Are you looking for a reliable template to help you draft a bank confirmation of funds letter? This essential document not only provides verification of your financial status but also ensures transparency in your transactions. With our straightforward template, you can easily communicate with your bank and present your confirmation needs clearly. Ready to streamline your process? Read on for more details!

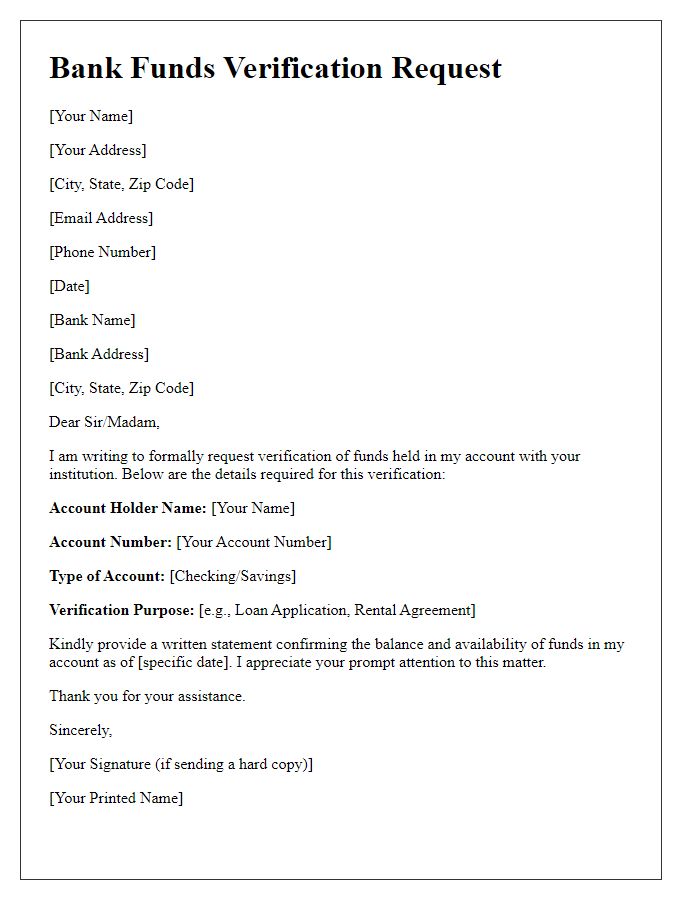

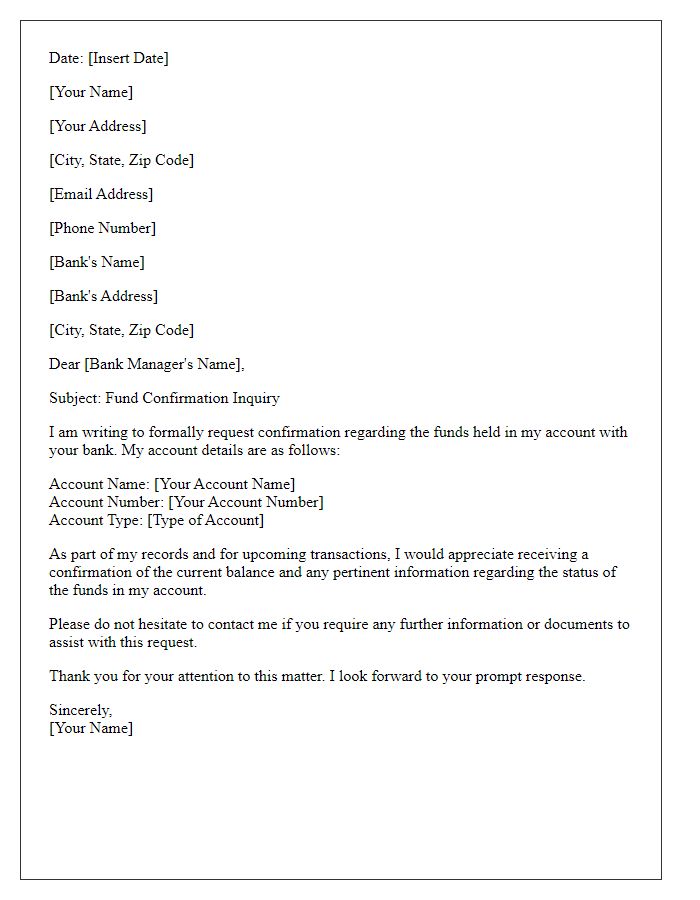

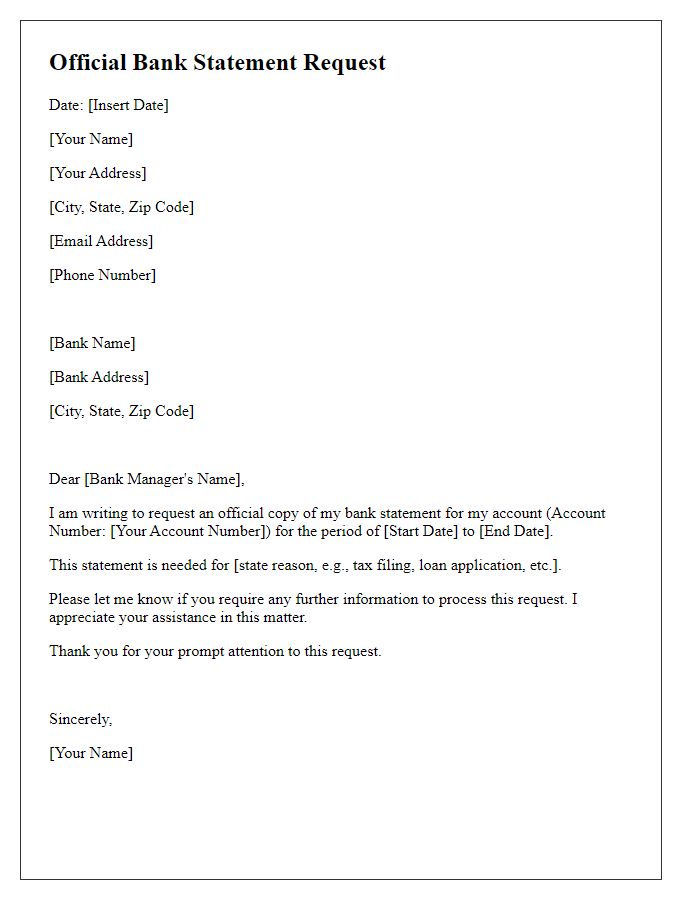

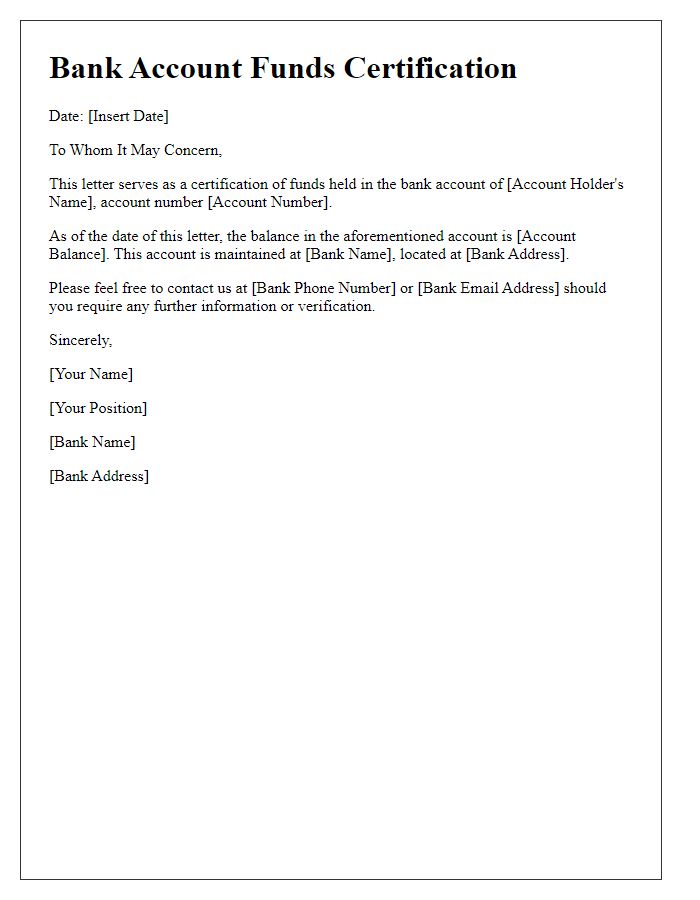

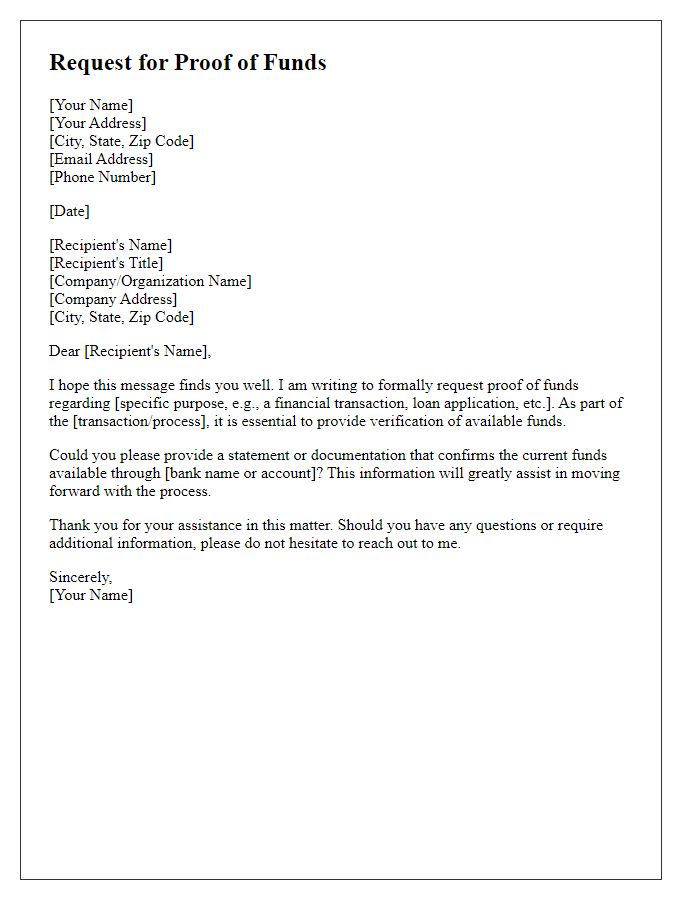

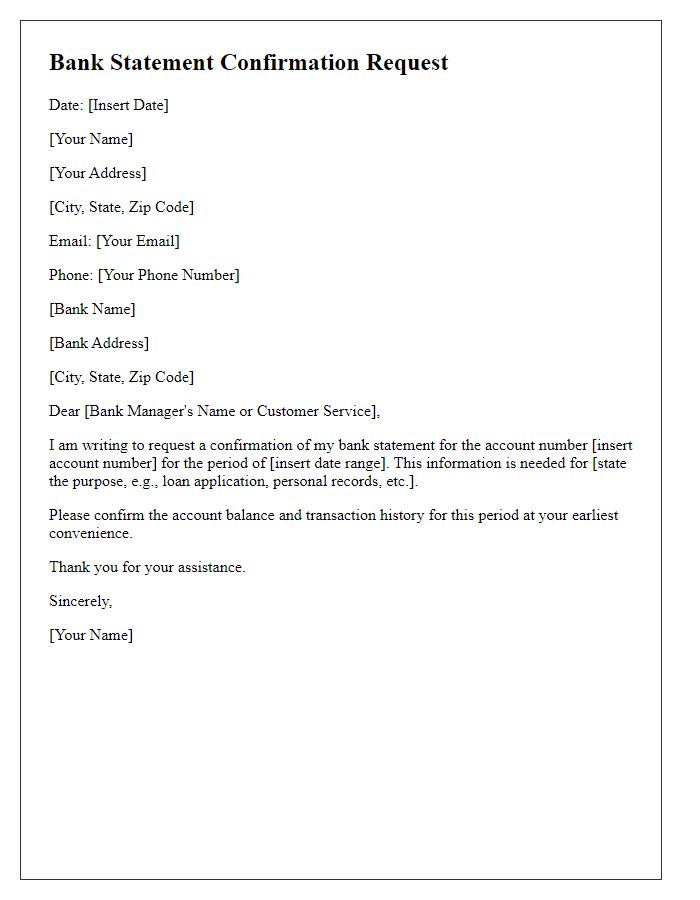

Bank's official letterhead and contact information

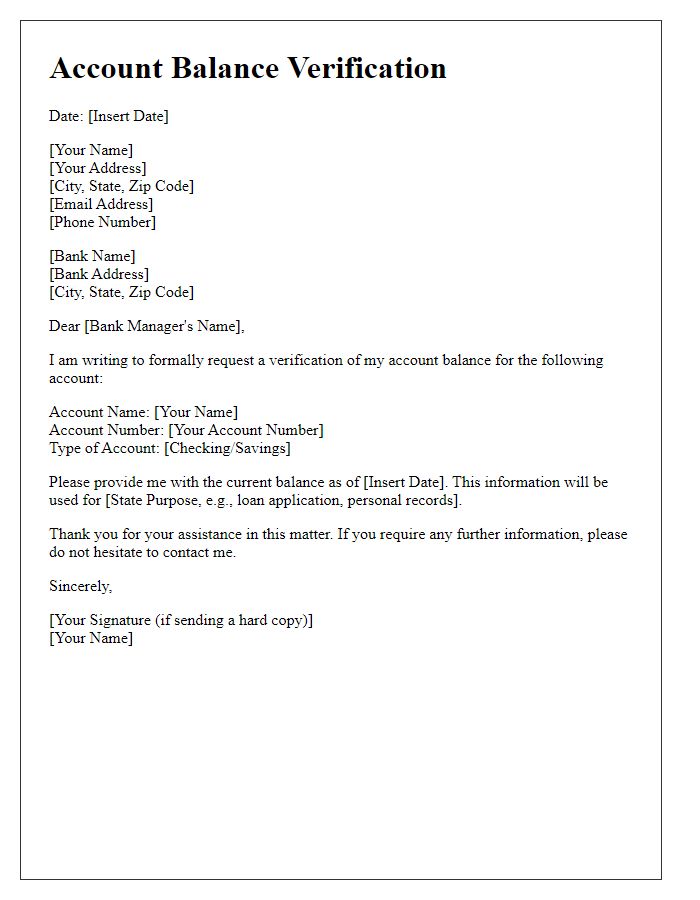

Bank confirmation of funds is a crucial document utilized by businesses and individuals to verify the availability of money in an account. This confirmation typically appears on the bank's official letterhead, which includes the bank's logo, address, and contact information. In this document, account details such as the account holder's name, account number, and the current balance are stated clearly. The letter also includes a date, ensuring the information is up-to-date, and often contains a signature from an authorized bank representative to authenticate its validity. This confirmation is frequently required for transactions like loan applications, leases, and investment opportunities, providing assurance to third parties regarding the financial status of the account holder.

Customer account details and funds amount

A bank confirmation of funds requires specific details to ensure accuracy and security for financial transactions. The document typically includes key elements such as customer account details--account number, account type, and customer name associated with the account, usually localized within banking systems in respective countries. It should explicitly state the funds amount, clearly defined with the corresponding currency denomination, such as USD (United States Dollar) or EUR (Euro). Additionally, it may involve verifications related to specific events like loans, investments, or transactions, depending on the customer's request, ensuring that the institution's policies (as per compliance protocols) are maintained throughout the process.

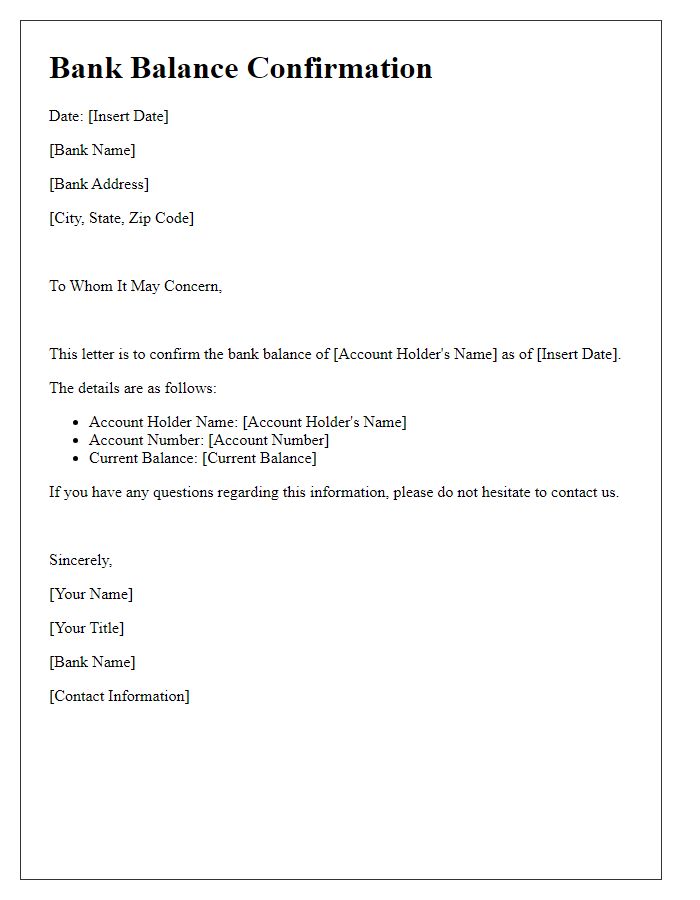

Confirmation statement from authorized bank representative

Bank confirmation of funds is a critical document for validating the availability of funds in personal or business accounts. This statement typically includes essential information such as the account holder's name, account number, and current balance. For instance, a bank statement issued by a representative of Bank of America (founded in 1998 in Charlotte, North Carolina) may affirm that the account holder possesses $50,000 in their checking account. The confirmation adds credibility to transactions like real estate purchasing or loan applications, where financial verification is imperative. An authorized bank representative, usually a branch manager or a customer service officer, signs this statement to ensure its authenticity, thereby providing assurance to third parties about the account holder's financial standing.

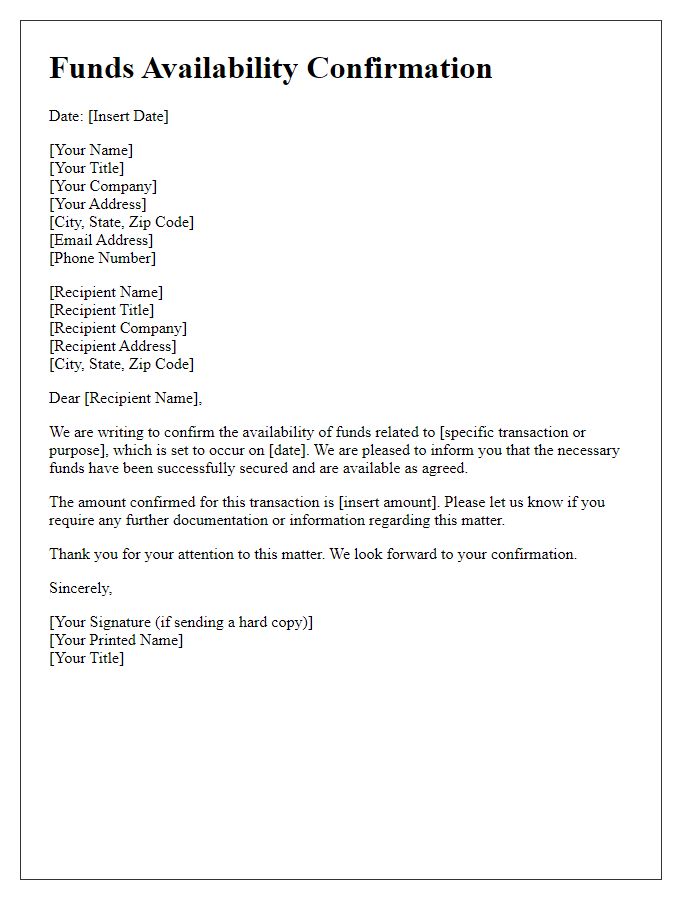

Date of issue and validity period

A bank confirmation of funds is a crucial financial document establishing the availability of funds for specific transactions or commitments. Typically issued by banks such as JPMorgan Chase (New York-based) or HSBC (international), these confirmations contain essential details, including the date of issue--often noted as the date the letter is generated--and the validity period, which usually spans a set timeframe ranging from 30 to 90 days, depending on banking policies. The document may be used for various purposes like mortgage approvals or large purchases, and should include the account holder's name, account number, and the total available balance, which adds clarity and assurance to potential lenders or sellers in business transactions.

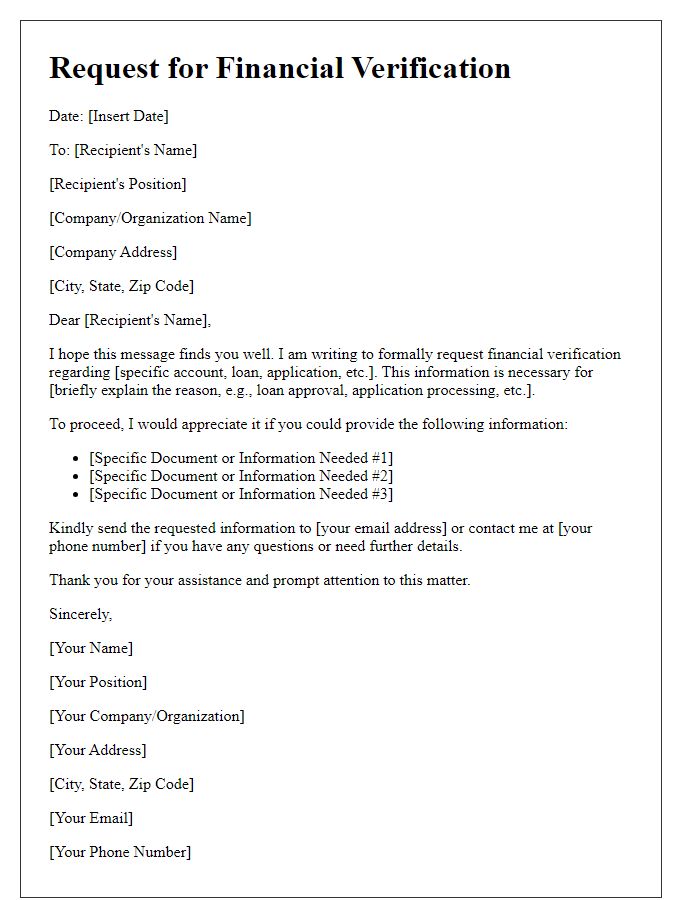

Legal disclosures and disclaimers

The bank confirmation of funds is critical for various financial transactions, including real estate purchases and loan applications. This document verifies account balances, transaction history, and the account holder's financial credibility. Legal disclosures ensure transparency, detailing the bank's liability limits, data privacy conditions, and applicable regulatory compliance, such as the Financial Crimes Enforcement Network (FinCEN) guidelines. Additionally, disclaimers may state that the confirmation only reflects balances as of a particular date, emphasizing the need for periodic updates to maintain accuracy. These elements are essential in establishing trust and meeting legal obligations during financial dealings.

Comments