Navigating student loan payments can often feel overwhelming, but keeping track of them is essential for your financial health. Whether you're just starting to make payments or are already in the thick of repayment, understanding the process and having a plan can make all the difference. In this article, we'll explore effective methods to streamline your student loan tracking and ensure you stay on top of your finances. Join us as we dive into practical tips that will help you manage your loans with confidence!

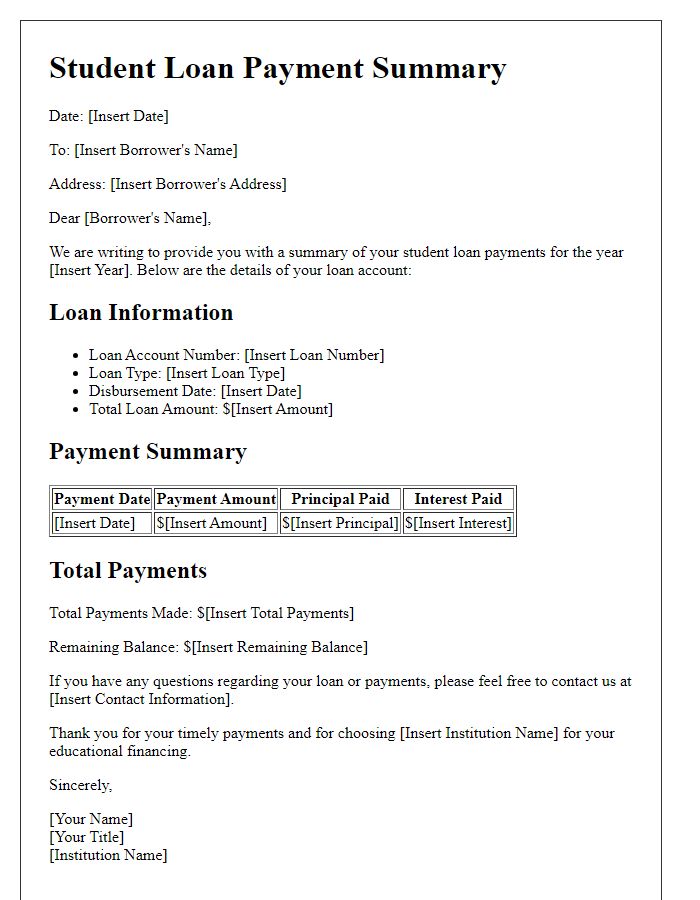

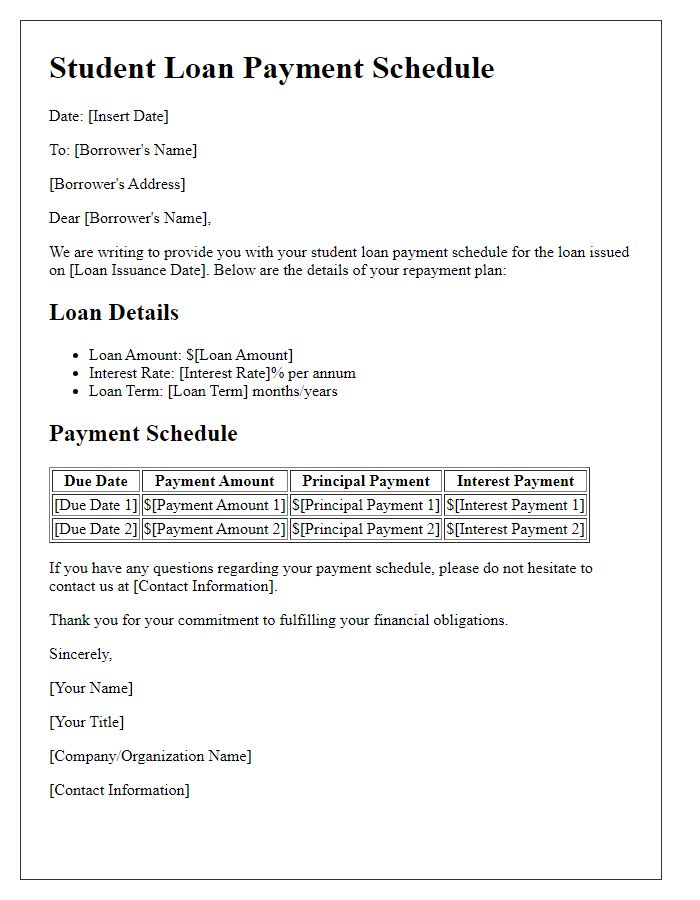

Payment Schedule Overview

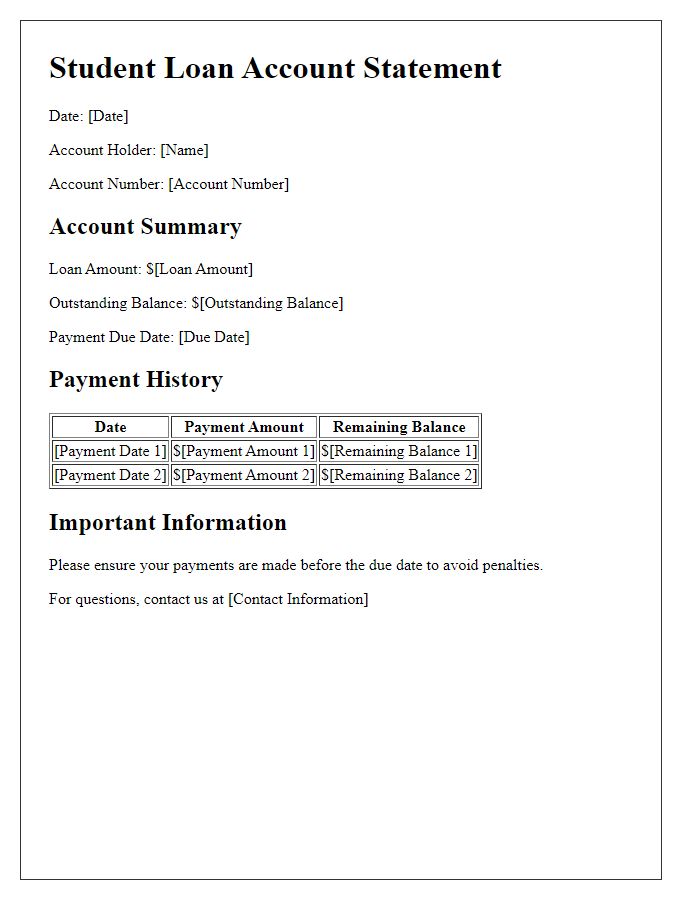

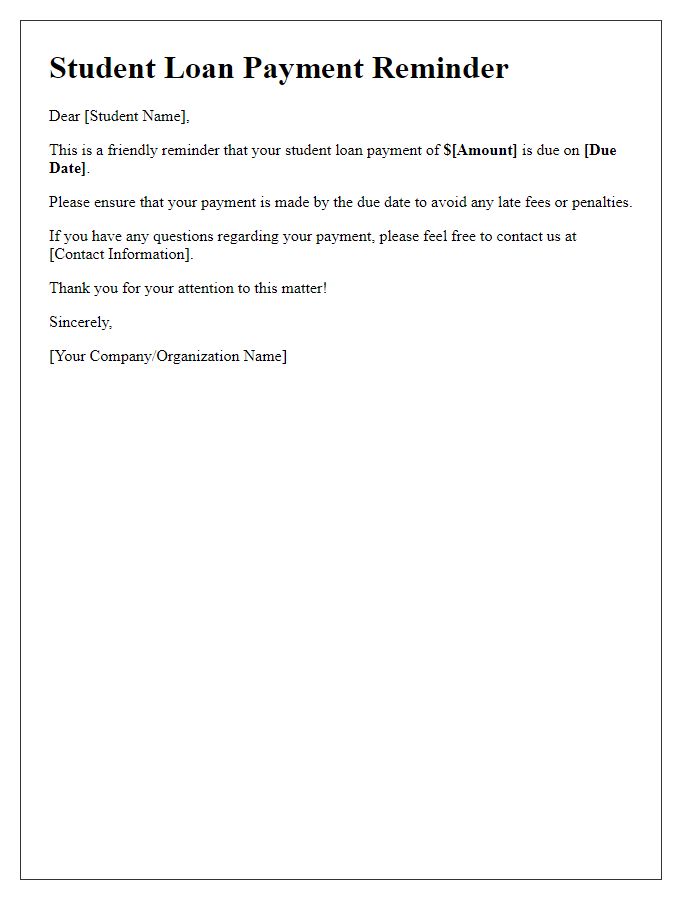

Tracking student loan payments effectively requires a detailed payment schedule overview. A comprehensive payment schedule includes key details such as the total loan amount, interest rates (typically ranging from 3% to 7% annually), and regular monthly payment amounts. Loan servicers (companies managing loan payments, like Nelnet or FedLoan) provide statements that outline payment due dates, which are often the first of each month, and potential grace periods (usually six months post-graduation). Late payment fees (generally around $25) may apply if payments are not made by the deadline. Additionally, noting the total payment duration (often 10 to 25 years) helps in planning for future financial commitments. Tracking these payments in an organized manner can also assist in assessing the remaining loan balance, ensuring effective budgeting and maintaining good credit scores.

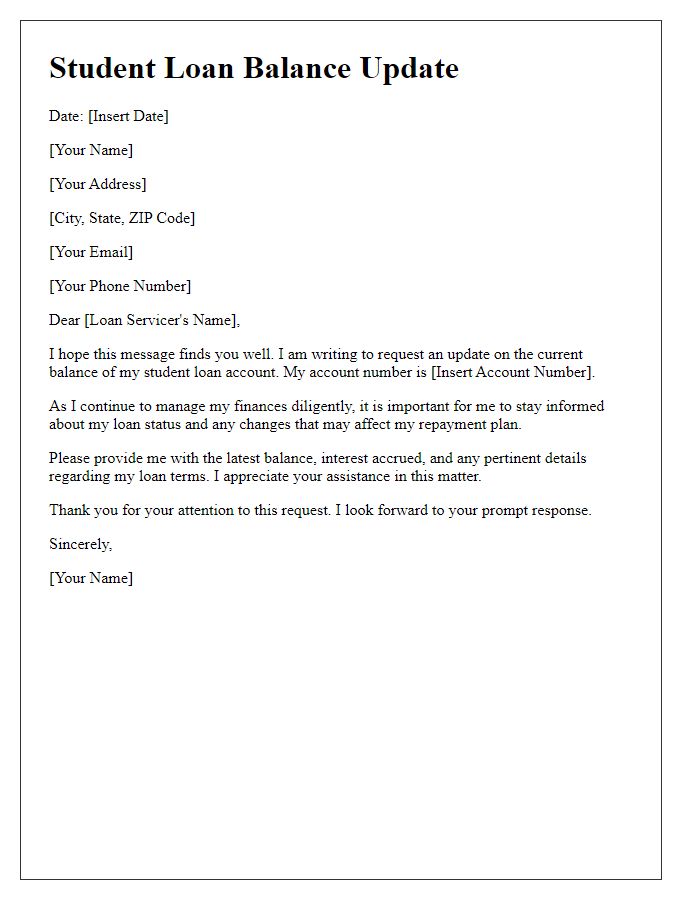

Loan Servicer Contact Details

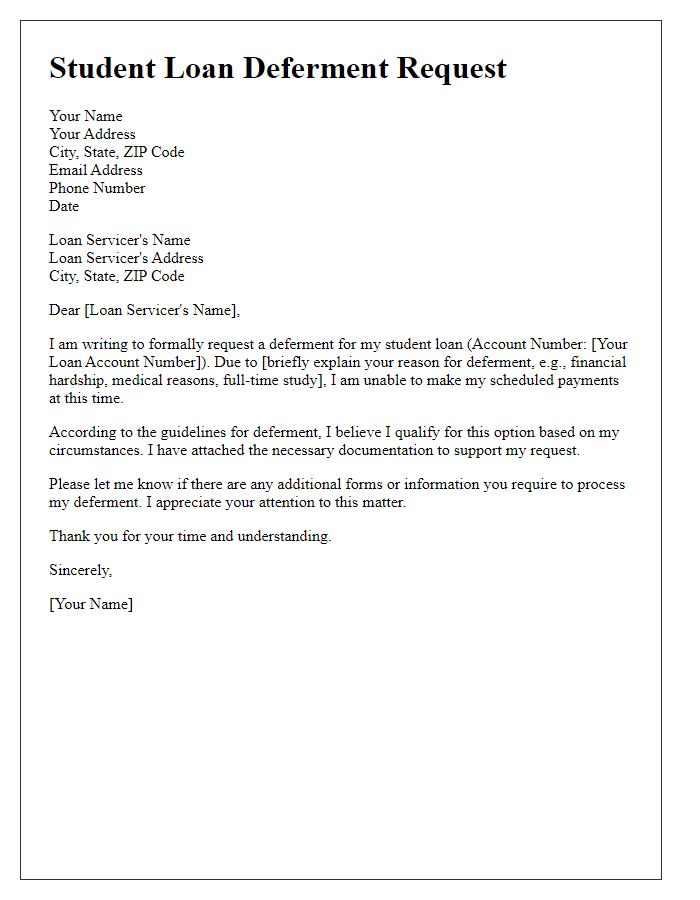

Loan servicers play a crucial role in managing student loans. For instance, Federal Student Aid (FSA) handles over $1.5 trillion in U.S. student loans, with servicers like Navient and Nelnet assisting borrowers in repayment. Contact details for these servicers, including phone numbers, email addresses, and physical addresses, are vital for students to manage their loan payments effectively. Accurate tracking of payment schedules can prevent missed payments, ensuring a positive credit score. Additionally, understanding the loan servicer's processes can aid in accessing deferment or forbearance options if financial hardships arise, maintaining financial stability.

Balance and Interest Rate Information

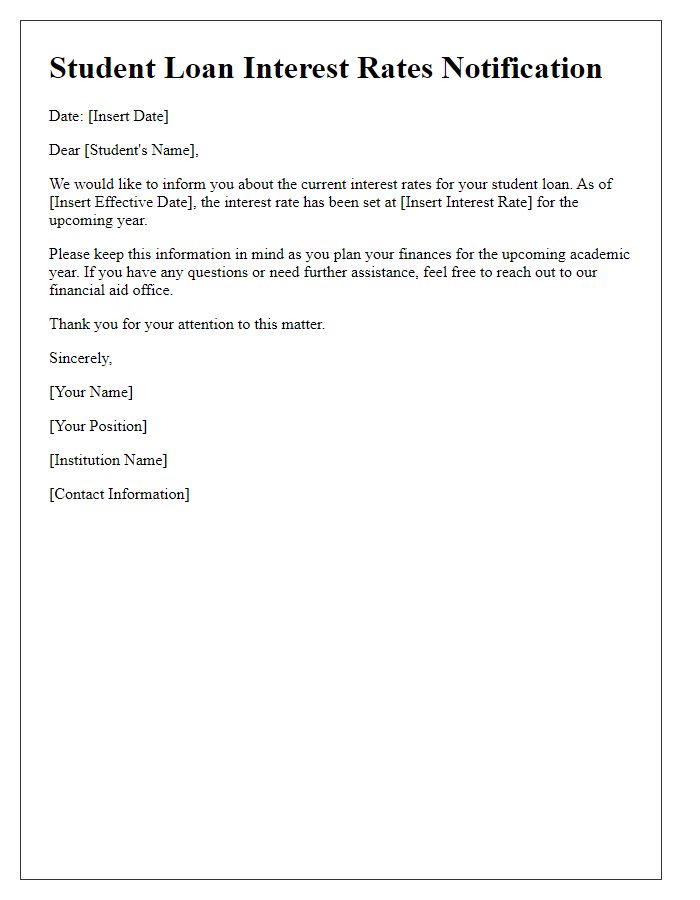

Tracking student loan payments involves monitoring various details regarding balance and interest rates. The total outstanding balance on federal and private student loans, typically ranging from $1,000 to $200,000 for recent graduates, is crucial. Interest rates fluctuate based on loan type--federal student loans often have fixed rates between 3.73% to 6.28%, while private loans can vary significantly, sometimes exceeding 10%. Monthly statements, usually provided electronically, detail accrued interest, payment history, and remaining principal. Tools such as online calculators or loan servicer portals assist in tracking payment progress toward principal reduction and interest accumulation over time, essential for effective financial planning and strategy development.

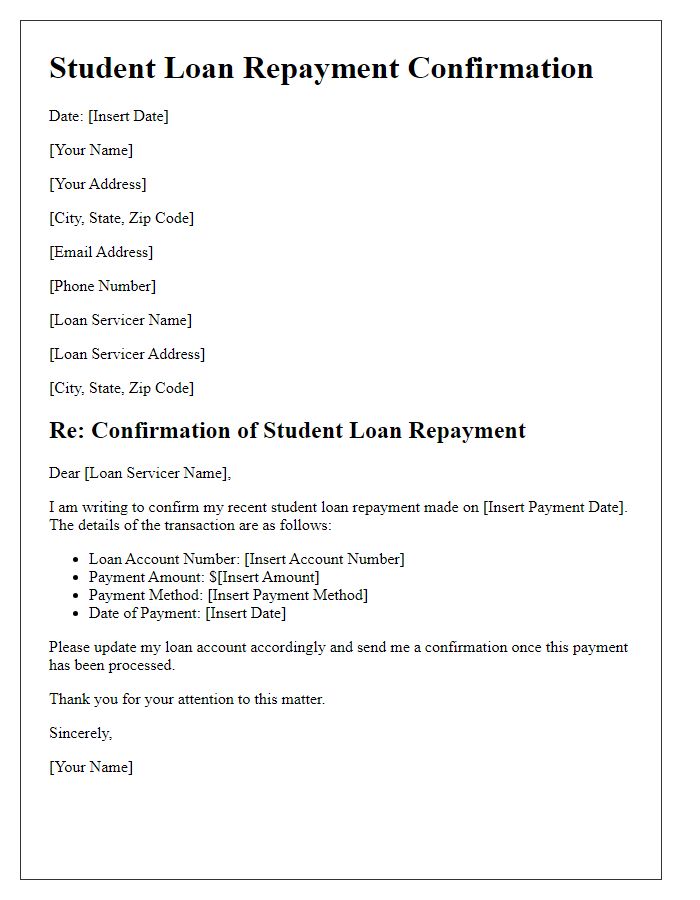

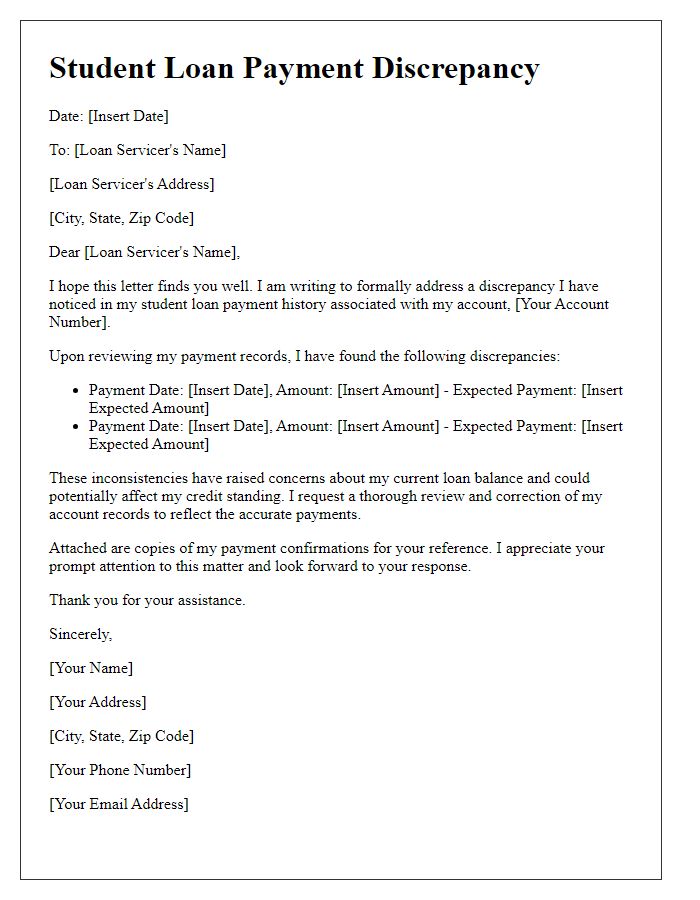

Payment Tracking and Recording Methods

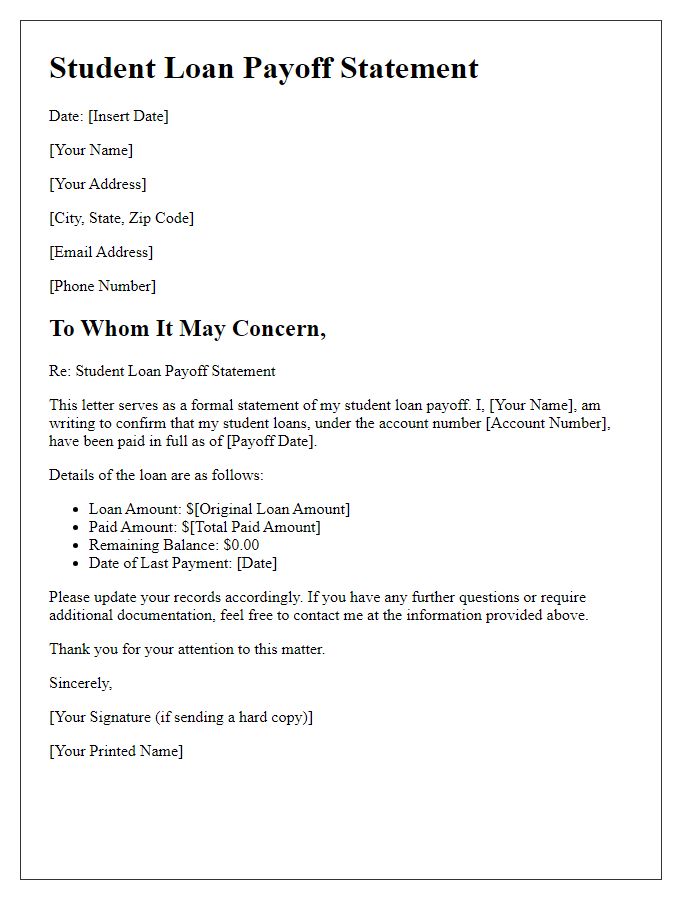

Effective payment tracking and recording methods are essential for managing student loan repayments. Utilizing digital tools such as budgeting applications, like Mint or YNAB (You Need A Budget), can streamline the tracking process, offering visual representation of payment timelines and due dates. Setting up automatic payments through loan servicer websites can ensure timely payments and prevent missed deadlines, often avoiding late fees that can accumulate to over $15 for each missed payment. Additionally, maintaining a dedicated spreadsheet in software like Microsoft Excel or Google Sheets allows for customized tracking of payment history, principal balances, interest accrual, and remaining loan duration. Regularly reviewing the loan servicer's statements will help identify discrepancies and ensure accurate record-keeping, ultimately aiding in effective financial planning and debt management strategies.

Options for Future Payment Adjustments

Navigating student loan repayment can be complex, particularly with options for future payment adjustments available to borrowers. Income-driven repayment plans, such as the Revised Pay As You Earn (REPAYE) or Income-Based Repayment (IBR), allow monthly payments to be tailored based on annual income, providing relief for those facing financial hardships. Additional programs like deferment and forbearance can temporarily suspend payments during economic difficulties, such as job loss or unexpected medical expenses. Additionally, utilizing resources from the U.S. Department of Education's Federal Student Aid website can provide guidance on adjusting repayment plans to better align with personal financial situations. Monitoring progress through platforms like LoanServicer can help ensure timely modifications to payment plans when life circumstances change, ensuring borrowers remain on track to fulfill their loan obligations while managing financial stability efficiently.

Comments