Are you navigating the complex waters of outlining your exit strategy? Whether you're a business owner planning a transition or an investor looking to maximize returns, understanding the intricacies of exit strategy disclosures is crucial. In this article, we'll break down the key elements that should be included in your letter template, ensuring clarity and compliance in your communications. Join us as we explore effective strategies and insights to create a compelling exit strategy disclosure that you won't want to miss!

Confidentiality Assurance

Confidentiality assurance in exit strategy disclosures is critical for safeguarding sensitive information concerning companies and stakeholders. Strict confidentiality protocols must be established for documents detailing exit strategies, including buy-sell agreements, merger insights, or divestiture plans. Unauthorized access to this information can lead to market speculation, affecting stock prices (which may fluctuate significantly, often by several percentage points), and damaging negotiations. Clear guidelines should dictate access limits, ensuring only designated parties, such as corporate attorneys and financial advisors, can view these documents. Legal frameworks, such as non-disclosure agreements (NDAs), must be reinforced to protect proprietary data and strategic plans before, during, and after the exit process, thus preserving the integrity of sensitive business operations.

Financial Details and Valuation

An exit strategy disclosure outlines crucial financial details and valuations for businesses considering transitions, such as mergers or acquisitions. In 2023, average valuation multiples for tech startups in the United States reached 5.2x EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), significantly impacting potential buyers' decisions. Furthermore, financial records showcase revenue trends, such as a 30% year-over-year growth, reflecting the company's market position. Important metrics like customer acquisition cost (CAC) of $250 and lifetime value (LTV) of $1,500 reveal profitability potential, enhancing attractiveness to investors. Market conditions, influenced by economic indicators like a 3.5% unemployment rate, can significantly influence exit timing decisions, affecting overall valuation and return on investment (ROI) calculations.

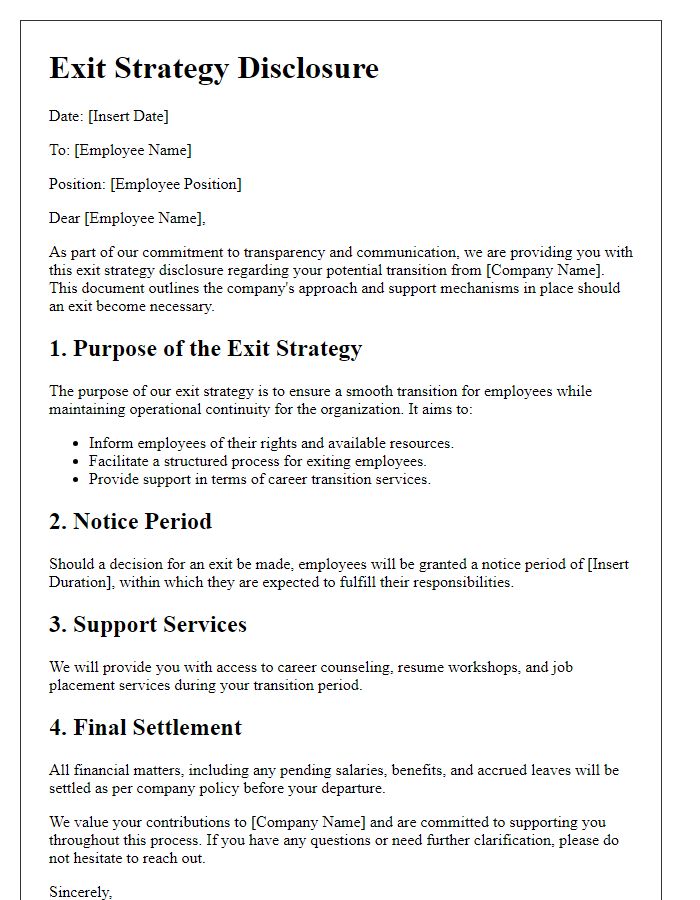

Transition Timeline

A well-defined transition timeline is essential for effective exit strategy disclosures, outlining the key phases of disengagement for businesses. This timeline may begin with initial planning stages occurring over a six-month period, detailing critical milestones such as stakeholder consultations and asset inventory assessments. Following planning, a six-week implementation phase is established, highlighting project kickoff meetings at corporate headquarters, along with detailed roles assigned to team members. The final stage focuses on post-transition evaluations including performance reviews and customer feedback sessions, scheduled to take place three months after the transition. Comprehensive documentation of each phase, including stakeholders like investors and employees, ensures transparency and encourages smooth communication throughout the process. Adhering to this structured timeline can reduce disruptions and foster ongoing relationships with all parties involved.

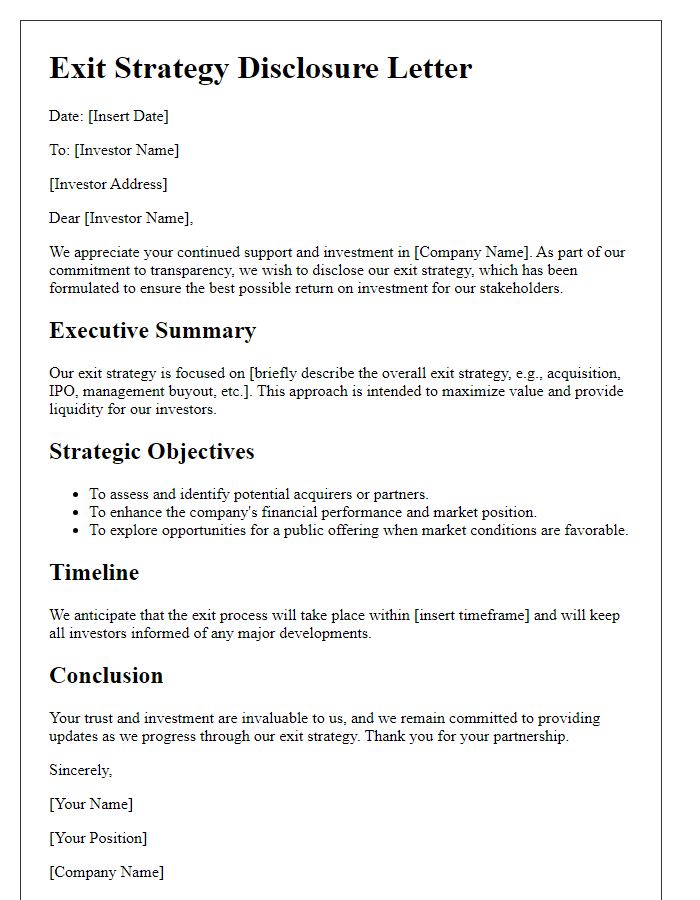

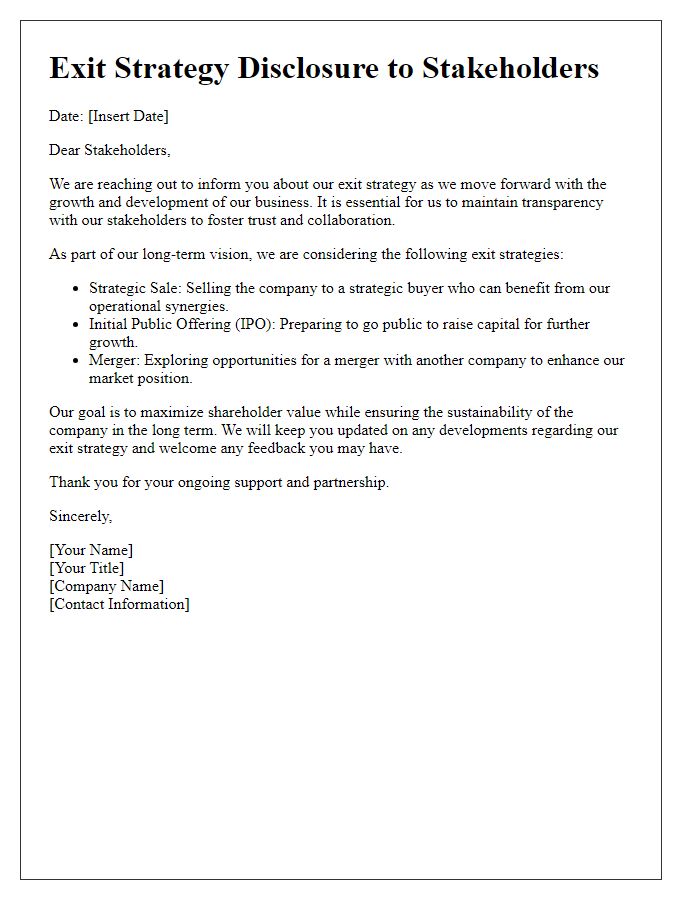

Stakeholder Communication Plan

An exit strategy disclosure outlines the approach organizations, such as public companies or startups, take when they plan to withdraw from a market or discontinue business operations. The Stakeholder Communication Plan serves as a crucial framework for managing interactions with various parties involved, such as employees, investors, suppliers, and clients. Clear communication channels ensure transparency during organizational changes, helping stakeholders understand the rationale behind the exit strategy and expected timelines. Timely updates regarding critical milestones, financial impacts, or employee transitions can alleviate uncertainties. Additionally, engaging stakeholders in discussions fosters collaboration, ensuring that their concerns are addressed while maintaining the organization's reputation throughout the exit process.

Regulatory Compliance and Legal Considerations

Regulatory compliance during exit strategy disclosures is crucial for businesses navigating complex legal frameworks. Various regulations, such as the Sarbanes-Oxley Act and the Foreign Corrupt Practices Act, set strict standards for financial disclosures in the United States. Companies must ensure that all financial statements are accurate and not misleading to avoid penalties. Additionally, industries may have specific regulatory bodies, like the Securities and Exchange Commission, overseeing compliance. Legal considerations also include contracts and agreements related to the exit process, which must adhere to state-specific business laws across different jurisdictions. Thorough documentation and transparency are essential to mitigate risks associated with potential litigation or regulatory scrutiny that could arise from poorly managed disclosures.

Comments