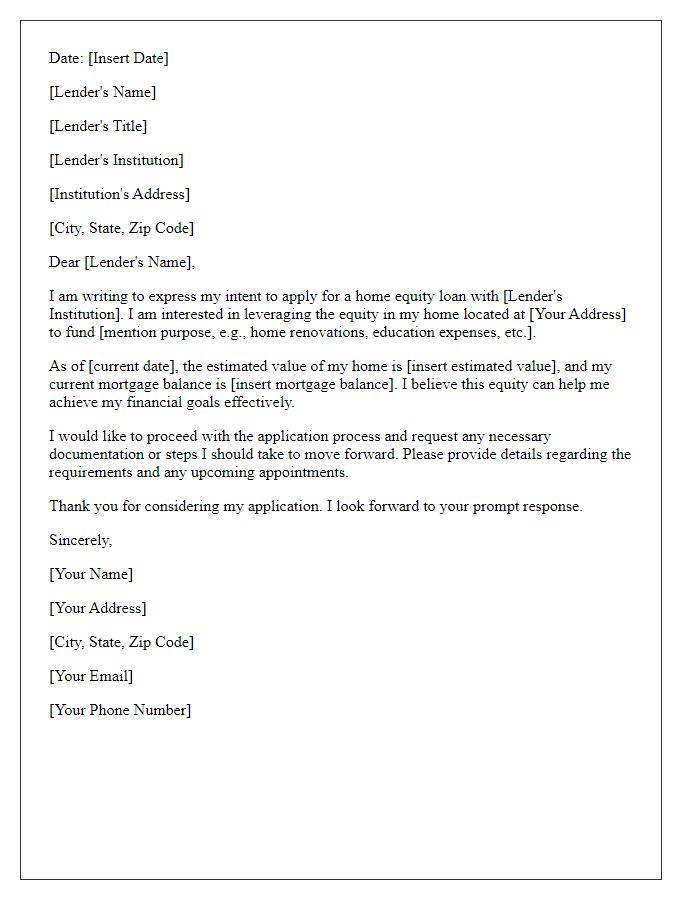

Are you thinking about tapping into the equity of your home to fund your next big project or make some necessary renovations? A home equity loan can be a great way to access the cash you need, and crafting a clear and concise application letter is an essential step in the process. In this article, we'll explore key components to include in your letter, ensuring you present the strongest case possible to lenders. So, let's dive in and discover how to make your home equity loan application stand out!

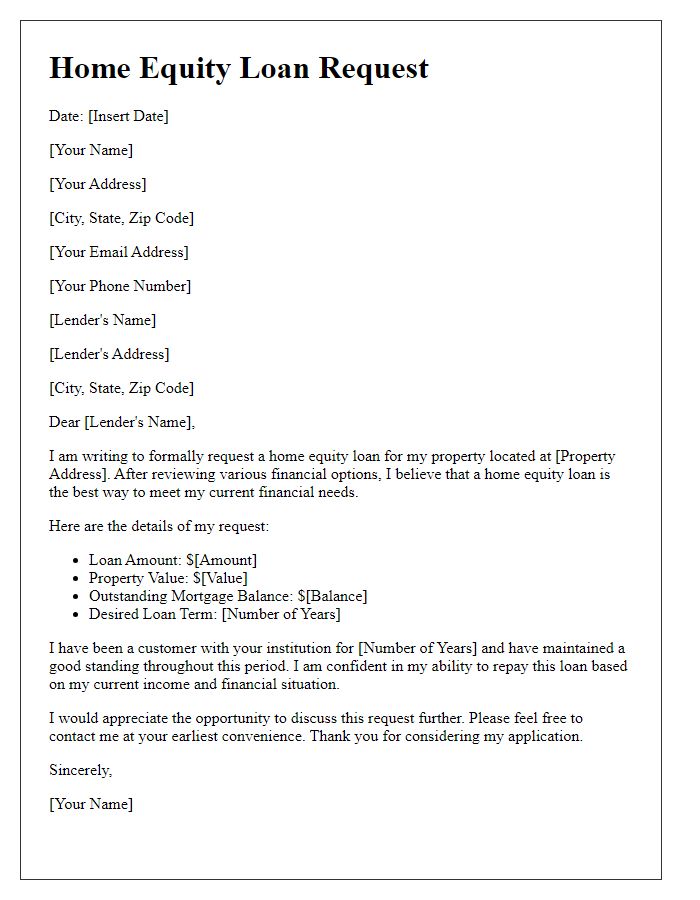

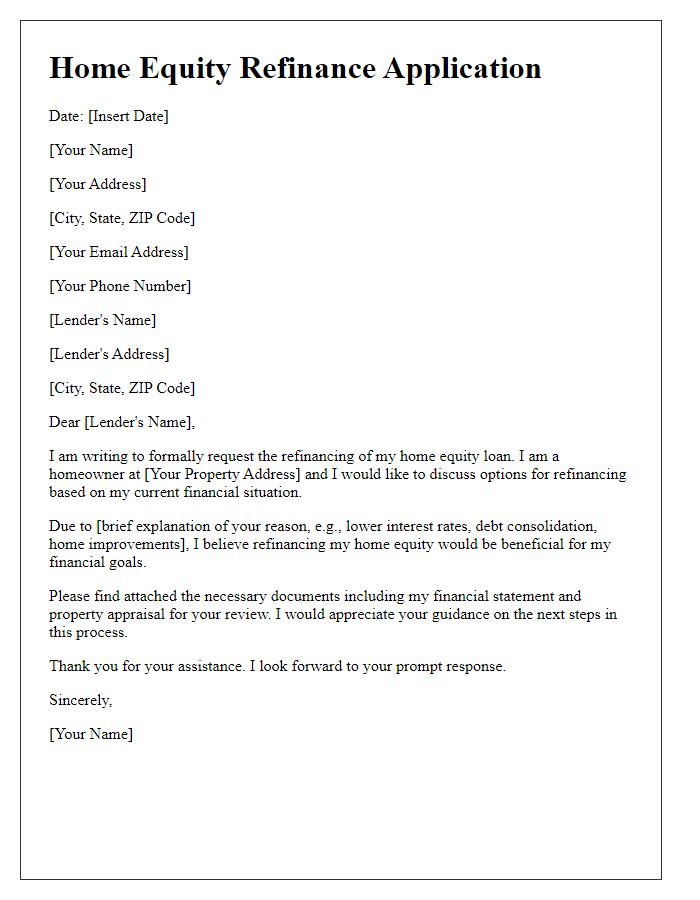

Borrower's personal information

When applying for a home equity loan, borrowers must provide essential personal information to the lender for consideration. Key details include the borrower's full name, contact information (address, phone number, and email), Social Security number (for credit verification), date of birth (to establish identity), and employment information (employer name, position, length of employment, and annual income). Additionally, borrowers should include property details such as the address of the home being leveraged, its estimated market value, and existing mortgage information (lender name, loan balance, and payment history) to give the lender a comprehensive overview of their financial situation. This information helps in determining creditworthiness and loan amount eligibility.

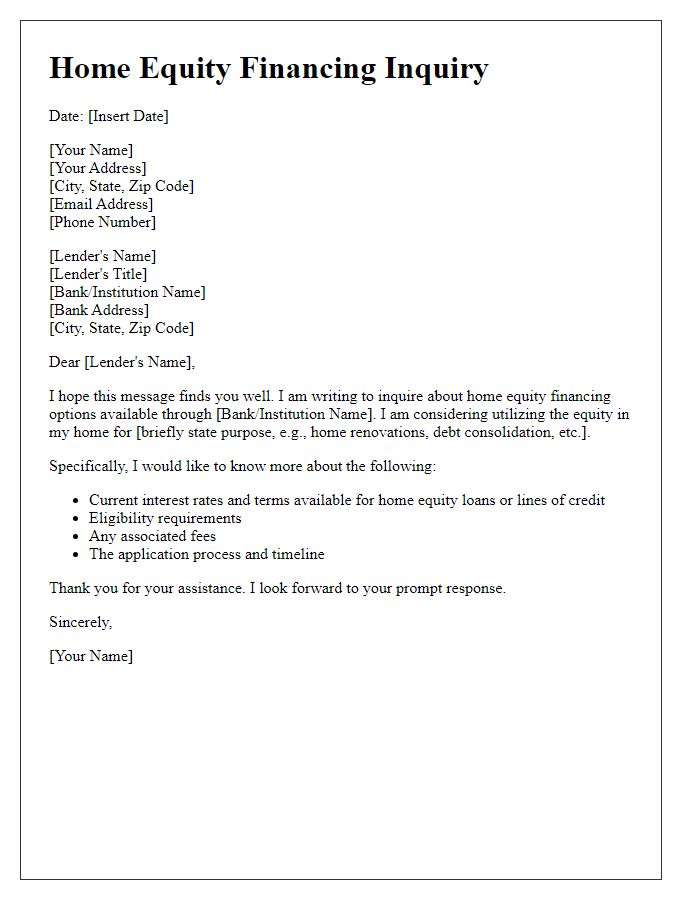

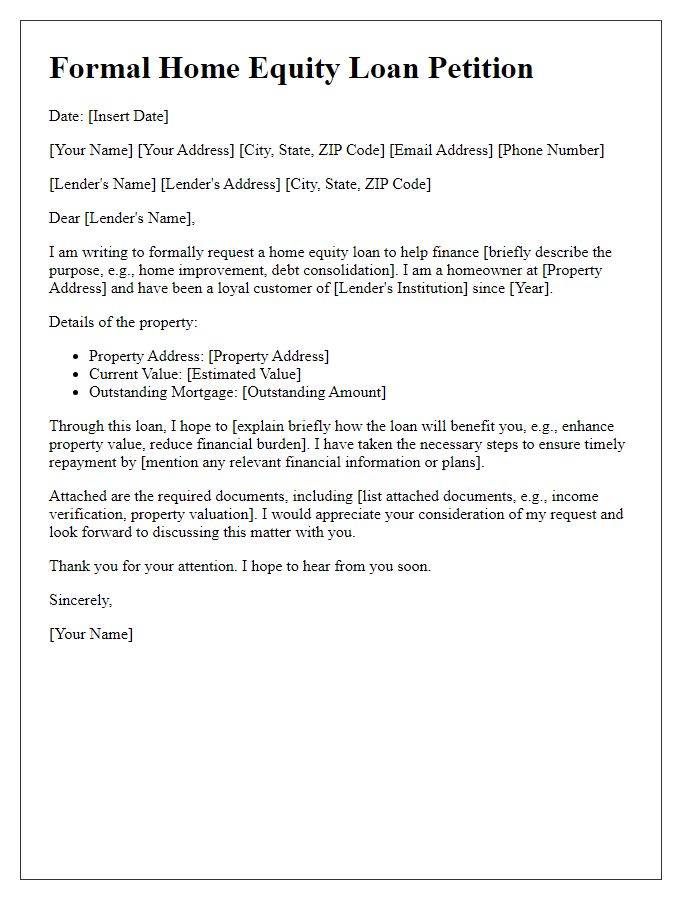

Property details and current value

Home equity loans utilize the existing value of residential properties such as single-family homes, townhouses, and condominiums as collateral for borrowing. A home's current market value is typically determined through an appraisal process, which evaluates factors such as location, comparable property sales, and appraised condition. Properties in areas with strong market demand, like urban centers or rapidly developing suburbs, may achieve values significantly above the national average, which can exceed $300,000 in many regions. Home equity ratios are calculated by taking the existing mortgage balance and comparing it to the property's appraised value, with lenders often allowing loans up to 85% of that equity.

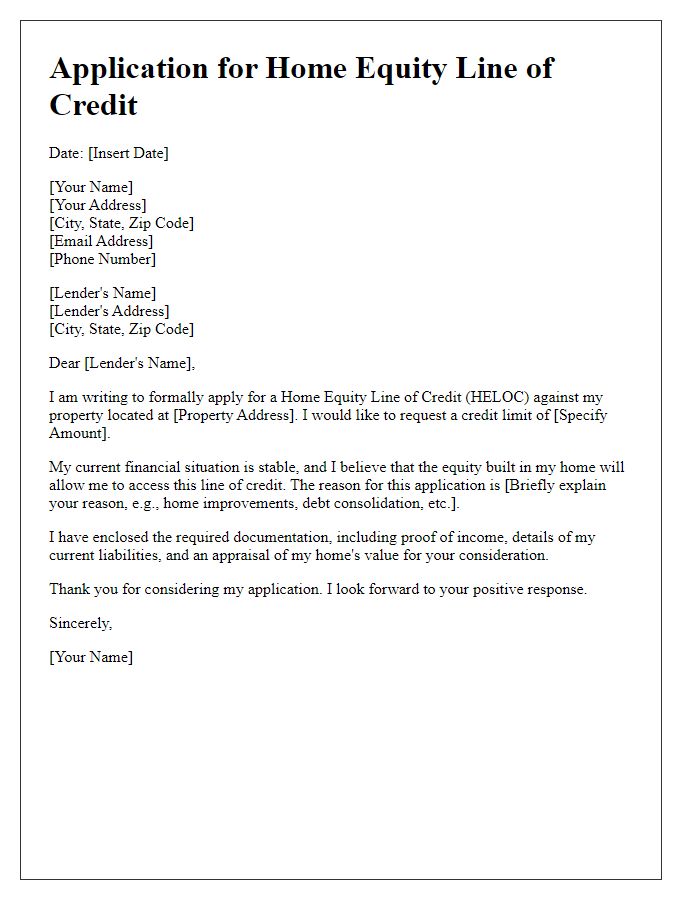

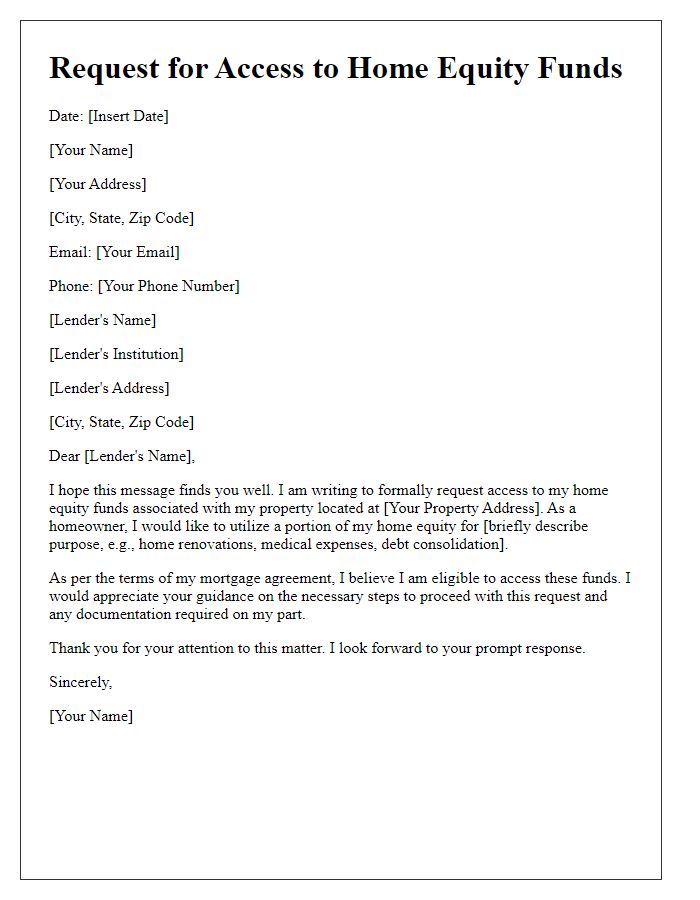

Loan amount requested and purpose

Home equity loans enable homeowners to leverage their property for various financial needs. Typical loan amounts range from $10,000 to $500,000, depending on the home's equity and lender policies. Purposes often include debt consolidation (paying off high-interest credit cards), home improvements (adding a new bathroom or kitchen), education expenses (covering tuition fees) or major purchases (such as a new vehicle). Lenders evaluate factors like credit score, income, and current mortgage balance during the application process to determine eligibility and terms. Understanding these elements helps applicants prepare effectively.

Borrower's employment and income details

The borrower, a resident of Springfield, has been employed at Tech Solutions Inc. for over five years as a Software Engineer, with an annual salary of $85,000, based on recent pay stubs. The company, located at 456 Technology Drive, specializes in innovative software development and has a strong market presence. Additionally, the borrower receives a yearly bonus averaging $5,000 based on performance metrics established by the employer. This combination of stable income and bonuses indicates a solid financial standing, ensuring the capability to manage the home equity loan effectively. The borrower has also provided tax documents from the last two years, showing consistent income without significant deductions.

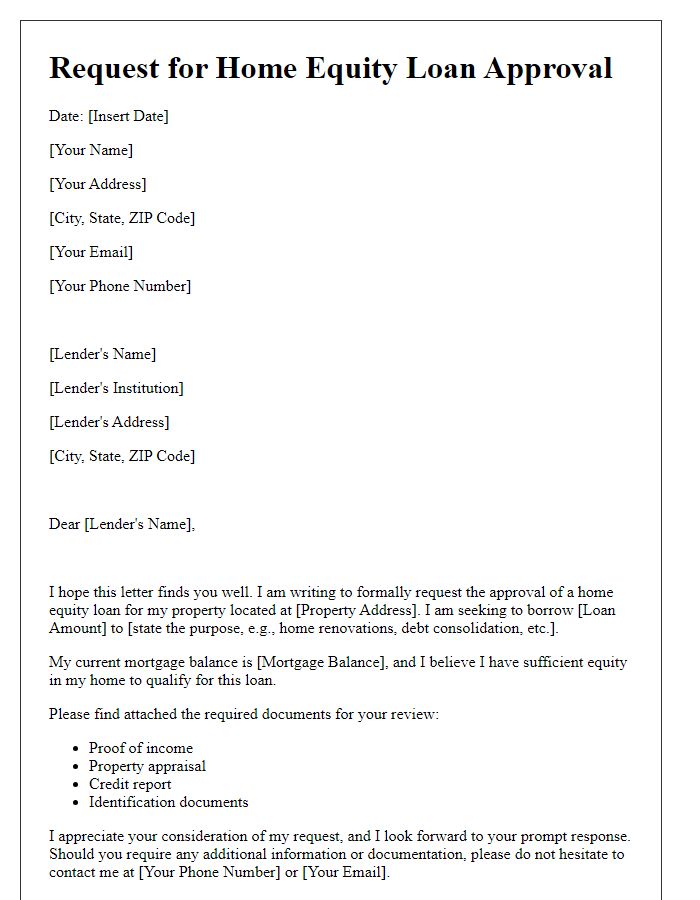

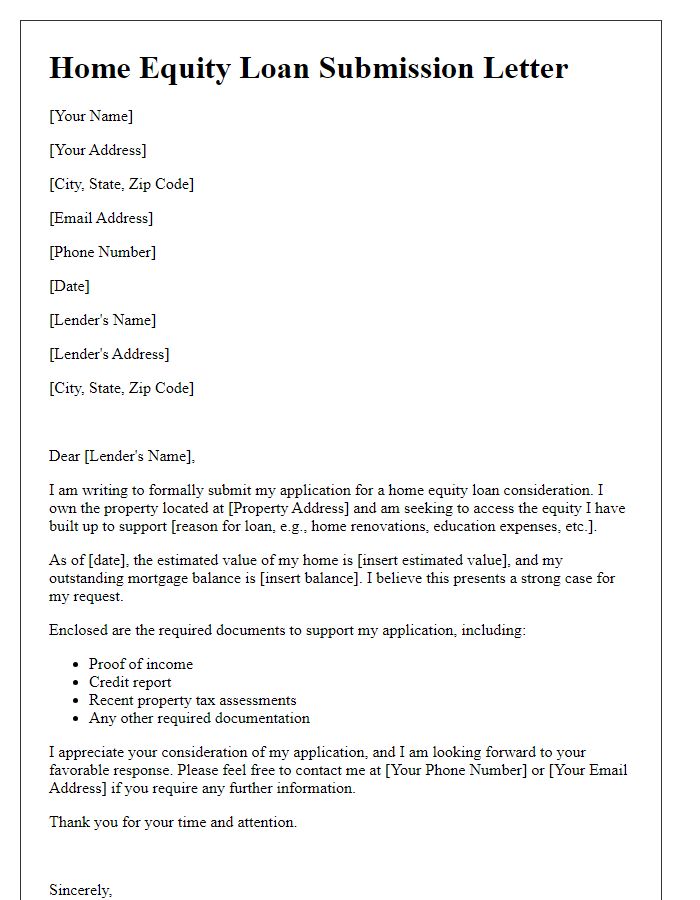

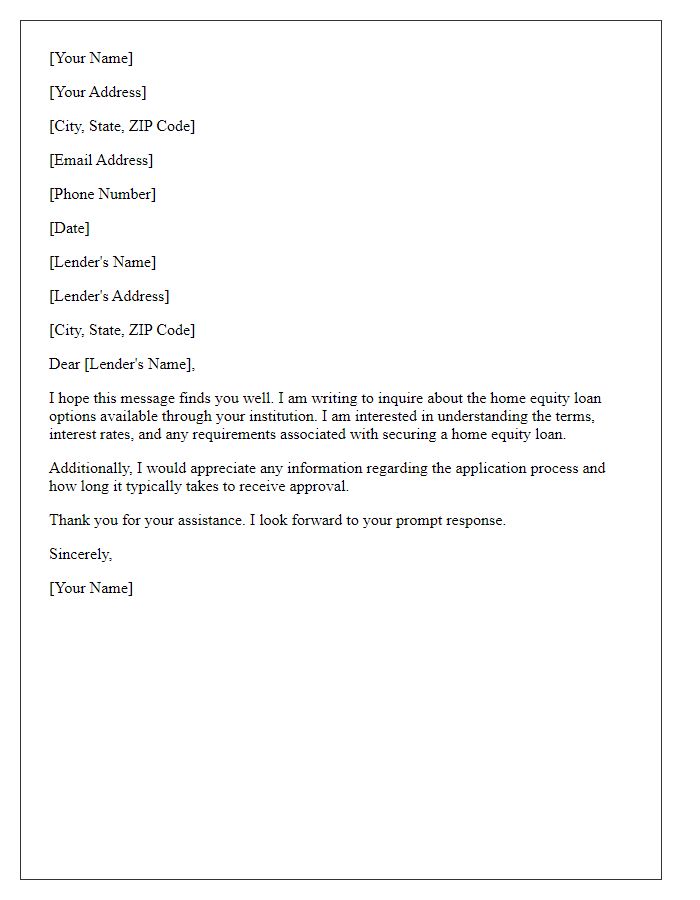

Documentation checklist and consent for credit check

A home equity loan application requires various essential documents to ensure a smooth processing experience. Applicants must provide proof of identity, such as a government-issued ID (passport or driver's license), income verification via recent pay stubs or tax returns, and property documentation, including the most recent mortgage statement and title deed. Additionally, a detailed credit report consent form must be signed, allowing lenders to assess creditworthiness and evaluate risk based on credit history. It is crucial to compile all these documents thoroughly, as incomplete submissions can lead to delays or rejection of the application. Understanding interest rates, potential fees, and terms associated with home equity loans can better prepare applicants for discussions with lenders.

Comments