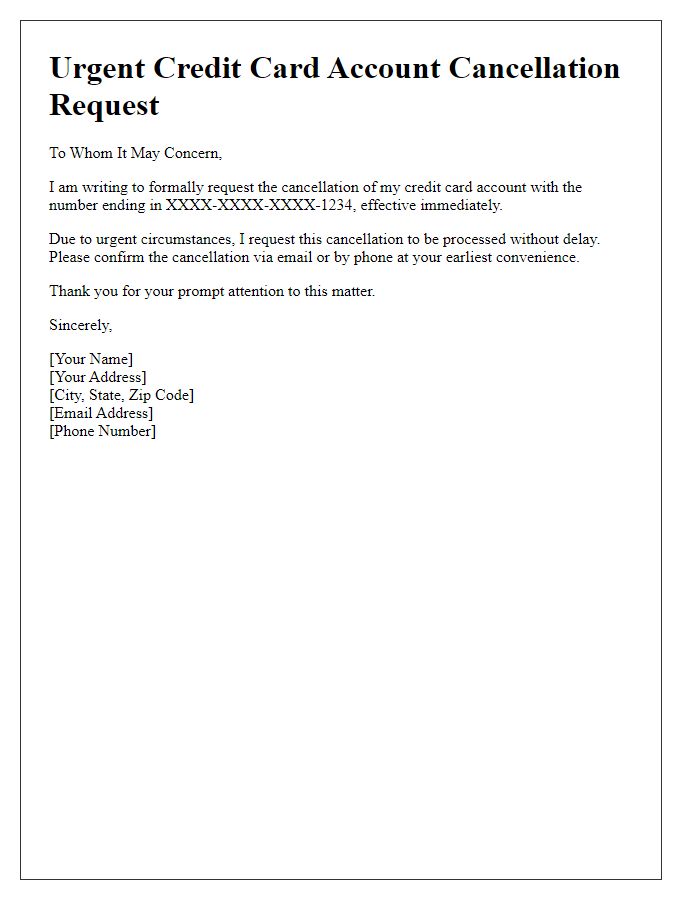

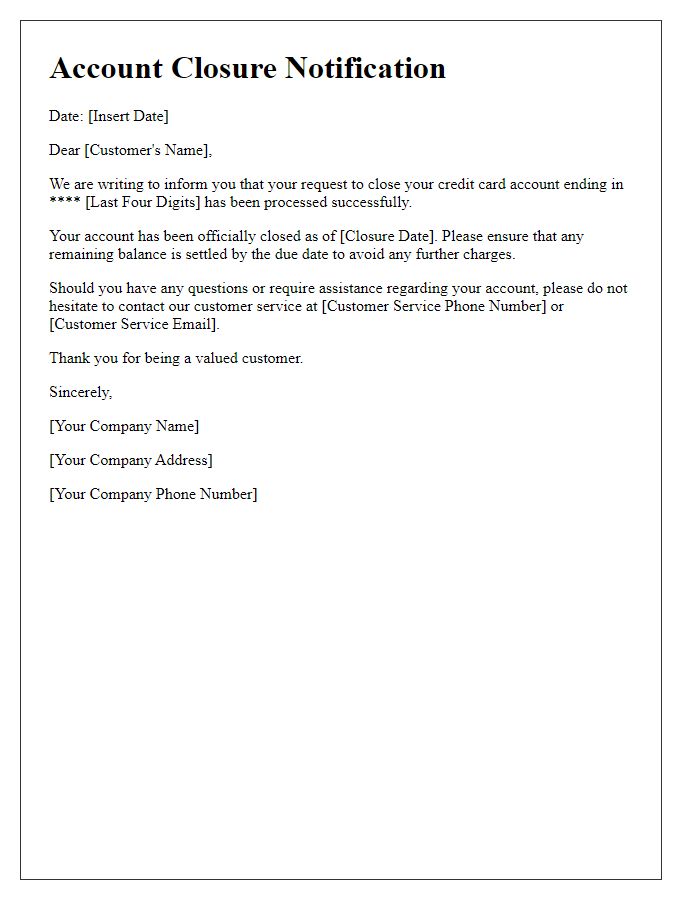

Request for Closure Confirmation

To close a credit card account for individuals seeking to manage their finances, a formal request should be submitted to the issuing bank or financial institution. This process typically requires including personal identification details, such as the account number, full name, and possibly the last four digits of the Social Security number for verification purposes. It's essential to communicate any outstanding balance or accrued rewards points, as these factors could influence the closure process. The request can be made through written correspondence or via customer service channels, whereby some banks may require the customer to verify their identity through additional security questions. Following the request, a confirmation of the closure should be obtained, ensuring that all accounts are settled and the credit report accurately reflects the account's status.

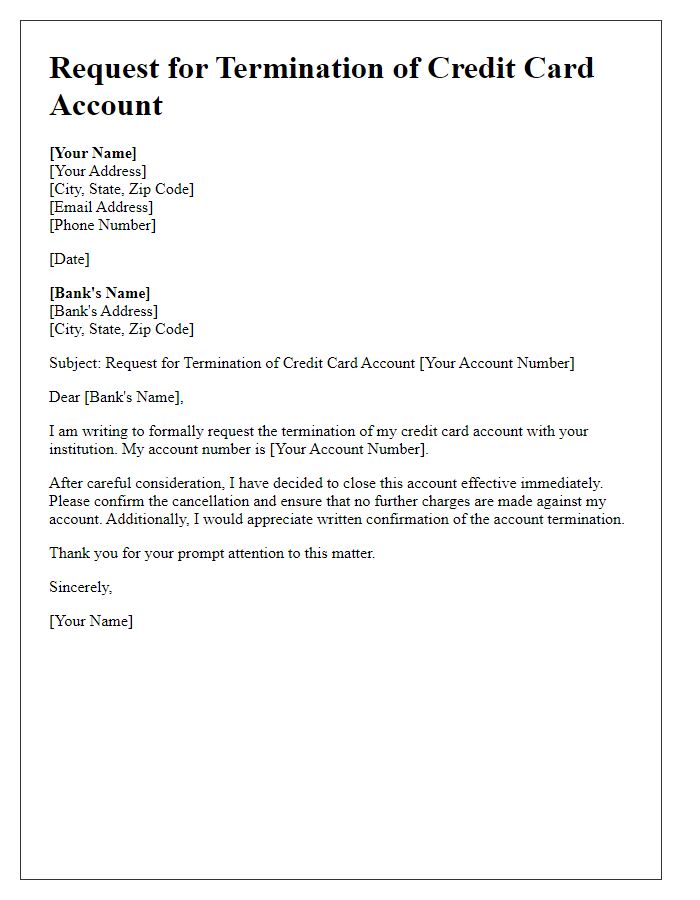

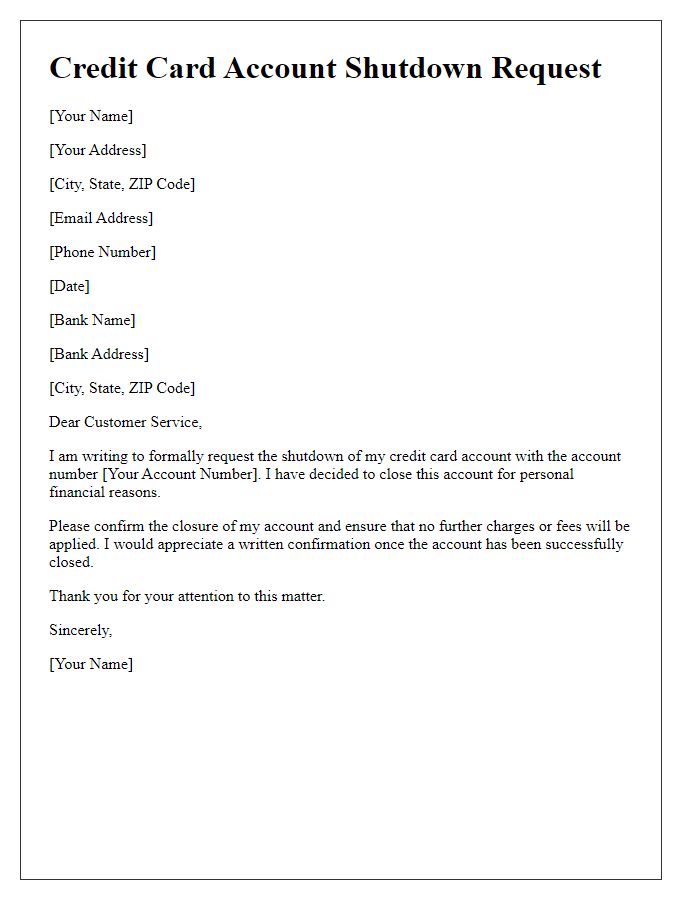

Payment of Outstanding Balance

Credit card account closure requests involve several important factors that ensure clarity and compliance with financial obligations. To initiate the closure process, cardholders must confirm payment of the outstanding balance, which may fluctuate based on interest rates and fees incurred, often detailed on the monthly statement provided by the issuing bank. It is crucial to obtain a confirmation letter from the bank, indicating the account status as 'closed' after the final payment is processed. Additionally, cardholders should verify that all auto-payments and pending transactions are settled to prevent future charges or lingering debts. The closure request must include identifying information such as the account number and cardholder name to facilitate prompt processing by the bank's customer service team, ensuring the account termination is traced accurately within the institution's records.

Return of Card and Associated Materials

To close a credit card account, the cardholder must follow a formal request process. The closure request should include relevant details such as account number, cardholder name, and contact information. Additionally, the request should specify the intention to return the physical card and any associated materials, such as billing statements, promotional materials, and payment instruments. Certain credit card issuers, like Visa and Mastercard, may require the cardholder to confirm that the balance is settled and no pending transactions exist before processing the closure. The cardholder should also inquire about confirmation of the account closure for record-keeping purposes.

Comments