In today's fast-paced corporate landscape, mergers and acquisitions are becoming more prevalent than ever. Companies are joining forces to enhance their market reach, drive innovation, and create value for stakeholders. This transition can feel daunting, but understanding the process and proper communication strategies can make all the difference. Curious to learn how to craft effective merger and acquisition notifications? Read on!

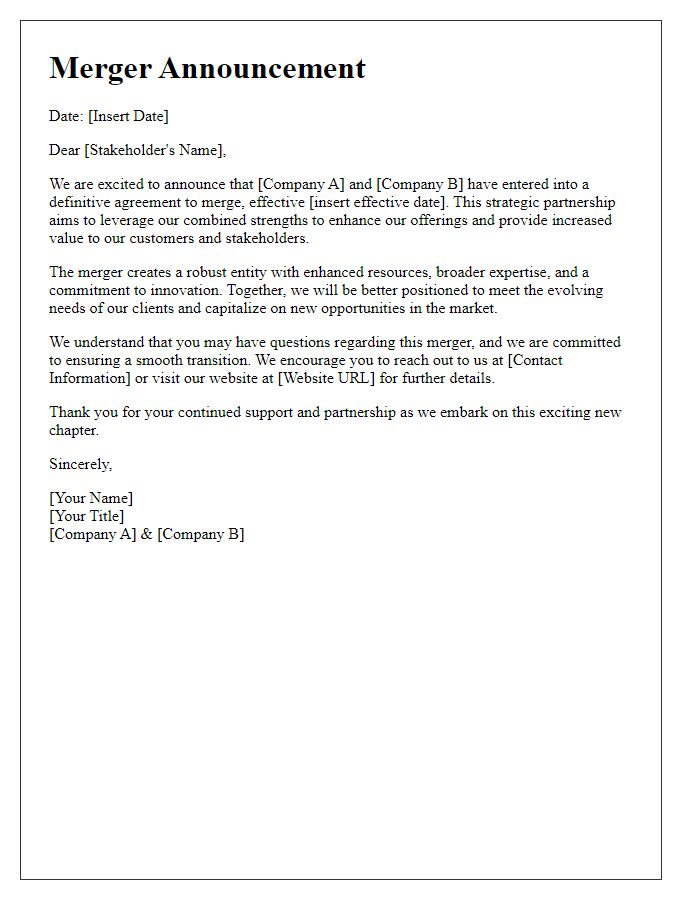

Company details and contact information

Company mergers and acquisitions can significantly impact business operations and market positioning. In the context of a merger, two companies, such as Tech Innovations Inc. and Future Solutions LLC, may decide to combine their resources to enhance product offerings and expand market reach. Essential details include the merger date, which might be set for January 15, 2024, and the new company name, Tech Future Holdings. Stakeholders should be informed of the contact information, including the corporate headquarters located at 500 Technology Drive, Silicon Valley, CA, 94043, and the primary contact, John Doe, Chief Financial Officer, reachable at johndoe@techfuture.com or (123) 456-7890. Notifications can outline strategic objectives and anticipated benefits, with a focus on the collaborative strengths that both companies bring to the table, such as enhanced innovation capabilities and an expanded customer base.

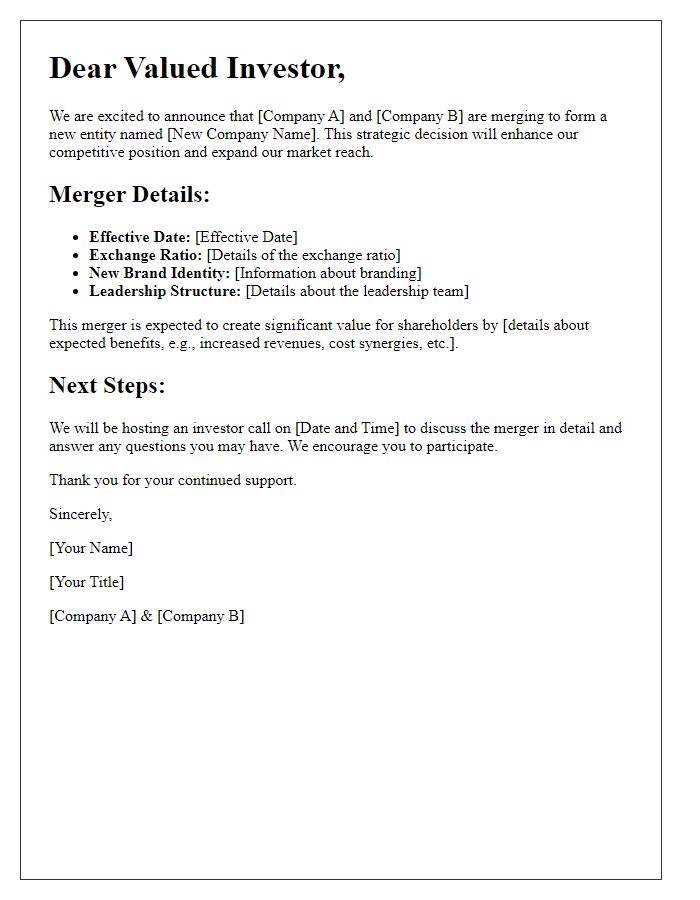

Purpose and overview of the transaction

The merger and acquisition transaction between Company A, a leading technology firm with a valuation exceeding $5 billion, and Company B, a prominent player in the renewable energy sector, aims to create a combined entity that enhances market reach and innovation capabilities. This strategic move, anticipated to close by Q2 2024, seeks to leverage Company A's expertise in software development and Company B's strengths in green energy solutions, ultimately fostering sustainable growth and operational efficiencies. The merger, which follows extensive negotiations initiated in early September 2023, intends to enhance shareholder value and expand product offerings, positioning the new entity as a frontrunner in the evolving energy technology landscape.

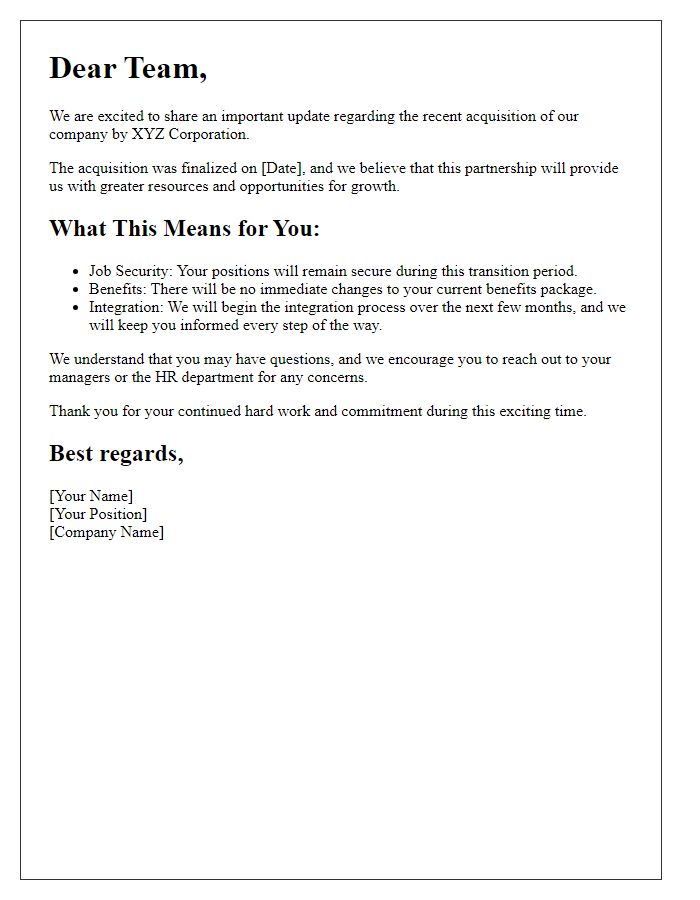

Key benefits and impact on stakeholders

The merger between Company A, a leading technology firm with a market capitalization of $10 billion, and Company B, a robust player in the software industry known for its innovative solutions and customer base of over 5 million users, represents a significant milestone in the business landscape. This strategic consolidation aims to create synergies that enhance operational efficiency, leading to projected cost savings of approximately $300 million annually. Stakeholders, including employees, investors, and customers, can expect improved product offerings through combined research and development resources. Enhanced market presence is anticipated, with an expanded international footprint in regions like North America and Europe. The merger is poised to drive increased shareholder value, with forecasts suggesting a 20% increase in stock prices within the next year, solidifying the financial stability and growth trajectory for all parties involved.

Timelines and transitional arrangements

The merger between Tech Innovations Inc. and Green Solutions Ltd., finalized on July 1, 2023, marks a significant milestone in the technology and environmental services sectors. The integration process will begin immediately, with departmental transitions scheduled to commence on July 15, 2023. Critical timelines include the completion of employee onboarding workshops by July 30, 2023, aimed at merging corporate cultures and communication strategies. Key systems such as project management platforms and customer relationship management tools will undergo a phased integration, with a full transition expected by August 31, 2023. Stakeholders will receive monthly updates on the integration progress, ensuring transparency throughout the merger process.

Regulatory and compliance information

Merger and acquisition notifications involve various regulatory and compliance considerations essential for a successful transition. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States oversee antitrust laws, ensuring that market competition is not negatively impacted. The Hart-Scott-Rodino Antitrust Improvements Act mandates that companies notify these federal agencies before merging if their transaction exceeds certain monetary thresholds, typically around $101 million. Regulatory authorities scrutinize vertical and horizontal mergers for potential monopolistic practices that could harm consumers and competition. Compliance with the Securities and Exchange Commission (SEC) guidelines is essential for publicly traded companies, including providing detailed disclosures and filing appropriate forms such as Form S-4 or 8-K. Furthermore, international regulations, such as the European Union's Merger Regulation, require notifications if the companies meet established turnover thresholds, emphasizing the global nature of merger compliance. Failure to adhere to these regulations may lead to fines or blocking of the merger, making meticulous attention to regulatory frameworks crucial for companies involved in significant consolidation activities.

Comments