Hey there! We know that keeping your account secure is super important, and sometimes you might have questions about the verification process. Our goal is to make it as smooth and straightforward as possible, so you can feel confident managing your account. Want to dive deeper into how we ensure your security and answer any lingering questions? Read on!

Personal information confirmation

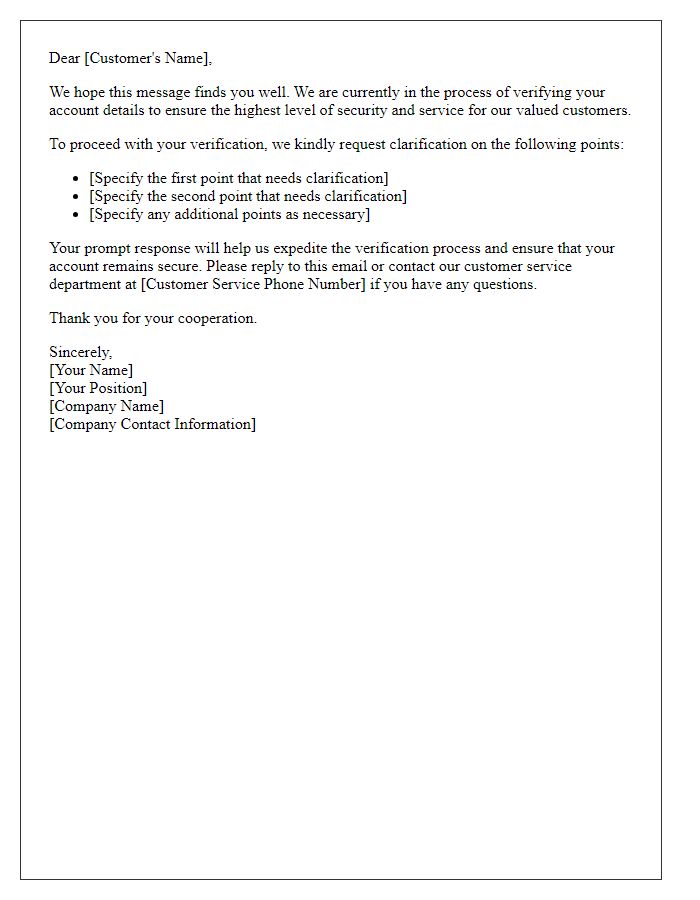

Personal information confirmation is crucial for customer account verification, especially within financial institutions. Entities like banks and online platforms often require details such as full name, date of birth (often formatted as MM/DD/YYYY), social security number (specific to the United States), and residential address for validation purposes. This rigorous process enhances security measures against identity theft, fraud, and unauthorized access. Certain organizations may also seek verification documents, including government-issued identification (like a driver's license or passport), utility bills for address verification, and recent bank statements to corroborate the individual's financial activity. Detailed record-keeping and secure handling of personal information is mandated by regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, ensuring consumer protection.

Documentation requirements

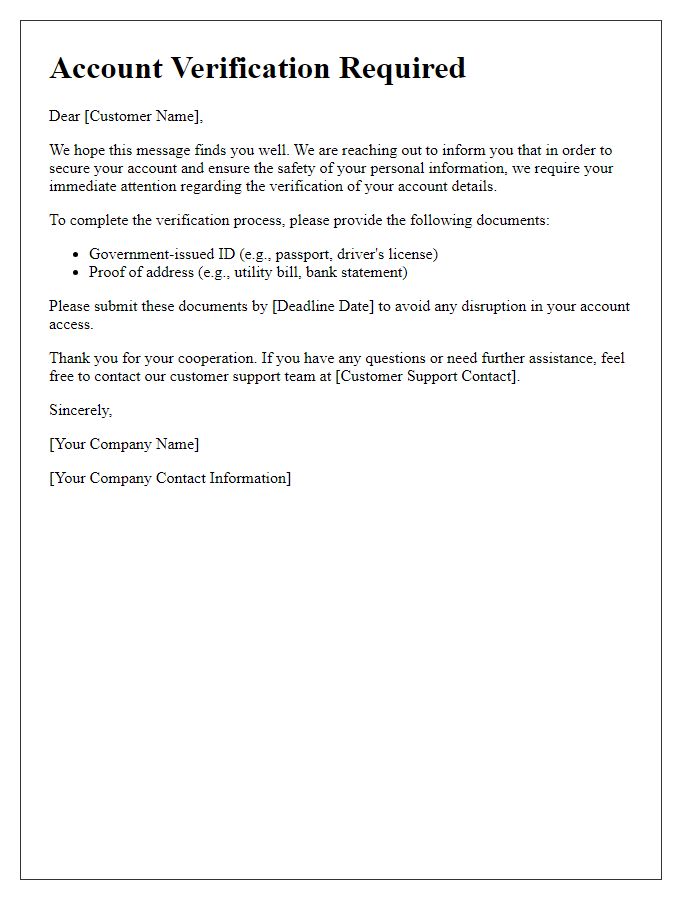

Customer account verification requires specific documentation to ensure security and compliance standards are met. A government-issued photo identification, such as a passport or driver's license, must be provided to confirm identity. Proof of address, such as a utility bill or bank statement, dated within the last three months, is essential to verify the customer's residence. Additionally, if applicable, any relevant business documents (for business accounts) such as incorporation papers may be necessary to validate business legitimacy. Submitting complete and accurate documents expedites the verification process, enhancing the overall account security for entities involved.

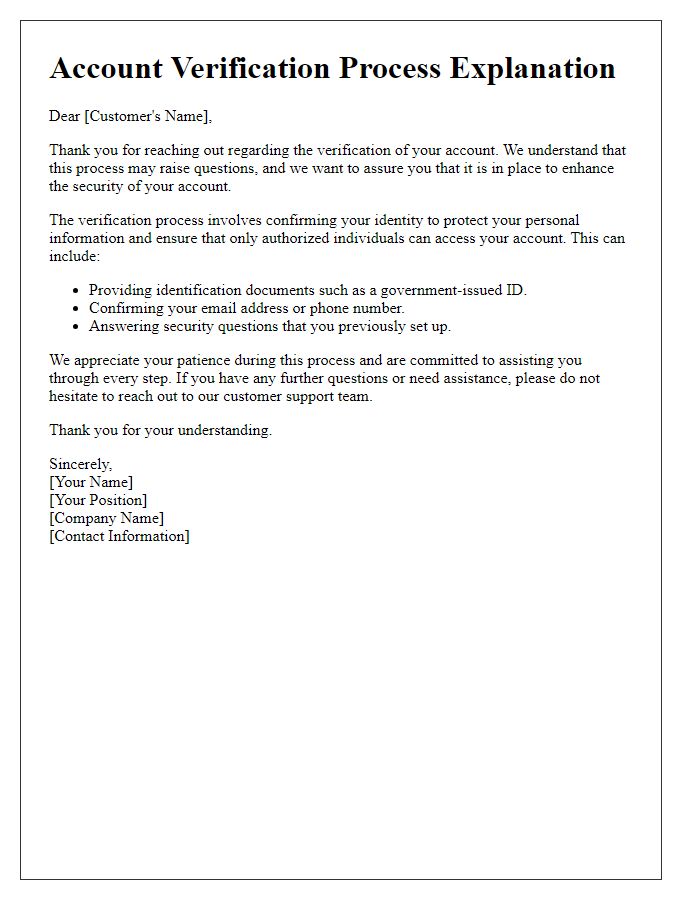

Verification process explanation

Account verification is a crucial process that ensures the security and integrity of user information. During verification, users typically submit identification documents such as government-issued IDs or utility bills. The verification usually takes place within 24 to 48 hours, depending on the volume of requests. Locations such as online banking platforms or e-commerce websites commonly implement this process to prevent fraud and unauthorized access. After successful verification, users gain full access to account features, enhancing overall security and trust in the service. Users are informed via email or SMS about the status of their verification, keeping them updated on any necessary actions needed to complete the process.

Contact details for assistance

Customer account verification processes are crucial for maintaining security and ensuring data integrity. Users often need to provide their contact information, including email addresses and phone numbers, to facilitate verification. In cases of discrepancies or issues, support centers are available to assist customers, typically reachable via dedicated hotlines (such as 1-800-555-0199 in the United States) or specific email addresses (like support@example.com). Verification protocols may involve sending confirmation codes to registered devices, enhancing security through multifactor authentication. Clear communication from verification teams ensures smooth resolution of queries.

Response deadline and instructions

Customer account verification involves crucial steps to ensure security and accuracy. Typically, verification requests should be responded to within specific deadlines, often 7 to 14 days, to maintain account integrity. Verification methods can include providing identification documents, such as government-issued IDs or utility bills, confirming address authenticity. Follow clear instructions provided in the communication, which may include submitting documents via secure online portals or encrypted email. Failure to respond within the designated timeframe can lead to account suspension or restrictions, emphasizing the importance of prompt action in the verification process.

Letter Template For Customer Account Verification Clarification Samples

Letter template of explanation for customer account verification process.

Letter template of clarification needed for customer account verification.

Letter template of notification for customer account verification requirements.

Letter template of information needed for customer account verification.

Letter template of confirmation on customer account verification procedures.

Comments