Are you feeling overwhelmed by the task of rebuilding your credit history after bankruptcy? You're not aloneâmany people find themselves in similar situations and are eager to turn things around. With the right steps and a bit of patience, you can pave the way for a brighter financial future. Join me as we explore effective strategies to reestablish your credit and regain your financial footing.

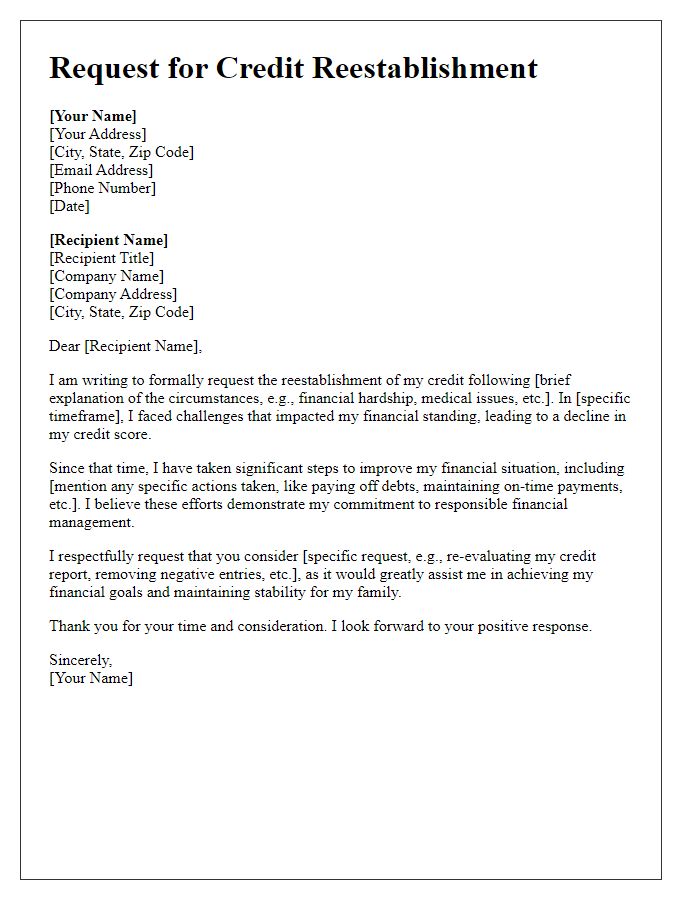

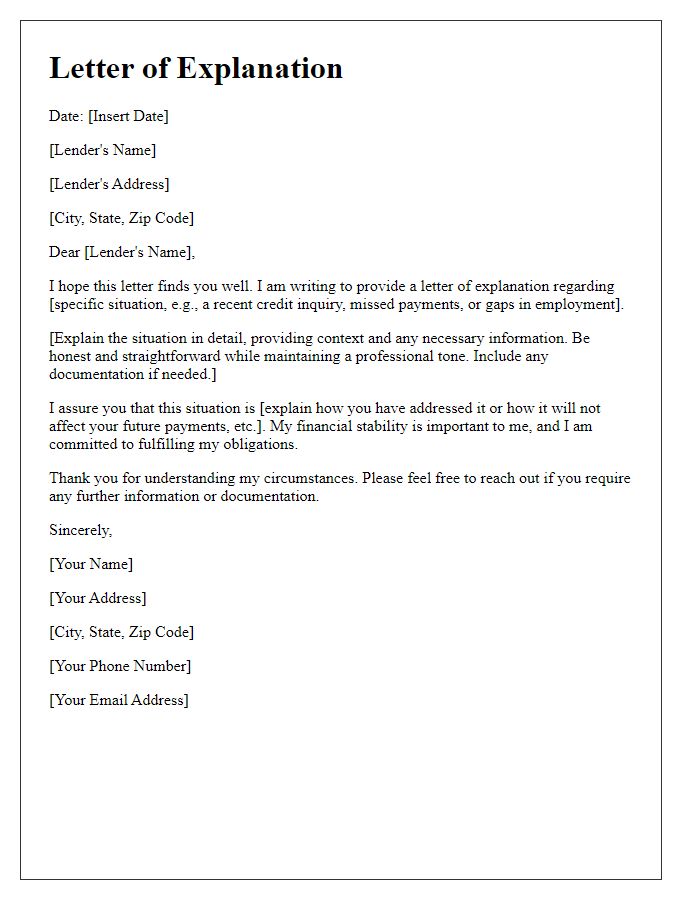

Personalized narrative of financial recovery

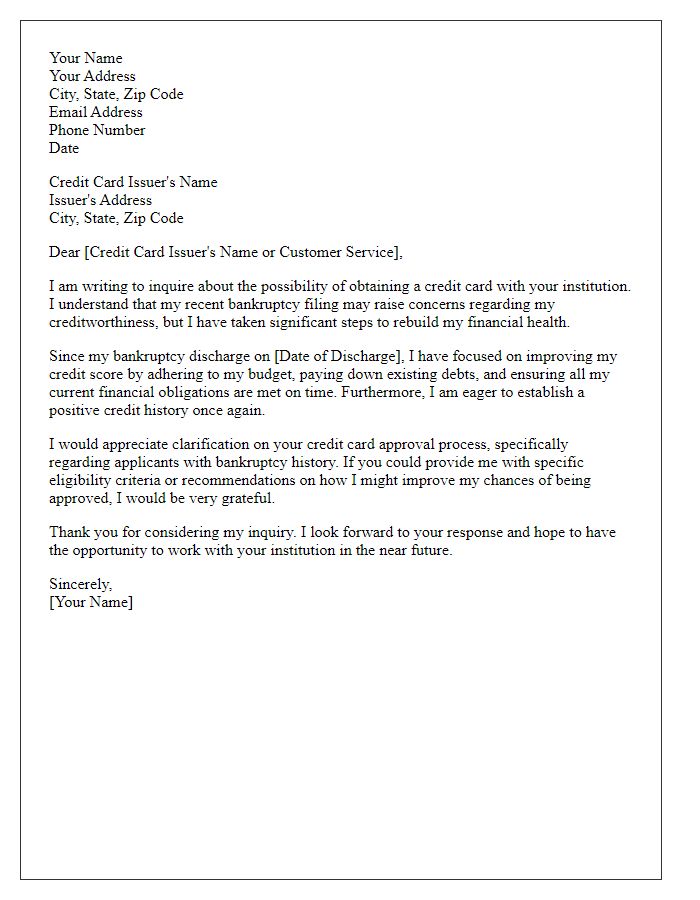

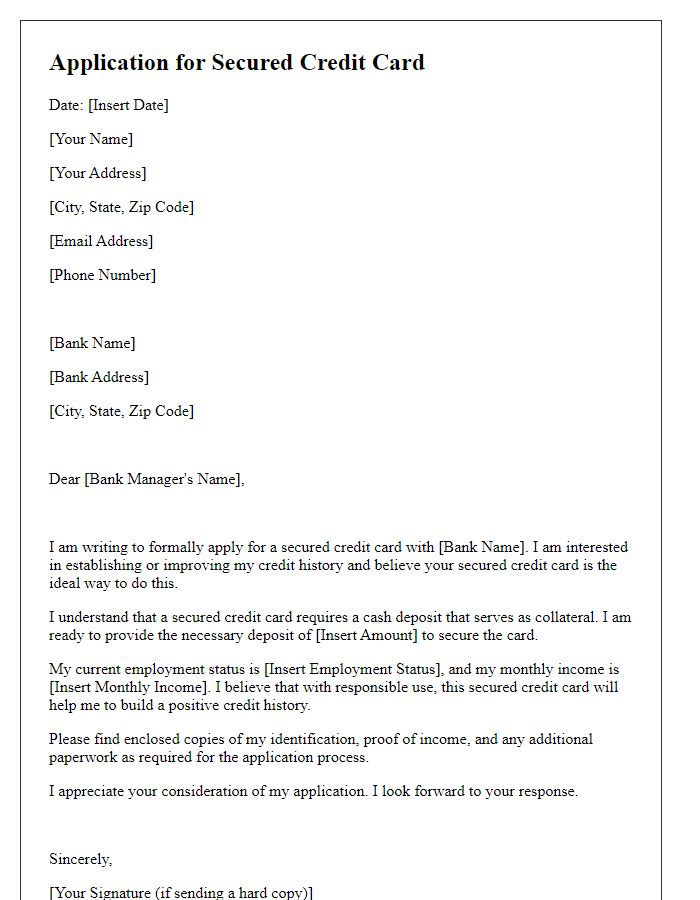

Reestablishing credit history after bankruptcy can commence with a focus on securing a secured credit card, specifically designed for individuals with a history of bankruptcy. These cards generally require a cash deposit that serves as the credit limit, often ranging from $200 to $500. Regular, timely payments on this account can gradually improve a credit score, which typically reflects on reports from major bureaus like Experian and TransUnion within 30 days. Establishing a diverse credit mix by incorporating personal installment loans, often available through credit unions, can further enhance the credit profile. Additionally, monitoring credit reports regularly through platforms like Credit Karma can help identify and dispute inaccuracies, ultimately fostering a more positive credit landscape. Engaging in educational programs on financial literacy offered by organizations such as the National Foundation for Credit Counseling can also provide valuable strategies for sustained financial improvement and management.

Demonstration of current financial stability

Reestablishing a solid credit history after experiencing bankruptcy requires careful financial planning and prudent management of resources. Since the discharge of bankruptcy, individuals often focus on essential expenses like housing (mortgage or rent payments), utilities (electricity, water, and internet services), and transportation (public transit or vehicle maintenance). Establishing a budget aids in tracking these necessary expenditures while avoiding unnecessary debt. Opening a secured credit card, where the user's deposit functions as the credit limit, can help in demonstrating responsible credit usage. Utilizing services like credit monitoring, available through various providers such as Experian or TransUnion, can aid in maintaining awareness of credit scores, helping one understand improvement over time. Engaging in community financial workshops, offered by local non-profits or banks, can provide additional resources and support. By maintaining timely payments and minimizing credit utilization, individuals can exhibit financial stability conducive to gradually improving creditworthiness post-bankruptcy.

Evidence of consistent income and employment

Reestablishing credit history after bankruptcy involves demonstrating financial stability and responsible credit use. Consistent income, ideally bolstered by a stable job in reputable organizations, plays a crucial role in this process. Employment verified by pay stubs (typically showing six months of income) can affirm financial reliability. Monthly income should meet or exceed a threshold (such as 300% of the federal poverty line for a specific household size) to illustrate the capability to handle new credit responsibly. Additionally, transitioning from a Chapter 7 bankruptcy (liquidation bankruptcy) to an income-driven repayment plan can further improve creditworthiness by establishing a track record of timely payments on secured debts, such as auto loans or mortgages. Credit counseling from certified agencies can provide guidance through this intricate process, enhancing the potential for loan approvals in the future.

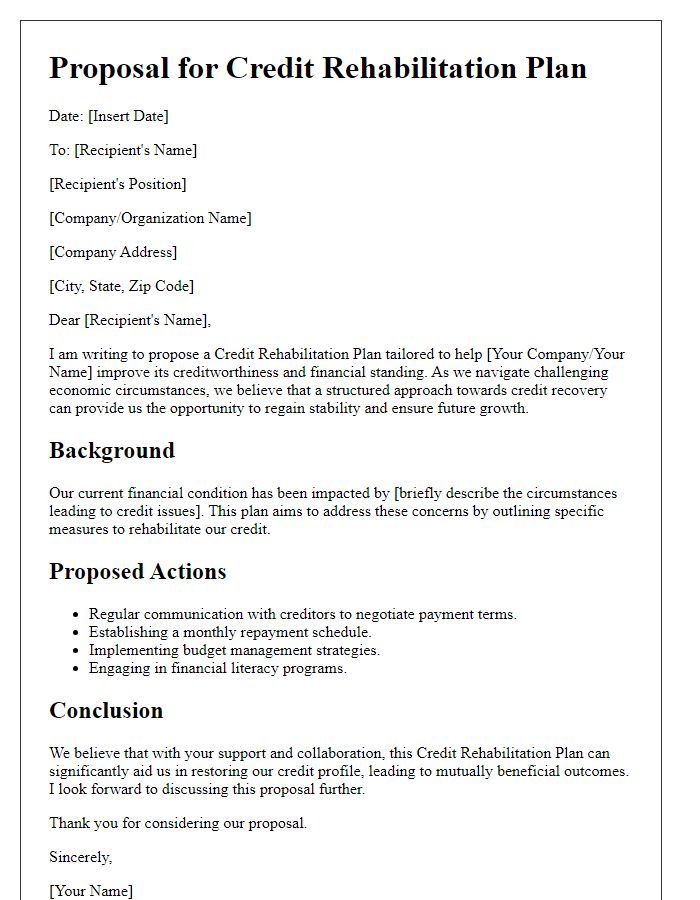

Reference to specific financial goals

Reestablishing credit history post-bankruptcy requires a focused strategy centered around specific financial goals. Initiating with secured credit cards, often requiring a cash deposit as collateral, can enhance credit scores derived from responsible usage (keeping balances under 30% of the credit limit). Establishing a savings account with local banks allows for consistent savings habits while also creating an emergency fund, essential for financial stability. Setting clear goals, such as purchasing a vehicle within three years or securing a mortgage for a home in five years, can motivate disciplined financial management. Monitoring credit reports regularly through services like AnnualCreditReport.com ensures awareness of progress and credit score improvements due to timely payments and active credit utilization. Engaging with reputable credit counseling services can aid in creating tailored plans towards these objectives, facilitating a smoother financial recovery journey.

Assurance of future credit management practices

Reestablishing credit history after bankruptcy requires diligent financial behavior and strategic planning. Individuals must begin by monitoring credit reports from agencies such as Experian, TransUnion, and Equifax, noting any discrepancies and disputing inaccuracies that may hinder recovery. Opening a secured credit card, ideally with a credit limit of around $300 to $500, can demonstrate responsible usage, while keeping utilization below 30% to positively influence credit scores. Timely payments on all accounts, including loans and utilities, are crucial, emphasizing consistency over several months. Enrolling in credit counseling services can provide additional support and education on effective budgeting techniques. Establishing an emergency fund of at least three to six months' worth of expenses can further enhance financial stability, reducing reliance on credit in the event of unforeseen circumstances.

Comments