Are you feeling overwhelmed by high credit card interest rates and fees? You're not aloneâmany people are looking for ways to ease their financial burden. Negotiating your credit card terms can be a powerful step towards saving money and regaining control over your finances. In this article, we'll guide you through the process and share tips that can help you successfully negotiate better terms; keep reading to discover how you can make those changes today!

Personalized Greeting

When negotiating credit card terms, it is essential to begin with a respectful and personalized greeting. For example, addressing the customer service representative or credit card manager with their name, such as "Dear Mr. Smith" or "Hello Ms. Johnson," establishes a courteous tone. This initial connection is crucial, as it sets the stage for a constructive conversation about interest rates, fees, or rewards programs, making it more likely for the representative to assist in resolving concerns or accommodating requests. Demonstrating politeness can lead to a more favorable outcome in negotiations.

Clear Statement of Purpose

Negotiating credit card terms can lead to more favorable conditions, especially regarding interest rates and fees. Credit card holders often seek lower annual percentage rates (APRs), typically around 15% to 25%, depending on individual credit profiles. Initiating a call to customer service or using secure online messaging through banking platforms helps establish direct communication with representatives. Presenting personal financial challenges, such as unexpected medical expenses or job loss, can support the request for reduced rates. Documenting payment history, including on-time payments and account age, builds a strong case for negotiating better terms. Moreover, discussing competitor offers from similar financial institutions also reinforces the request for favorable adjustments.

Detailed Account Information

Negotiating more favorable credit card terms can significantly reduce financial strain. Credit card accounts, such as Visa or MasterCard, often charge interest rates exceeding 15% annually, particularly for individuals with lower credit scores (typically below 600). Multiple late payments can compound these rates, leading borrowers deeper into debt. Account holders should prepare detailed information, including current balances, payment history over the past 12 months, and any recent changes in income or expenses. Additionally, documenting comparable offers from other financial institutions can strengthen the argument for lower interest rates or waived fees. Engaging in conversations with customer service representatives can provide insights into available programs or potential solutions, such as hardship plans designed for temporary financial difficulty.

Specific Request for Terms Adjustment

To negotiate credit card terms effectively, one can start by outlining specific requests, such as lower interest rates or waived fees. For instance, requesting a reduction of the annual percentage rate (APR) from 20% to 15% directly impacts the overall cost of borrowing. Additionally, if the current monthly maintenance fee is $10, proposing a waiver can enhance financial flexibility. It's crucial to mention factors like a consistent payment history, demonstrating fiscal responsibility over the past twelve months, along with the credit card issuer's loyalty programs. The importance of timely payments and maintaining a healthy credit score, such as above 700, could be emphasized to support the negotiation position. This approach can lead to favorable amendments in credit card agreements.

Expression of Appreciation and Next Steps

To enhance your understanding of credit card negotiations, express gratitude toward the issuer for past support. Acknowledge the positive experiences, such as reliable customer service or rewards programs that benefit frequent flyers like those offered by airlines (e.g., Delta SkyMiles credit card). Present your request clearly, using specific figures or terms, such as a lower annual percentage rate (APR), potentially aiming for 12% instead of the current 19%. Highlight any changes in financial circumstances, such as an increased income or improvements in credit score (e.g., a FICO score above 700). Conclude by suggesting a follow-up discussion or a preferred method of contact, emphasizing readiness to maintain a long-term relationship with the issuer, like those established with major banks (e.g., JPMorgan Chase).

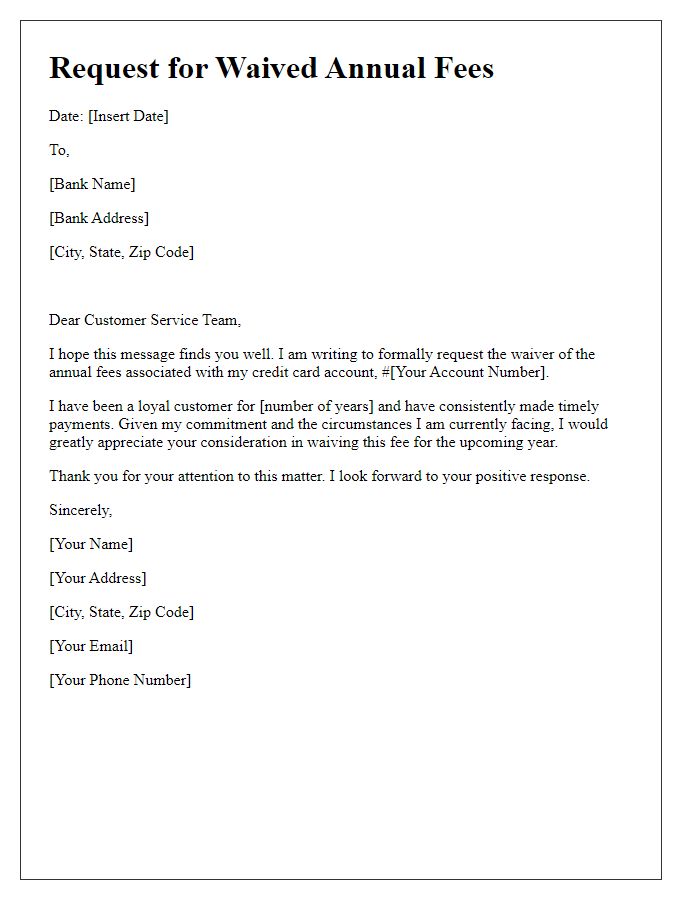

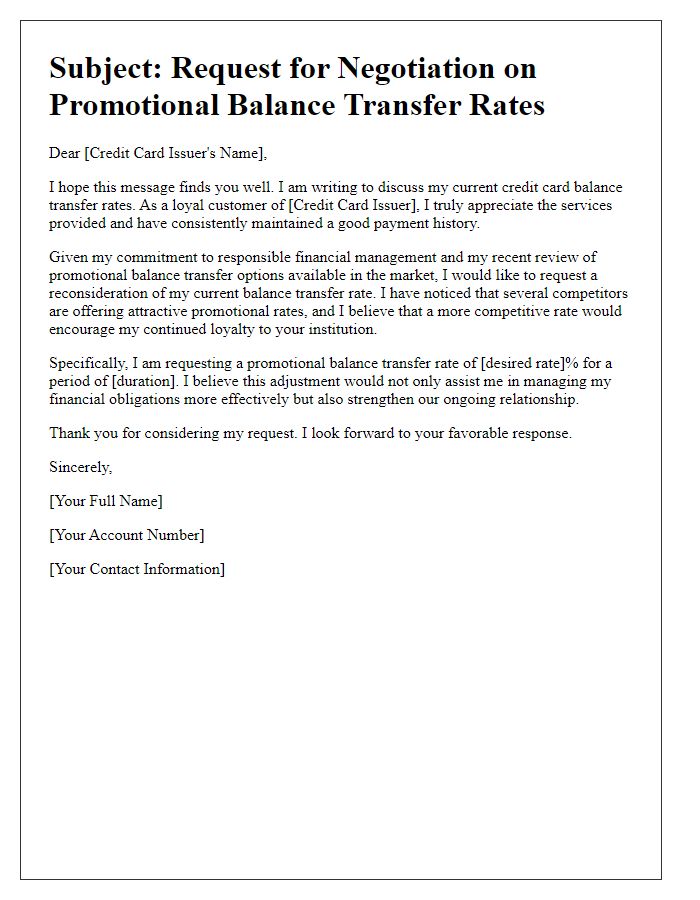

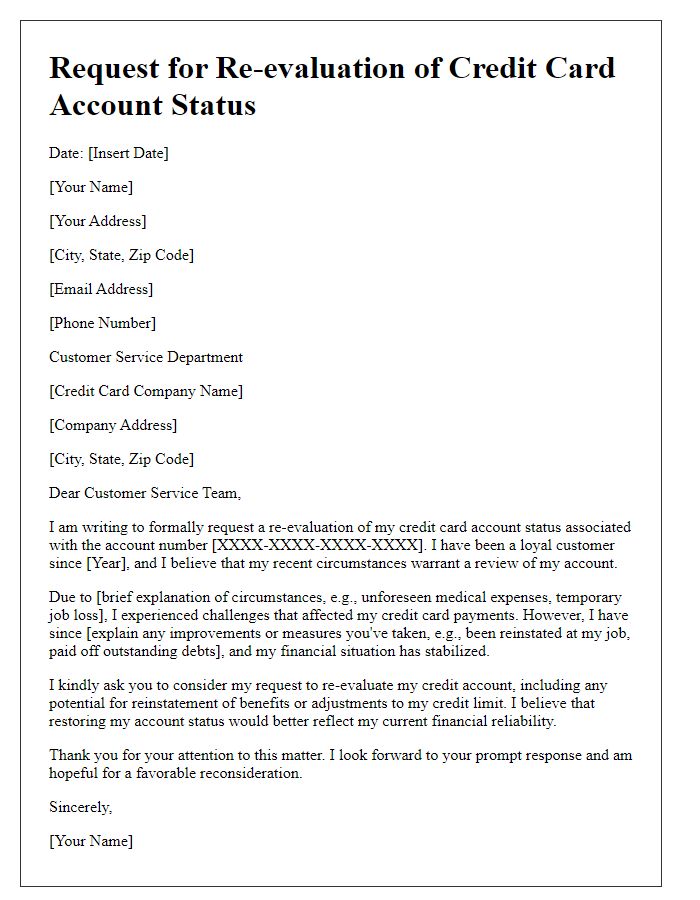

Letter Template For Negotiating Credit Card Terms Samples

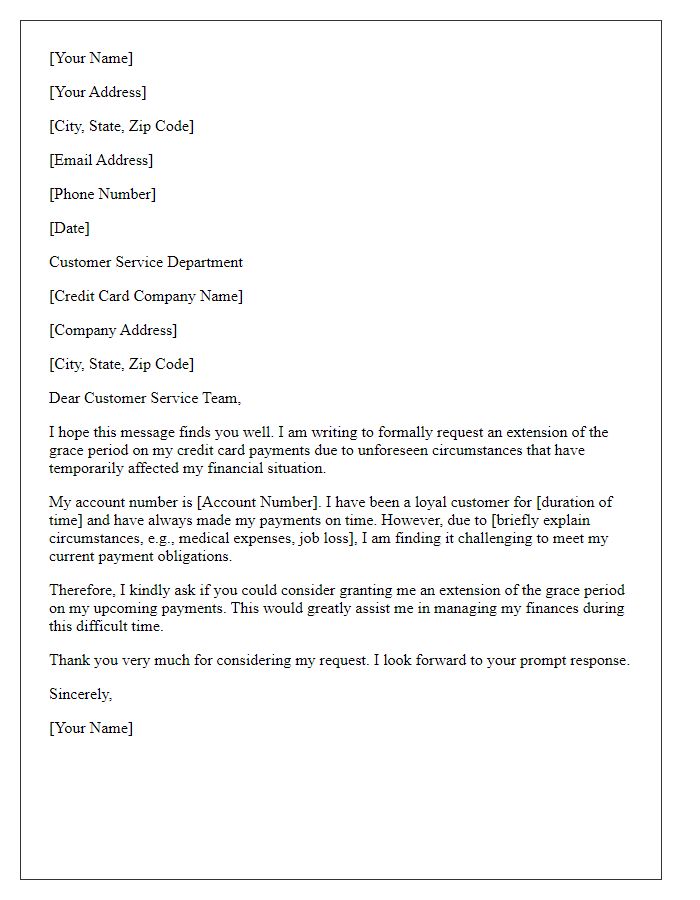

Letter template of inquiry for grace period extension on credit card payments.

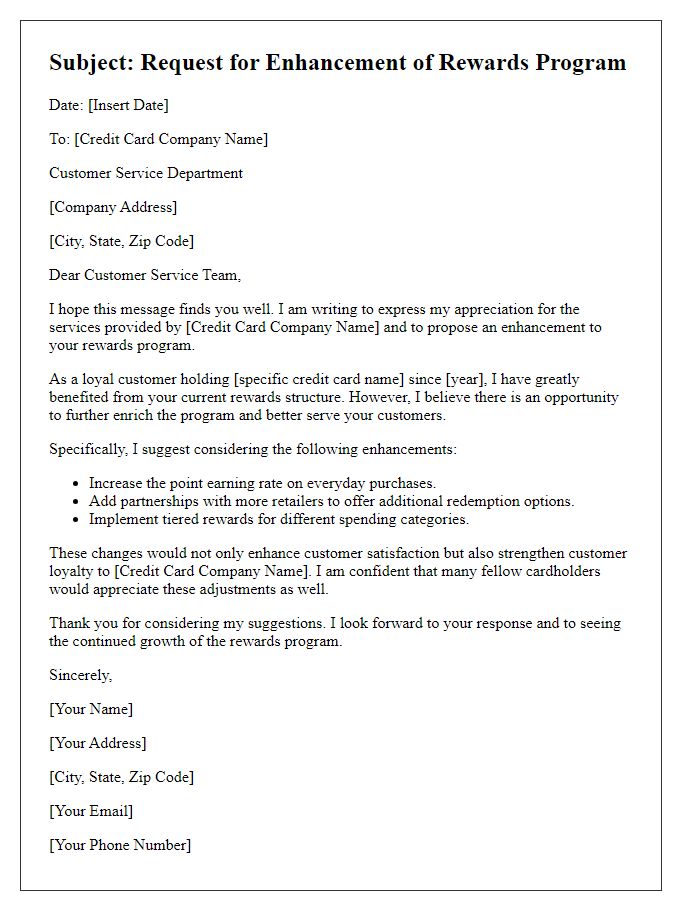

Letter template of appeal for rewards program enhancement on credit card.

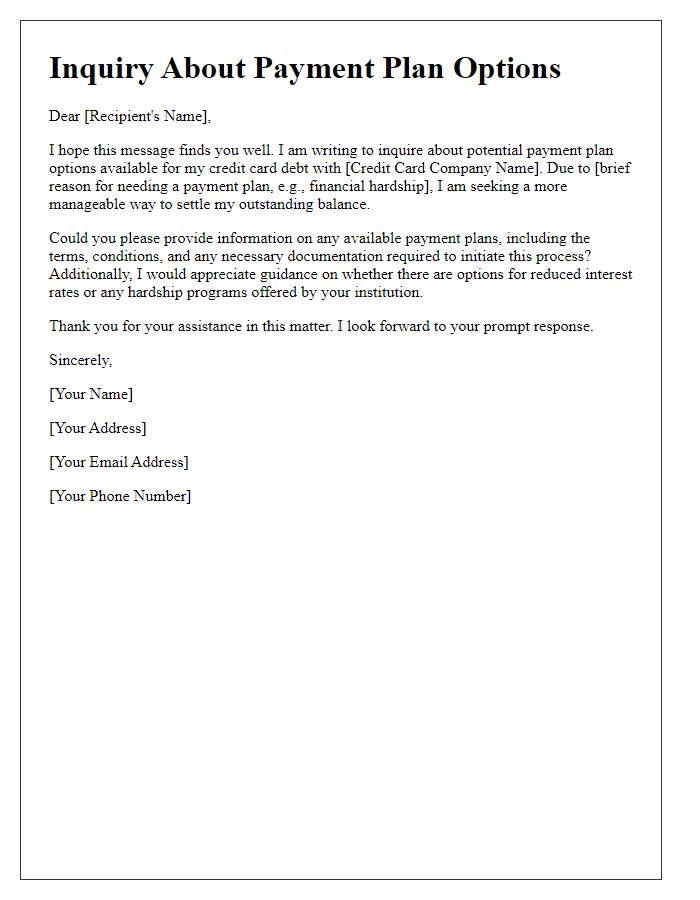

Letter template of inquiry about payment plan options for credit card debt.

Letter template of request for clarification on credit card terms and conditions.

Letter template of negotiation for late fee waiver on credit card account.

Comments