Are you looking to ensure that your beneficiary designations are confirmed and in good order? It's essential to have clarity on who will benefit from your assets in the future, and drafting a confirmation letter is a vital step in that process. By outlining the specifics of your chosen beneficiaries, you can provide peace of mind for both yourself and your loved ones. Dive into this article to discover a simple letter template that will help you solidify your beneficiary designations!

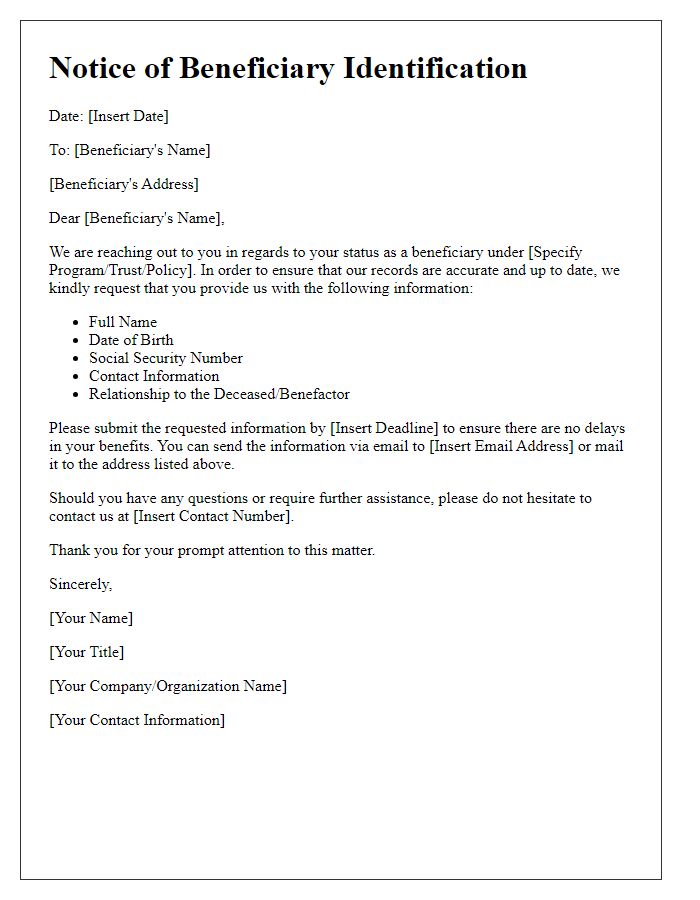

Accurate Identification Details

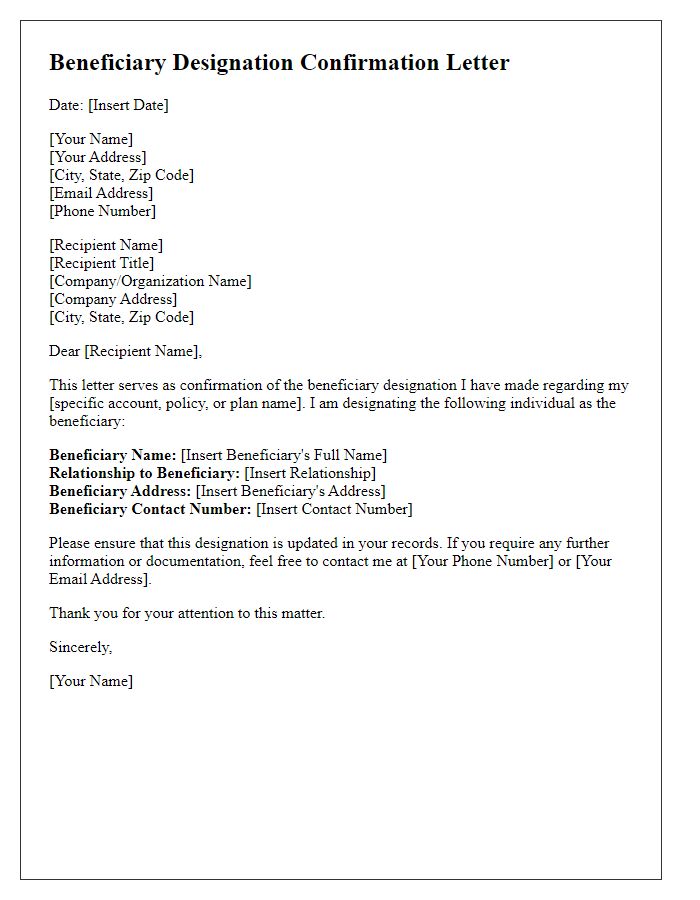

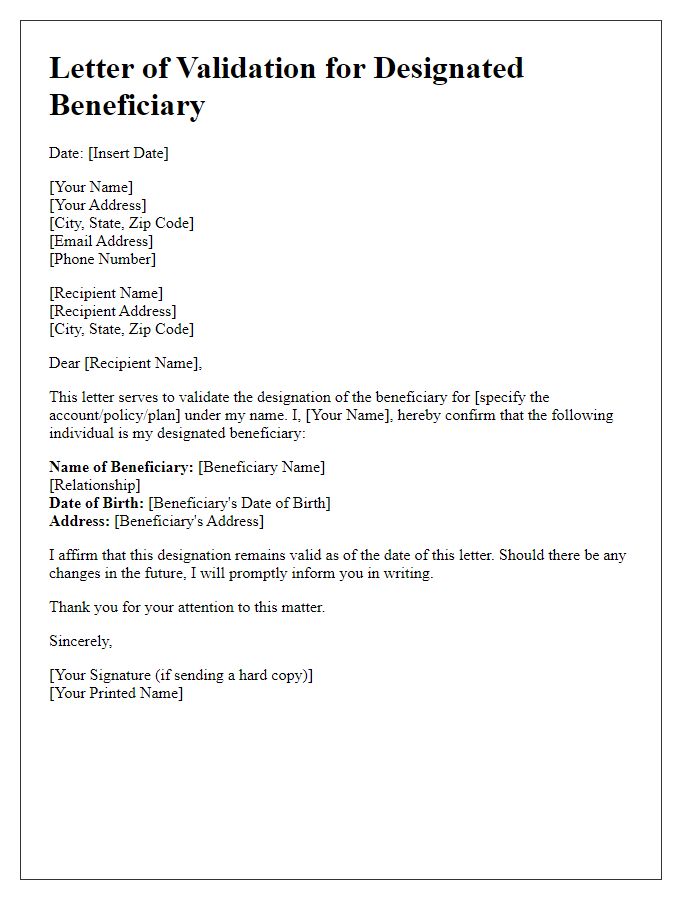

Accurate identification details are crucial when confirming beneficiary designations in financial documents, such as wills or insurance policies. Essential information includes full names, addresses, Social Security numbers, and date of birth. For example, the beneficiary's full legal name should match official identification documents, such as a driver's license or passport. In the case of a life insurance policy, these details ensure that the intended recipient, like a family member or friend, receives benefits without legal complications. Furthermore, providing precise identification minimizes potential disputes among heirs, ensuring a smooth transfer of assets, particularly in complex legal environments like California or New York, where inheritance laws may vary.

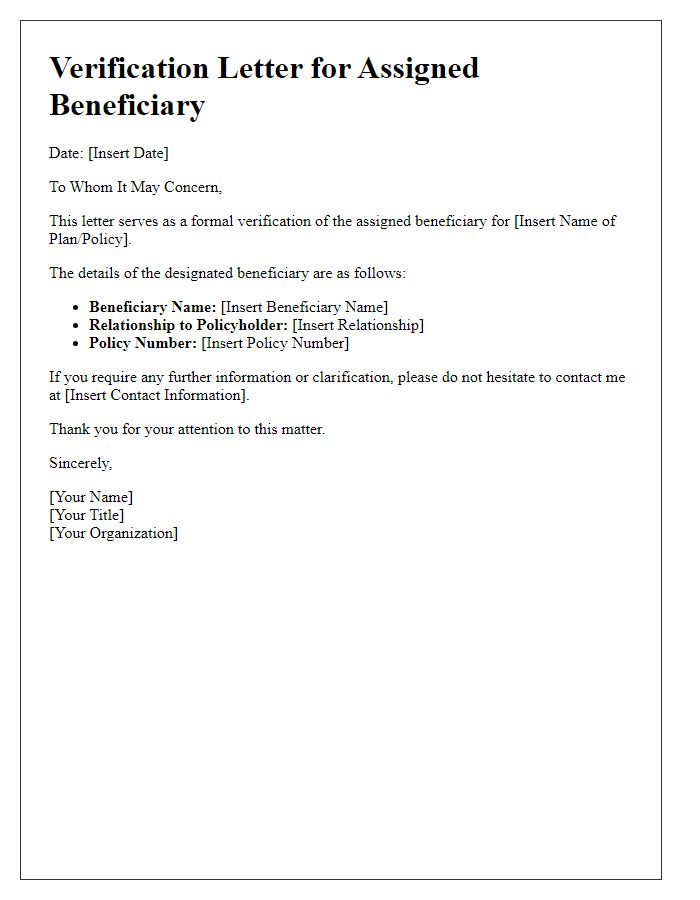

Legal Compliance and Terminology

The confirmation of a beneficiary designation is a crucial legal document ensuring that the intended recipient receives assets upon the policyholder's death. In financial instruments such as life insurance policies or retirement accounts (e.g., IRAs, 401(k)s), clarity on beneficiary details prevents disputes. Accurate terminology is essential; "primary beneficiary" identifies the first in line to receive benefits, while "contingent beneficiary" serves as an alternative if the primary beneficiary is unavailable. Legal requirements vary by jurisdiction, so it's vital to adhere to state-specific laws regarding notarization and witness signatures. Ensuring beneficiaries are clearly named, along with relevant identification details (e.g., Social Security numbers, birthdates), protects against potential misallocations and promotes compliance with regulatory standards.

Explicit Beneficiary Information

Confirmation of beneficiary designation includes essential details ensuring clarity in intent. Beneficiaries may include individuals or entities, defined by full name, date of birth, and Social Security Number for individuals, or Tax Identification Number for entities. Accurate designations are critical for the distribution of assets, impacting estates valued in millions, often governed by state law such as the Uniform Probate Code. Ensuring explicit beneficiary information prevents potential disputes, ensuring smooth transitions in cases of policyholder demise. Documenting these details in policies, such as life insurance from companies like MetLife or Prudential, guarantees that funds directly support the intended recipients.

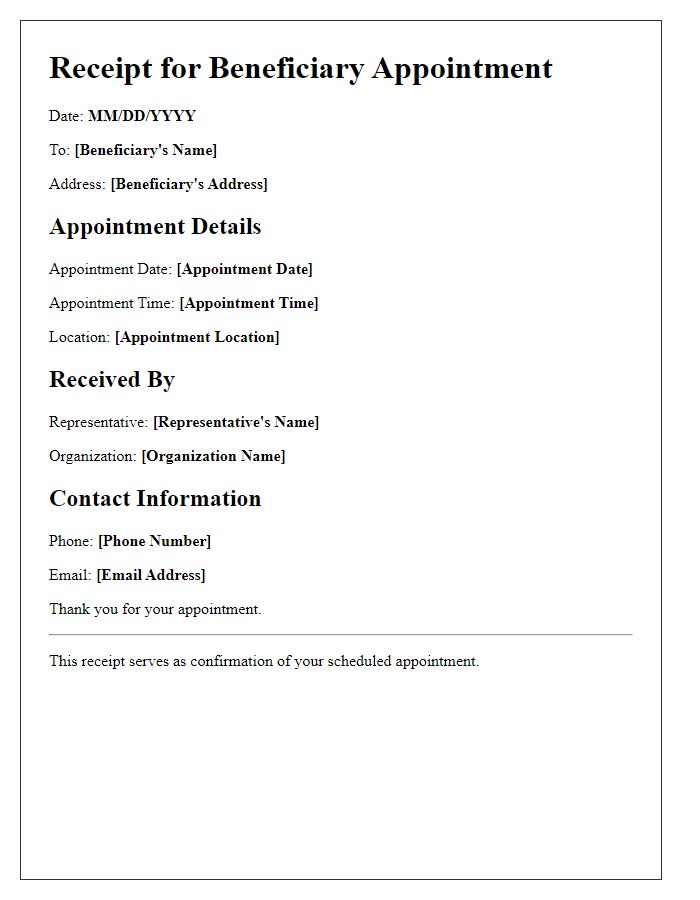

Contact and Follow-up Details

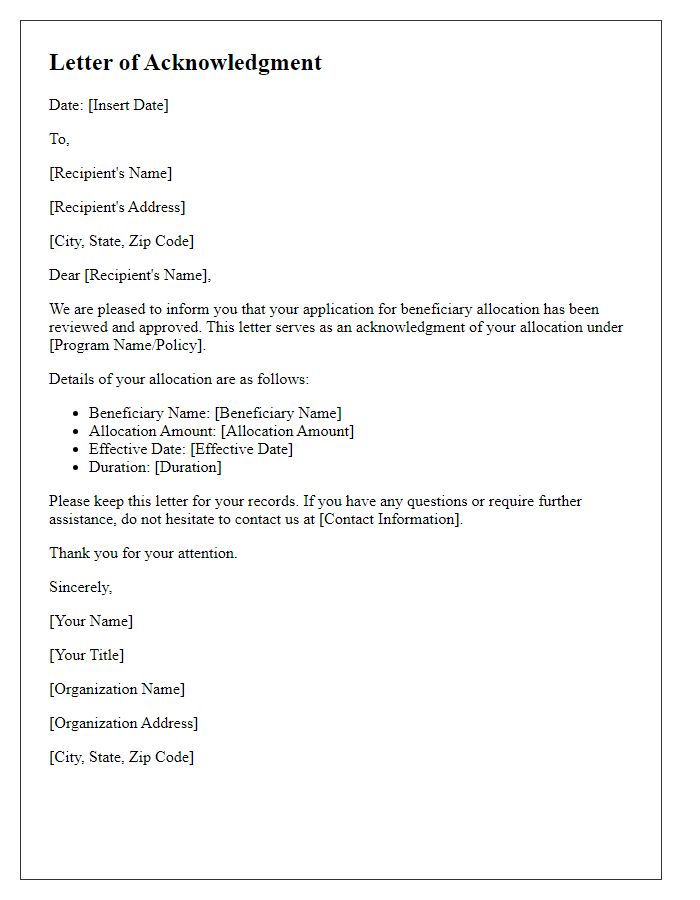

Beneficiary designation confirmation serves as an important document for individuals to verify and solidify their chosen recipients for assets, insurance policies, or retirement accounts. The confirmation process typically includes contact details, such as the beneficiary's full name, relationship to the account holder, and their Social Security number, enhancing legal clarity. Furthermore, follow-up details may encompass the designated institution's phone number, such as the local insurance agency or financial institution, and the account officer's email address for any inquiries. This ensures beneficiaries can easily access information regarding their future entitlements and prepares for events like account holder's passing (anticipated dates or issues). Proper documentation of this information plays a crucial role in estate planning and the smooth transition of assets, reducing potential disputes among heirs.

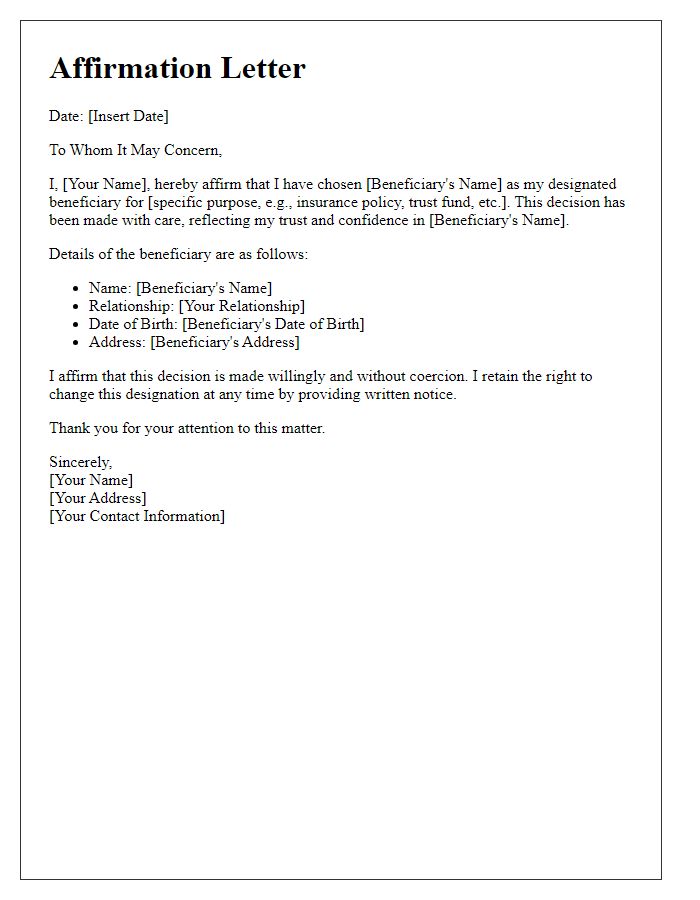

Clear Confirmation Statement

A clear confirmation statement verifies the designation of beneficiaries for financial accounts or insurance policies. This statement typically includes key details such as the account owner's name, the specific account number, and a list of named beneficiaries with their respective percentages or shares. For instance, a retirement account may state that John Smith has designated his spouse, Jane Smith, as the primary beneficiary, receiving 100% of the account upon his passing. This document serves to eliminate ambiguities and document the owner's final wishes regarding asset distribution, ensuring all parties are informed and legally bound to the specifications outlined in the statement. It's essential to keep this confirmation updated, especially after significant life changes like marriage, divorce, or birth of children, which may alter beneficiary choices.

Comments