Are you ready to streamline your import processes and ensure compliance with regulations? In this article, we'll guide you through the essential steps to craft a professional letter confirming your import quota allocation. With practical tips and a comprehensive template, you'll find it easy to navigate the intricacies of import documentation. So, let's dive in and explore how to effectively communicate your quota allocation details!

Recipient Information

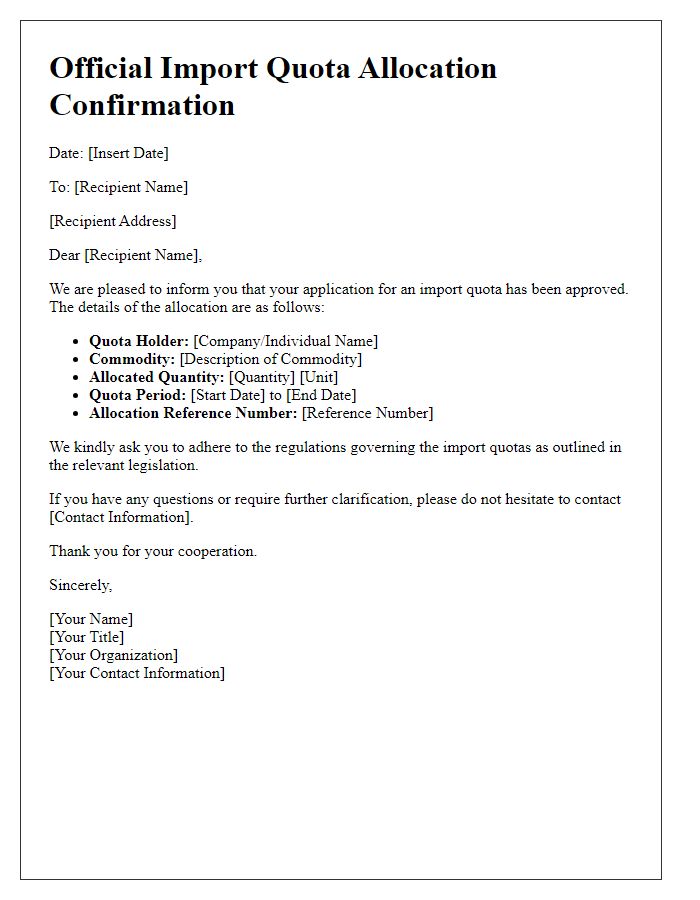

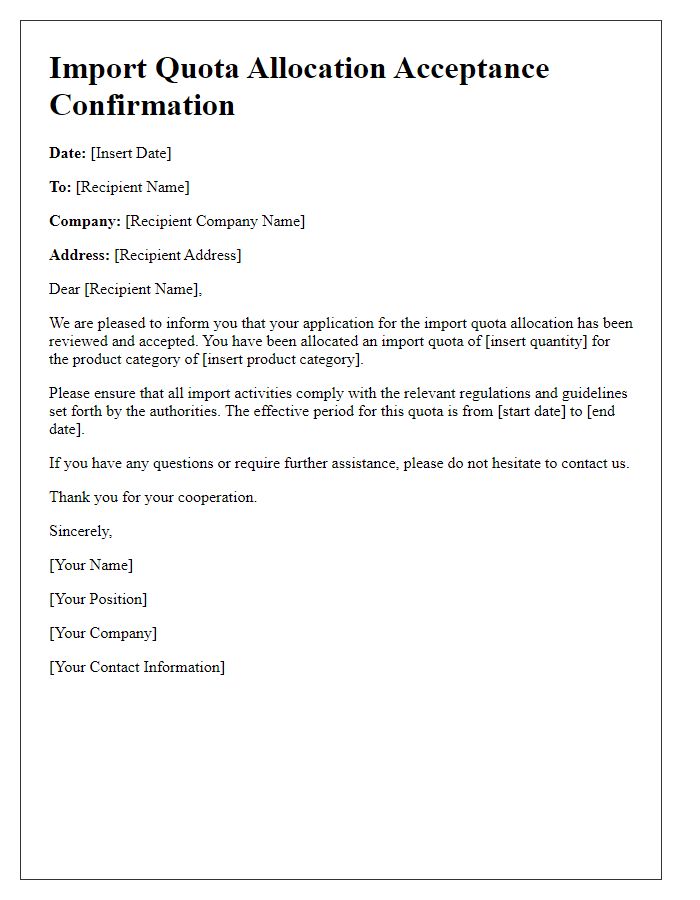

The import quota allocation confirmation is a crucial document for businesses engaged in international trade, particularly in industries such as textiles, electronics, and agriculture. This confirmation serves to inform the recipient, often a manufacturer or distributor, of the specific quantity of goods that they are authorized to import into a country during a designated period, such as a fiscal year. The allocation is typically governed by governmental regulations to manage trade balances and protect domestic markets. Entities like the World Trade Organization (WTO) and various national trade departments oversee these quotas. Providing detailed information such as reference number, allocation amount, valid dates, and any conditions associated with the quota ensures clarity and compliance with regulatory standards. This process may require additional documentation, including a Certificate of Origin or an Import License, depending on the nature of the products being imported.

Allocation Details

Import quota allocations play a crucial role in international trade, particularly within the context of specific goods like textiles or agricultural products. Each country, such as the United States or members of the European Union, imposes these quotas to regulate the volume of imports within a given timeframe (often annually), ensuring balance between domestic production and foreign competition. For example, the U.S. might allocate a quota of 500,000 tons for cotton imports in 2023. This allocation is typically communicated through official documents outlining the recipient company, the allocated quantity, and the applicable period. To comply with regulations, importers must keep meticulous records and adhere to any conditions associated with their quota, avoiding penalties or restrictions on future allocations.

Terms and Conditions

Import quotas play a crucial role in international trade, regulating the amount of goods allowed into a country, particularly in sectors like textiles or agriculture. For instance, the United States imposes quotas on sugar imports, capping the annual allowance to around 1.5 million metric tons to protect domestic producers. Companies receiving quota allocations must adhere to specific terms and conditions, including compliance deadlines and documentation requirements, to ensure transparency and regulatory adherence. Failure to meet these terms can result in penalties, reduced future quotas, or even legal implications. Maintaining accurate records of quota usage and adhering to trade laws, such as the World Trade Organization (WTO) regulations, is essential for businesses engaged in international trade.

Contact Information

The confirmation of import quota allocation, essential for regulating the volume of goods entering a country, typically includes key details such as agency names, allocation numbers, and recipient contact information (name, phone number, email address). Each quota, governed by regulations set forth by international trade agreements, can significantly impact the economy, industry supply chains, and importers' strategic planning. Import quotas often specify restrictions on commodities, like textiles or agricultural products, with the aim to protect domestic markets. Detailed instructions usually accompany these confirmations, ensuring compliance with customs regulations and necessary documentation, fostering smooth transactions in global trade.

Closing and Signatory

Import quota allocation confirmation is critical for international trade compliance, especially for products subject to restrictions. Import quotas can dictate the amount of specific goods that can be brought into a country, such as textiles or agricultural products. Ensuring the proper allocation is vital for businesses to avoid penalties. Each quota is monitored by trade authorities to regulate supply and demand within domestic markets. Businesses must adhere to these allocations to promote fair competition and protect local industries. In closing, the signatory should emphasize gratitude for cooperation and express readiness for further discussions regarding the import quota process.

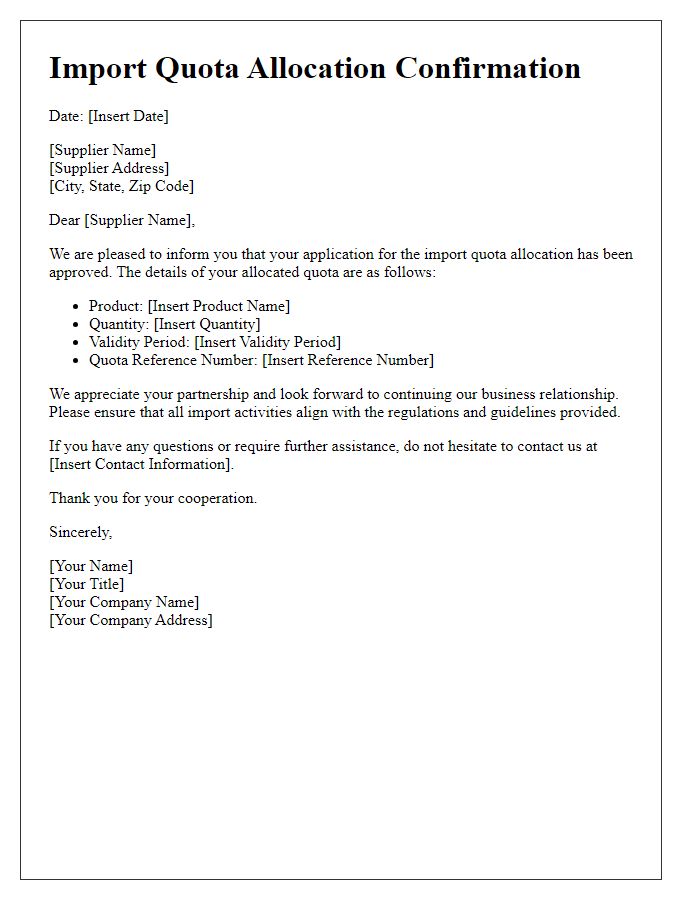

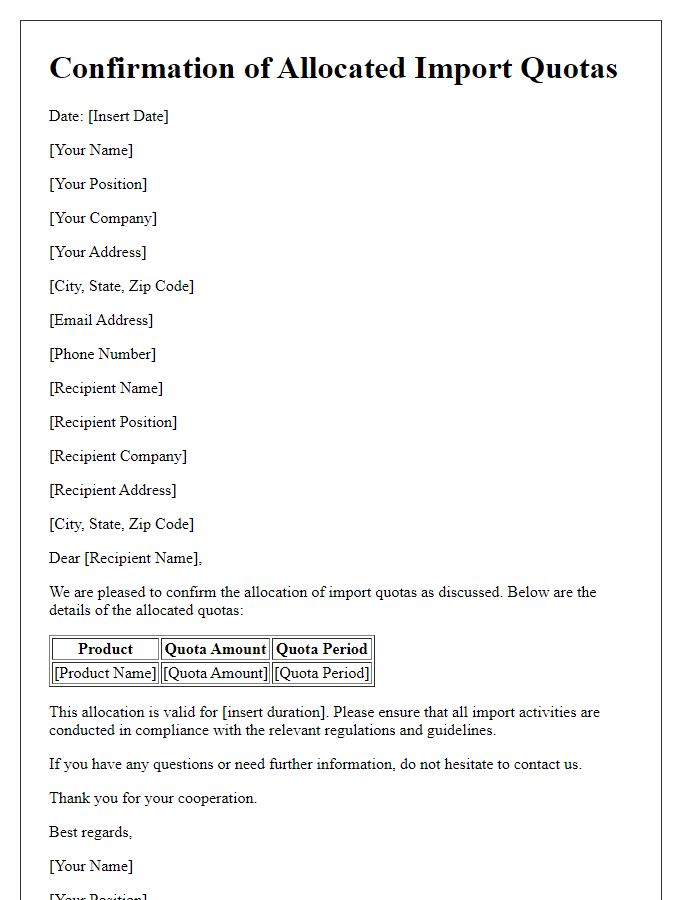

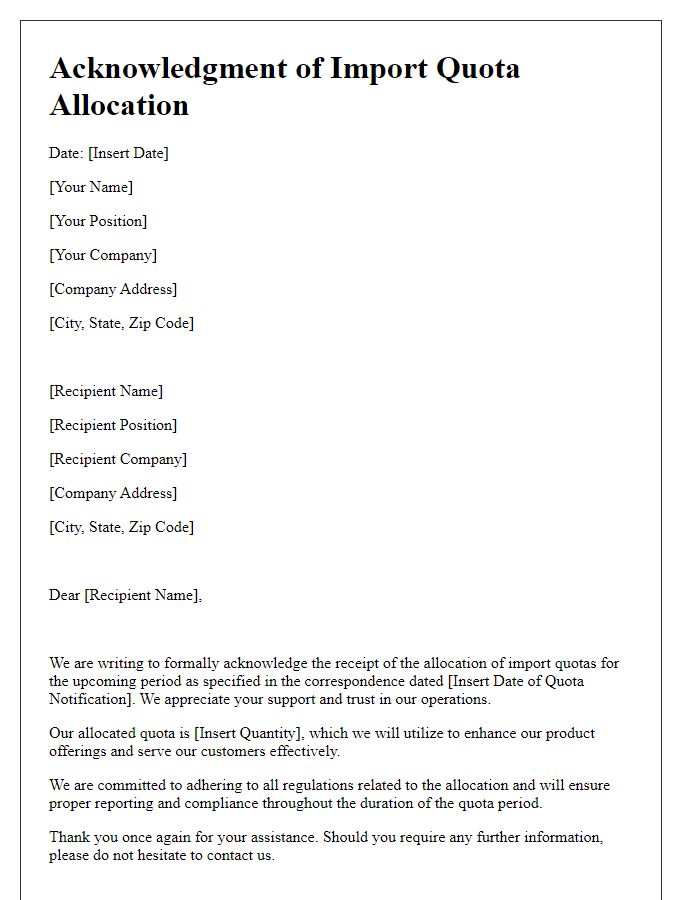

Letter Template For Confirming Import Quota Allocation Samples

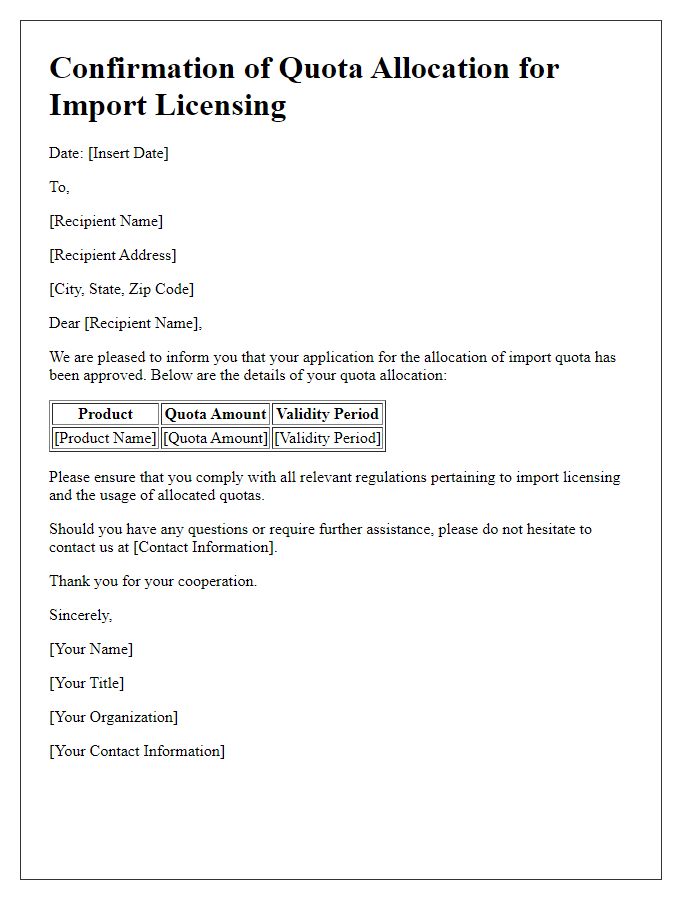

Letter template of Confirmation of Quota Allocation for Import Licensing

Comments