Are you feeling overwhelmed by financial obligations and considering requesting a payment extension? You're not alone, as many individuals find themselves in similar situations and seek ways to ease their financial burdens. In this article, we'll explore effective approaches to crafting a payment extension inquiry letter, ensuring you communicate your needs clearly and professionally. So, grab a seat and let's dive into the essential tips that will guide you through the process!

Polite and respectful tone

Understanding the need for financial accommodation, individuals often seek extensions on payment deadlines. Payment extensions enable clients to manage their finances more effectively, especially in light of unforeseen circumstances like medical emergencies, job loss, or unexpected expenses. Communicating with creditors or service providers through a formal inquiry emphasizes respect and professionalism, which improves the chances of a favorable response. Clear details regarding the payment amount, due date, and reasons for the request play a crucial role in the inquiry's success. Whether dealing with a mortgage lender, utility company, or credit card issuer, maintaining a polite and respectful tone fosters goodwill and understanding, paving the way for potential leniency in financial agreements.

Clear reason for extension request

A letter template for a payment extension inquiry provides a structured format for individuals or businesses seeking additional time to settle financial obligations. This template typically includes key details such as the debtor's account information, the specific reason for the extension request--such as unexpected medical expenses or temporary job loss--and the proposed new payment timeline. The clarity of the reason helps establish the context of the request, making it more likely to be understood and approved by creditors. A polite tone enhances communication, reflecting the seriousness of the financial situation while maintaining professionalism. Including any relevant documentation, such as proof of income or expenses, can further substantiate the request.

Proposed payment plan

Many individuals and businesses sometimes face cash flow challenges that necessitate a payment extension inquiry. A proposed payment plan outlines specific terms, including the total amount owed, installment frequency (weekly, monthly), and extended duration (typically 30, 60, or 90 days). Clear communication is crucial in writing this inquiry, ensuring that the financial institution or creditor understands the reason for the request, such as unexpected expenses or economic difficulties. A professional tone is essential, emphasizing a commitment to fulfilling the financial obligation. Including personal or business details, like the account number and previous payment history, can provide context and support the request for consideration.

Contact information and preferred method

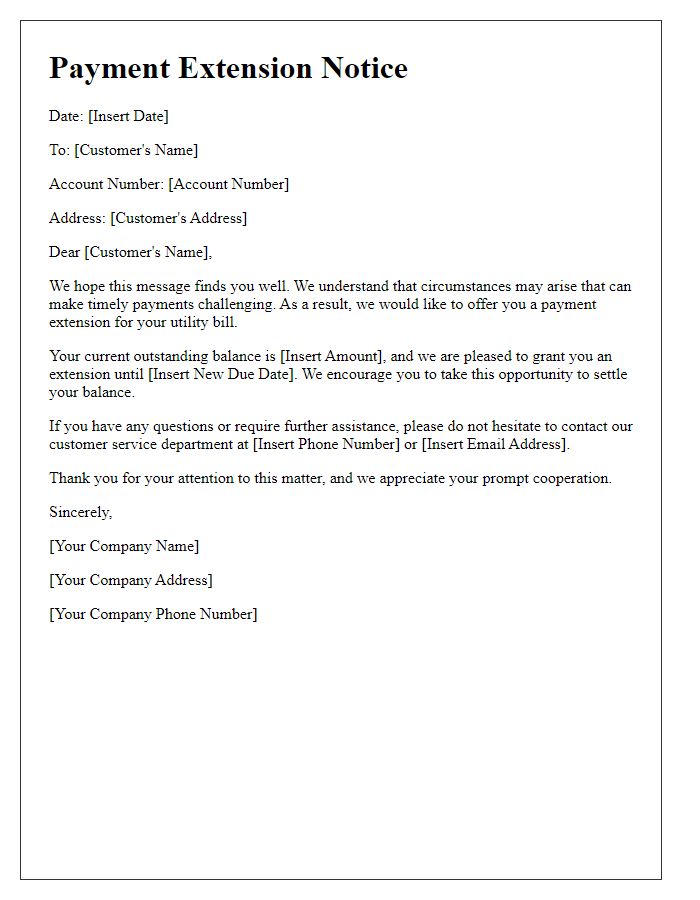

A payment extension inquiry can be essential for managing financial commitments effectively. Payment extensions allow individuals or businesses to delay deadlines for financial obligations, such as loan payments, utility bills, or credit card dues. Providing clear contact information (including phone number and email address) ensures smooth communication with creditors or service providers. Indicating preferred methods for communication, such as email correspondence or phone calls, streamlines the discussion and facilitates quicker responses. Identifying these details prepares individuals to negotiate extensions, making it more manageable to meet obligations while maintaining financial stability.

Appreciation for consideration

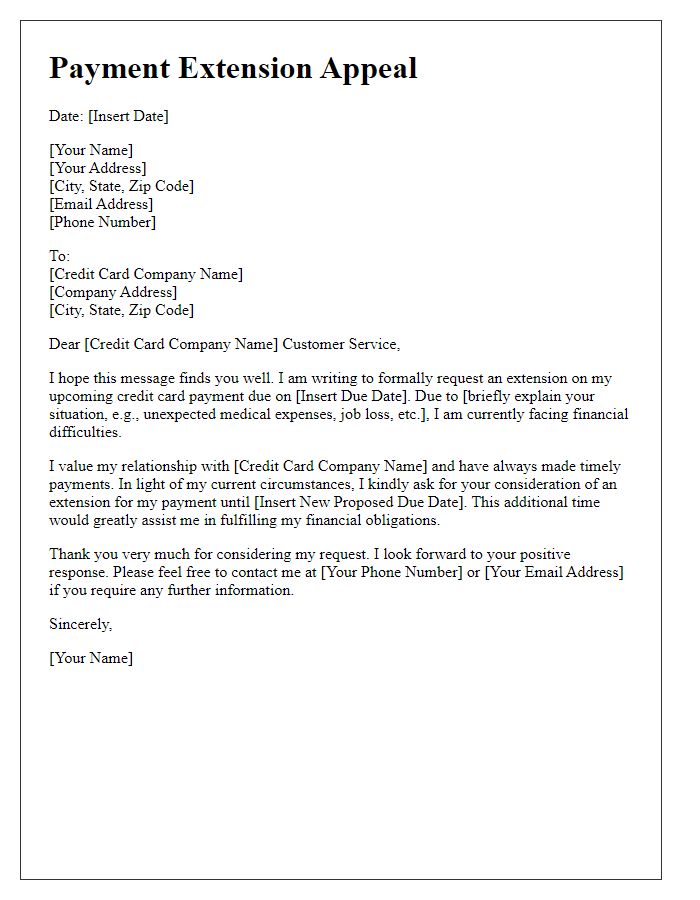

A payment extension inquiry typically reflects a request for additional time to settle a financial obligation, often due to unforeseen circumstances. Borrowers may express gratitude for anticipated understanding and flexibility in the repayment arrangement. Clear communication regarding the intended duration of the extension (e.g., 30 days) and the specific circumstances requiring the request, such as temporary unemployment or unexpected medical expenses, often enhances the legitimacy of the appeal. Emphasizing a commitment to fulfilling the obligations, alongside a timeline for resolution and payment, can foster goodwill and increase the likelihood of a favorable response from lenders or creditors.

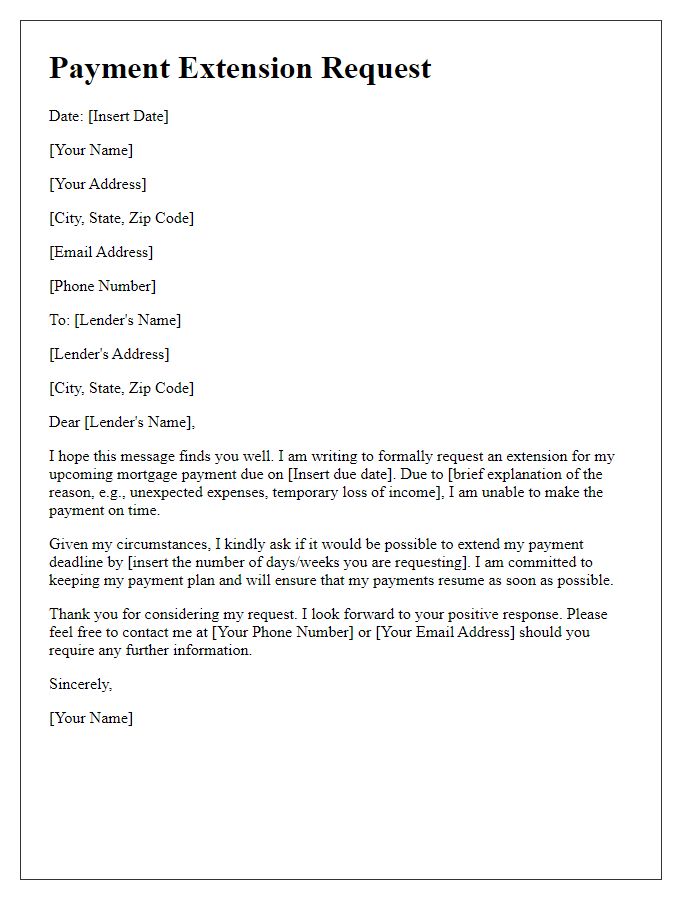

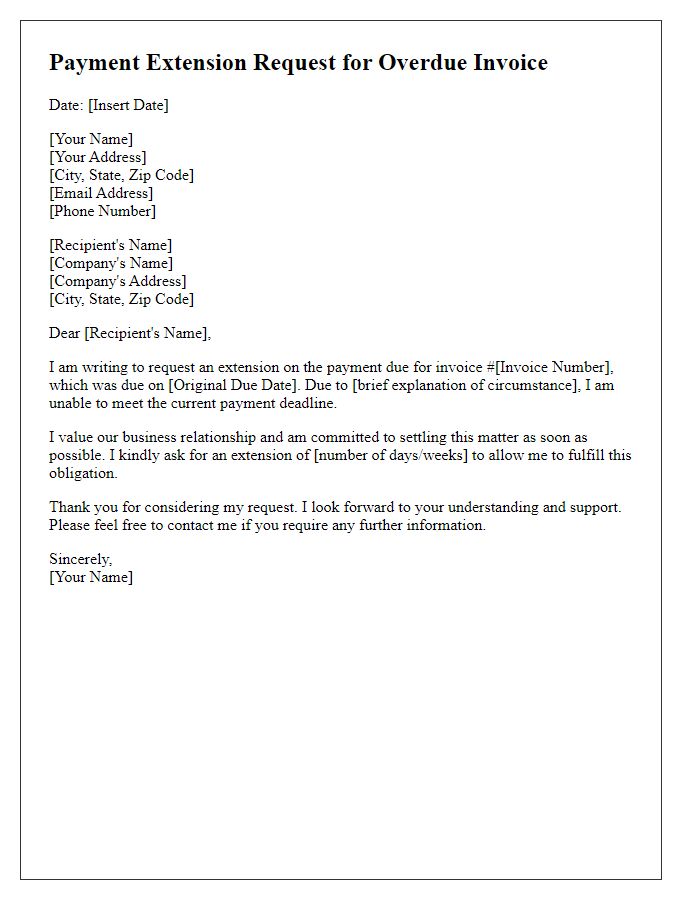

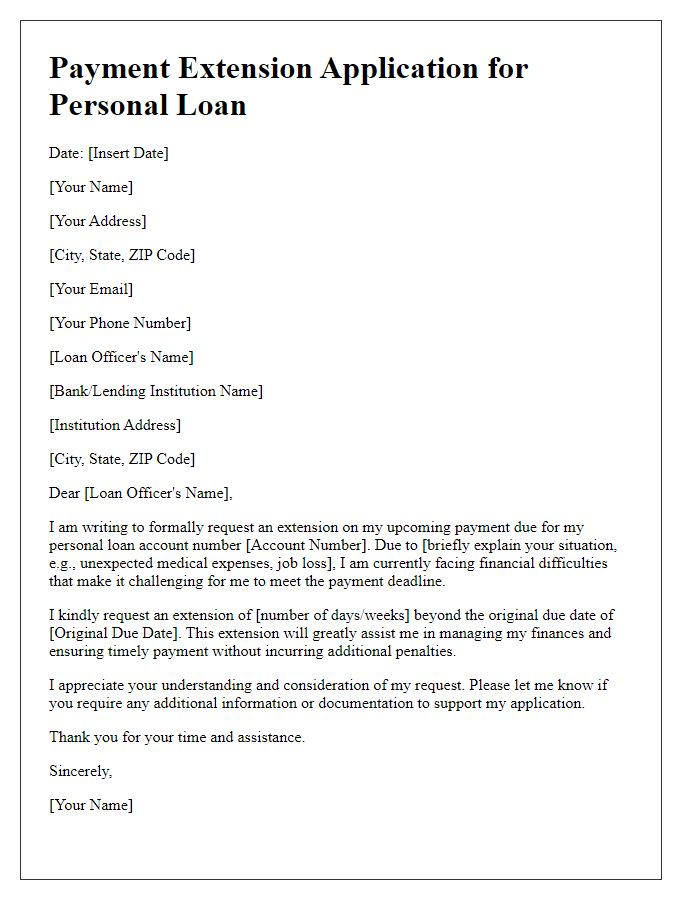

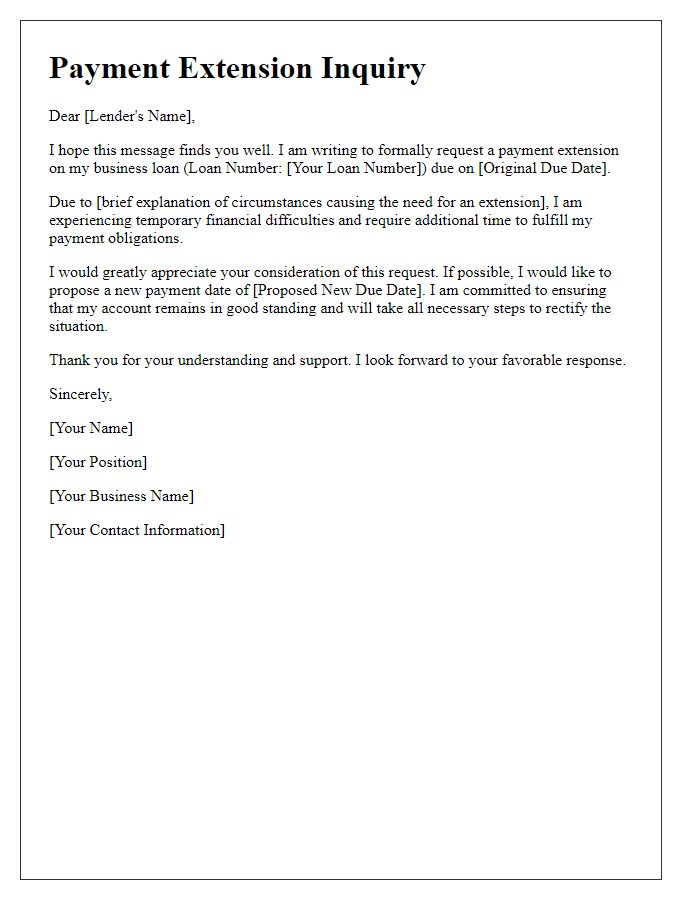

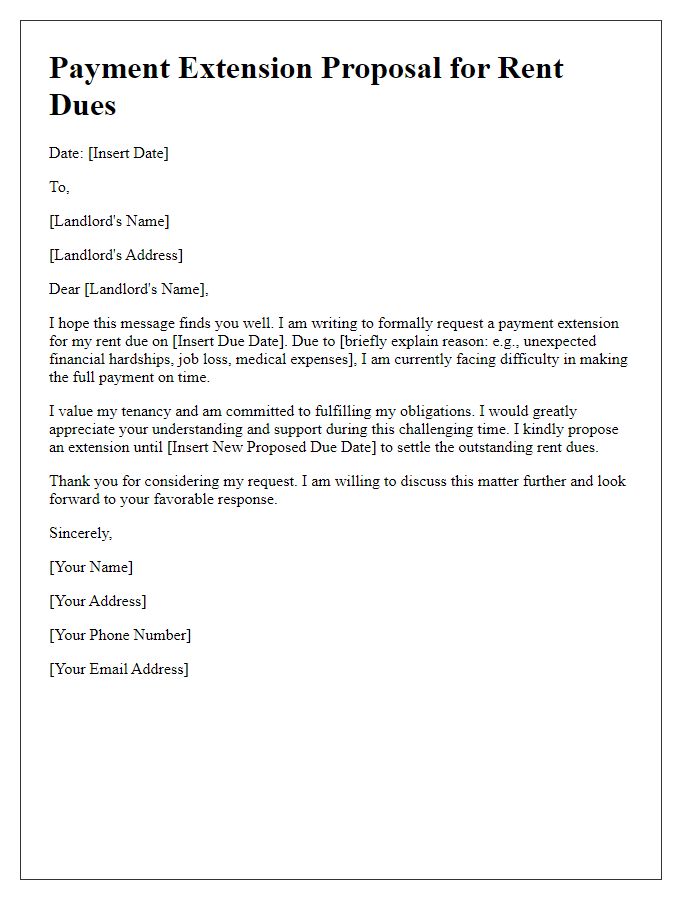

Letter Template For Payment Extension Inquiry Samples

Letter template of payment extension communication for mortgage payments

Comments