Hey there, esteemed shareholders! We're excited to share some fantastic news about our annual dividend announcement that highlights our commitment to you and our company's growth. In this letter, we'll dive into the details of the dividend payout, its significance for your investment, and the overall performance of our company over the past year. So, grab a cup of coffee and join us as we explore what this means for you and our future together!

Company Information

XYZ Corporation, a publicly traded company based in New York, reported a net profit of $500 million for the fiscal year ending December 31, 2022. The board of directors approved a dividend payout of $1.50 per share, reflecting a 15% increase compared to the previous year. This decision, driven by robust revenue growth in the technology sector, highlights the commitment to returning value to shareholders. The dividend, scheduled for distribution on March 15, 2023, will benefit approximately 10 million shareholders. The company's strong financial performance and resilient market position, particularly following the recent launch of its innovative product line, have positioned it well for continued growth and profitability.

Dividend Declaration and Amount

In an official announcement, the board of directors of XYZ Corporation declared a dividend of $0.50 per share, payable on December 15, 2023, to shareholders of record as of December 1, 2023. This decision reflects the company's robust financial performance, showcasing a year-over-year revenue increase of 12% and a net income surge reaching $5 million. The dividend represents a 5% return on the current share price of $10, providing a substantial benefit to shareholders. Stakeholders can expect the dividend to enhance their investment portfolio, with a total distribution estimated at $1 million, reinforcing the firm's commitment to delivering value to its investors.

Record Date and Payment Date

Annual shareholder dividends play a crucial role in maintaining investor confidence and ensuring stable returns. The record date, which designates the shareholders eligible for the dividend, is set for March 15, 2024. This date serves as a critical cutoff point, as shareholders on record will benefit from the upcoming payout. The payment date follows on April 1, 2024, when eligible shareholders will receive their dividends, reinforcing the financial stability and profitability of the company. Clear communication regarding these dates fosters transparency and encourages ongoing investment by demonstrating the company's commitment to rewarding its shareholders.

Reinvestment Options

In the fiscal year of 2023, our company, XYZ Corporation, announced a significant dividend of $2.50 per share, reflecting our commitment to returning value to our dedicated shareholders. The dividend payout, a result of robust financial performance with a 15% increase in revenue, is scheduled for distribution on April 15, 2024. Shareholders can choose to reinvest dividends through our Dividend Reinvestment Plan (DRIP), which allows for the automatic purchase of additional shares at a 5% discount to the market price, providing a strategic opportunity for long-term growth. Eligible shareholders must enroll in the plan by March 1, 2024, to take advantage of this cost-effective investment option.

Contact Information for Inquiries

Annual shareholder dividend announcements typically include significant financial details and company insights. Each year, a publicly traded corporation, such as Apple Inc. or Microsoft Corporation, communicates dividends to its shareholders, often announcing the rate per share, important dates like declaration and payment dates, and overall financial performance indicators. For inquiries regarding the announcement, shareholders may contact the investor relations department of the corporation through designated email addresses or phone numbers specified in official press releases or on the company's website. Responses may involve clarifying dividend amounts, payment processes, or updating shareholder records to ensure accurate distributions.

Letter Template For Annual Shareholder Dividend Announcement Samples

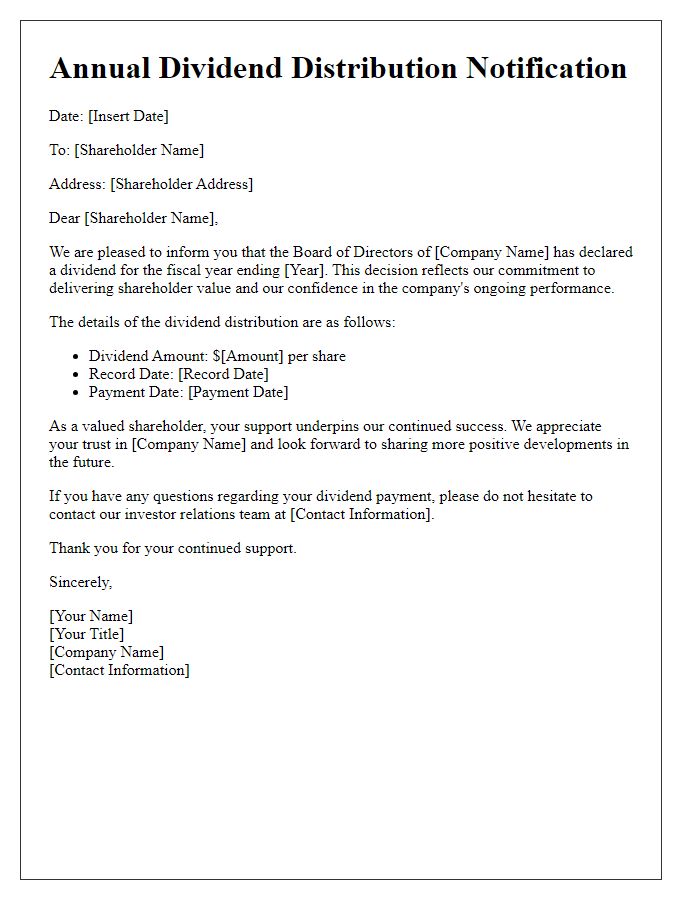

Letter template of annual shareholder dividend distribution announcement.

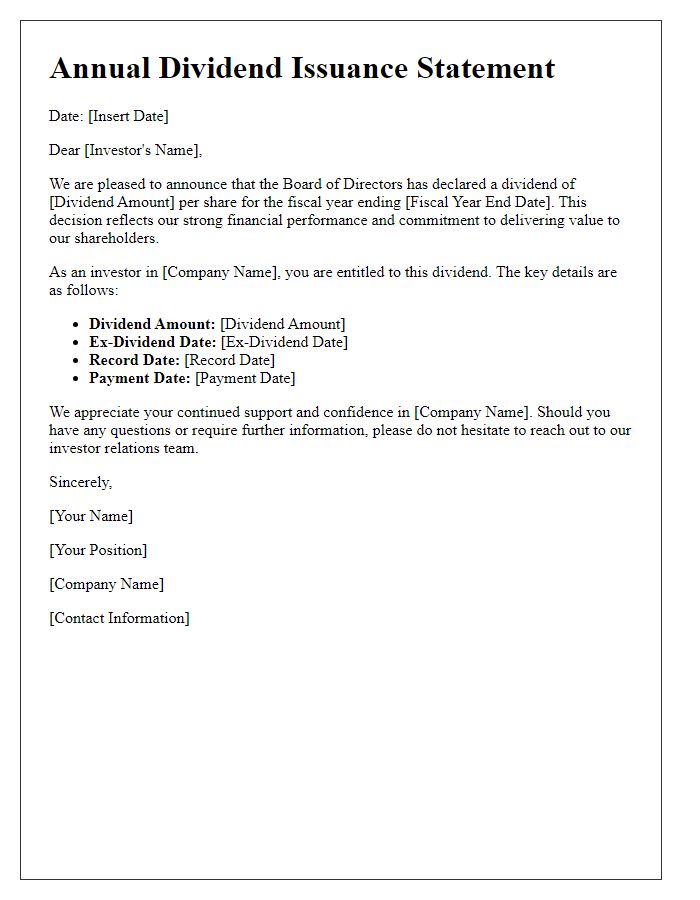

Letter template of shareholder dividend declaration for the fiscal year.

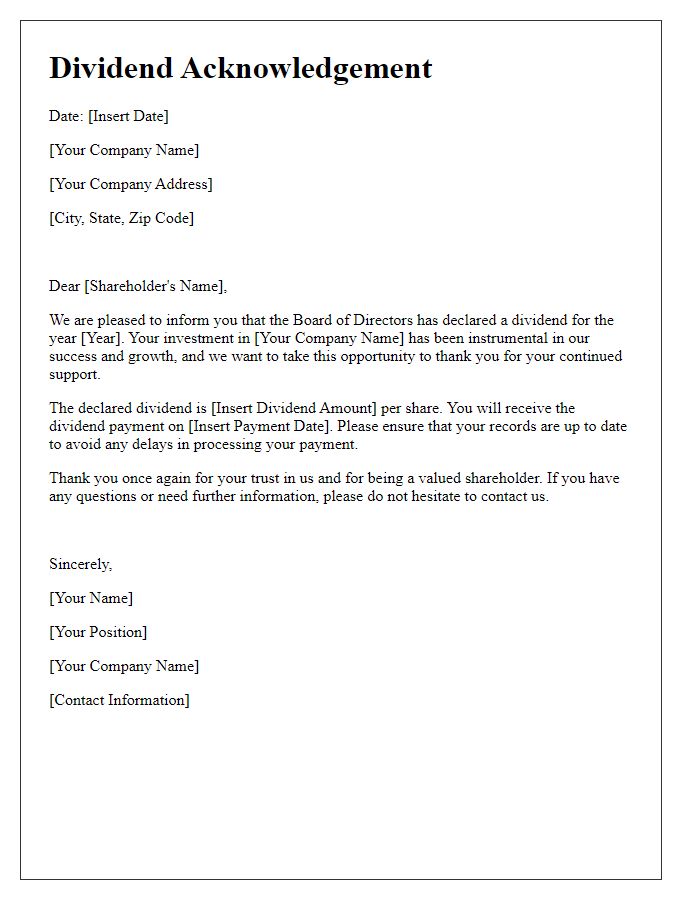

Letter template of yearly dividend benefits communication for stockholders.

Comments