Are you wrestling with a charge-off account that seems unjust? Disputing these accounts can often feel overwhelming, but with the right approach, you can take charge of your financial narrative. In this article, we'll explore a clear and effective letter template to help you address charge-offs with confidence and clarity. So, let's dive in and uncover how you can advocate for your financial future!

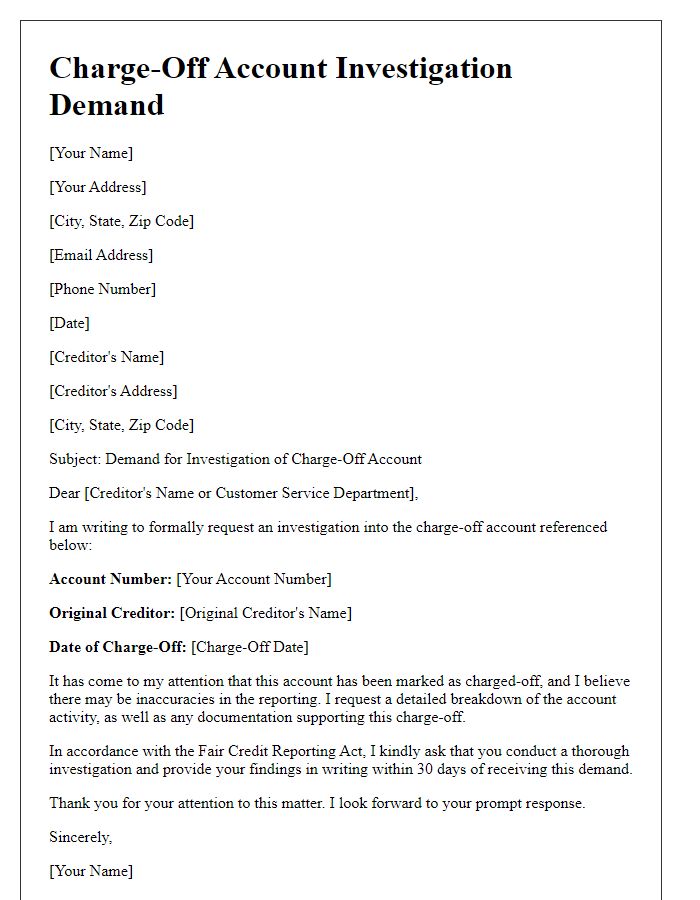

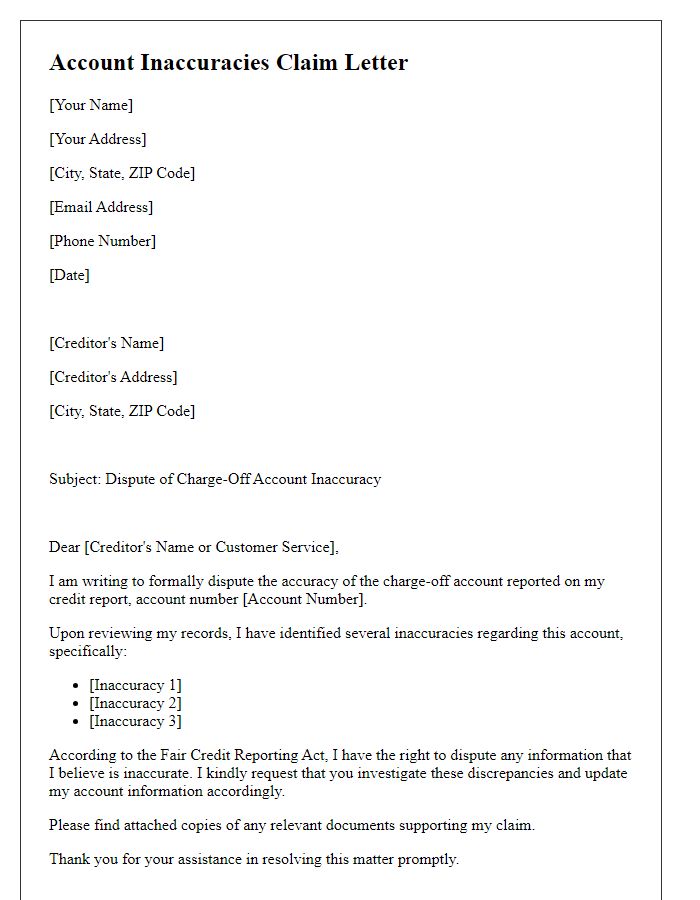

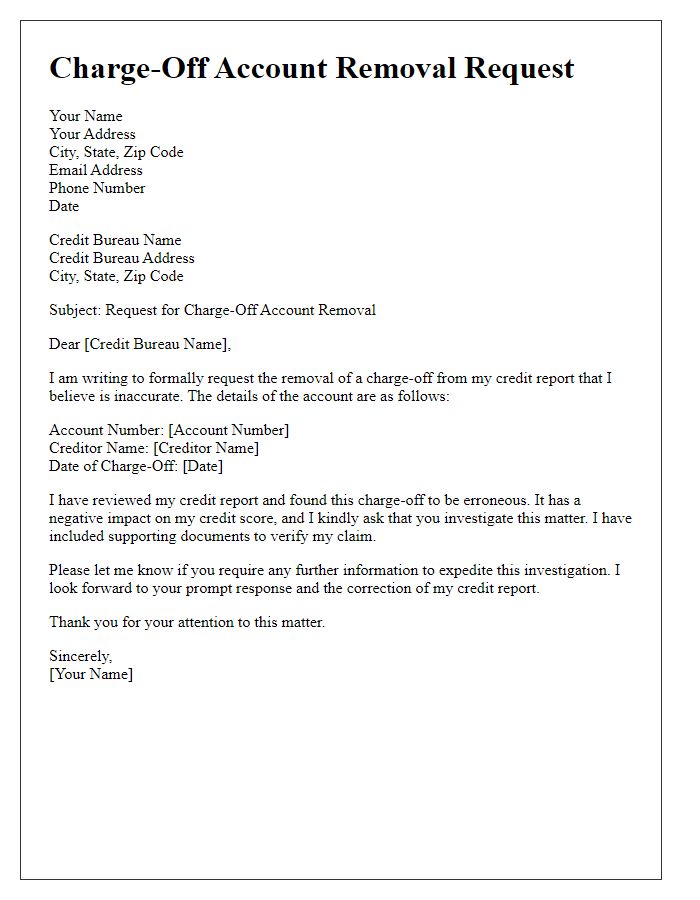

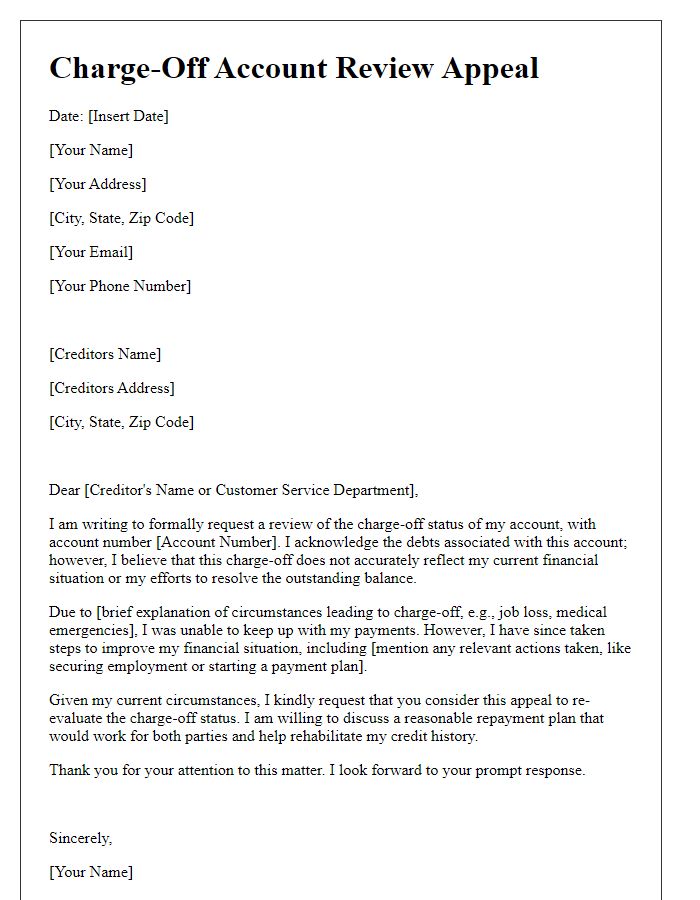

Creditor's contact information

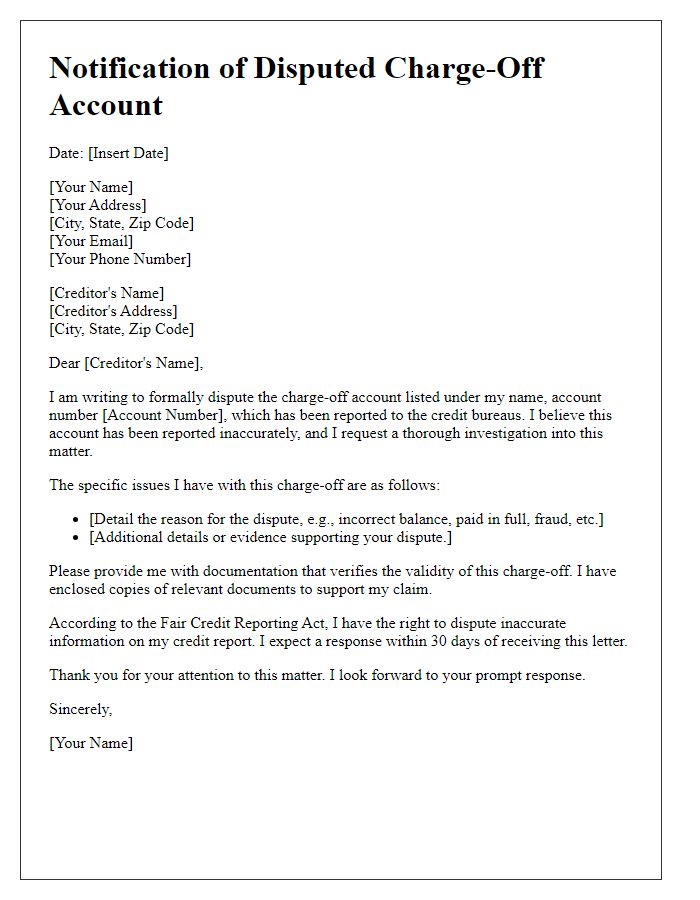

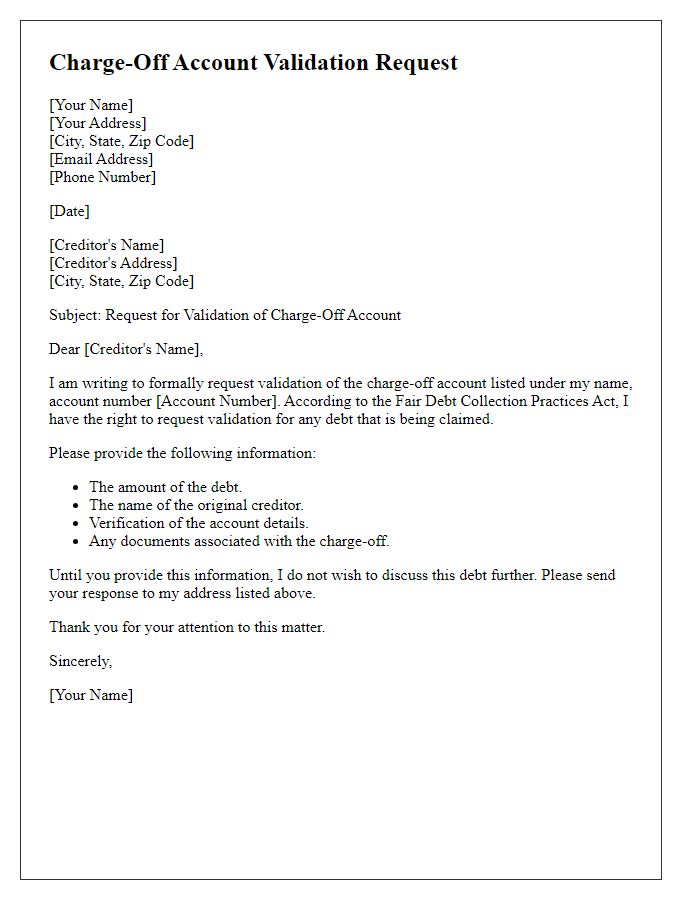

A charge-off account, typically reported by creditors after 180 days of non-payment, significantly impacts credit scores in the United States. Disputing such accounts often requires contacting the creditor, which could be a bank or financial institution, to address inaccuracies. To effectively engage in a dispute, specific creditor contact details such as the mailing address, phone number, and email are essential. Accuracy in presenting account information, including account numbers and dates of charge-off, strengthens the case for disputing erroneous negative marks on credit reports, ultimately aiming to restore financial credibility.

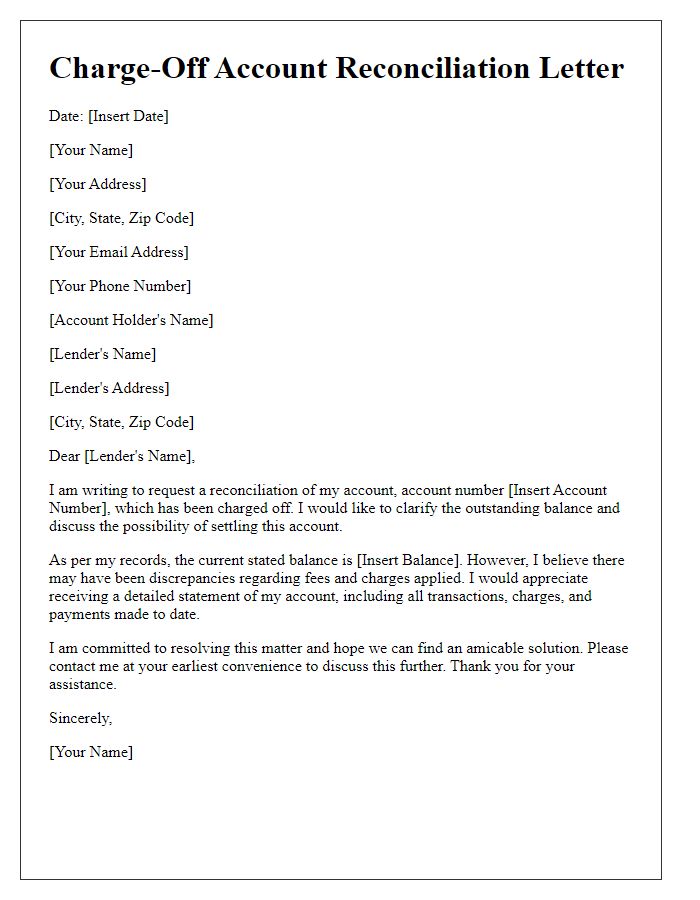

Accurate account details

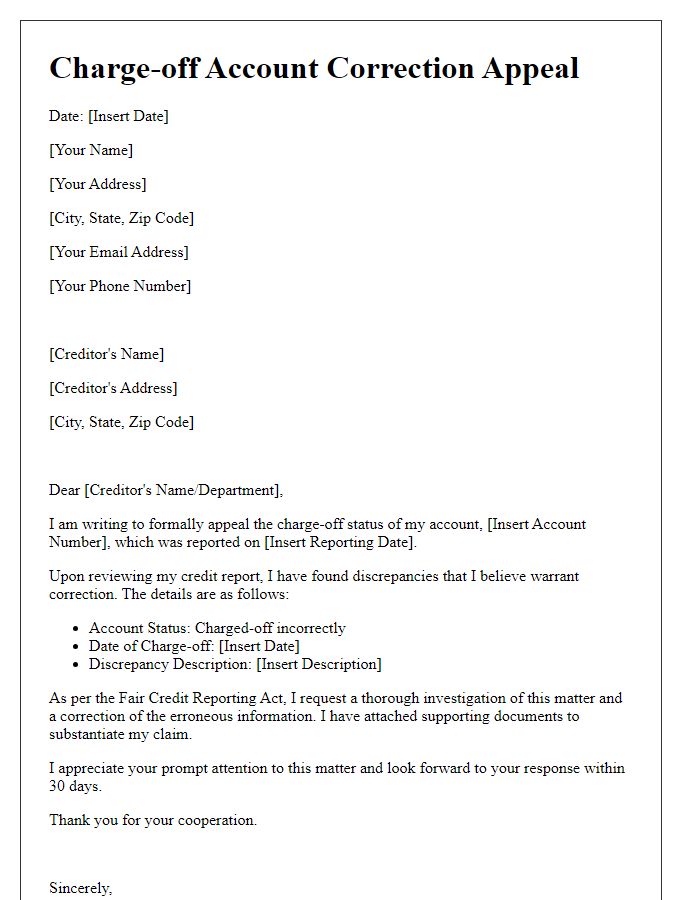

Disputes regarding charge-off accounts can significantly impact credit scores and financial standing. Charge-off accounts, labeled as such after 180 days of non-payment, indicate that a creditor has deemed the debt as unlikely to be collected. Accurate account details are essential for effective dispute resolution. These details include the original creditor's name, account number, date of charge-off, and balance owed. Additionally, documentation proving payment or evidence disputing the validity of the charge-off, such as bank statements from January 2020, can strengthen the dispute. Accurate personal information, including a current address and contact number, ensures that communication remains clear and direct. Engaging with credit bureaus immediately upon discovering inaccuracies can expedite the correction process and potentially improve credit scores.

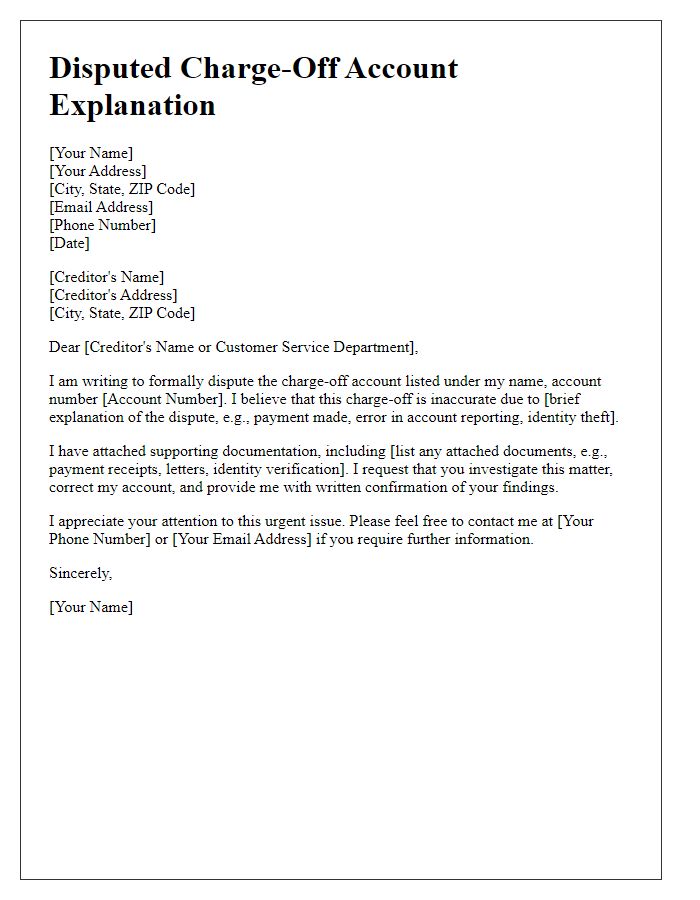

Clear dispute statement

A charge-off account occurs when a creditor, such as a credit card company or lender, determines that a debt is unlikely to be collected after several months of missed payments. This status typically happens after 180 days of delinquency, and it can significantly impact credit scores, potentially lowering them by at least 100 points. Disputing a charge-off involves contacting credit reporting agencies like Experian, TransUnion, or Equifax, and providing evidence that the information is inaccurate or incomplete. To successfully dispute, individuals should gather documentation such as payment records, communication with creditors, and any relevant agreements, ensuring that all information is submitted within the 30-day response window set by the Fair Credit Reporting Act. This process can lead to a correction in credit reports, restoring financial health.

Supporting evidence

Disputing a charge-off account necessitates gathering robust supporting evidence to strengthen the case. First, locate the account details, including the account number and the creditor's name, essential for identifying the dispute. Collect any documentation showcasing payment history, such as bank statements or receipts, evidencing on-time payments or discrepancies in reported amounts. Obtain credit reports from major credit bureaus like Experian, TransUnion, and Equifax, which may reveal inaccuracies in reported charge-off status. If applicable, retrieve communications with the creditor, including emails or letters, that may illustrate attempts to resolve the account or errors in the reporting process. Lastly, ensure to document any relevant consumer protection laws, such as the Fair Credit Reporting Act, which may support the claim against the inaccurate charge-off listing. This organized compilation of evidence enhances the clarity and credibility of the dispute.

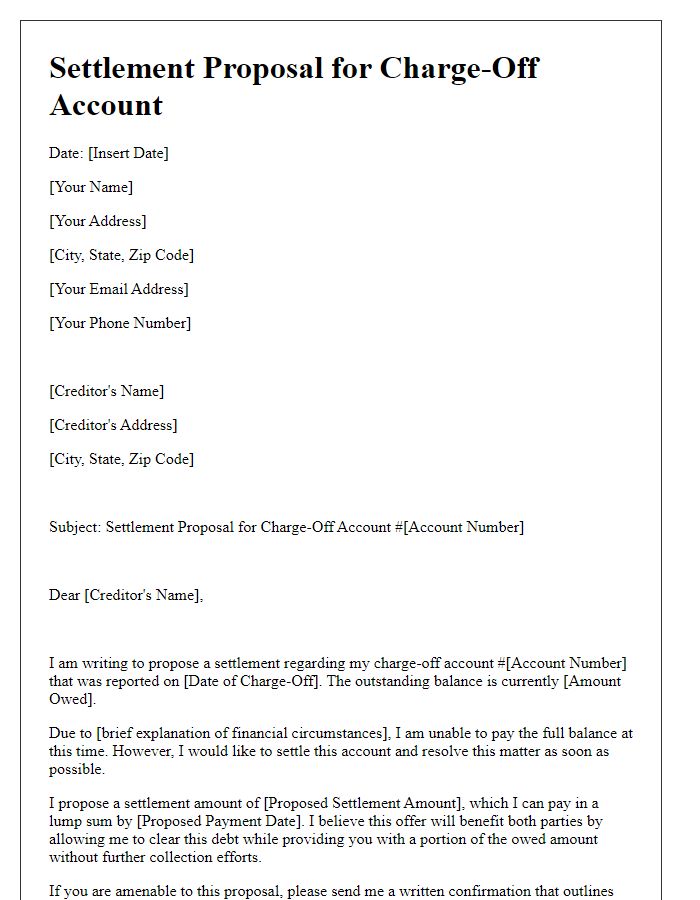

Request for written confirmation

A charge-off account can significantly impact an individual's credit score and financial opportunities. When a creditor writes off a debt due to lack of payment (typically after 180 days of delinquency), the account status is marked as "charge-off." Consumers have the right to dispute inaccuracies associated with these charge-offs, especially if the amount reported differs from their records or if the debt is disputed altogether. Written confirmation from the creditor about the accuracy and validity of the charge-off account is essential. This request should detail specific information about the account, including account number, the amount owed, and the dates of service, while seeking clarification on the reporting aspect. Documentation of any previous correspondences related to the dispute should ideally be enclosed to support the request.

Comments