Ending a business partnership can be a sensitive matter, but with the right approach, it can be handled smoothly. It's essential to communicate clearly and respectfully with your partner to ensure both parties understand the reasons behind the decision. Crafting a well-structured termination letter can set the stage for a professional conclusion to your collaboration. Ready to navigate this challenging process? Let's delve into the key elements of a business partnership termination letter.

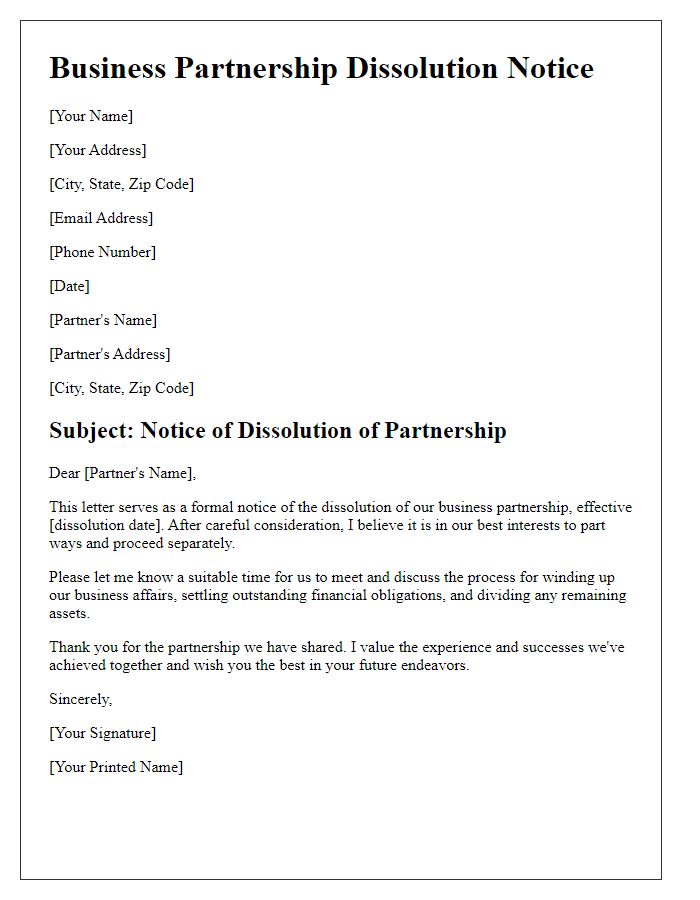

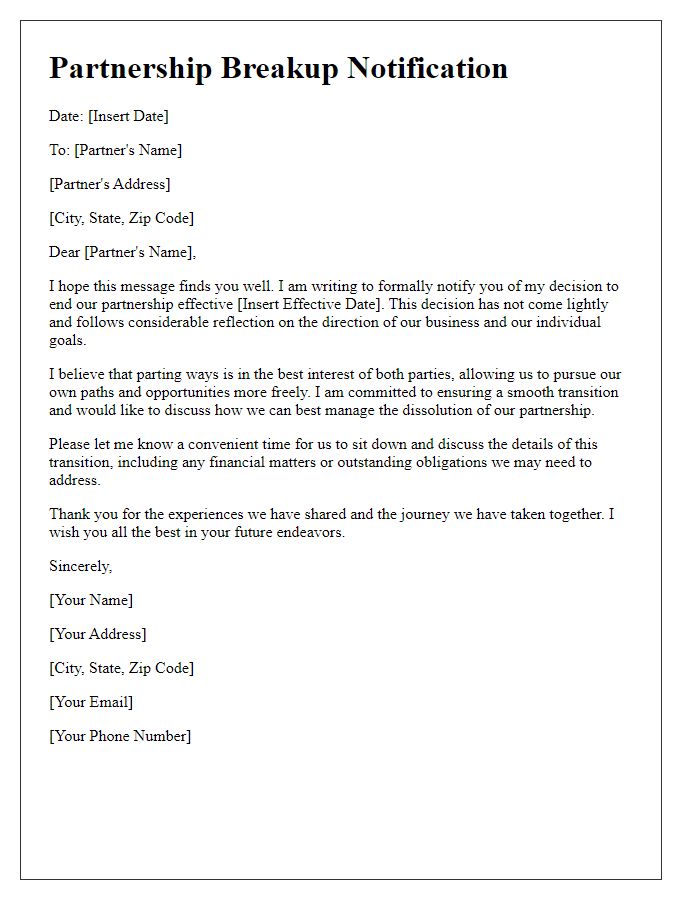

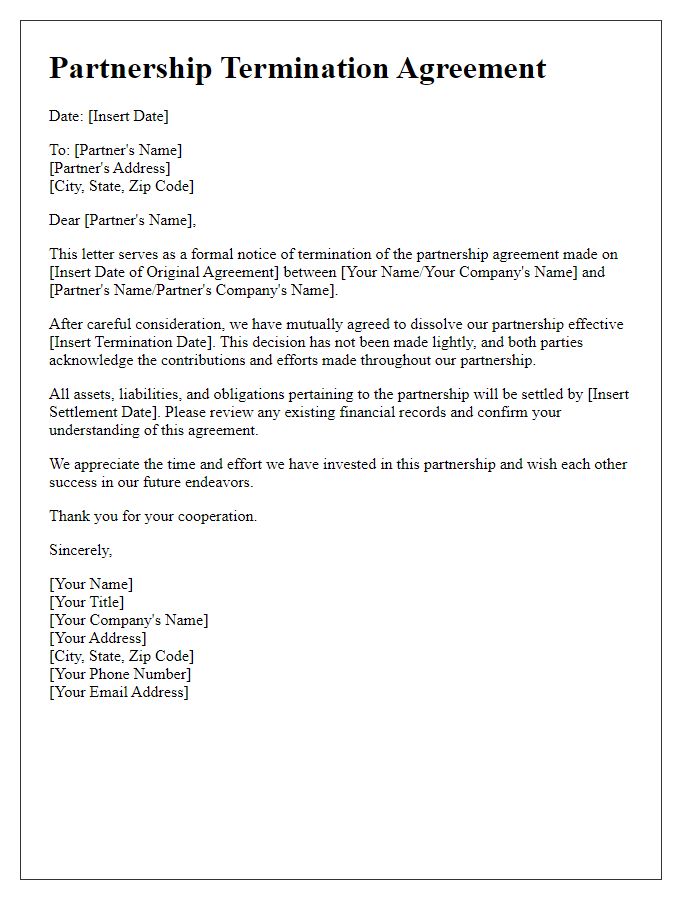

Clear Subject Line

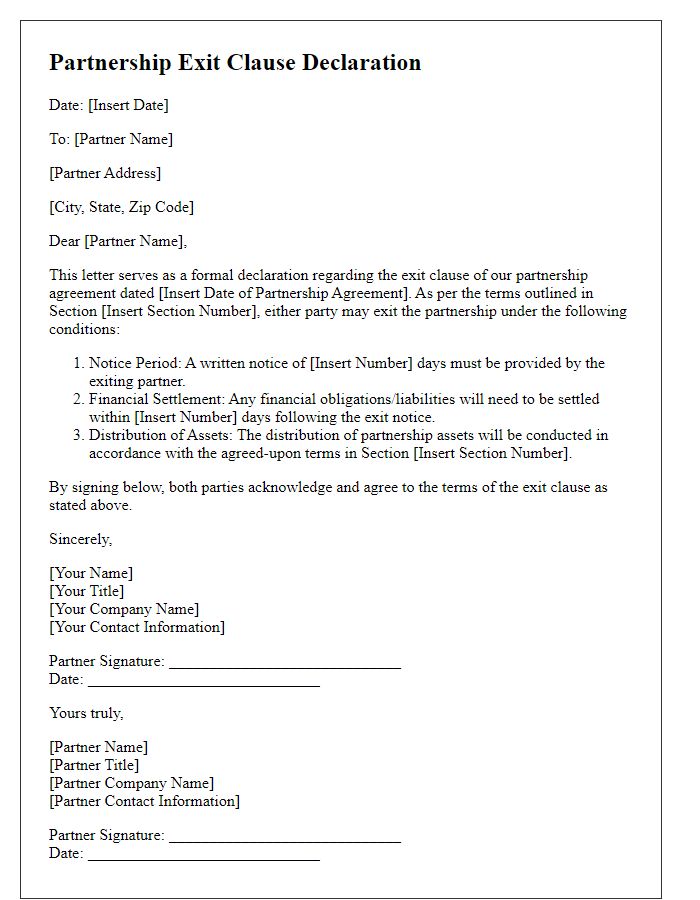

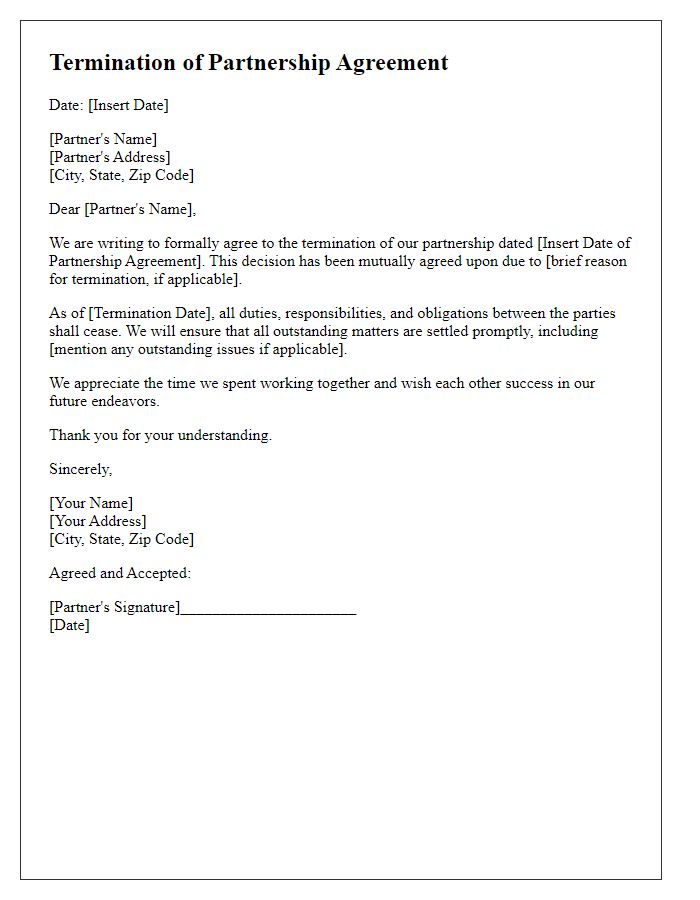

Terminating a business partnership may arise from various factors, such as differing visions, financial challenges, or personal conflicts. Clear communication is crucial. In your termination notice, specify the partnership agreement details from its inception, including the founding date, involved parties, and the nature of business operations. Additionally, include the termination date, expectations for a smooth transition, and the handling of any outstanding financial obligations, assets, or liabilities. Reference any relevant laws governing partnership dissolutions, such as those outlined in the Uniform Partnership Act, to ensure legal compliance and protect all parties involved.

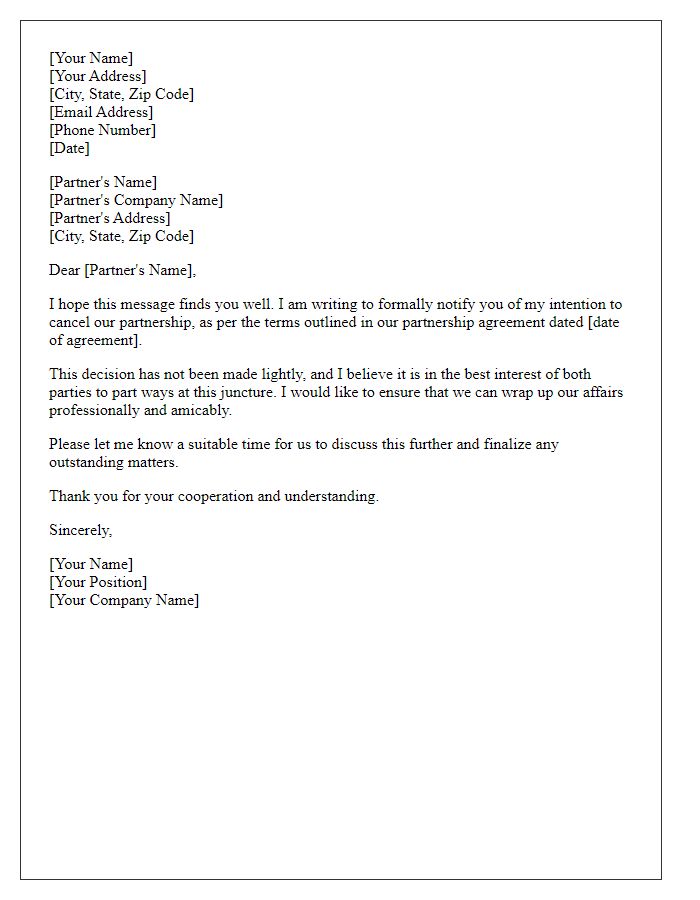

Formal Opening/Salutation

The formal opening of a business partnership termination letter typically begins with a courteous salutation, addressing the recipient by their official title or full name, followed by a respectful phrase such as "Dear [Recipient's Name]," or "To [Title/Position] [Recipient's Name]." This sets a professional tone for the communication regarding the significant decision to dissolve a partnership, emphasizing the gravity of the matter while maintaining respect for the individual involved.

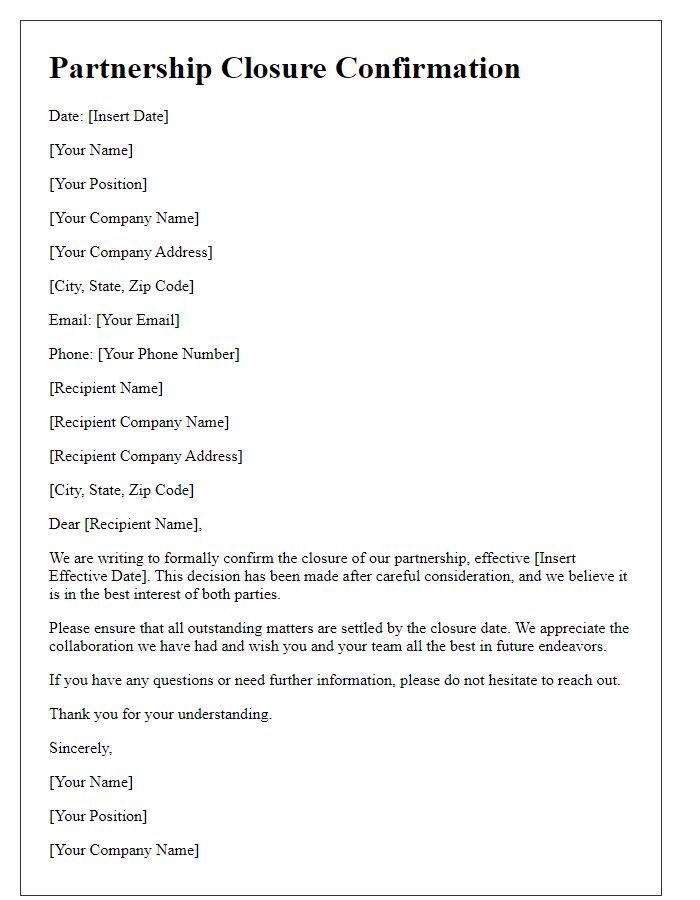

Statement of Termination

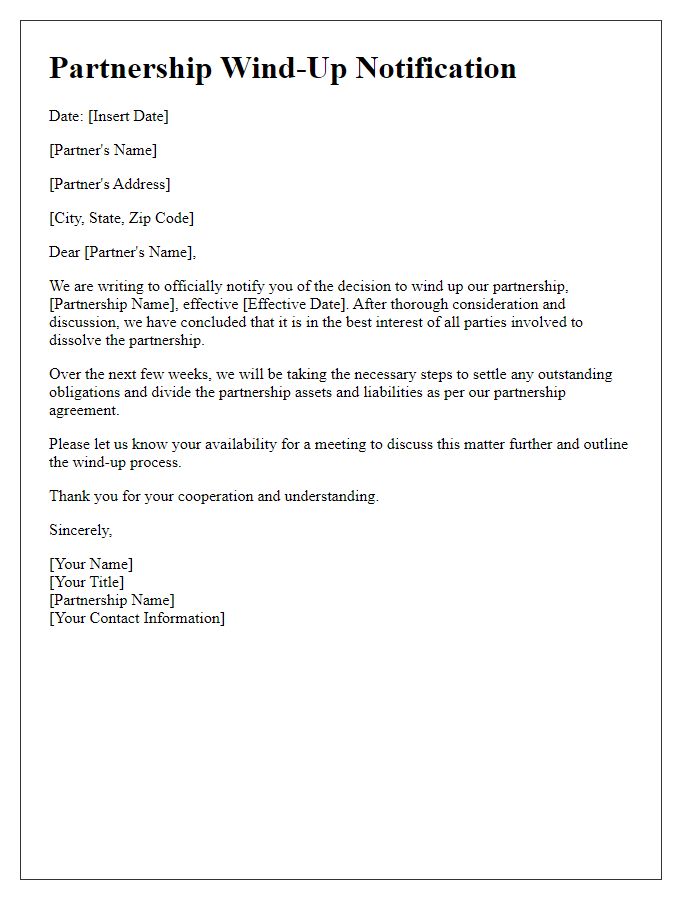

Business partnerships can sometimes reach a conclusion, necessitating a formal Statement of Termination. The legal document outlines the cessation of all business activities between partners, detailing the reason for termination, such as financial disputes or strategic misalignment. This document should include key elements such as the date of termination, the names of the parties involved, and a summary of asset distribution or responsibilities pertaining to any lingering obligations. Clear delineation of the termination process aids in preventing potential misunderstandings, ensuring a smooth exit from the partnership. Legal counsel is often recommended to ensure compliance with local laws and regulations surrounding partnership dissolution.

Reason for Termination

Termination of a business partnership often stems from several critical reasons that impact operations and strategy. Financial disputes can arise when revenue sharing discrepancies occur, undermining trust and collaboration. Diverging business objectives may lead to conflicts, especially when one partner pivots towards a different market, causing disconnect in vision. Personal conflicts, often exacerbated by high-stress environments, can hinder effective decision-making, resulting in a toxic workplace atmosphere. Legal issues, such as compliance violations, can force partners to reevaluate their association, especially in regulated industries. Additionally, external factors like economic downturns or market shifts can lead to unsustainable business practices, prompting a reevaluation of partnership viability. Remember to include specific reasons tailored to the unique circumstances of the partnership in question for clarity and legal propriety.

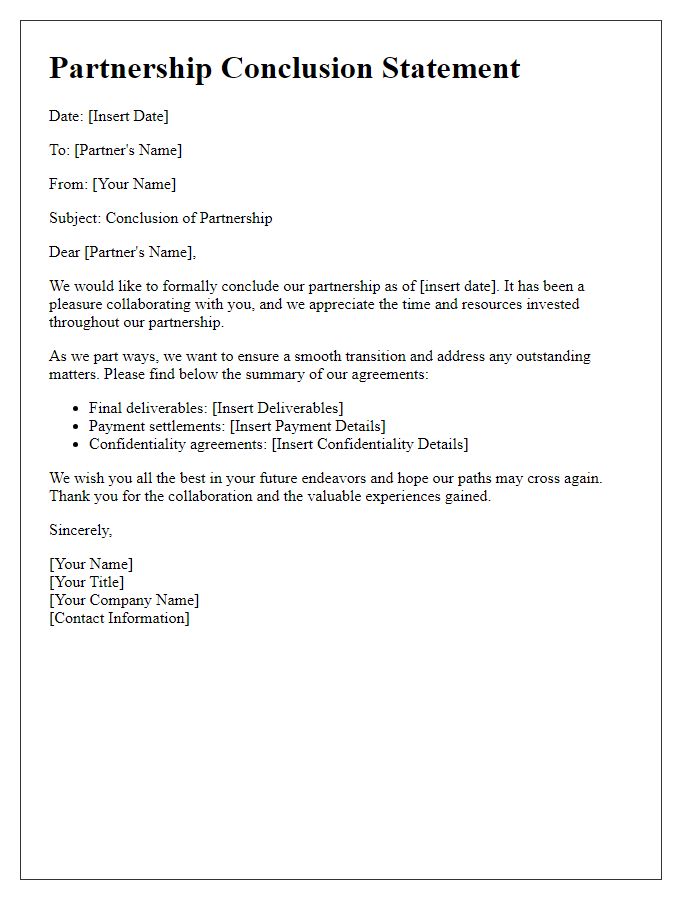

Closing Remarks and Contact Information

The conclusion of a business partnership requires careful consideration and clear communication to ensure that all parties understand the terms and implications of the termination. It is pivotal that both partners review the final agreements meticulously to avoid any potential misunderstandings. Contact information must be exchanged to facilitate any necessary follow-up discussions or the resolution of outstanding matters, including financial settlements or transfer of responsibilities. Please provide updated contact details, including email and phone numbers, to ensure seamless conversations continue beyond the official termination date. Follow-up communications may include final accounting details or discussions about asset distribution, requiring transparency and cooperation to navigate the dissolution process effectively.

Comments