Are you looking for a professional yet friendly way to communicate the decision on a business credit application? It's essential to convey the message clearly while maintaining a positive relationship with the applicant. In this article, we'll explore effective language and strategies for crafting a letter that respectfully denies a credit application while providing encouragement for future opportunities. Ready to navigate this delicate process? Let's dive in!

Clear and concise opening statement.

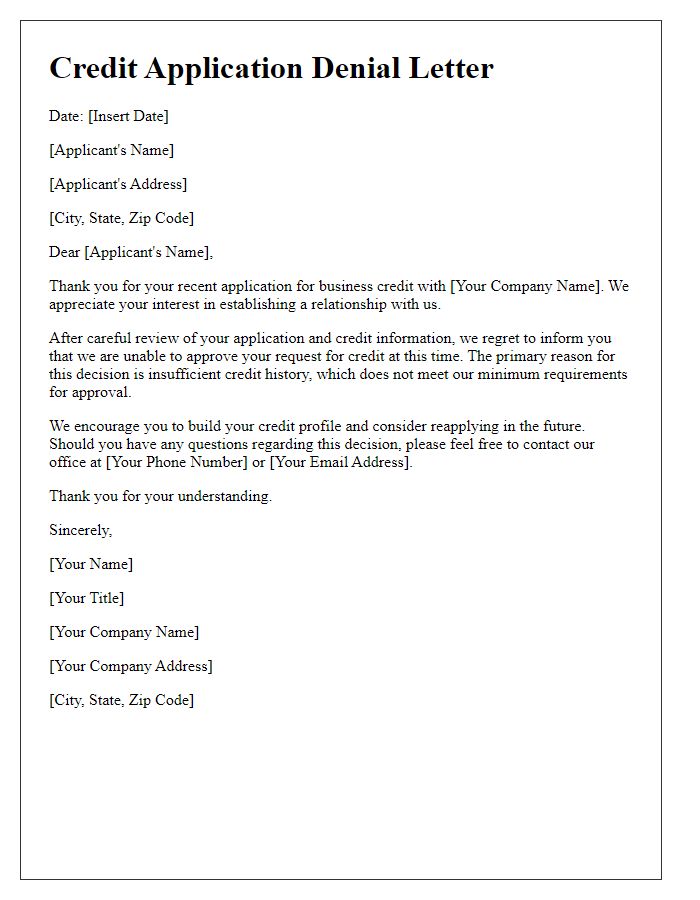

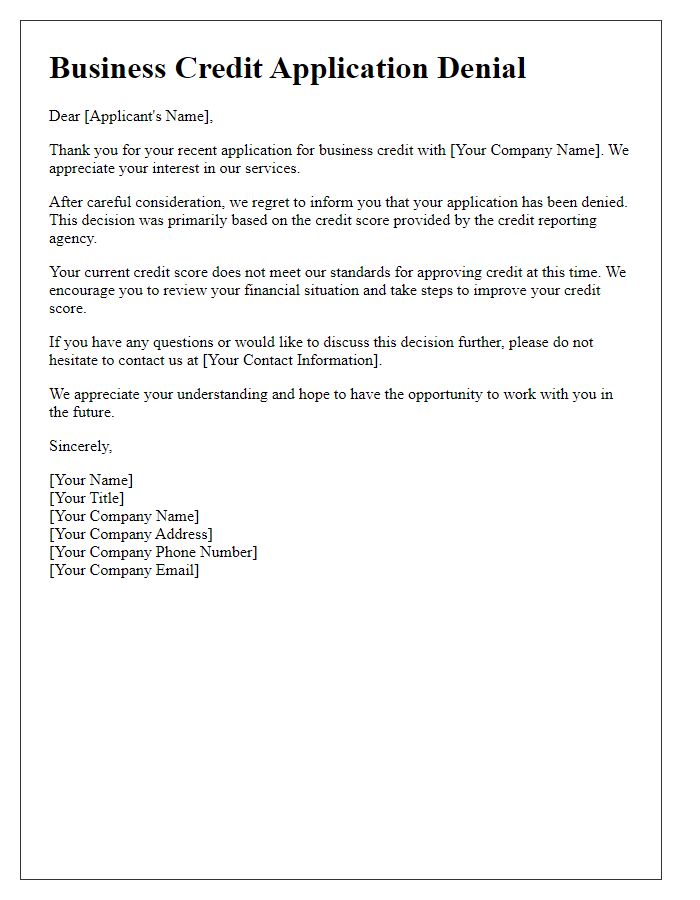

A recent analysis of your business credit application revealed insufficient credit history to meet our lending criteria. Current credit score (represented numerically in the 500-600 range) does not align with our required standards for approval. Additionally, numerous recent credit inquiries (totaling over four in the past six months) raise concerns about financial stability and repayment capacity. Consequently, we must respectfully decline your application at this time. Thank you for your understanding.

Mention specific reasons for denial.

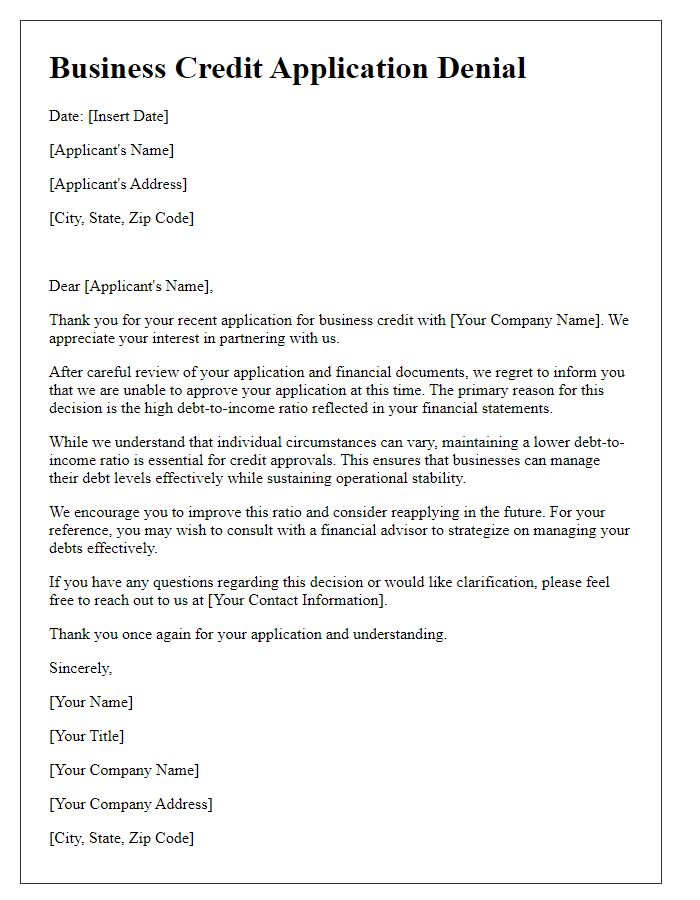

The business credit application was denied due to several key factors. Insufficient credit history demonstrated limited financial activity over the past three years. High debt-to-income ratio, measured at 70%, indicated potential risk in managing existing financial obligations. Recent late payments on business loans, specifically one in March 2023, raised concerns about creditworthiness. Additionally, lack of collateral to support the credit request further compounded potential risks. Overall, these factors contributed to the decision against approval for business credit at this time.

Offer suggestions or alternatives.

Many small businesses experience challenges when applying for credit, especially during economic downturns. A credit application denial might occur due to insufficient credit history, low credit scores below 650, or high existing debt-to-income ratios. However, alternative options exist for businesses in need of funds. Consider seeking a secured credit card backed by a cash deposit, allowing for rebuilding credit over time. Explore peer-to-peer lending platforms like LendingClub or Prosper, which connect borrowers directly with investors. Another viable route is approaching local credit unions known for flexible lending criteria, often providing more personalized support. Additionally, applying for a business line of credit can offer a more versatile funding option, allowing for borrowing only as needed while maintaining lower interest rates than standard loans.

Provide contact information for queries.

A business credit application denial can significantly impact the financial plans of a small business or startup. Applicants may receive communication from institutions like banks or credit unions explaining the decision. Denials typically arise due to factors including insufficient credit history, low credit scores, or existing debt obligations exceeding acceptable limits. Often, specific reasons related to the company's financial statements and cash flow analysis are included to offer clarity. For further clarification regarding the decision, applicants are encouraged to contact the institution's customer service directly via the provided phone number or email address, enabling them to discuss potential avenues for future credit applications or improvements.

Positive and respectful closing.

In recent years, businesses have increasingly sought credit to expand operations and enhance cash flow. However, after careful evaluation, we regret to inform you that your application for business credit has not been approved. Credit assessments take into account various factors including credit history, income levels, and outstanding debts. Unfortunately, your current financial situation does not meet our lending criteria at this time. We encourage you to explore alternative funding options and welcome you to reapply in the future as your financial profile improves. Thank you for considering our services, and we wish you continued success in your business endeavors.

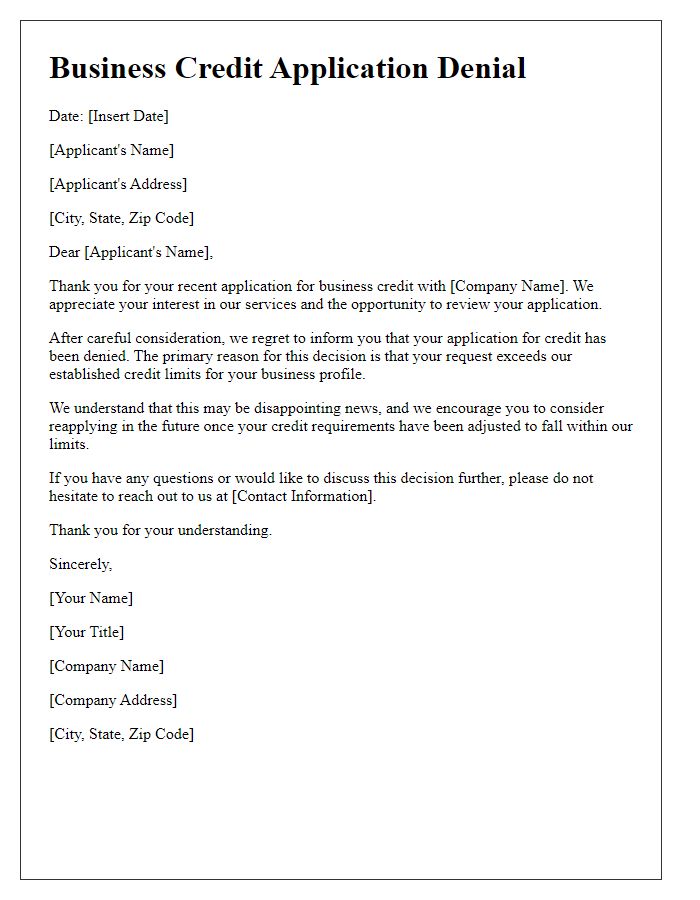

Letter Template For Denying Business Credit Application Samples

Letter template of business credit application denial for insufficient credit history.

Letter template of business credit application denial due to low credit score.

Letter template of business credit application denial based on high debt-to-income ratio.

Letter template of business credit application denial for incomplete documentation.

Letter template of business credit application denial citing unfavorable payment history.

Letter template of business credit application denial owing to recent bankruptcies.

Letter template of business credit application denial due to industry risk factors.

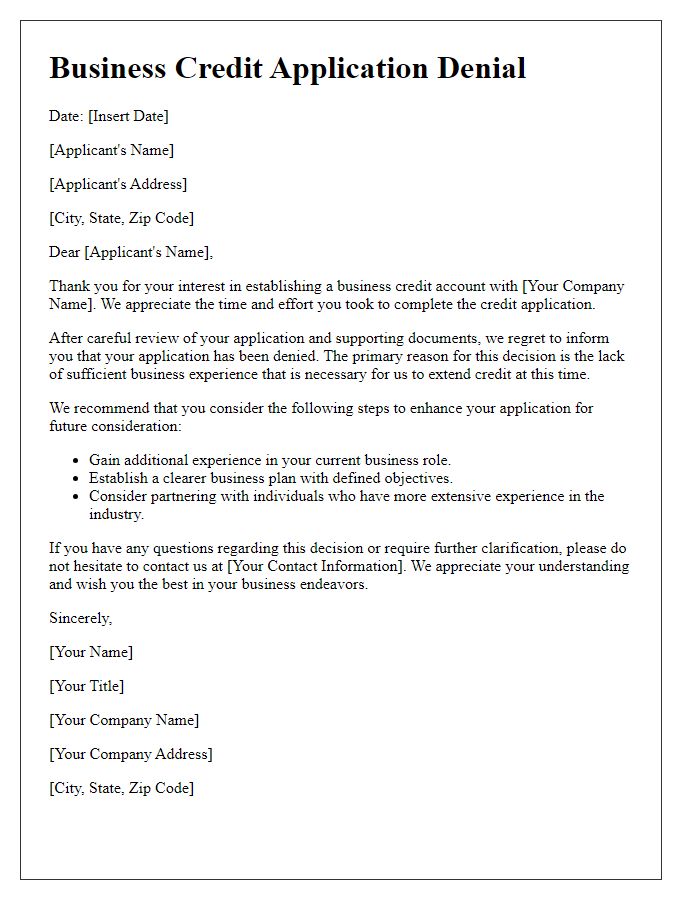

Letter template of business credit application denial for lack of business experience.

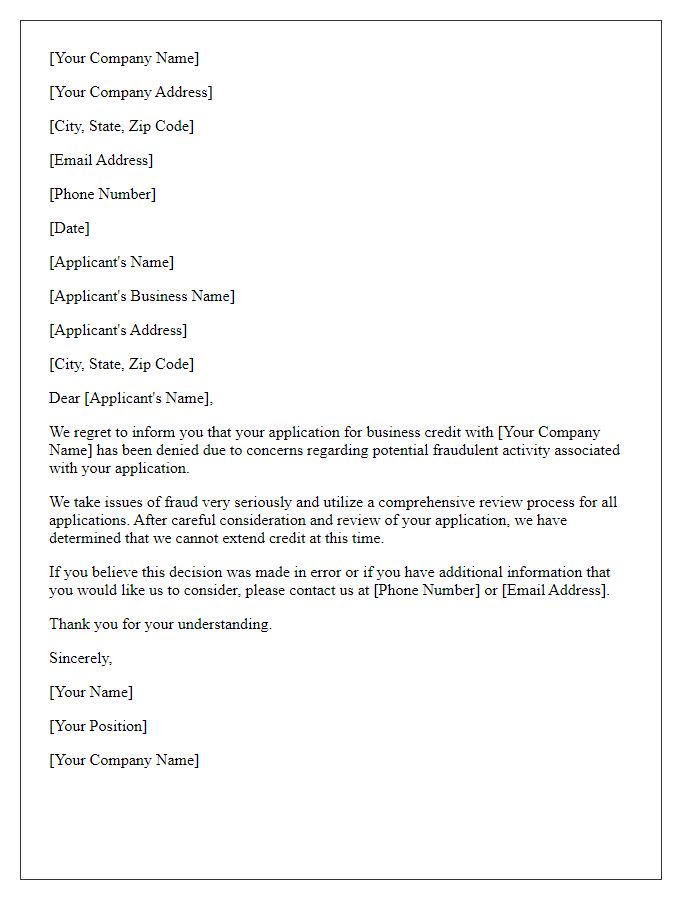

Letter template of business credit application denial linked to fraudulent activity concerns.

Comments