Are you frustrated with outdated credit information dragging your score down? You're not alone, and it's essential to take action to ensure your credit report reflects accurate data. Disputing outdated information can seem daunting, but it's your right as a consumer to advocate for yourself. Ready to learn how to craft an effective letter to challenge that old credit information? Let's dive in!

Accurate Personal Information

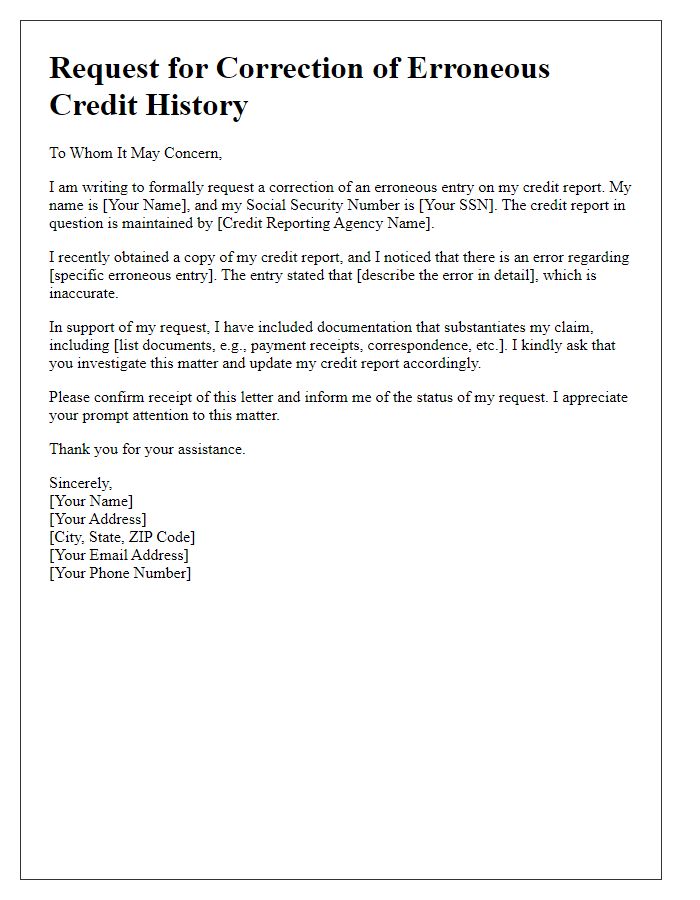

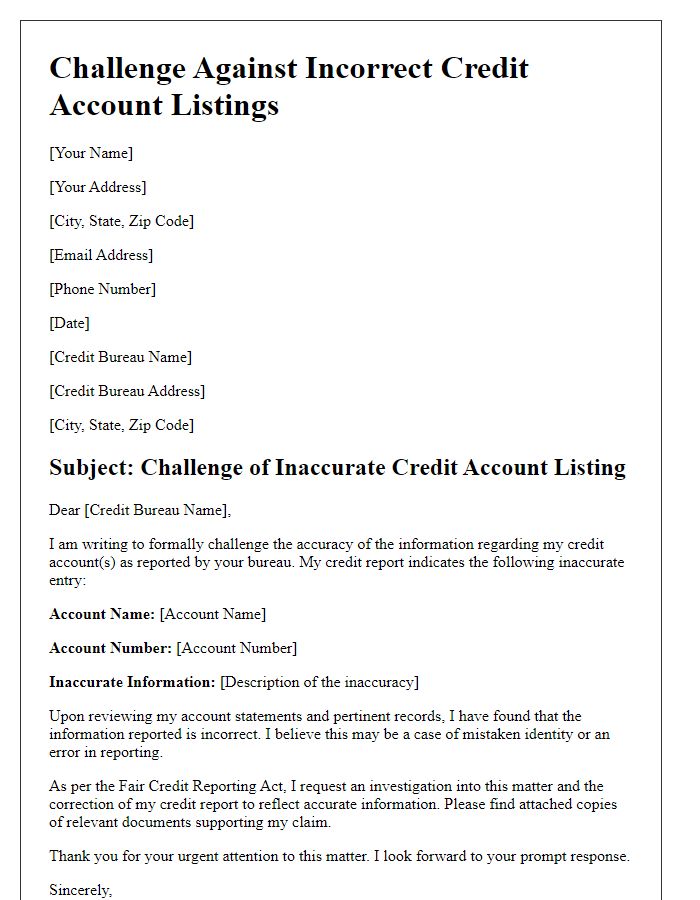

Inaccurate personal information on credit reports can significantly impact an individual's credit score and financial opportunities. Errors, such as incorrect names, addresses, or Social Security numbers, can lead to misunderstandings in credit evaluations. The Fair Credit Reporting Act (FCRA) stipulates that consumers have the right to dispute inaccurate information, focusing on the need for accuracy and integrity in personal records. Consumers should collect evidence, such as recent utility bills or official identification, to support their claims. Reporting agencies, like Experian or TransUnion, are required to investigate disputes within a specified timeframe, often 30 days, ensuring consumers can maintain their financial health.

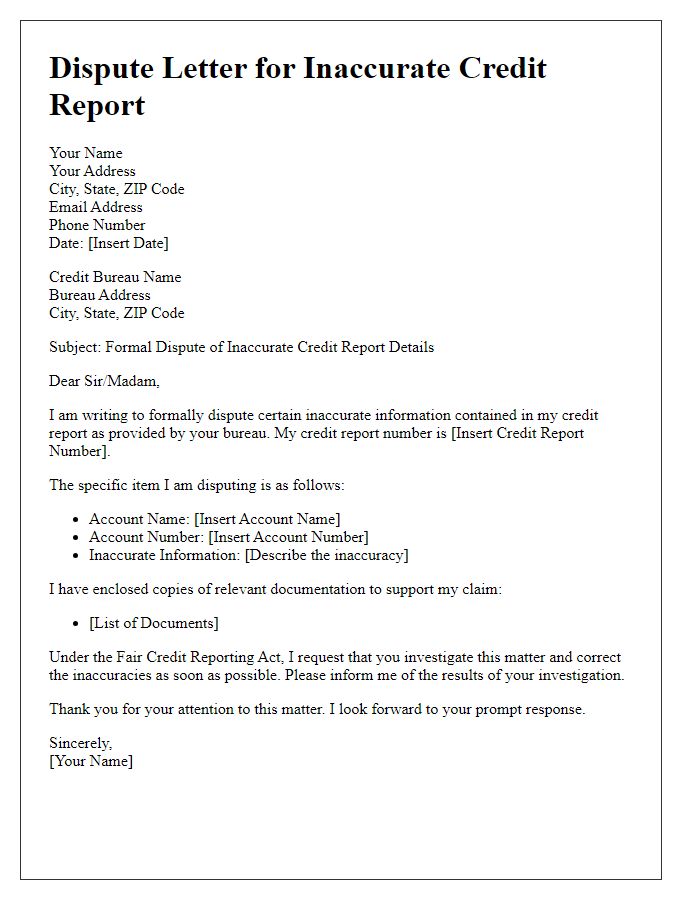

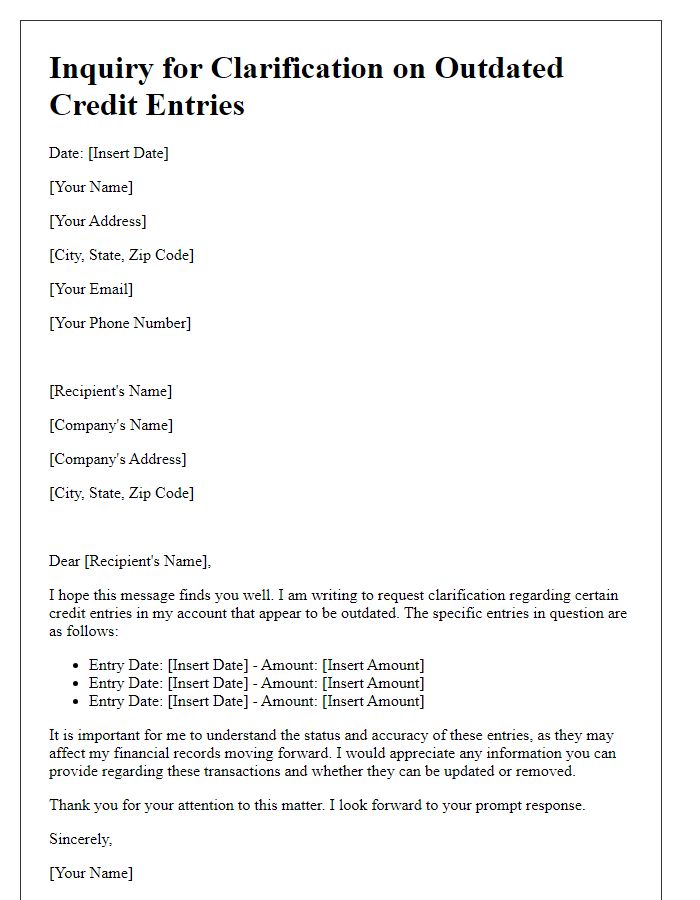

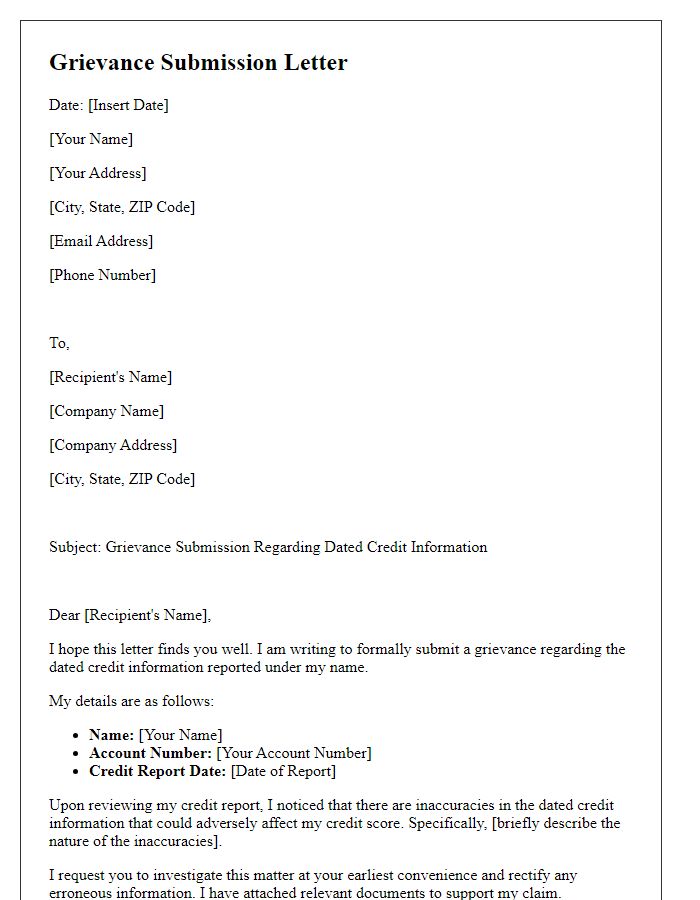

Clearly Identify the Outdated Item

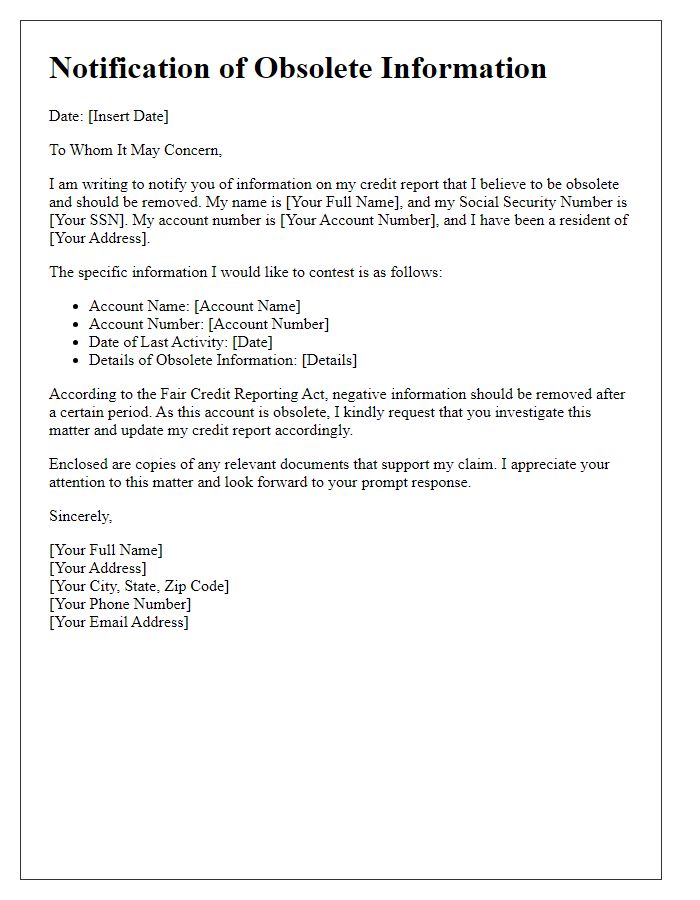

Disputing outdated credit information is essential for maintaining an accurate credit report. The first step involves clearly identifying the outdated item on the credit report, such as an incorrect account status, late payment records, or expired collection accounts. For instance, a collection account that should have been removed after seven years, according to the Fair Credit Reporting Act, can detrimentally affect credit scores if not addressed. Credit bureaus such as Experian, Equifax, and TransUnion must be informed of the specific entry, including details like the account number, creditor name, and the date of the last activity associated with the outdated entry. Accurate identification aids in expedient resolution, ensuring that individuals can restore their financial credibility efficiently.

Supporting Documentation

Outdated credit information can significantly impact an individual's credit score and financial standing. For example, a missed payment from 2018 may continue to appear on a credit report, affecting loan applications and interest rates. Supporting documentation, such as bank statements or payment receipts, serves as evidence to dispute inaccuracies. Credit reporting agencies, like Experian, Equifax, and TransUnion, require this documentation to validate claims and correct errors. Timely submission of disputes, within 30 days of identifying the mistake, is crucial to ensure prompt resolution and a more accurate credit report.

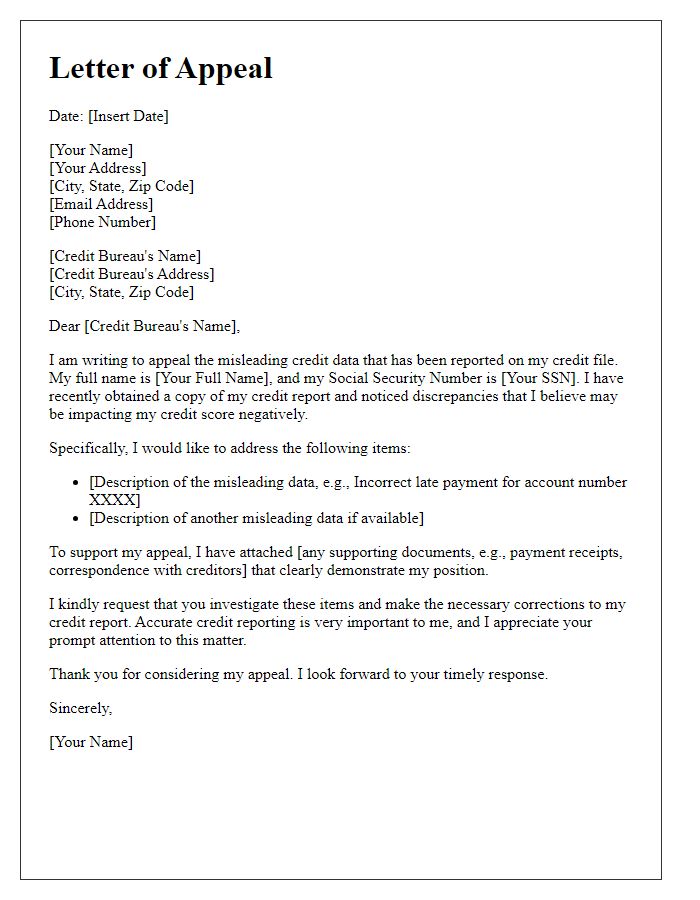

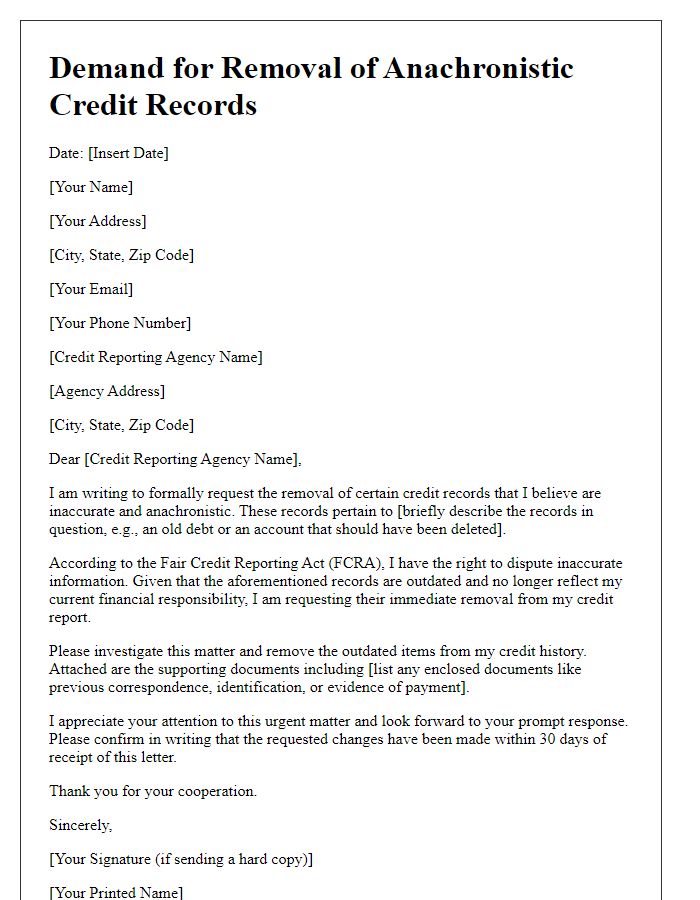

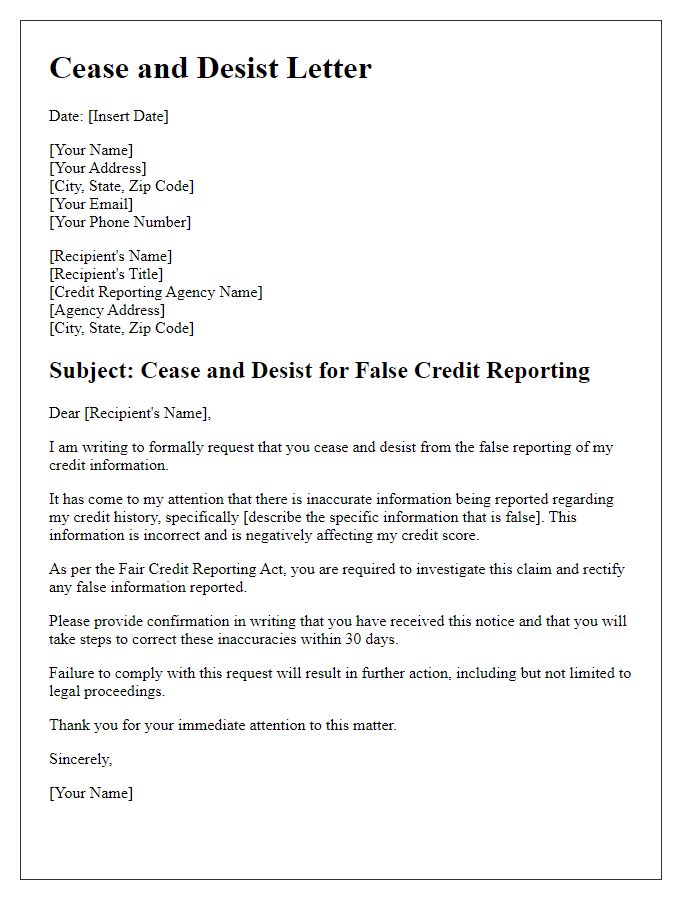

Formal Request for Removal

Disputing outdated credit information requires a detailed approach. Outdated credit information, such as late payments from over seven years ago or bankruptcies exceeding ten years, can significantly affect credit scores. The Fair Credit Reporting Act (FCRA) mandates accurate reporting of credit data. Credit bureaus, including Experian, TransUnion, and Equifax, must investigate disputes within 30 days. Providing supporting documents, such as account statements or discharge papers, strengthens the request. Including personal identification information, like Social Security numbers and previous addresses, is essential for accurate processing. Requesting formal removal of inaccuracies promotes improved financial opportunities, such as securing loans or favorable interest rates. Timely follow-up after submission ensures prompt resolution of disputes.

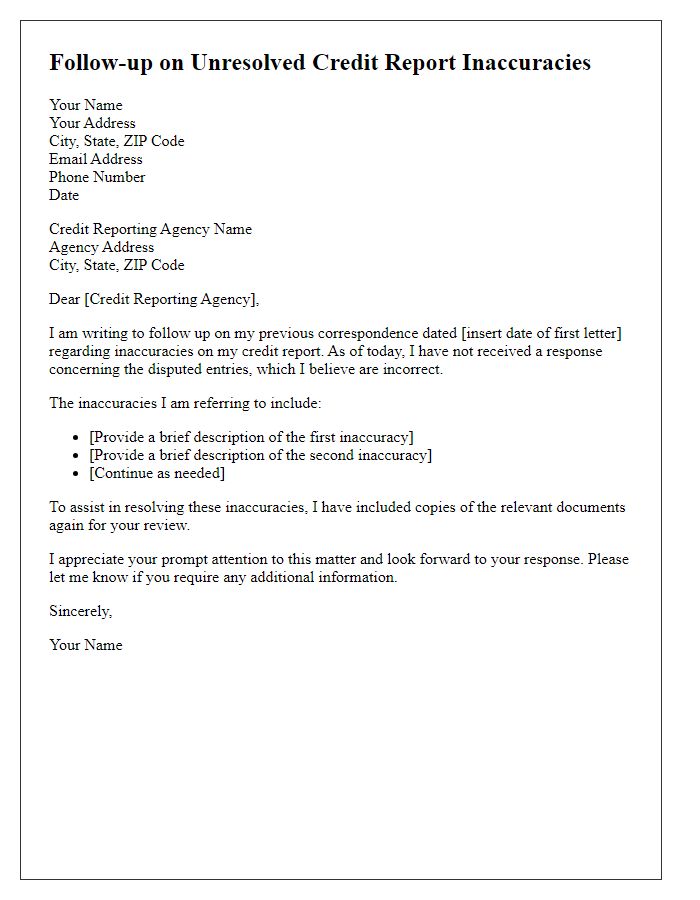

Contact Information for Follow-Up

Disputing outdated credit information requires meticulous attention to detail. An individual may gather contact information such as the name of the credit bureau, for example, Experian, Equifax, or TransUnion, along with their respective addresses (e.g., Experian: 701 Experian Parkway, Allen, TX 75013). It is essential to include phone numbers (for instance, Experian's customer service: 1-888-397-3742) and email addresses (like disputes@experian.com) for follow-up purposes. Accurate identification (such as Social Security number) and pertinent documentation (including previous correspondences and updated credit reports) must be organized to facilitate efficient resolution. Timely submission of the dispute form, usually available on the bureau's official website, enhances the likelihood of prompt attention to the outdated credit information and ensures a clear pathway for ongoing communication.

Letter Template For Disputing Outdated Credit Information Samples

Letter template of notification to credit bureau about obsolete information

Comments