Are you looking to improve your credit score and diversify your credit portfolio? Understanding how to effectively manage different types of credit accounts can significantly impact your financial health. In this article, we'll explore practical strategies and insightful tips to enhance your credit diversity while boosting your financial confidence. So, grab a cup of coffee, and let's dive into the world of credit improvement together!

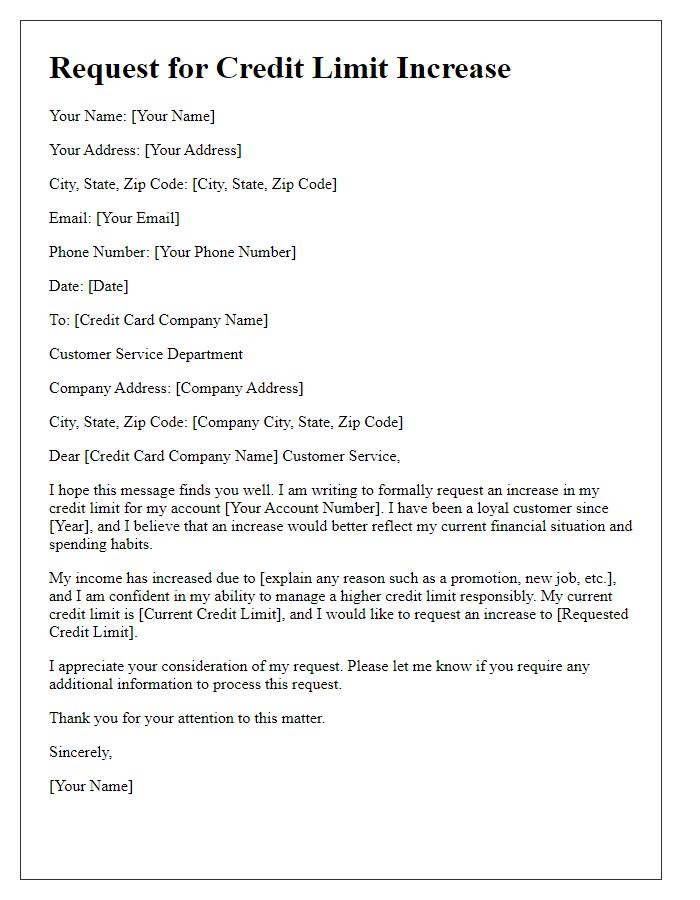

Clear Subject Line

Improving credit diversity is essential for enhancing credit scores and increasing financial opportunities. Credit mix, representing various types of credit such as revolving accounts (credit cards) and installment loans (mortgages, auto loans), plays a crucial role in shaping creditworthiness. A diversified credit portfolio typically leads to better scores, as scoring models like FICO favor applicants with varied credit experiences. Lenders in the United States, especially major entities like Experian, Equifax, and TransUnion, often assess this diversity during loan evaluations. Individuals can enhance credit diversity by responsibly managing different types of accounts and ensuring timely payments, leading to greater financial flexibility and potential for larger loans.

Polite Opening Statement

Establishing a diverse credit profile is essential for overall financial health and the potential for better loan terms. Credit diversity involves a mix of credit types, such as revolving credit accounts like credit cards and installment loans like auto loans or mortgages, which play a significant role in credit scoring models. Lenders often view a varied credit mix favorably, indicating a borrower's ability to manage different types of debt effectively. Engaging responsibly with multiple credit accounts can improve credit scores over time, resulting in lower interest rates and enhanced borrowing opportunities in cities like New York or Los Angeles, where living expenses are significant and financing options are often competitive. Each account's payment history contributes to credit utilization ratios that lenders analyze when considering loan applications.

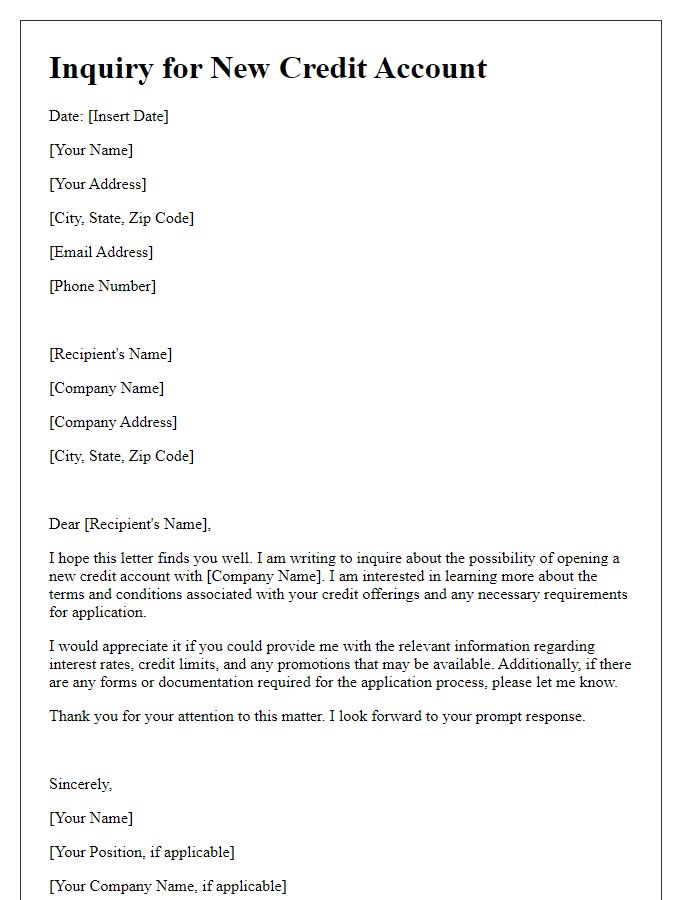

Specific Credit Accounts Inquiry

Improving credit diversity involves obtaining various types of credit accounts to enhance overall credit health. Specific credit accounts, such as installment loans (including personal loans and auto loans), revolving credit accounts (like credit cards), and mortgage loans, can significantly influence credit scores. Financial institutions, including banks and credit unions, often evaluate credit diversity during the loan approval process. A balanced mix of credit types can demonstrate responsible credit management, potentially leading to higher credit scores. Best practice involves regularly reviewing credit reports from major bureaus, including Experian, TransUnion, and Equifax, to monitor account activity and ensure an optimal credit mix.

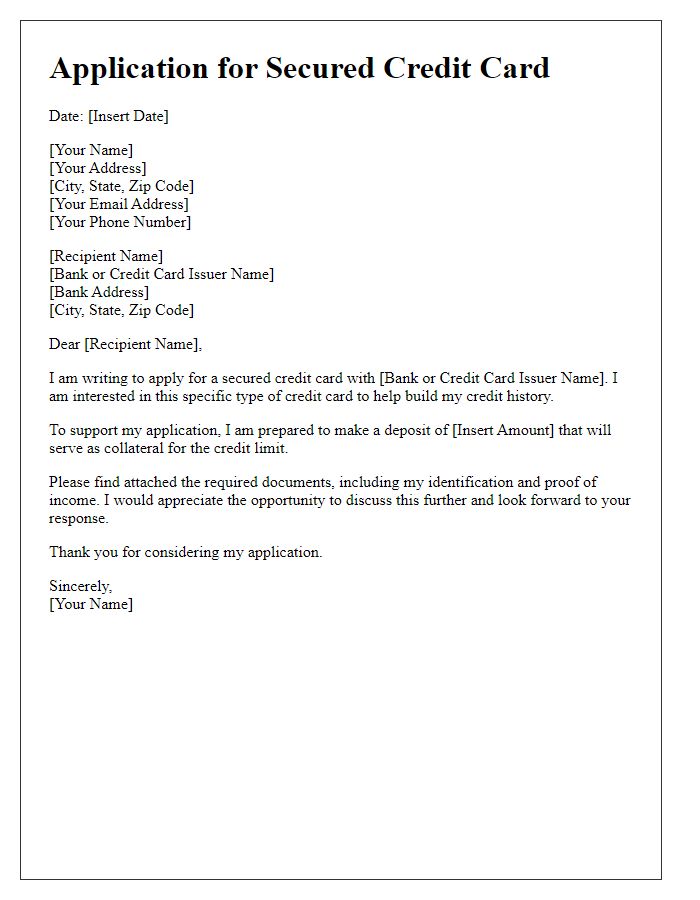

Request for Credit Line Recommendations

Building a robust credit profile involves incorporating diverse credit lines that contribute to a higher credit score. Credit diversity can include revolving credit accounts like credit cards, installment loans such as personal loans, auto financing, and mortgage agreements. Each credit line impacts credit utilization ratios; for example, maintaining below 30% utilization on revolving accounts boosts scores substantially. Additionally, timely payments across various credit types enhance payment history, accounting for 35% of credit scores. Seeking recommendations for credit lines can help identify options that align with both financial goals and current credit standings. Institutions such as credit unions or major banks often provide tailored advice on acceptable credit products suited for diverse financial profiles.

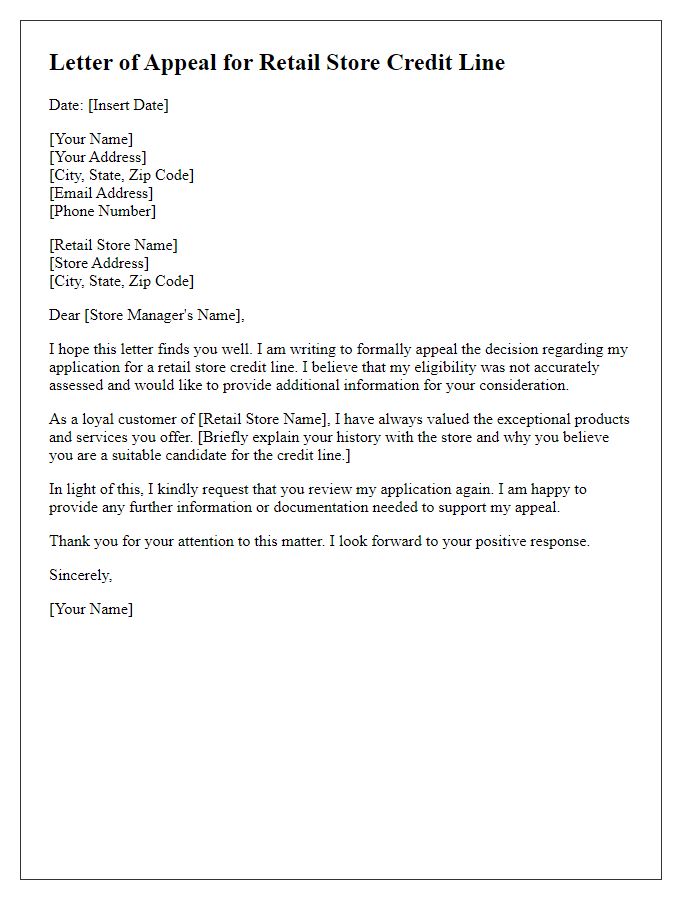

Closing with Contact Information and Request for Confirmation

Improving credit diversity involves strategic management of various credit accounts, such as revolving credit lines and installment loans, to enhance credit scores. Maintaining a mix of credit types, like credit cards and personal loans, can positively impact credit scores by demonstrating responsible credit usage. Regular monitoring of credit reports from agencies such as Experian, TransUnion, and Equifax can provide insights into areas for improvement. Timely payment history on each account contributes significantly to building a positive credit reputation. Additionally, seeking pre-qualification offers from lenders can help individuals explore opportunities for diversifying their credit without negatively impacting their credit score.

Comments