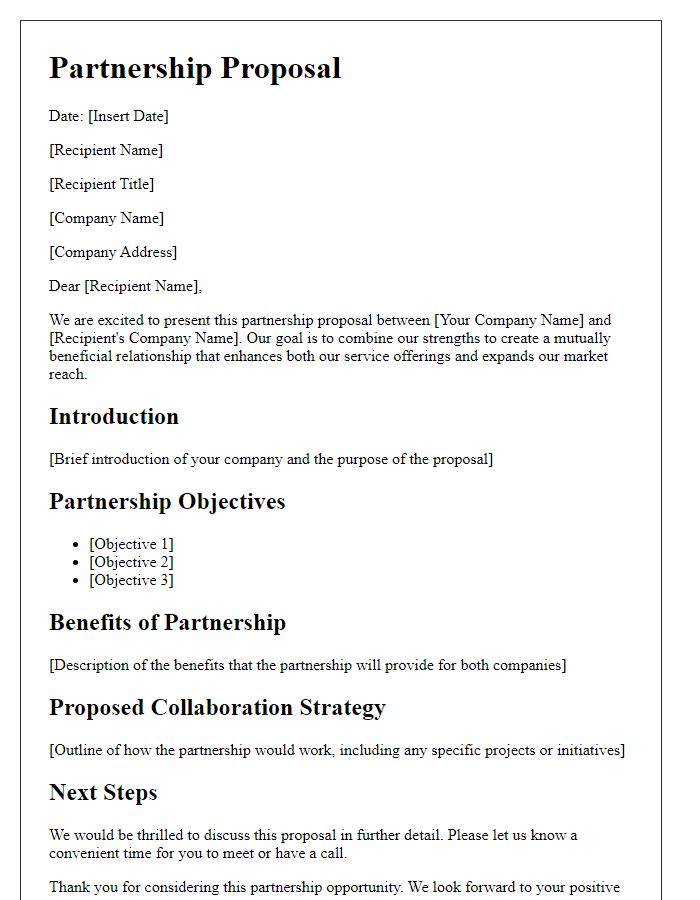

Are you looking to enhance your financial service offerings and stand out in a competitive market? Crafting the perfect proposal is essential to showcase your strengths and outline the unique solutions you can provide. By understanding your audience and addressing their specific needs, you can create a compelling narrative that resonates with potential clients. Dive into our comprehensive letter template to discover how to effectively present your financial services, and invite your clients to explore the benefits of partnering with you.

Clear and compelling introduction

A financial service proposal targets small to medium-sized businesses seeking comprehensive financial management solutions. Our firm, established in 2020, has guided over 150 clients in various industries, including technology and retail, through financial forecasting and strategic planning. The growing concern for efficient cash flow management, especially in fluctuating economic conditions, necessitates expert advice. Our tailored approach emphasizes risk assessment and investment strategies that align with each client's unique goals. By leveraging advanced analytics tools, such as predictive modeling software, we ensure insightful decision-making and optimal resource allocation, ultimately fostering sustainable growth in a competitive market.

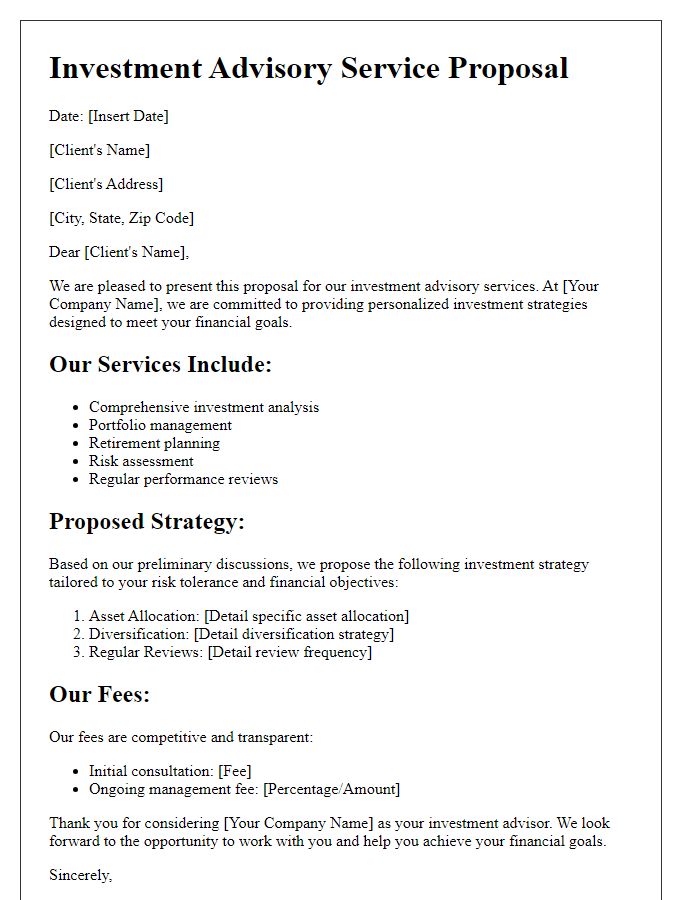

Detailed service offerings

A comprehensive financial service proposal emphasizes the importance of tailored solutions for businesses and individuals seeking financial stability and growth. Key offerings typically include investment management, which encompasses portfolio construction and risk assessment strategies, aimed at maximizing returns while mitigating financial risks. Financial planning services involve cash flow analysis and retirement planning, ensuring clients have a roadmap for achieving short and long-term financial goals. Additionally, tax advisory services provide insights into tax-efficient strategies, optimizing client liabilities, and compliance with regulations. Furthermore, estate planning ensures assets are transferred according to the client's wishes, minimizing taxes and maintaining family harmony. Each service is customized to meet the specific needs of clients, whether they are small business owners in New York or individual investors in California, creating a personalized experience in the financial landscape.

Benefits and unique value propositions

A financial service proposal typically highlights a range of benefits tailored to meet the unique needs of clients. Personalized financial planning can provide clients with tailored investment strategies that match their goals, risk tolerances, and timelines. Expert financial advisors, with certifications such as Certified Financial Planner (CFP), offer insights based on extensive market research and industry experience, ensuring informed decision-making. Comprehensive portfolio management services aim to optimize asset growth while minimizing risks through diversification across various asset classes, such as stocks, bonds, and mutual funds. Regular performance reviews can offer clients ongoing transparency and adaptability to changing market conditions. Additionally, exclusive access to proprietary research tools and analytics can set a financial service apart, providing clients with cutting-edge information for making strategic investment decisions.

Pricing and financial terms

A comprehensive financial service proposal requires careful consideration of pricing and financial terms. Transparent pricing models, such as fixed fees, hourly rates, or performance-based fees, should be clearly outlined to ensure potential clients understand the costs involved. Detailed payment terms may include timelines (e.g., monthly, quarterly, or upon project milestones) and accepted payment methods, like bank transfers or credit cards. Additionally, any potential discounts for long-term contracts or bundled services need clarification to enhance the proposal's appeal. Furthermore, a breakdown of the proposed services, including initial consultations, ongoing support, and additional fees for specialized services, will provide clients with a clearer financial picture, enabling informed decision-making. Regular reviews of financial terms should be offered to adapt to changing client needs and market conditions.

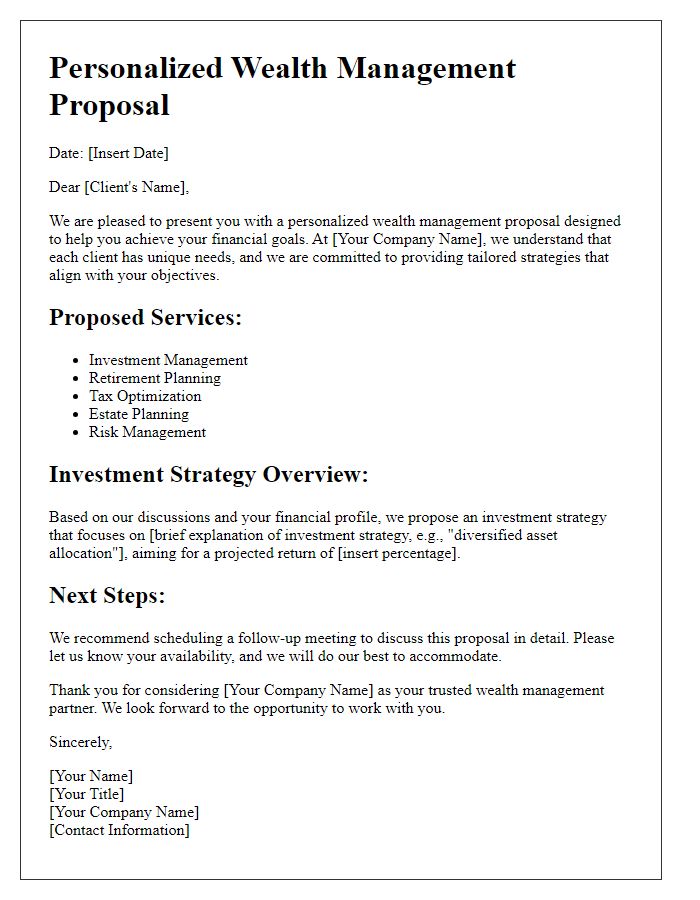

Call to action and contact information

A compelling financial service proposal should conclude with a strong call to action that invites potential clients to engage further. For example, contacting our dedicated financial advisor team at 1-800-FINANCE or emailing info@financialservices.com ensures that queries are addressed promptly. Additionally, to schedule a consultation, clients can visit our website at www.financialservices.com to set up a meeting. Timely responses allow for better financial planning and informed decision-making to achieve personal or business financial goals. Access to our financial expertise can significantly enhance the effectiveness of investment strategies, minimize risks, and maximize returns.

Comments