If you've ever found yourself puzzled about exempt income and how it affects your financial landscape, you're not alone. Understanding the ins and outs of exempt income notifications is crucial for making informed decisions and maintaining compliance with tax obligations. In this article, we'll break down what exempt income is, why you need to notify the relevant authorities, and how to effectively communicate this in a letter. So, grab a cup of coffee, settle in, and let's dive deeper into this important topic!

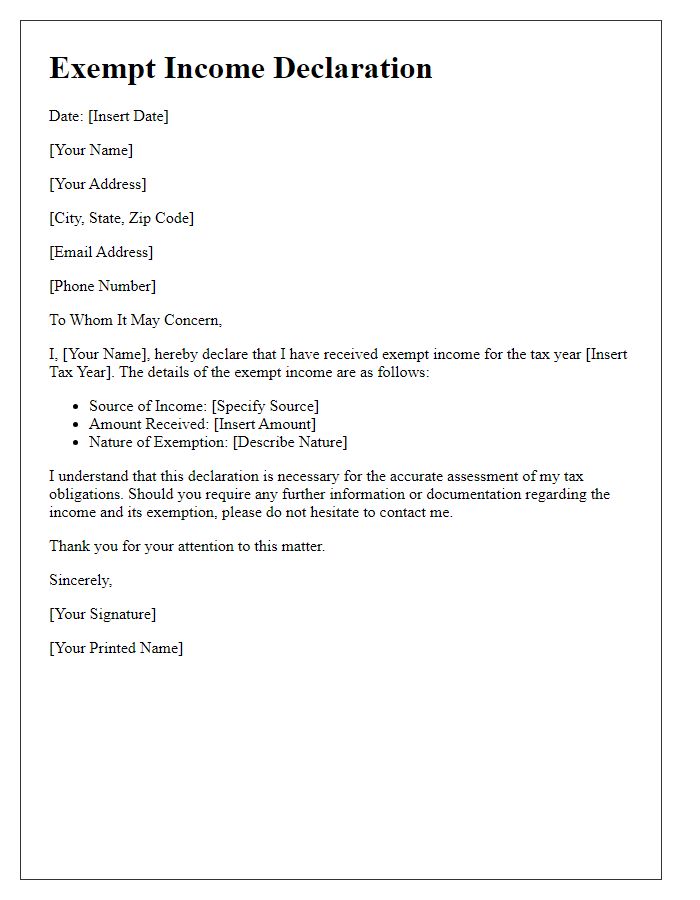

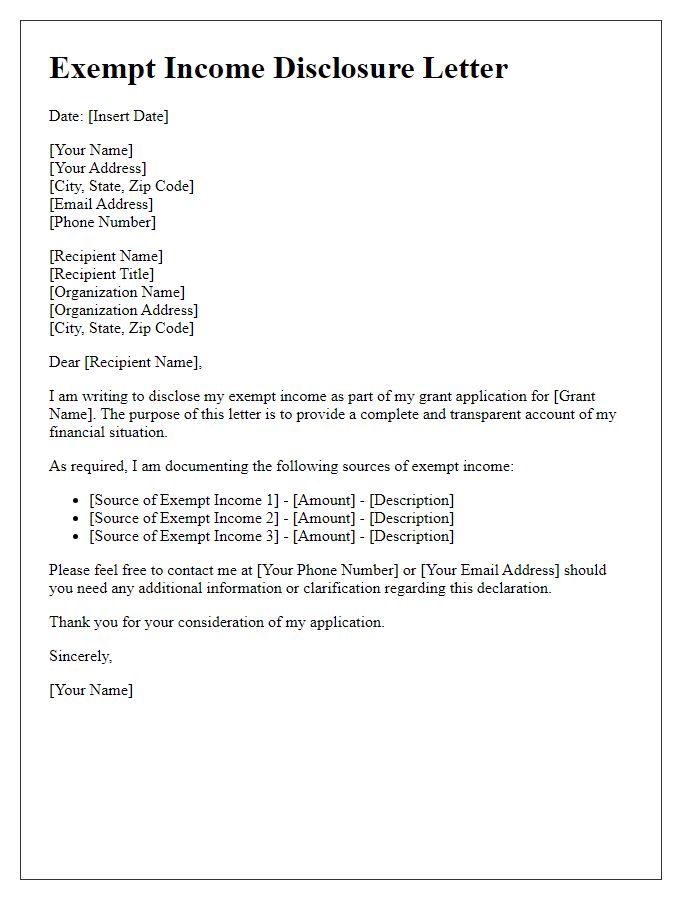

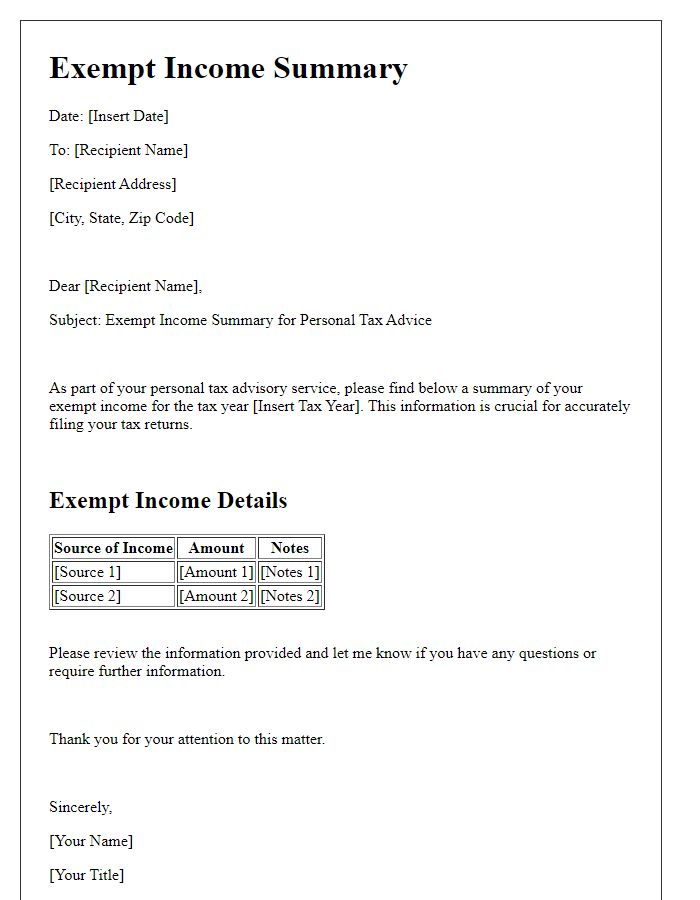

Accurate Personal and Contact Information

Accurate personal and contact information is crucial for tax documentation, especially when notifying relevant authorities about exempt income status. Full name (as recorded on tax returns), Social Security Number (or Tax Identification Number, TIN), complete mailing address (including street address, city, state, and zip code) should be clearly stated. Additionally, a valid phone number (with area code) and email address are essential for further communication. The notification should clearly state the specific exemption references such as IRS Publication 526 for charitable contributions or other relevant tax forms. Maintaining accurate records ensures that tax entities can process the exemption efficiently without delays or complications.

Clear Explanation of Exemption Criteria

Exempt income notifications must include a clear explanation of exemption criteria, relevant to tax regulations established by the Internal Revenue Service (IRS). Various sources of exempt income, such as scholarships for education (up to a certain amount), certain social security benefits, and specific interest earned on municipal bonds, can significantly influence an individual's taxable income. To qualify for exemption, individuals must meet specific requirements, including age, income level, and specific use of the funds, often outlined in the IRS guidelines under sections such as 115 and 132. Detailed documentation, including form 1099 and proof of eligibility, is essential to substantiate claims. Understanding these criteria helps taxpayers navigate their financial responsibilities effectively while maximizing benefits from potential exempt incomes.

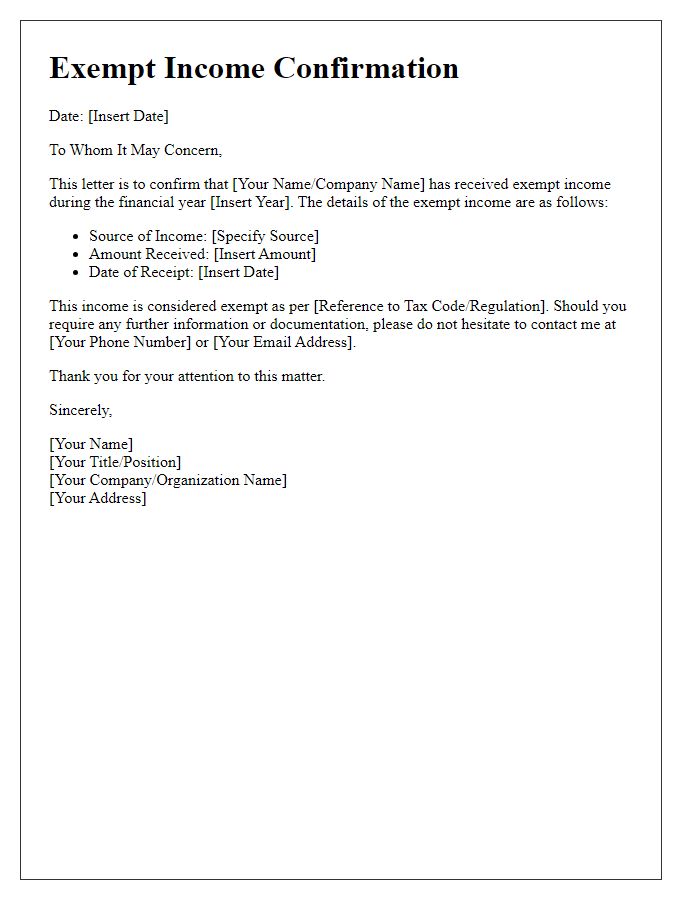

Reference to Relevant Tax Codes

Exempt income notifications require meticulous attention to various tax codes and regulations specific to each jurisdiction. Certain categories of exempt income, such as social security benefits (referenced under IRS Publication 915 for the United States), may not be subject to federal income tax depending on the recipient's total income level. Meanwhile, tax-free contributions to Health Savings Accounts (HSAs) can be referenced under Section 223 of the Internal Revenue Code, allowing individuals to save for medical expenses without incurring tax liabilities. Additionally, municipal bond interest is often exempt from federal income tax pursuant to IRS Code Section 103. It is crucial for taxpayers to retain proper documentation detailing these income sources and their respective exemption qualifications for potential audits, ensuring compliance with pertinent regulations and maximizing eligible deductions.

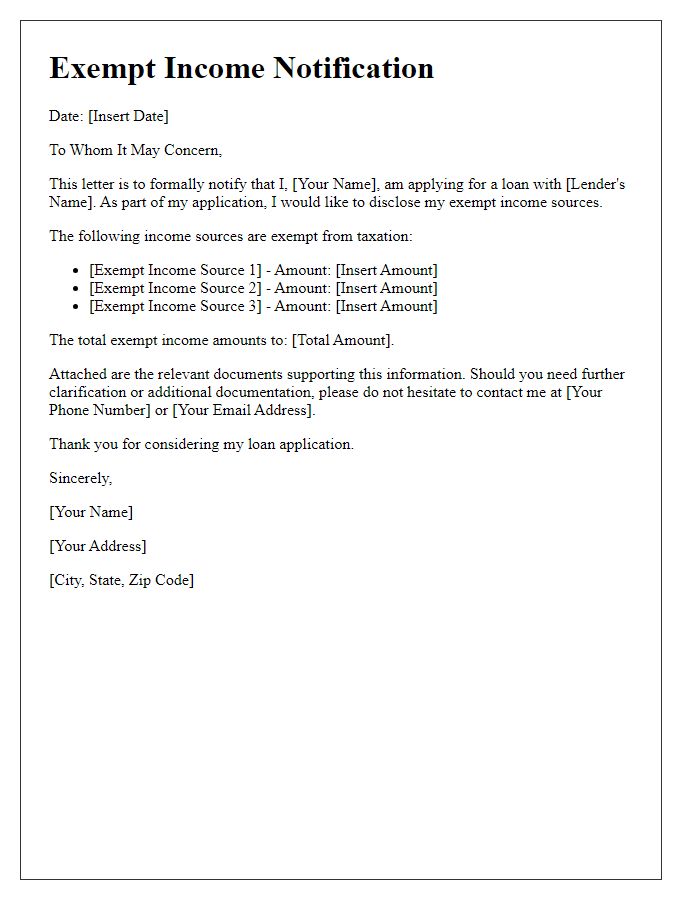

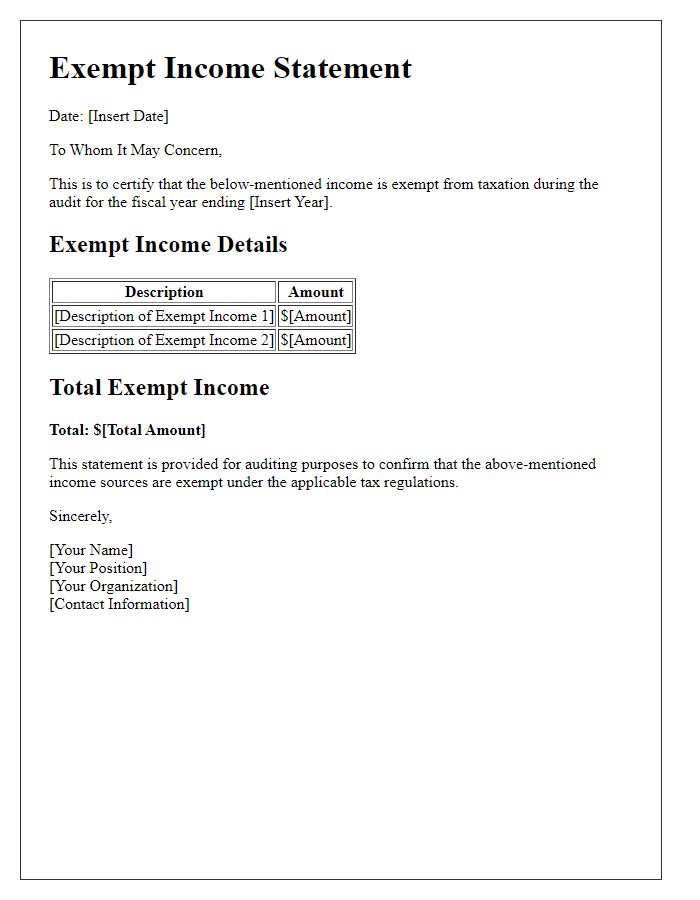

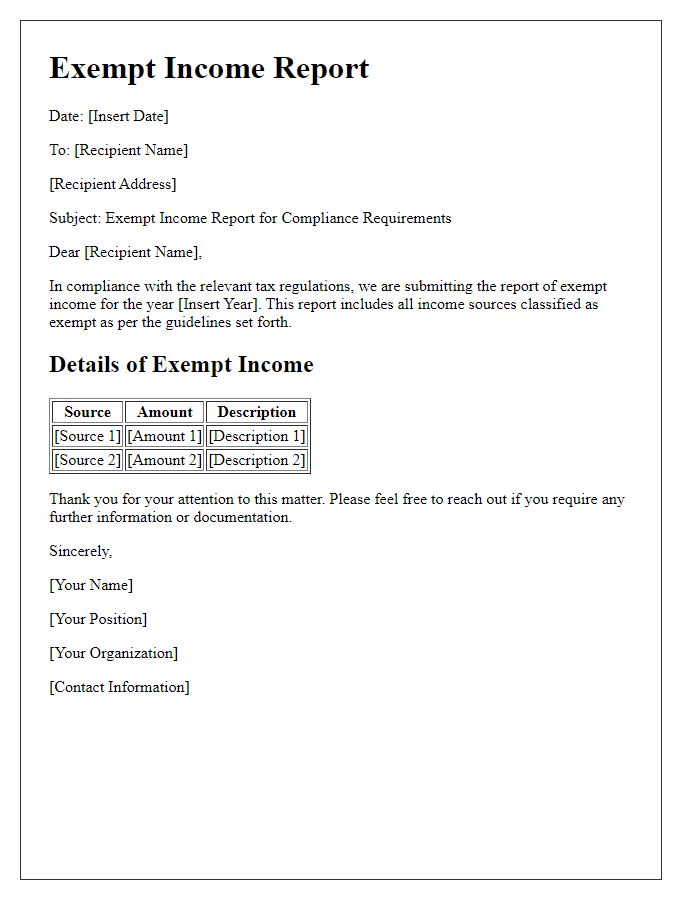

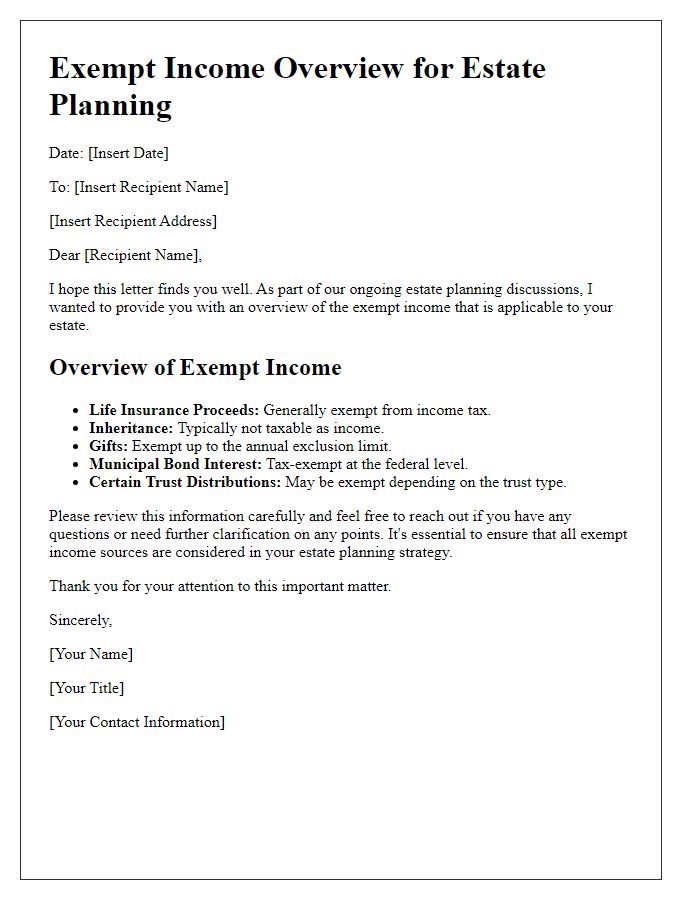

Detailed Income Breakdown

A detailed income breakdown is crucial for understanding exempt income, particularly for tax purposes. Exempt income can come from various sources, such as federal grants, specific disability payments, or interest from municipal bonds. Individuals must categorize this income accurately to comply with regulations. For instance, in the United States, the Internal Revenue Service (IRS) outlines exclusions that apply to specific forms of income. Individuals receiving Social Security Disability Insurance (SSDI) should document the monthly payment amount, while those with interest from municipal bonds must note the bond issuer and total interest earned, as these are typically tax-exempt. Accurate record-keeping ensures that cumulative exempt income is properly reported, ultimately affecting taxable income calculations.

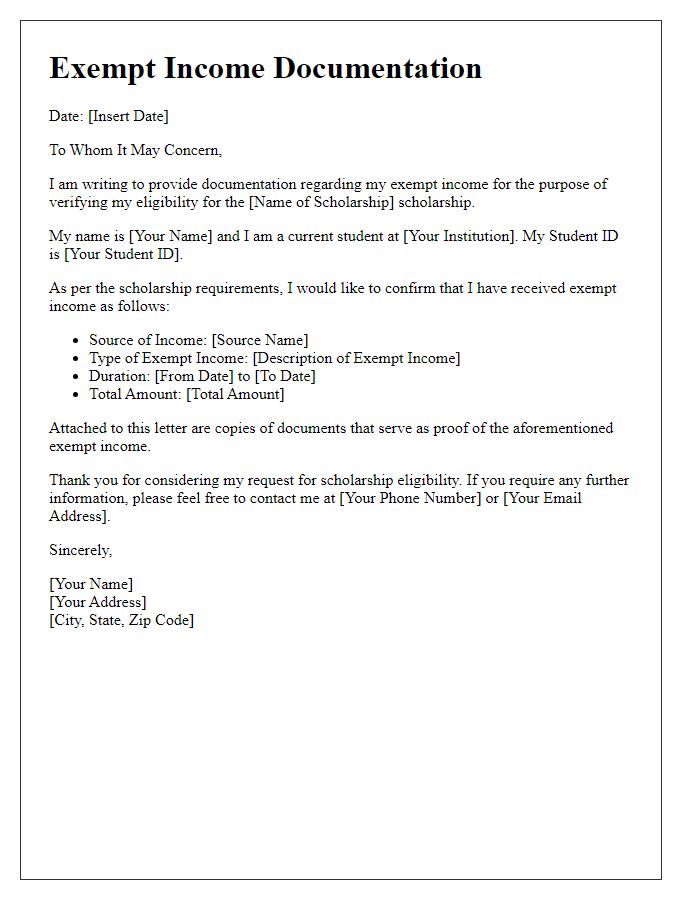

Supporting Documentation References

Supporting documentation references are essential for the verification of exempt income notifications. Tax forms, such as IRS Form 1040, report various income types including exemptions. Legal documents, such as the Certificate of Exemption, specify income sources that are not subject to taxation, including specific state laws or federal statutes. Financial statements from institutions like banks or investment firms provide evidence of income sources and any exempt interest earned. Additionally, letters from employers or governmental agencies can clarify unusual income situations, ensuring transparency and compliance with regulations. Accurate citations of documents enhance credibility, aiding in swift processing by tax authorities.

Comments