Are you ready to stay protected with your renewed policy? We understand how important it is to have peace of mind when it comes to securing your assets and wellbeing. Our commitment to providing you with seamless coverage continues, ensuring you're safeguarded against unexpected events. Read on to discover the details of your renewal and what it means for you moving forward!

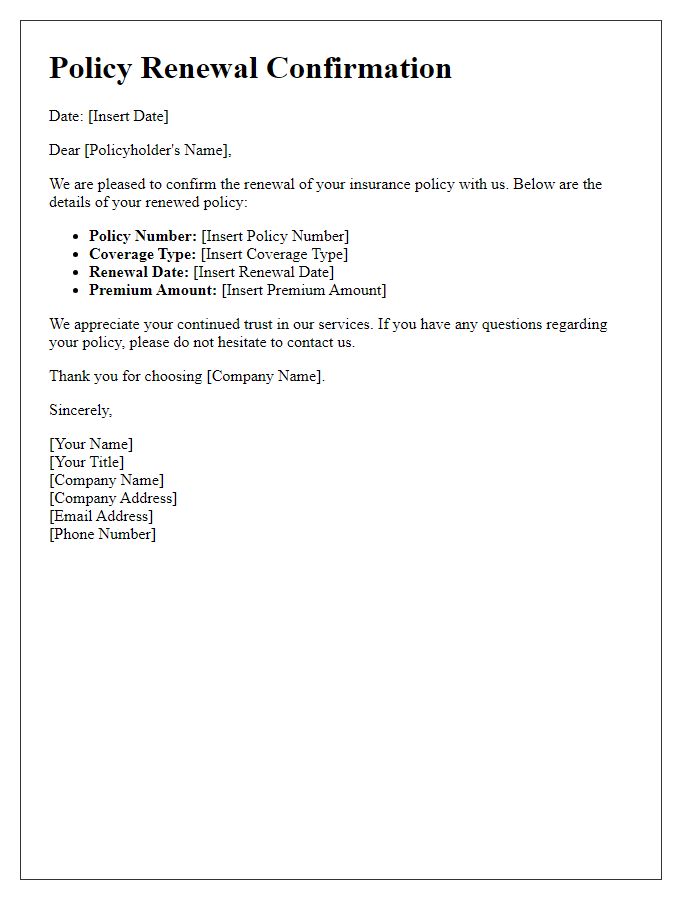

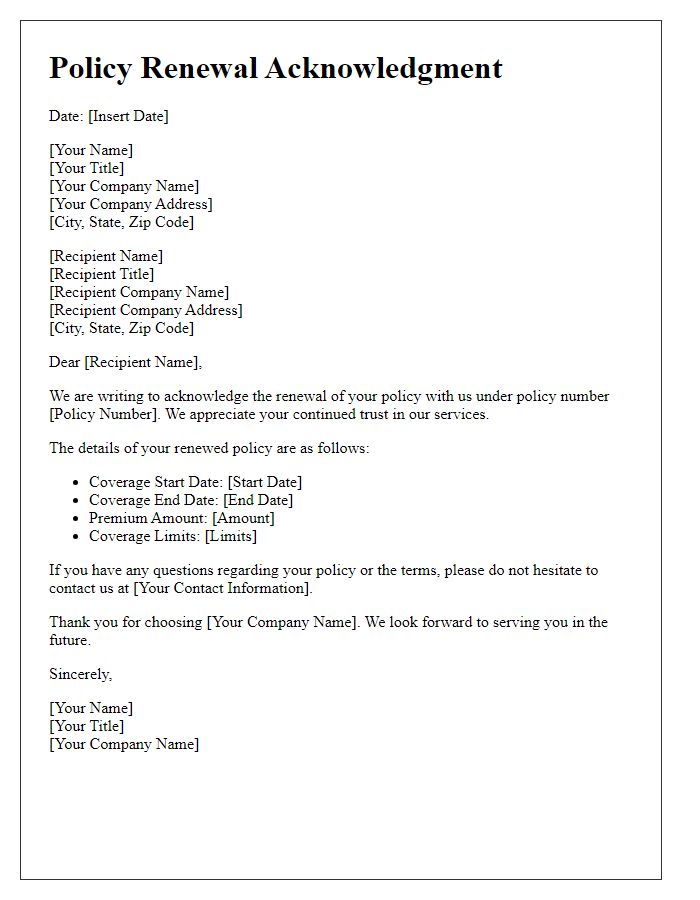

Client's Personal Information

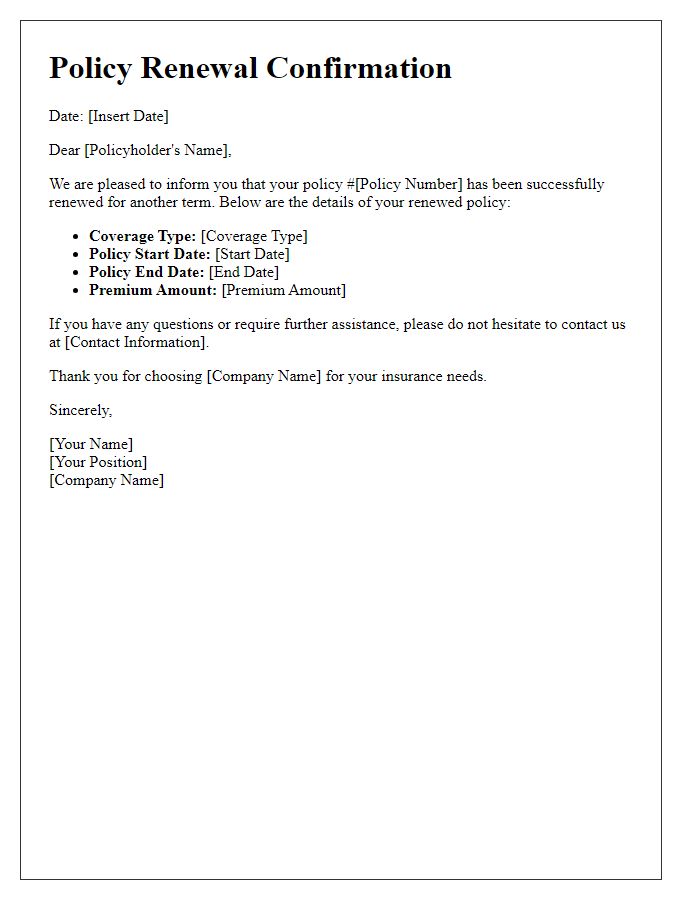

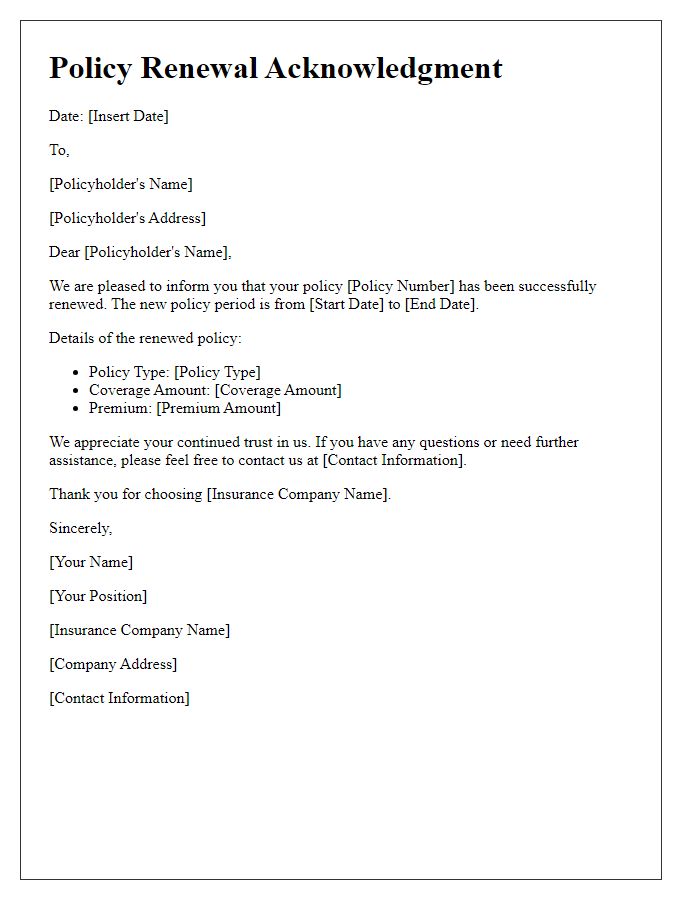

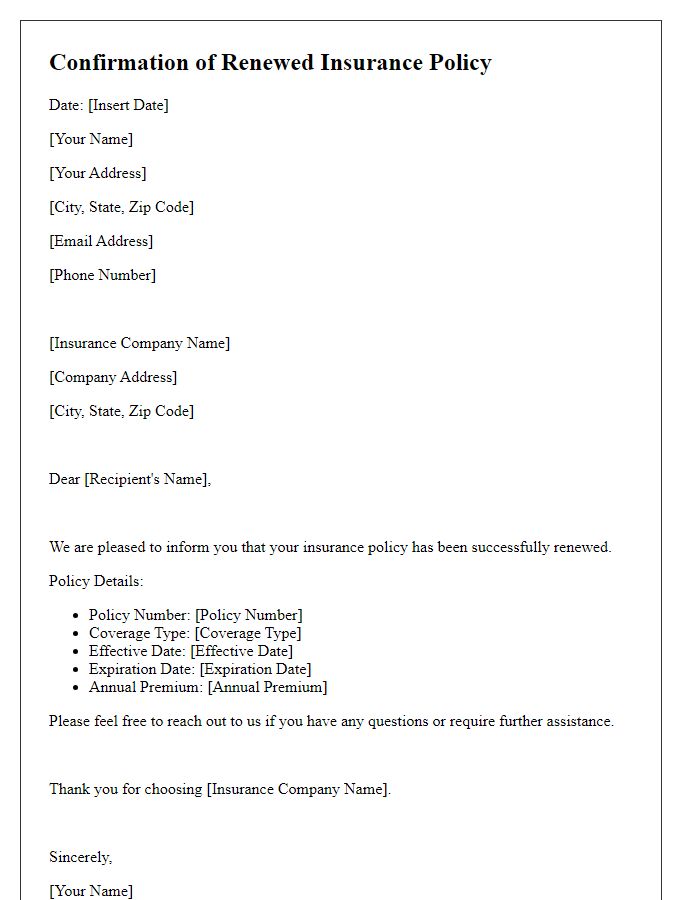

The confirmation of policy renewal serves as an important document for clients, containing critical details pertaining to their insurance coverage. This document typically includes the client's personal information, such as full name, date of birth (often required for identification), and mailing address, ensuring accuracy in records. The effective date of the renewed policy is also highlighted, signifying the start of coverage, while the policy number provides a unique identifier for the specific insurance agreement. Premium amounts are outlined to inform clients of their financial obligations over the policy term, which could span several months or years. Finally, any changes to policy terms or coverage limits during renewal must be explicitly stated to prevent misunderstandings, allowing clients to review and confirm the modifications.

Policy Details (Number and Type)

Policy renewal confirmation includes key details such as policy number (e.g., 123456789) and policy type (e.g., Homeowners Insurance). The policy's renewal date (e.g., January 1, 2024) marks the beginning of the next coverage term, typically lasting one year. Premium payment information may specify the amount due (e.g., $1,200) along with payment methods accepted (e.g., credit card, bank transfer). Additional coverage options, such as increased liability limits or added endorsements for personal property, can enhance the existing policy. The notice can also include contact information for customer service in case of inquiries or claims assistance.

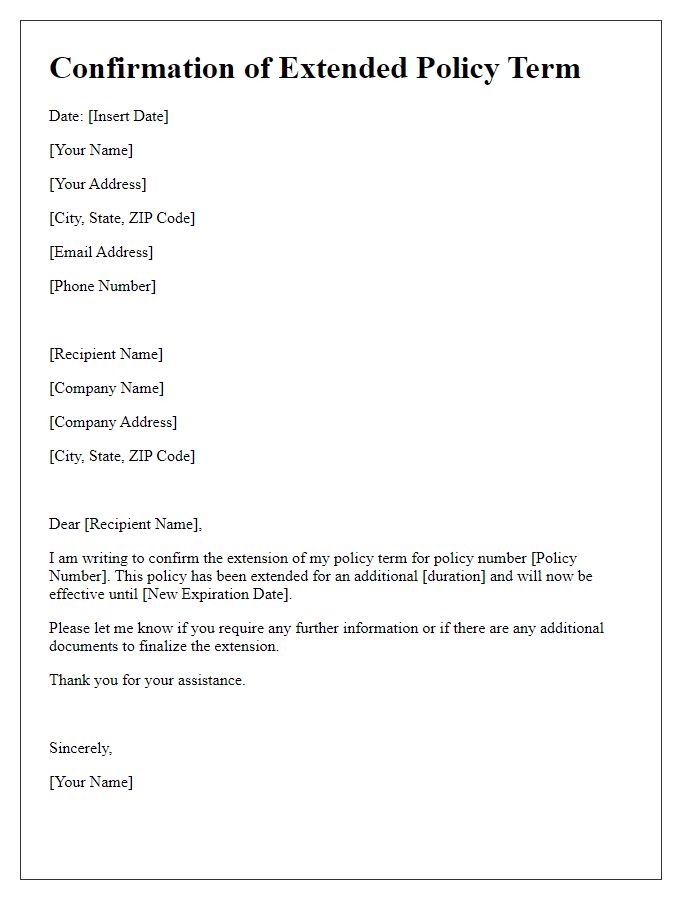

Renewal Terms and Conditions

Policy renewal confirmations are essential documents that outline the agreed-upon terms and conditions, ensuring transparency for both the insurer and the policyholder. The renewal typically includes factors such as the updated premium amount, effective dates indicating the start and end of coverage, and specific endorsements related to changes in coverage limits or deductibles. Additionally, any alterations to existing exclusions (situations not covered by the policy) or amendments to the policy's provisions should be explicitly stated. It is critical to highlight payment methods (automatic bank transfers, credit card payments) and deadlines to avoid coverage lapses. Acknowledgement of the policyholder's review and acceptance of the renewal terms is vital for maintaining a clear contractual relationship, ultimately protecting both parties from potential disputes.

Payment Information and Amount

Policy renewal confirmation includes essential payment information detailing the financial transaction necessary to maintain coverage. Amount due varies based on the type of insurance, such as auto, home, or health, with costs increasing annually due to inflation or changes in risk assessment. Payment methods accepted often include credit cards, electronic fund transfers, or checks, with deadlines typically set 30 days before policy expiration to ensure uninterrupted service. Renewal documents highlight the policy number, effective date, and contact information for customer service, facilitating clarity and support throughout the renewal process.

Contact Information for Inquiries

Customer support for policy renewal inquiries is crucial for maintaining effective communication. For questions related to policy renewals, clients can reach out to dedicated representatives via a toll-free number, such as 1-800-555-0199, available Monday through Friday from 8 AM to 6 PM Eastern Standard Time. Additionally, clients may send inquiries via email to support@insurancecompany.com for prompt assistance. Social media platforms like Twitter (@InsuranceCompany) and Facebook provide alternative channels for engaging with customer service, ensuring accessibility for all clients seeking information about their policy renewals.

Comments