Are you looking for a clear and professional way to communicate merger and acquisition news to your board directors? Crafting the perfect letter is essential to convey the significance of this pivotal moment for your organization. With the right template, you can ensure that all necessary details are covered while maintaining a conversational and engaging tone. Join us as we explore effective strategies and tips for composing an impactful letter to your board, and read on to discover a valuable template that you can easily adapt for your needs.

Key Details of the Merger and Acquisition

The recent merger and acquisition proposal between TechInnovate Corp., a leading software solutions provider, and DigitalSolutions Ltd., a prominent cybersecurity firm, marks a significant milestone in the technology sector. The estimated value of this deal is approximately $250 million, creating a combined entity poised to generate an annual revenue exceeding $1 billion. This strategic union aims to enhance service offerings, improve market competitiveness in North America, and leverage advanced technological capabilities. The merger, anticipated to finalize by the end of Q2 2024, will consolidate resources, talent, and innovation, presenting a strengthened portfolio of products and services, particularly in artificial intelligence and data protection. Both companies anticipate significant synergies, targeting a 20% increase in operational efficiency within the first year post-merger. This transition is expected to reshape the landscape of the tech industry, solidifying the new entity's position among the top five firms in the marketplace.

Strategic Objectives and Benefits

The recent merger between tech giants Amazon and MGM stands as a significant milestone in the media landscape. This $8.45 billion acquisition amplifies Amazon's streaming footprint, enabling enhanced content offerings on Prime Video. The strategic objective focuses on integrating MGM's vast library of over 4,000 films, including classics like The Wizard of Oz, with Amazon's robust distribution channels. Such synergy seeks to increase market share amid growing competition from platforms like Netflix and Disney+. Additionally, the merger aims to diversify revenue streams through advertising and original content, capitalizing on MGM's production capabilities. Increased consumer engagement anticipated through exclusive content releases and collaborations is projected to drive subscriber growth significantly, reinforcing Amazon's position in the ever-evolving digital entertainment industry.

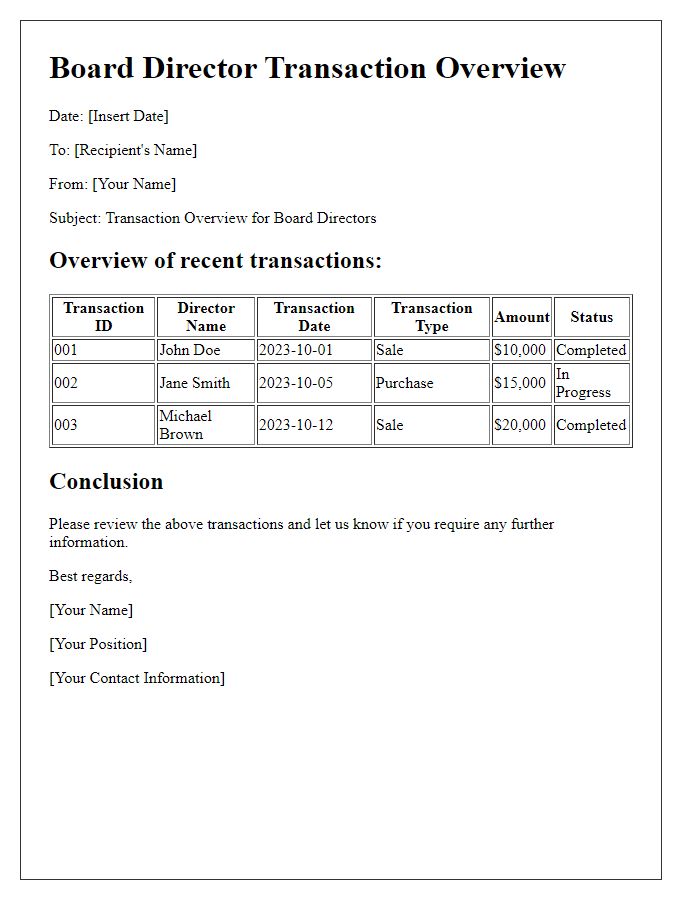

Financial Implications and Projections

The recent merger and acquisition (M&A) agreement between Company A and Company B, finalized on August 15, 2023, marks a significant strategic shift in the competitive landscape within the technology sector. Financial implications include an anticipated increase in annual revenue projections by approximately 30%, driven by enhanced operational efficiencies and expanded market reach. Cost synergies, estimated at $50 million annually, will result from streamlined operations and reduced redundancies in overlapping departments. The combined entity aims to capture a larger share of the global market, projected to grow at a compound annual growth rate (CAGR) of 8% over the next five years. Additionally, the merger is expected to bolster the balance sheet, with an increased asset base valued at $1.2 billion, thereby improving credit ratings and enhancing access to capital markets for future investments and innovation.

Legal and Regulatory Compliance

Mergers and acquisitions often require meticulous attention to legal and regulatory compliance standards. In the United States, the Federal Trade Commission (FTC) and the Securities and Exchange Commission (SEC) oversee these transactions to ensure transparency and fairness. Key aspects include the Hart-Scott-Rodino Antitrust Improvements Act, which mandates pre-merger notification, and the requirement for accurate disclosures during the due diligence process. Additionally, state laws may impose specific regulations, demanding thorough reviews of corporate governance. Legal counsel must scrutinize the merger agreement to ensure alignment with labor laws, intellectual property rights, and environmental regulations, which can impact operational continuity. Comprehensive compliance strategies mitigate risks associated with potential litigation and regulatory challenges during the merger process.

Integration Plans and Timeline

Merger and acquisition processes involve complex integration plans and timelines that dictate how two companies will combine operationally and culturally. The integration plan outlines various stages, including initial assessments, aligning business strategies, personnel onboarding (with estimated timelines for each departmental transition), and systems integration (spanning IT frameworks like ERP systems). Key milestones might include the completion of due diligence by early Q2, followed by the official merger date, and an 18-month integration timeline that includes regular check-ins with stakeholders. Potential challenges may arise during personnel integration, such as blending work cultures at headquarters located in New York City and San Francisco, complicating communication methods and impacting productivity. Understanding these dynamics is crucial for effective execution and achieving strategic goals post-merger.

Comments