Are you looking for a way to communicate the confirmation of your updated bank statement? Crafting the right letter can ensure clarity and professionalism. Whether you're sending it to a financial institution or a personal contact, it's essential to include key details to keep everyone on the same page. If you're curious about how to structure your letter effectively, read on for a comprehensive template.

Clear Identification of Account Holder

The confirmation of a bank statement update serves to ensure proper communication between the bank and the account holder, emphasizing the importance of accurate identification of the account holder. For instance, the account holder's full name, such as John Smith, along with an associated account number (e.g., 123456789) must be clearly stated. The bank's official letterhead, including the bank's name like First National Bank and address, will establish credibility. Identification methods may include mentioning the required documentation, such as a government-issued ID (passport or driver's license), to verify the account holder's identity, ensuring that sensitive information remains secure. Such updates may also include details about the specific changes made to the bank statement, like updated mailing address or new contact information, providing a comprehensive overview of the account status for the holder's peace of mind.

Statement Period Covered

A confirmation of a bank statement update typically includes specific details such as the statement period covered, account information, and any changes made. The statement period covered often refers to the range of dates for which the account transactions are being reviewed, such as from January 1 to December 31, 2022. Account information may include the bank's name, branch details, and the customer's account number for identification. Any changes made might detail corrected transactions, updated balances, or changes in account status. Accurate documentation is crucial for maintaining trust and transparency between the bank and the customer.

Confirmation of Updated Details

A confirmation of updated bank statement details provides acknowledgment of recent changes made to account information, ensuring accuracy for financial records. This document typically includes specific details such as the account holder's name (e.g., John Smith), account number (e.g., 123456789), and the date of the statement update, which may fall within the current month, such as October 2023. It reassures the account holder that adjustments to personal details, like address or contact information, have been correctly recorded in the bank's system, minimizing the risk of any financial discrepancies and facilitating seamless transactions.

Contact Information for Further Assistance

In the banking sector, efficient communication is crucial for maintaining customer satisfaction. A confirmation of bank statement update, often sent via email or postal service, serves the purpose of informing customers about changes or updates in their financial records. Many banks include contact information in these confirmations, enabling clients to reach out for further assistance or clarification. This contact information typically consists of a dedicated customer service phone number, such as 1-800-123-4567, an email address like support@bankname.com, and the bank's physical address at 123 Main St, Cityville, State, Zipcode. Providing these details ensures that customers can quickly resolve any inquiries related to their updates, fostering a dependable relationship between the bank and its clients.

Professional and Polite Tone

A bank statement update confirms adjustments made to account statements, reflecting recent transactions or changes. The process typically involves reviewing the financial record's accuracy to ensure transparency for clients. Important details include the bank name, account number, and statement date, which are critical for identification. Clients should expect updates within monthly cycles, allowing them to monitor their financial activities effectively. Regular updates can help in spotting discrepancies and managing finances responsibly.

Letter Template For Confirmation Of Bank Statement Update Samples

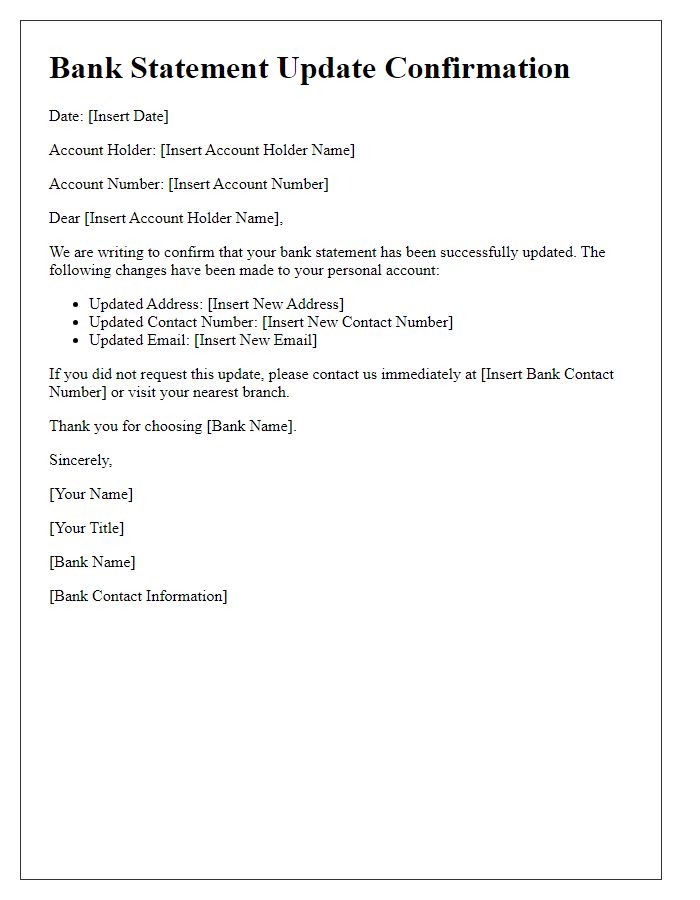

Letter template of bank statement update confirmation for personal account.

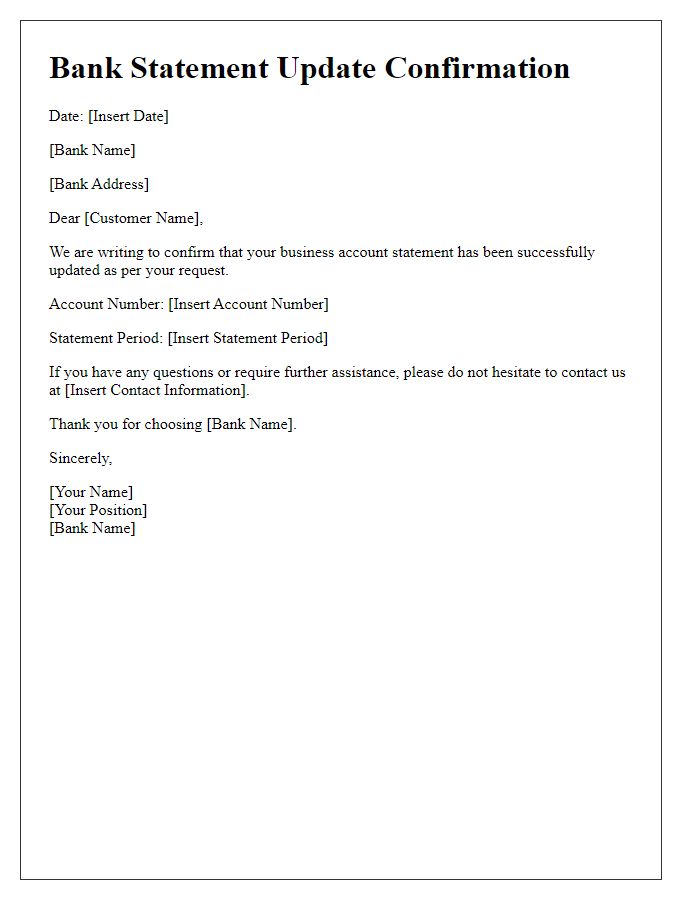

Letter template of bank statement update confirmation for business account.

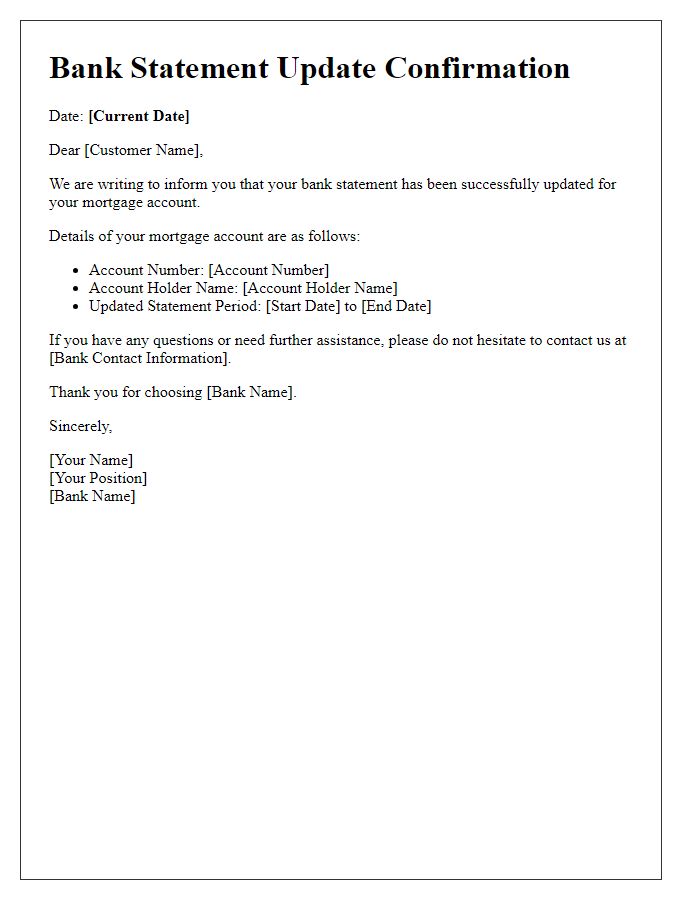

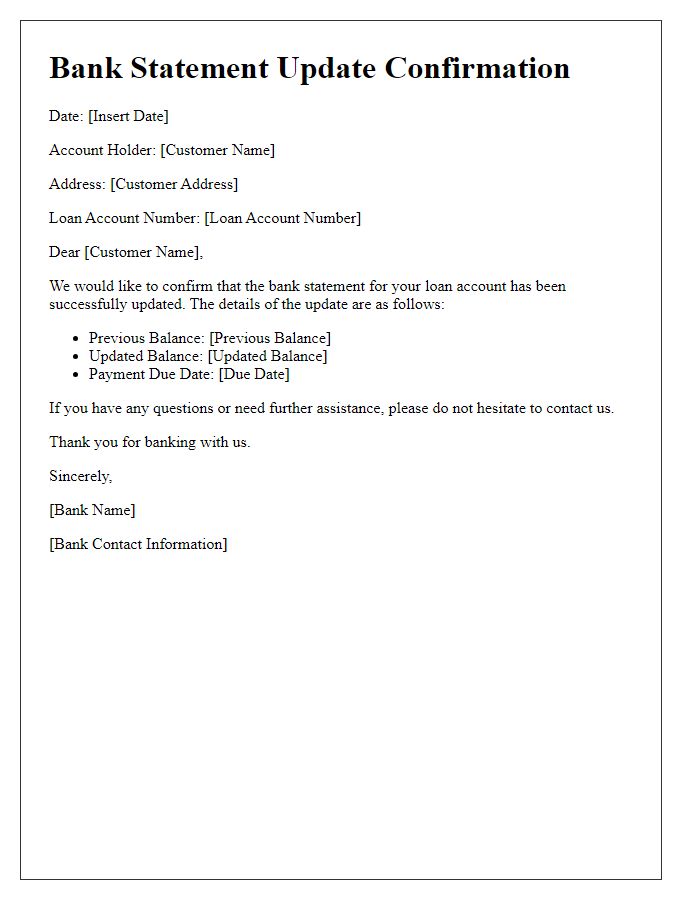

Letter template of bank statement update confirmation for mortgage account.

Letter template of bank statement update confirmation for savings account.

Letter template of bank statement update confirmation for joint account.

Letter template of bank statement update confirmation for investment account.

Letter template of bank statement update confirmation for credit card account.

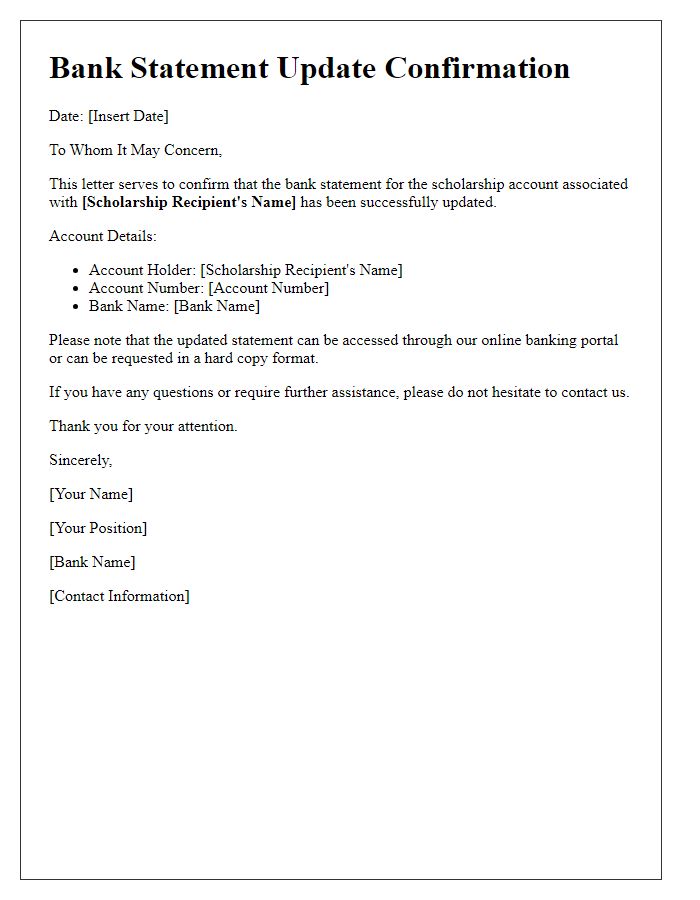

Letter template of bank statement update confirmation for scholarship account.

Comments