Are you facing challenges with your financial service provider? It can be stressful to deal with issues like unexpected fees, poor customer service, or delayed responses. Writing a complaint letter can be an effective way to communicate your concerns and seek a resolution. Stick around as we delve into tips and a template to help you craft the perfect letter for your financial service complaint.

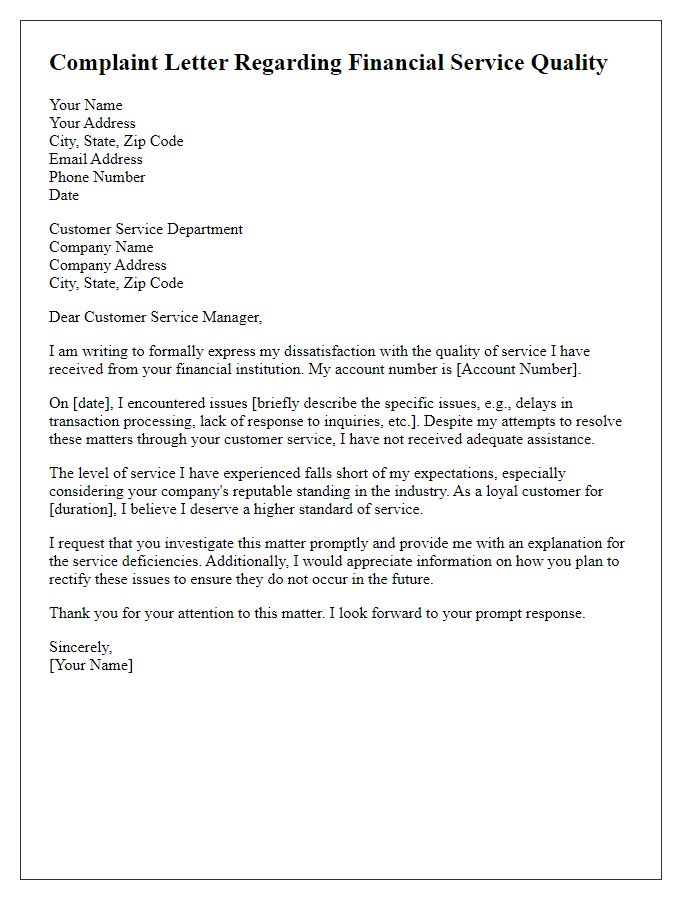

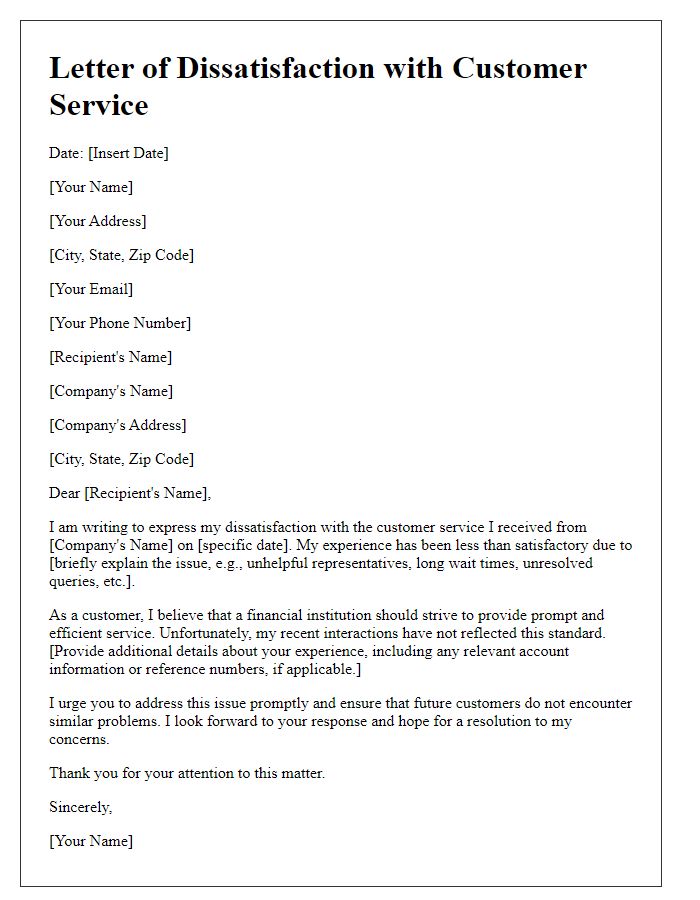

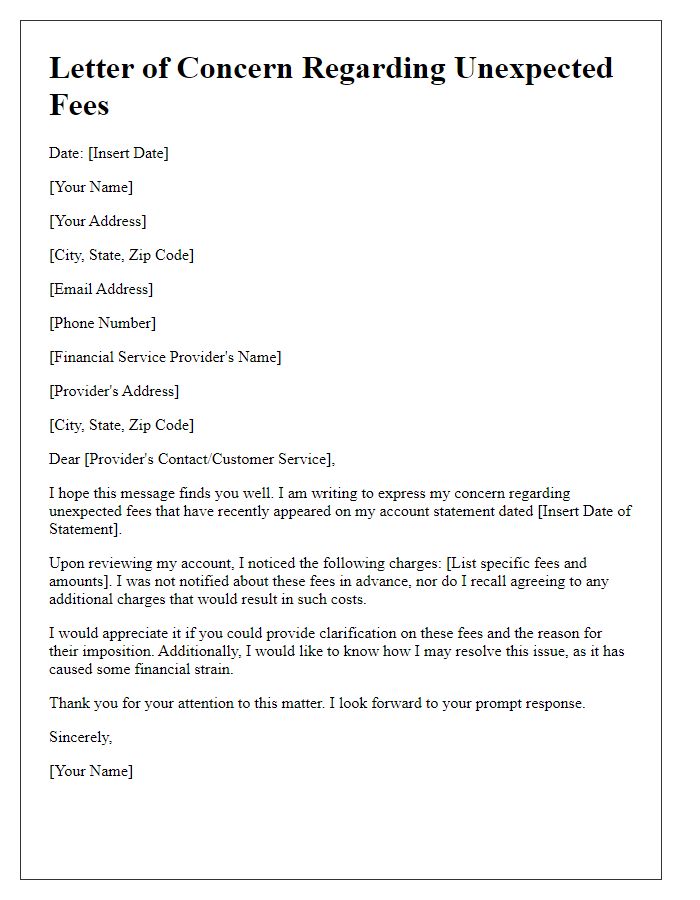

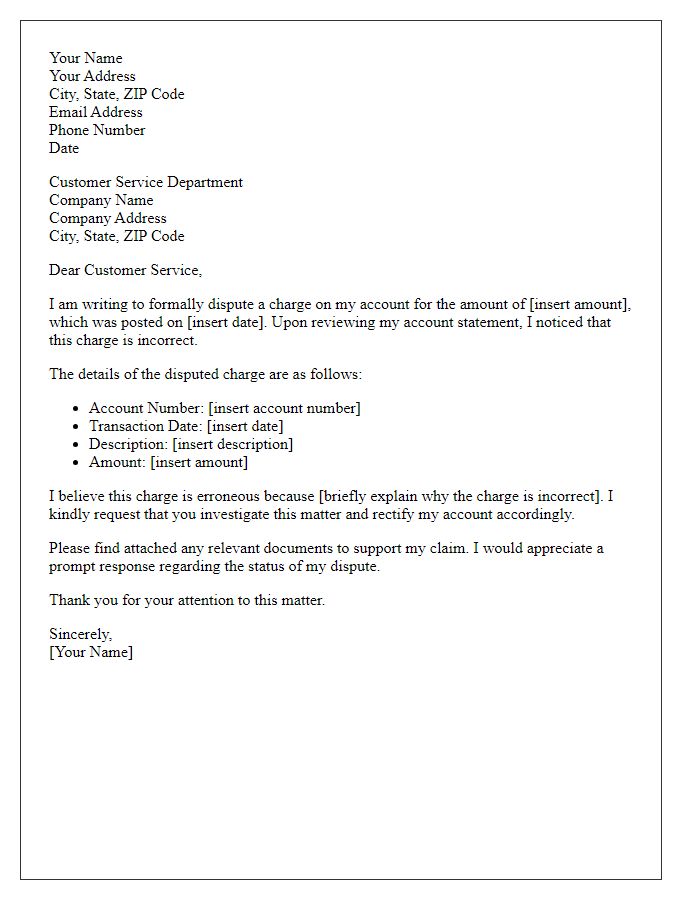

Subject Line

Financial service complaints often arise from issues related to customer service, account management, or transaction discrepancies. Key entities may include different financial institutions such as banks (e.g., Bank of America, Chase) or financial service platforms like PayPal. Common numeric indicators can involve transaction amounts (like $500) or account balances (such as $1,000). Important events often cited include unauthorized charges or service outages during critical financial transactions. In some instances, specific complaints may reference regulations or consumer protection acts (e.g., the Fair Credit Reporting Act).

Account Information

Inadequate account information can lead to significant issues for clients using financial services, such as discrepancies in transaction records. Financial institutions, including banks like Bank of America and Wells Fargo, are required to provide accurate and timely account statements monthly. Failing to deliver correct information can result in unauthorized charges, affecting client trust and satisfaction. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB), set forth guidelines to ensure transparency in account management. Clients experiencing issues with their account information may face obstacles in reconciling balances, leading to potential overdraft fees and financial mismanagement. Proper training of customer service representatives is crucial for addressing these concerns promptly and effectively.

Detailed Description of Issue

Customers frequently encounter issues with financial service providers, particularly regarding discrepancies in billing statements. For example, ABC Bank may send a monthly statement showing a charge of $200 for overdraft fees incurred in September 2023, despite the account holder claiming to have maintained a positive balance throughout that month. Disputes arise when account holders receive automated responses to investigation requests, often resulting in frustration due to the lack of personalized customer service. This impersonal approach can escalate issues, as clients feel their concerns are not being taken seriously. Further complications can lead to negative impacts on credit scores, creating more significant long-term financial difficulties for customers. Addressing such concerns swiftly is crucial to maintaining customer trust within the competitive financial sector.

Supporting Documentation

Submitting a financial service complaint often requires supporting documentation to substantiate claims. Key documents may include account statements detailing transactions, correspondence records (emails or letters) with the financial institution, and any applicable forms (like loan agreements or withdrawal requests). Additionally, identification documents (such as a driver's license or passport) might be necessary to verify identity. Transaction receipts or confirmation numbers (often six to eight digits) can serve as evidence of specific interactions. Ensure clarity in presentation (chronological order recommended) to facilitate the review process by customer service representatives or regulatory bodies overseeing consumer financial protection.

Desired Resolution

A financial service complaint regarding an erroneous charge can lead to a significant impact on personal finances, such as unexpected withdrawal amounts affecting total budget calculations. The desired resolution typically involves a full refund of the incorrect charges amounting to $150, alongside a comprehensive review of account statements dating back six months to ensure no further discrepancies exist. Additionally, an assurance of corrective measures being implemented within the financial institution's billing processes can help restore confidence in the service, particularly if previous complaints have gone unresolved. Finally, obtaining formal written communication from the financial service provider confirming the resolution details is essential for record-keeping purposes and future reference.

Comments