Are you tired of waiting for that perfect moment to get your credit card application approved? Instant credit access can transform your shopping experience, giving you the financial freedom you deserve without the long wait. Imagine walking into a store, making that spontaneous purchase, and knowing you have the backing of instant credit right in your wallet. Curious to learn how you can unlock this convenience? Keep reading!

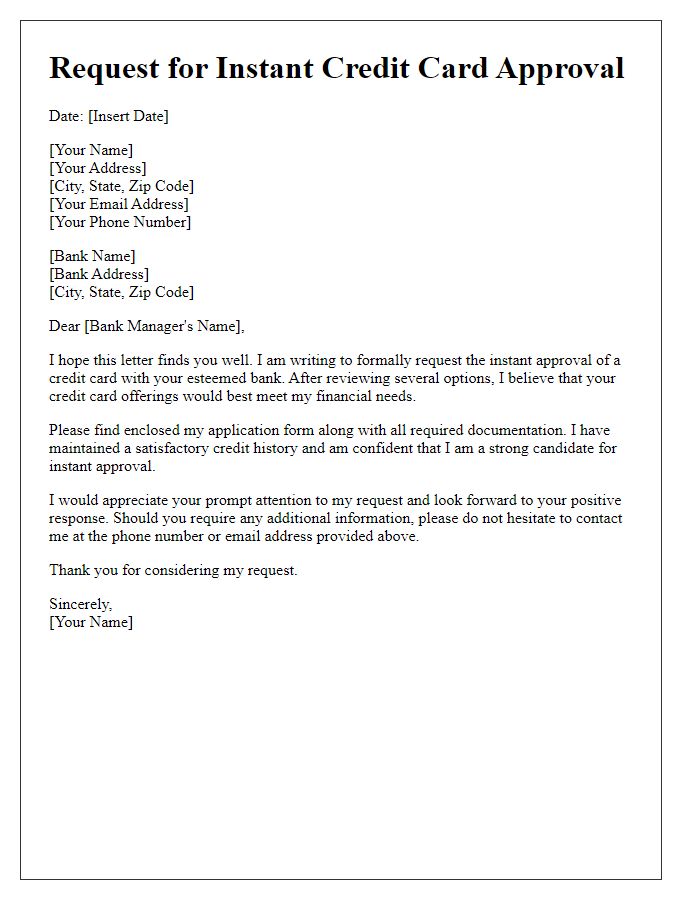

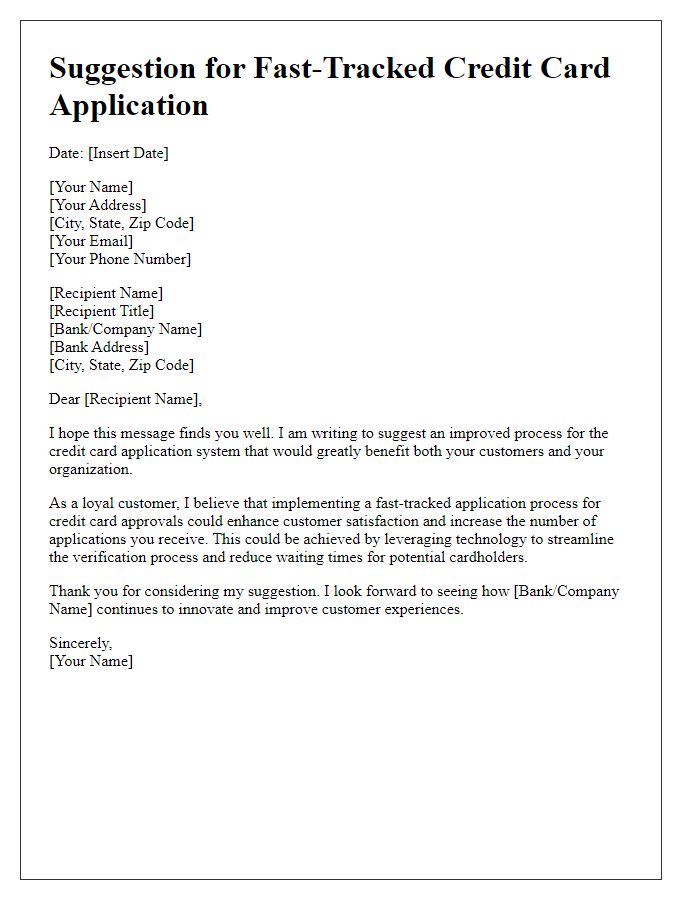

Clear and concise greeting.

Instant credit card access allows consumers to utilize financial benefits immediately upon approval, often within minutes after application submission. Many banking institutions, such as Visa and Mastercard, offer digital platforms where users can receive a credit limit notification, typically ranging from $500 to $5,000. Approval rates can vary based on factors like credit score, income, and existing debt levels. Users appreciate the seamless process, which often includes a simple online application form and instant decision-making technology. Accessing instant credit enhances purchasing power at retailers, both online and in physical stores, where promotional offers may also apply. Additionally, many credit cards provide bonuses, such as cashback rewards or travel points, incentivizing immediate usage.

Explanation of credit access benefits.

Instant credit access offers numerous benefits to consumers seeking financial flexibility. Immediate availability of funds allows individuals to handle unexpected expenses such as medical emergencies (averaging around $1,500) or urgent home repairs (often exceeding $2,000) without delay. Users can benefit from promotional offers, including zero percent APR for an introductory period lasting up to 12 months, enabling them to make large purchases without accruing interest immediately. Instant access to credit also enhances purchasing power, reinforcing confidence in making larger transactions, whether for electronics, travel (average spending around $1,200), or home improvements (costing upwards of $10,000). Additionally, responsible use of credit can improve credit scores by maintaining lower credit utilization ratios, contributing to long-term financial health and increased borrowing capacity for future needs.

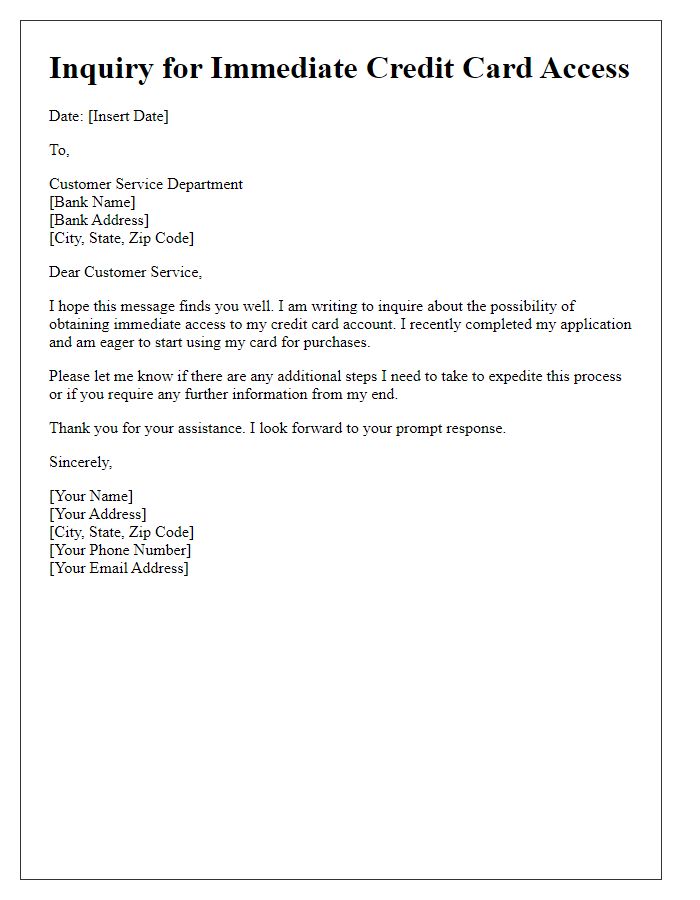

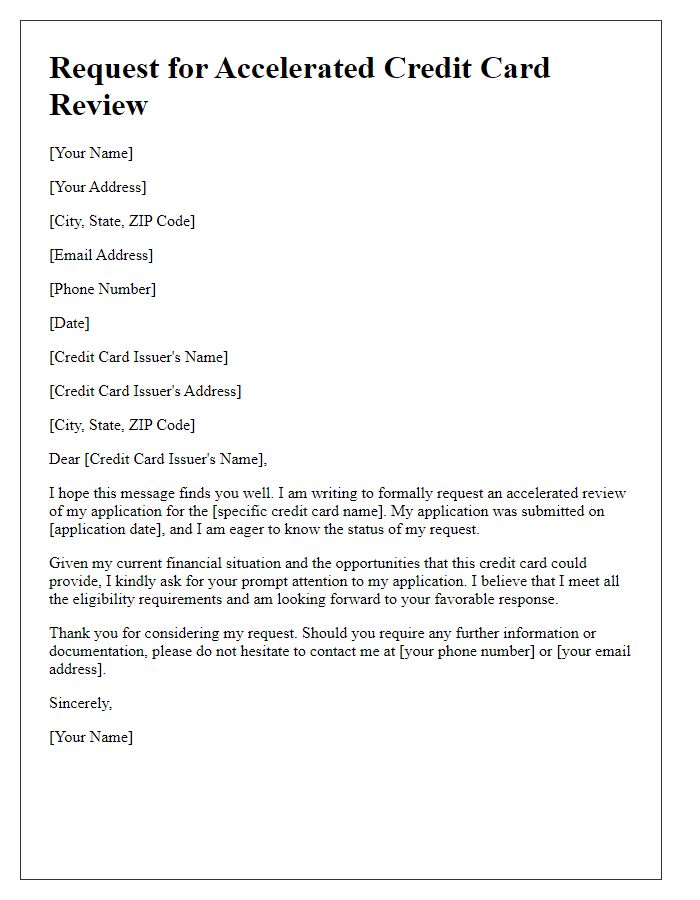

Step-by-step activation instructions.

Instant credit access allows cardholders to use their credit cards immediately after approval. To activate, locate the card provided by the issuing bank, usually delivered within 5 to 7 business days post-approval. Visit the bank's official website or mobile app. Input your card details, including the 16-digit card number, expiration date, and CVV code (three-digit security number located on the back). Next, create a secure online account by entering personal information such as your Social Security Number and date of birth for verification. Follow prompts to set up a unique password. Finally, confirm the activation via email or SMS notification, validating immediate access to funds for purchases.

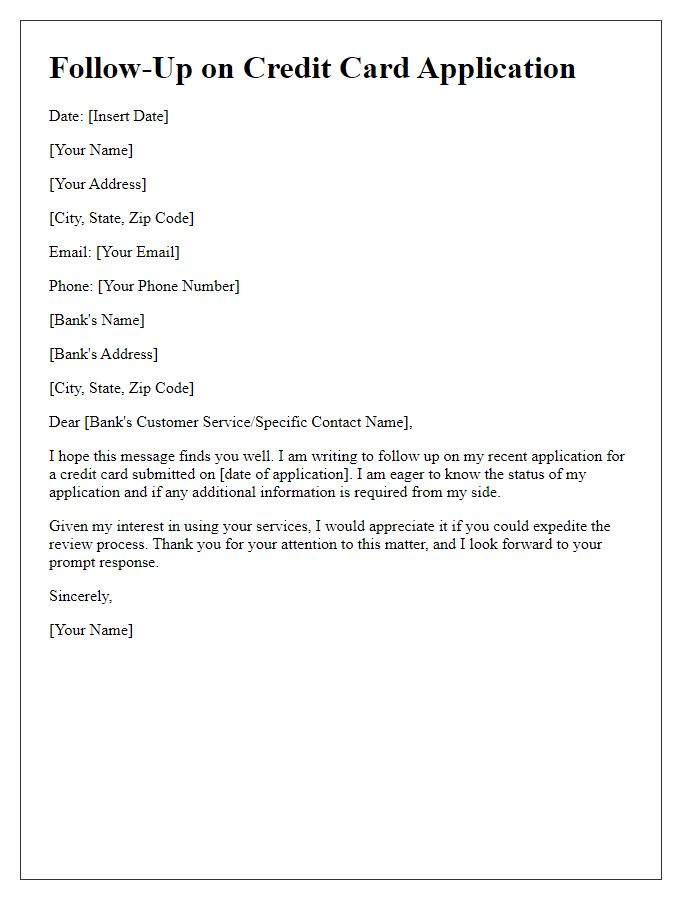

Contact information for inquiries.

Instant credit access for a credit card, such as the Visa Cash Rewards Card, provides consumers immediate financial flexibility. Customers can obtain instant access to a predetermined credit limit, often ranging from $500 to $10,000, upon approval of their application. This service typically allows for online purchases, in-store transactions, and quick withdrawal options at ATMs. For inquiries regarding account management or potential credit limit increases, customers should refer to the customer service helpline, usually found on the back of the card, which operates 24/7, ensuring assistance is always available.

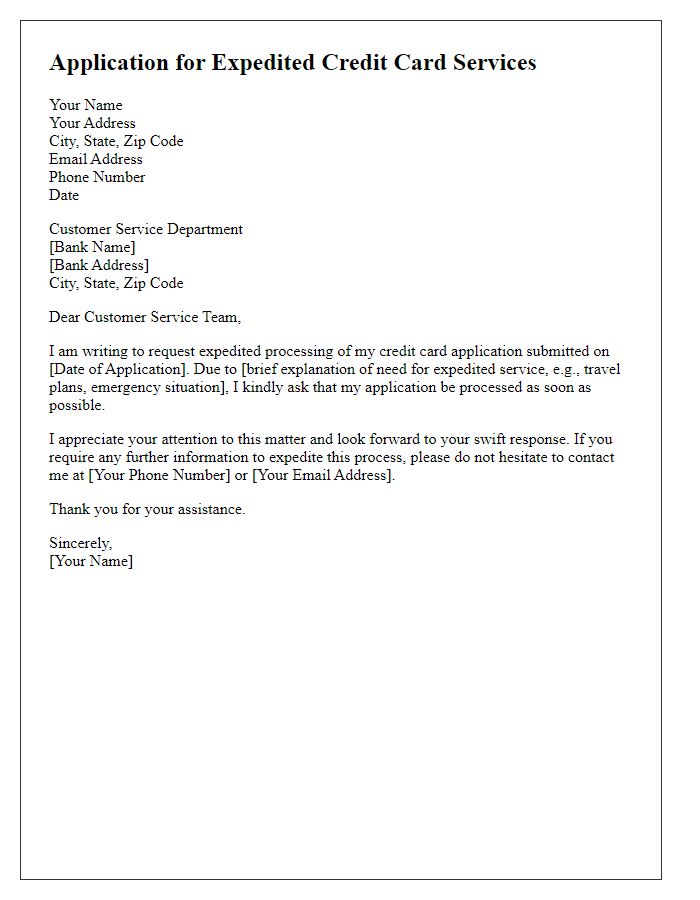

Reassurance of privacy and security measures.

Instant credit access for credit cards entails a user-friendly application process designed to ensure privacy and security of personal information. Financial institutions employ advanced encryption technologies, such as AES (Advanced Encryption Standard), that protect sensitive data during transmission. Regular security audits help identify vulnerabilities, ensuring continual compliance with regulations laid out by agencies like PCI DSS (Payment Card Industry Data Security Standard). Additionally, multi-factor authentication is employed, requiring users to verify their identity through additional means, such as a one-time password sent via SMS. Privacy policies explicitly outline data handling practices, assuring customers that their information will not be shared with unauthorized entities. This comprehensive approach fosters trust, enabling consumers to confidently utilize instant credit options.

Comments