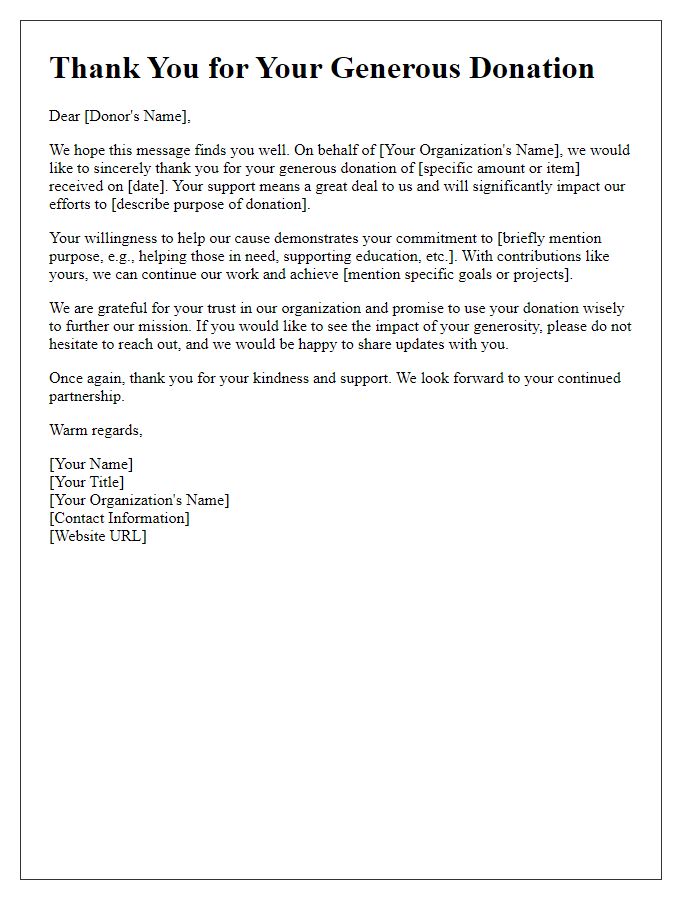

Hey there! If you've ever wondered how to craft the perfect letter confirming a donation receipt, you're in luck! Writing a clear and courteous acknowledgement not only expresses appreciation but also maintains good communication with your donors. Stick around as we share some handy templates and tips to help you create a warm and professional message that will delight your supporters!

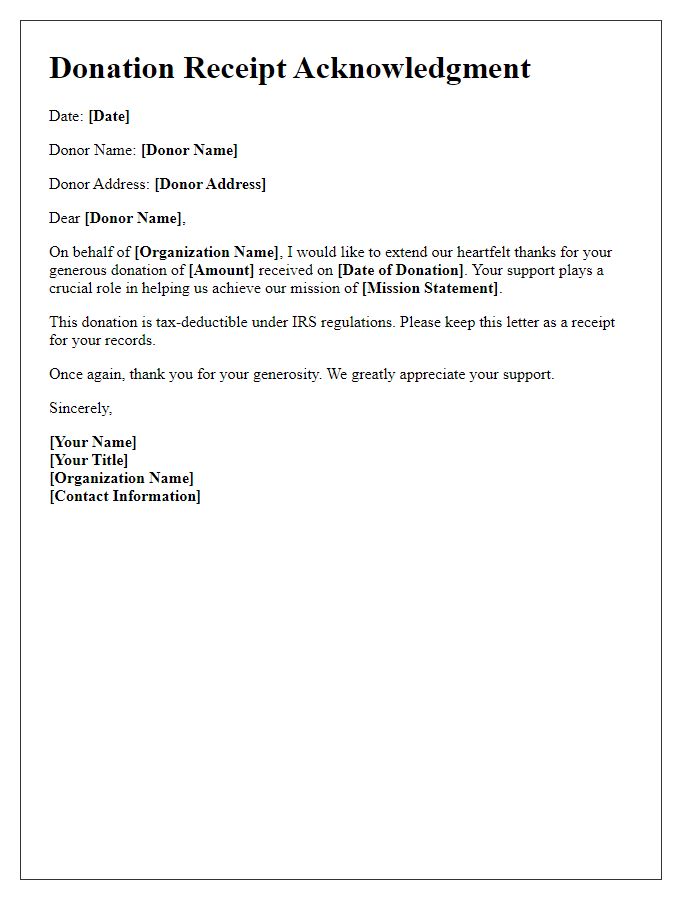

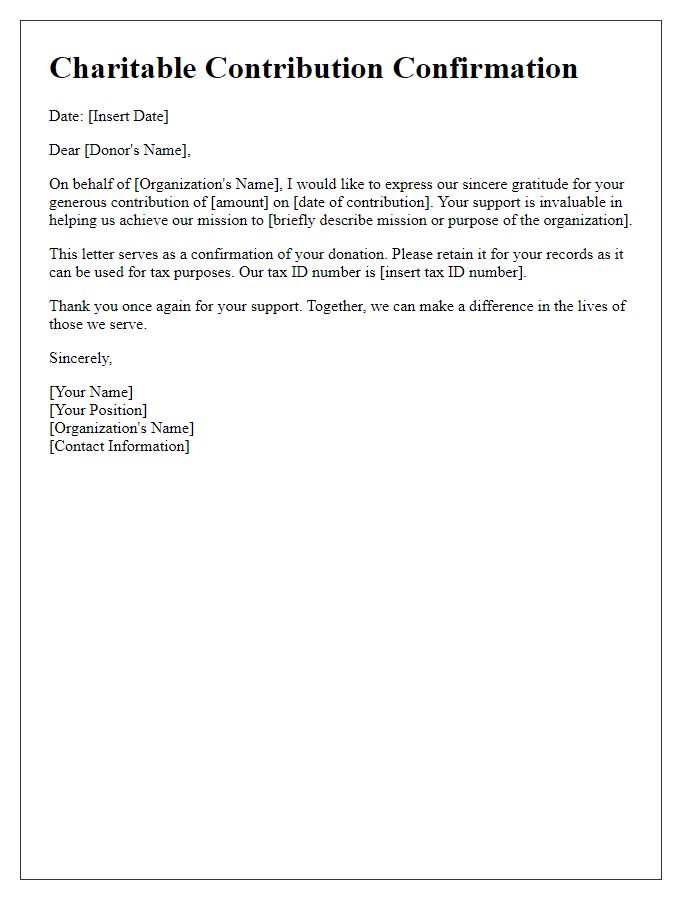

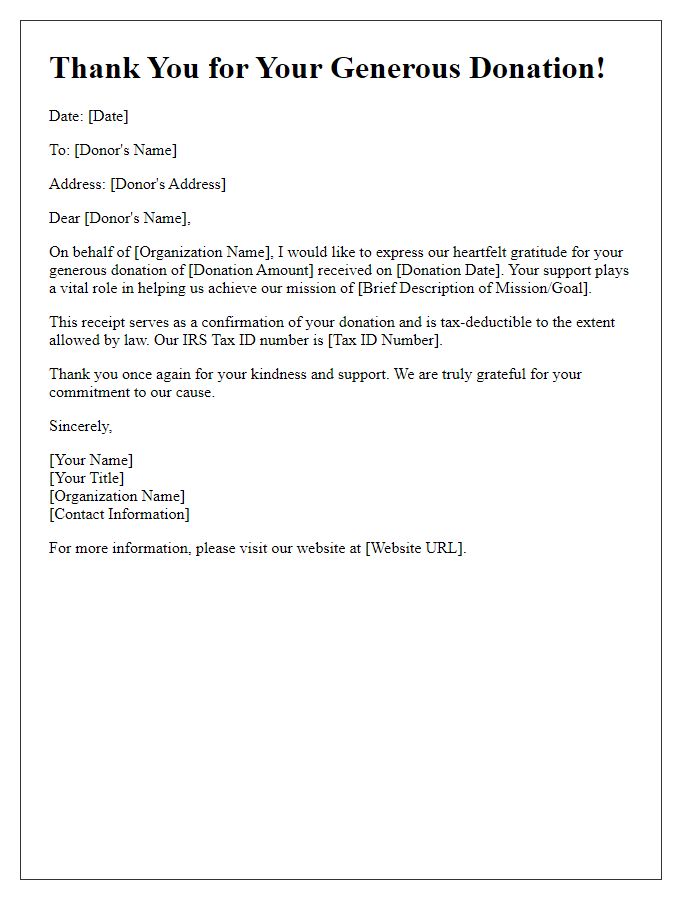

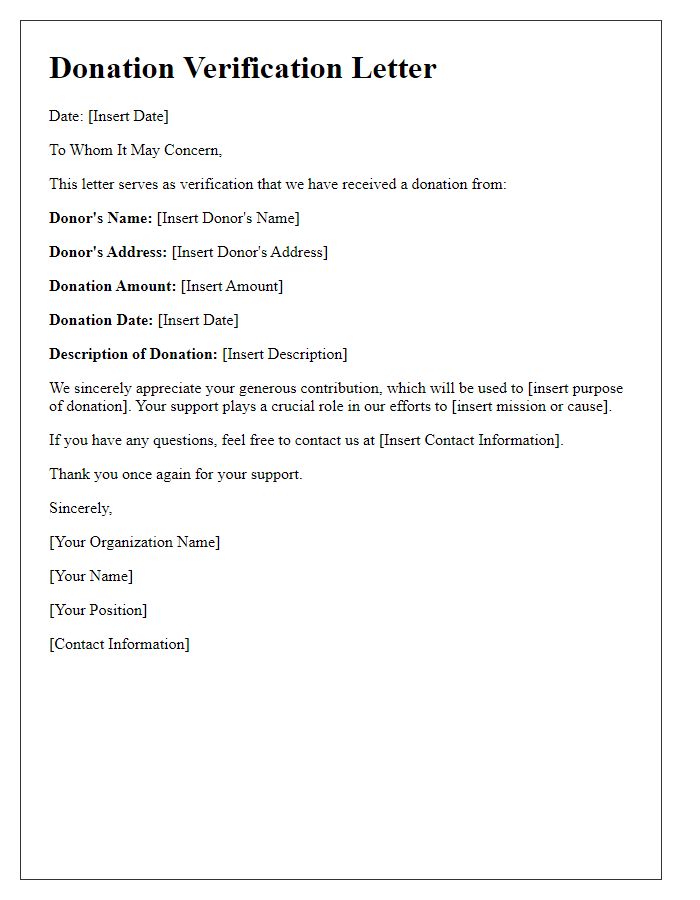

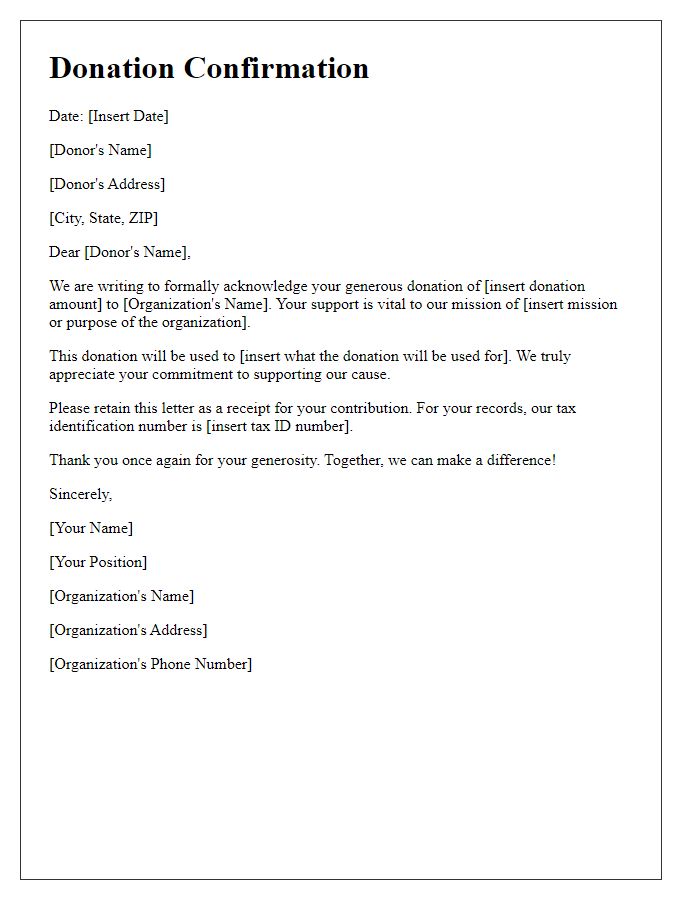

Donor's Information (Name, Address)

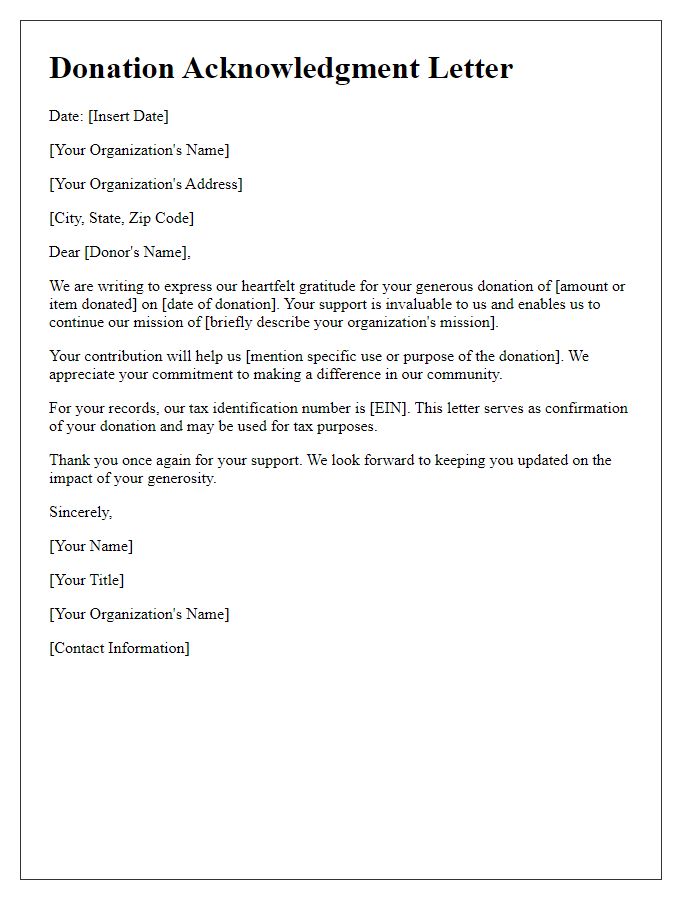

Thank you for your generous support. Your donation plays a vital role in our mission to make a difference. We have received your contribution of [donation amount] made on [donation date]. This donation will help fund our programs focused on [specific programs or causes], directly impacting the lives of [specific beneficiaries or communities]. Your support is greatly appreciated and vital to our continued success. For your records, our tax-exempt status is [tax ID]. Thank you again for your commitment to [organization's mission].

Donation Details (Amount, Date, Purpose)

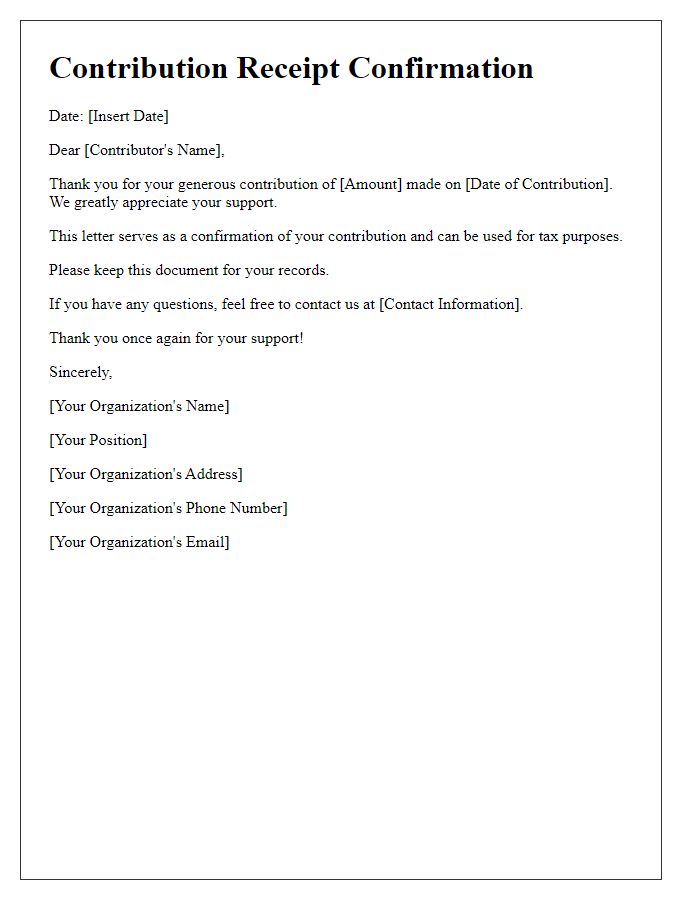

A donation receipt serves as a vital document for both donors and organizations. For instance, a donation of $500 made on December 1, 2023, for a community food drive significantly aids local families in need. This contribution played an essential role in providing meals to over 300 individuals during the holiday season. Recording the purpose ensures transparency and accountability in funds allocation, allowing donors to track the impact of their generosity. Moreover, detailed acknowledgment of the donation reinforces the relationship between donors and the organization, fostering continued support for future initiatives.

Tax Deductible Statement

A donation receipt serves as an important document for nonprofit organizations and their donors, providing proof of contribution for tax purposes. Charitable contributions made to qualified organizations can be tax-deductible, subject to regulations specified by the Internal Revenue Service (IRS) in the United States. The donation receipt must include essential details such as the organization's name, address, and federal tax identification number (EIN). Additionally, it should clearly state the date of the donation, the amount contributed, and a description of any non-cash items donated. This document is invaluable during tax season, as it allows donors to accurately report their charitable contributions and potentially lower their taxable income. Proper record-keeping of these receipts can lead to potential savings of hundreds or thousands of dollars in taxes owed.

Organization's Information (Name, Address, Tax ID)

The organization, Compassionate Hearts Foundation, located at 123 Hope Lane, Springfield, IL 62701, with Tax ID 12-3456789, acknowledges the generous donation received on October 15, 2023. This contribution, totaling $500, will significantly aid our ongoing programs aimed at providing essential resources and support to underprivileged communities in the region. Your support plays a crucial role in our mission to foster positive change and uplift lives. Thank you for your commitment to making a difference; it fuels our dedication to serve those in need effectively.

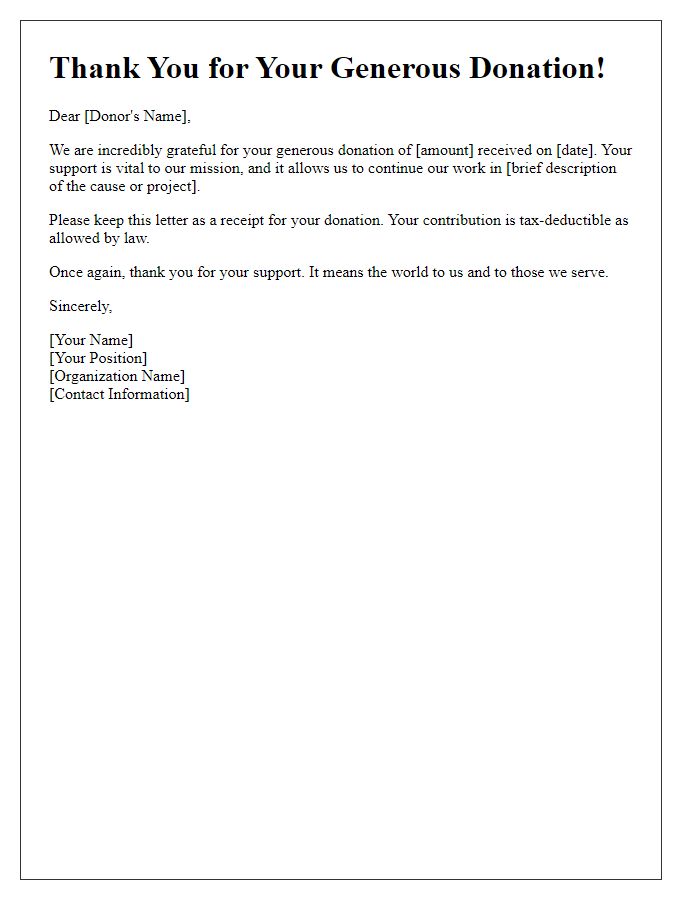

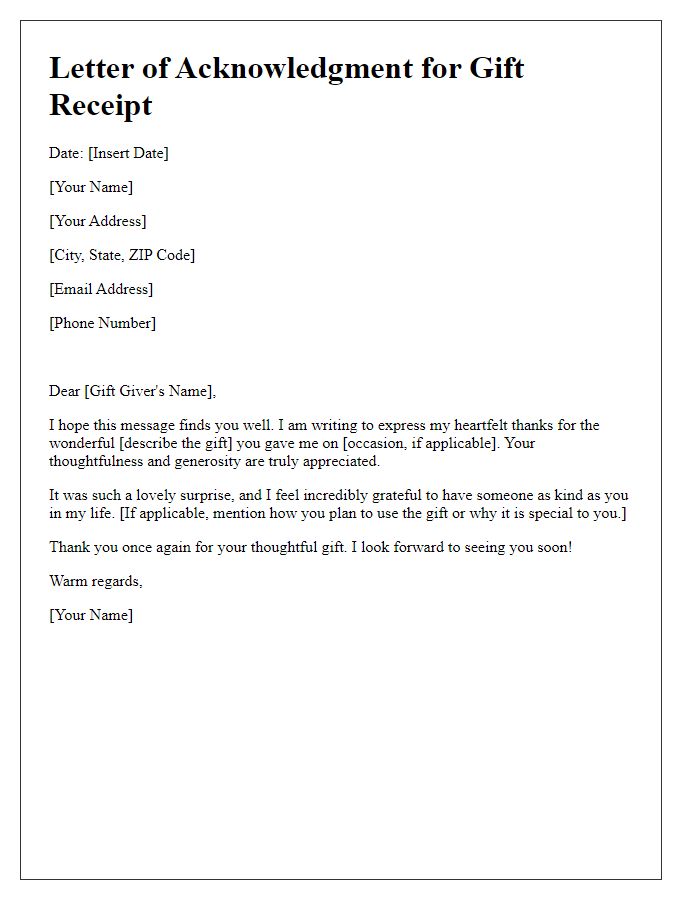

Thank You Message and Contact Information

A donation receipt confirms the generous financial contribution made by an individual or organization to a specific cause or charity, serving as an acknowledgment for tax purposes. For example, the donation might be directed toward the Red Cross (established in 1881) for disaster relief initiatives, bringing immediate support to affected areas. This confirmation typically includes the donor's name, the amount donated, the date of the transaction, and the charity's contact information for any inquiries, ensuring transparency and trust in the financial support process. Non-profits often express gratitude in a thank-you message, emphasizing the impact of donations, such as providing food and shelter for those in need, cultivating a relationship with donors for future contributions.

Comments