Are you grappling with the aftermath of a charge-off account and unsure where to turn? You're not alone; many individuals face these challenging financial situations and often feel overwhelmed. However, understanding the process and having a game plan can make all the difference in achieving a resolution. Join us as we explore effective strategies to address charge-off accounts and take control of your financial future!

Accurate Account Details

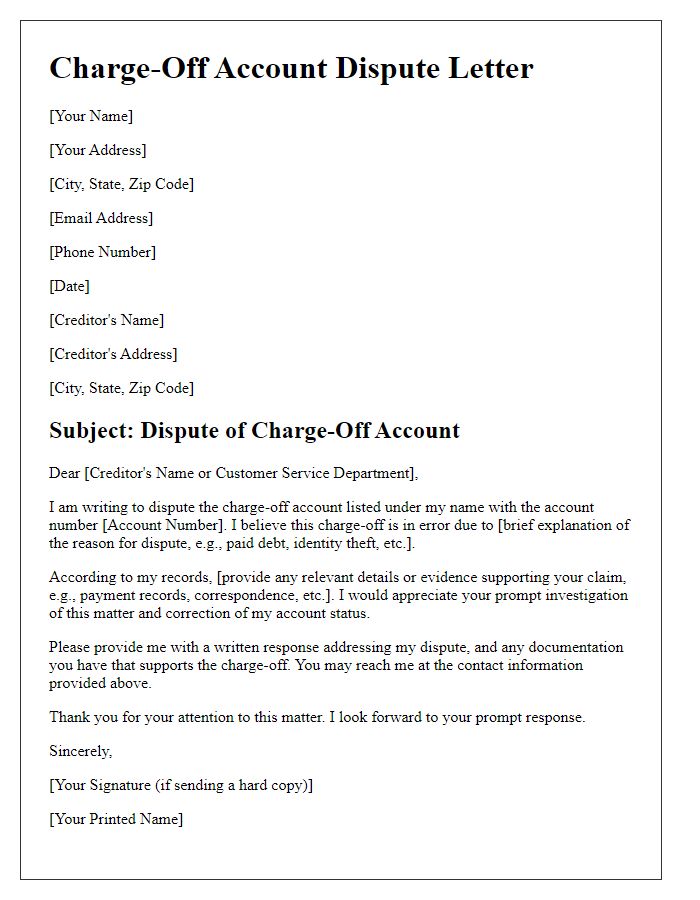

A charge-off account represents a significant financial event where a lender, such as a credit card company or bank, deems a debt uncollectible after several months of nonpayment, typically around six months. Accurate account details include the account number, outstanding balance, and original creditor information. The Fair Debt Collection Practices Act (FDCPA) governs the collection of charged-off debts, providing consumers with protection against abusive practices. In the United States, resolving a charge-off can impact credit scores significantly, usually lowering it by 100 points or more. Timely and thorough resolution of these accounts is crucial for restoring creditworthiness, often requiring negotiation with collection agencies or exploring debt settlement options to avoid long-term financial repercussions.

Acknowledgment of Debt

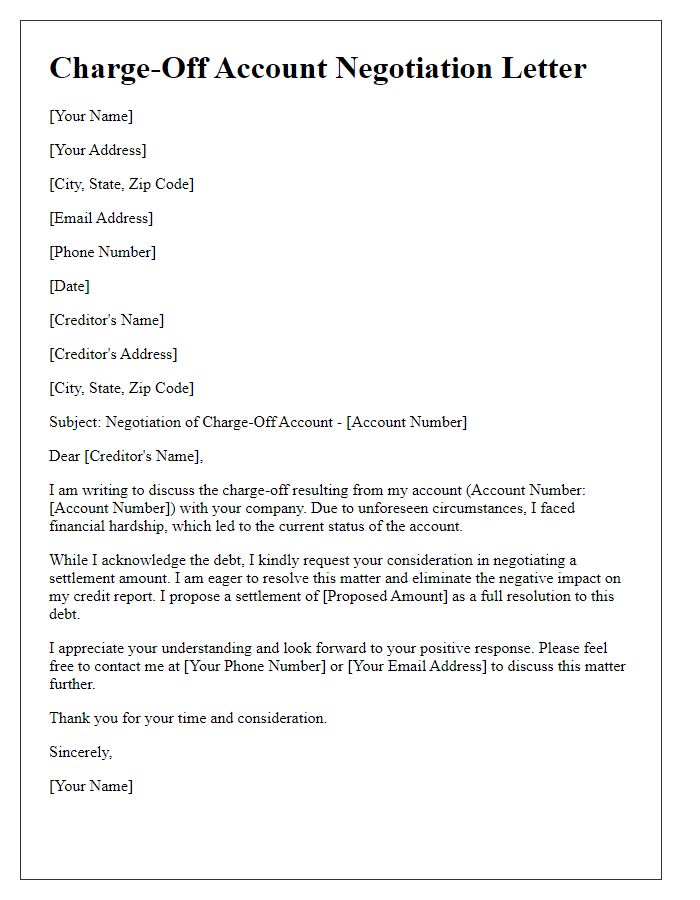

Customers with charge-off accounts may face difficulties in their credit reports, impacting scores significantly. Acknowledgment of debt refers to a formal admission of responsibility for repayment, often initiated after accounts become overdue for extended periods (typically six months). Charge-offs occur when creditors, like banks or credit card companies, determine that the debt is unlikely to be collected, leading to asset write-offs in financial records. These accounts can remain on credit reports for up to seven years, signaling potential repayment issues to future creditors. Understanding state-specific collection laws is essential, as they dictate the resolution process and may influence the negotiation of settlement amounts, helping consumers regain financial stability.

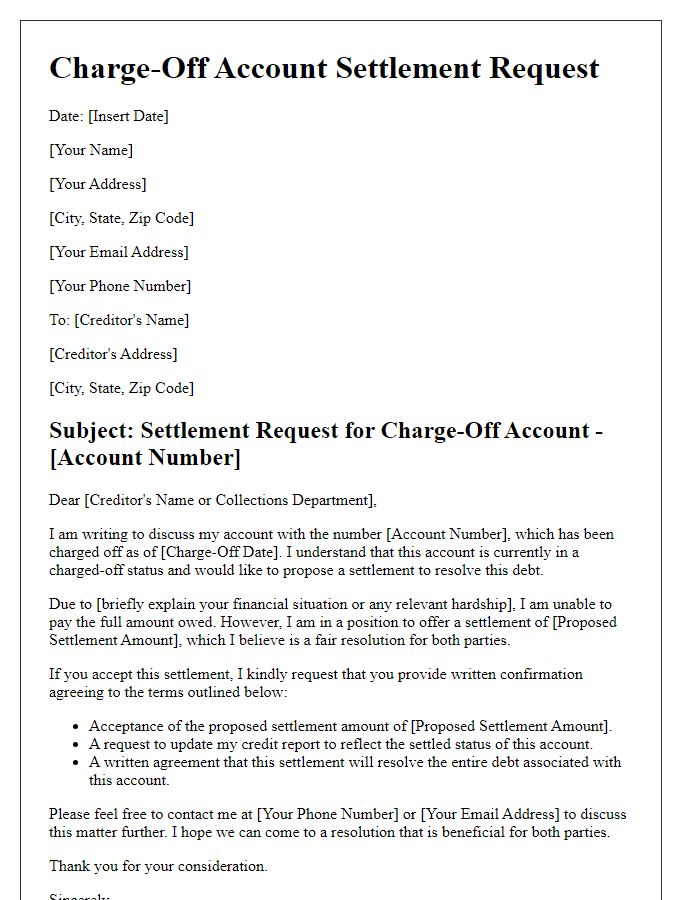

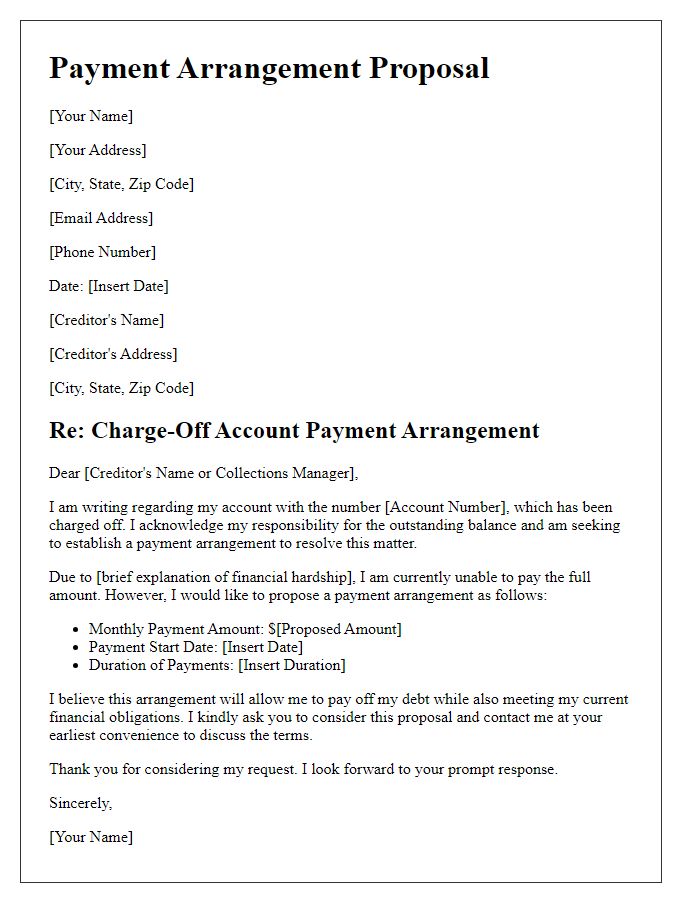

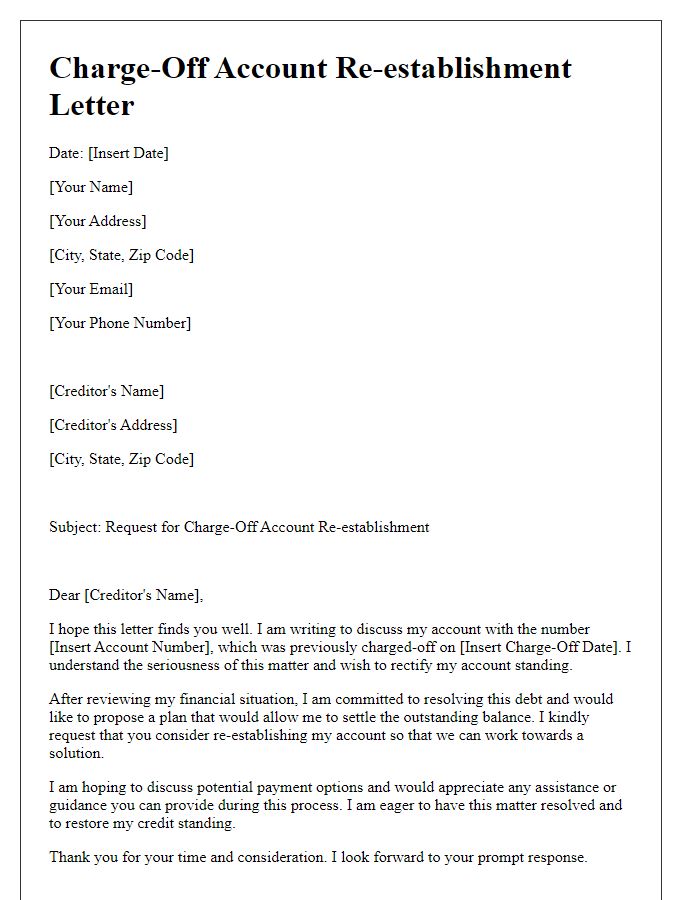

Proposed Resolution Plan

A charge-off account represents a debt that a creditor no longer expects to collect, typically after 180 days of delinquency, which impacts credit scores significantly. The proposed resolution plan aims to negotiate a settlement for the outstanding balance, taking into account the total amount owed, typically ranging from hundreds to thousands of dollars. This plan can involve a one-time payment or a structured payment arrangement over several months. The goal is to achieve a reduced payment amount, often as low as 50% of the original debt, while ensuring that the creditor reports the account as "paid" or "settled" to the major credit bureaus--Equifax, Experian, and TransUnion--thereby improving creditworthiness. Following the completion of the plan, it is vital to monitor credit reports for accurate updates reflecting the settled status of the account.

Assurance of Future Communication

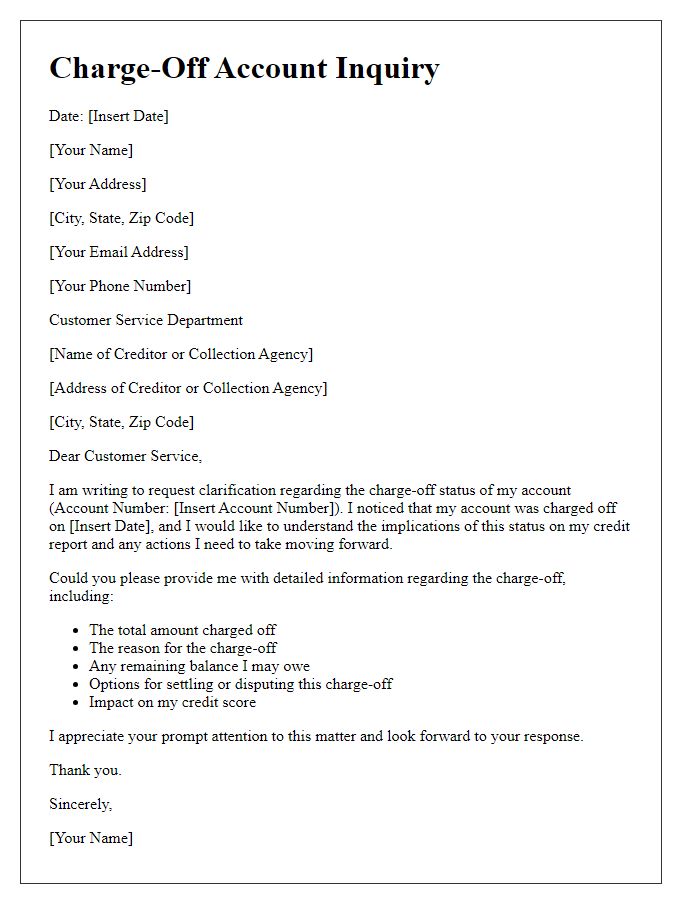

A charge-off account indicates a debt that a creditor deems unlikely to be collected, often after several months of missed payments. This status appears on credit reports, significantly impacting credit scores, with potential reductions of over 100 points depending on credit history. Resolving charge-off accounts often requires negotiation for settlements, typically involving amounts lesser than the owed balance. Frequent communication with creditors or collection agencies, such as discussing repayment plans or disputing inaccuracies, is crucial for improving financial standing. Maintaining documentation of all interactions fosters clarity and accountability, ensuring pathways for future correspondence remain open.

Request for Confirmation of Agreement

A charge-off account, often representing unpaid debt, signifies an account that a creditor has deemed unlikely to collect, typically after 180 days of non-payment. Consumers facing charge-offs may negotiate with creditors for resolution. This situation often involves communication with financial institutions, such as banks or credit card companies, to establish a payment plan or settlement amount. Contacting them promptly can lead to potential removal from credit reports, usually maintained for up to seven years. Establishing a written agreement includes key details: agreed payment amounts, deadlines, and confirmation of debt cancellation. Additionally, obtaining written documentation ensures accountability and may aid in improving overall credit scores once resolved.

Comments