Are you looking to simplify the process of requesting beneficiary trust documentation? Our guide will provide you with a handy letter template that streamlines your request, ensuring clarity and professionalism. With the right wording, you can effectively communicate your needs to the trustee or relevant parties, making your experience smoother and more efficient. So, let's dive in and discover how you can create an impactful request!

Beneficiary's Full Name

Beneficiary trust documentation serves as essential legal evidence in financial and estate planning contexts. Beneficiary's Full Name denotes the individual designated to receive benefits from the trust, which may include assets, properties, or income upon the trustor's passing or under specific conditions outlined in the trust agreement. Accurately documenting this name ensures proper identification and eligibility to claim benefits, potentially affecting the distribution of substantial estates valued at millions of dollars. Additionally, having precise details can simplify legal processes and prevent disputes among potential heirs or stakeholders, fostering a transparent and efficient transition of trust assets.

Trustee's Contact Information

The Trustee's Contact Information is crucial for facilitating efficient communication regarding the Beneficiary Trust, which is a legal entity established to manage assets for the benefit of designated individuals or groups. This information typically includes the full name of the Trustee, along with the organization or firm they represent, if applicable. Essential contact details include the mailing address, which should be a physical location where correspondence can be reliably sent. An email address is vital for quick, electronic communications, while a direct phone number ensures direct and immediate contact. It is also beneficial to note the Trustee's office hours, providing clear expectations for when inquiries can be made.

Trust Account Number

The documentation request for a beneficiary trust account requires specific details for clarification and processing. A trust account number, a unique identifier assigned to a particular trust fund, is essential for tracking and managing assets within fiduciary arrangements. Gathering necessary documents, such as trust agreements, account statements, and beneficiary designations, ensures compliance with legal and financial regulations. Accurate information facilitates transparency and upholds the integrity of the trust, safeguarding the interests of beneficiaries while allowing trustees to fulfill their fiduciary duties effectively.

Specific Documentation Request

Beneficiary trusts, established for financial planning and asset protection, often require comprehensive documentation for proper management. Essential documents may include the trust agreement, which outlines the terms and conditions guiding trust operation, and a list of beneficiaries, detailing their names and respective interests. In addition, financial statements from reputable institutions such as banks and investment firms may be necessary to assess asset values. Tax records, including IRS Form 1041 (U.S. Income Tax Return for Estates and Trusts), are vital for compliance and financial transparency. Furthermore, any amendments or restatements of the original trust document should be included to clarify any changes made over time, ensuring all relevant information is accessible for both beneficiaries and trustees.

Signature and Date

Beneficiary trusts, such as irrevocable and revocable trusts, require precise documentation to ensure compliance with legal requirements. Trusted individuals, known as trustees, manage assets on behalf of beneficiaries, usually family members or dependents. Documentation requests often involve forms outlining beneficiary details, trust terms, and asset descriptions. Important dates, such as the trust creation date, and signatures from involved parties confirm authenticity. Properly executed forms, including acknowledgment from beneficiaries, help prevent disputes and clarify intentions regarding asset distribution and management responsibilities. Legal counsel may assist in drafting documentation to adhere to state regulations and ensure the trust's validity.

Letter Template For Beneficiary Trust Documentation Request Samples

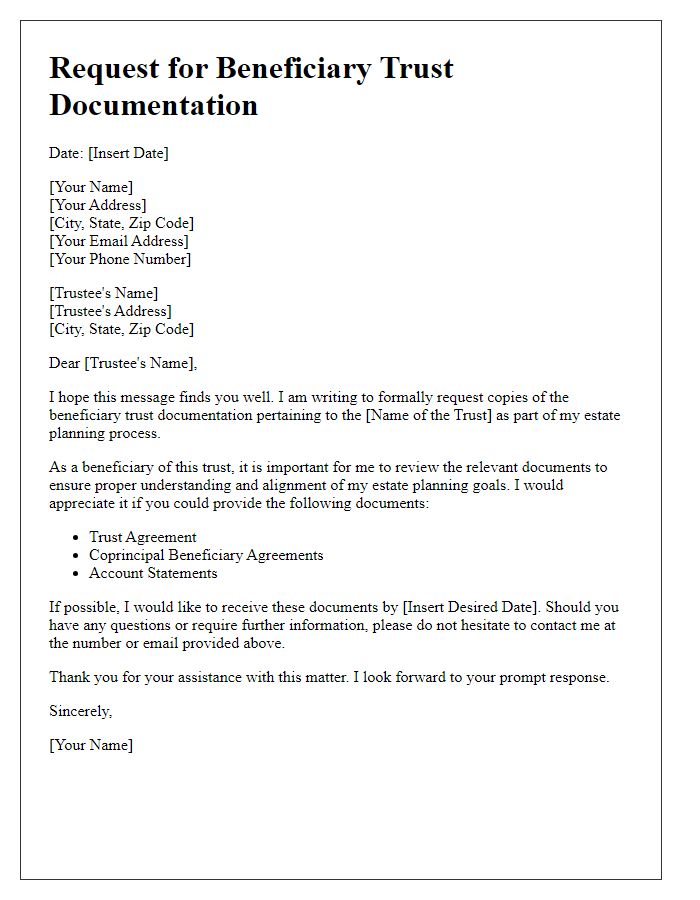

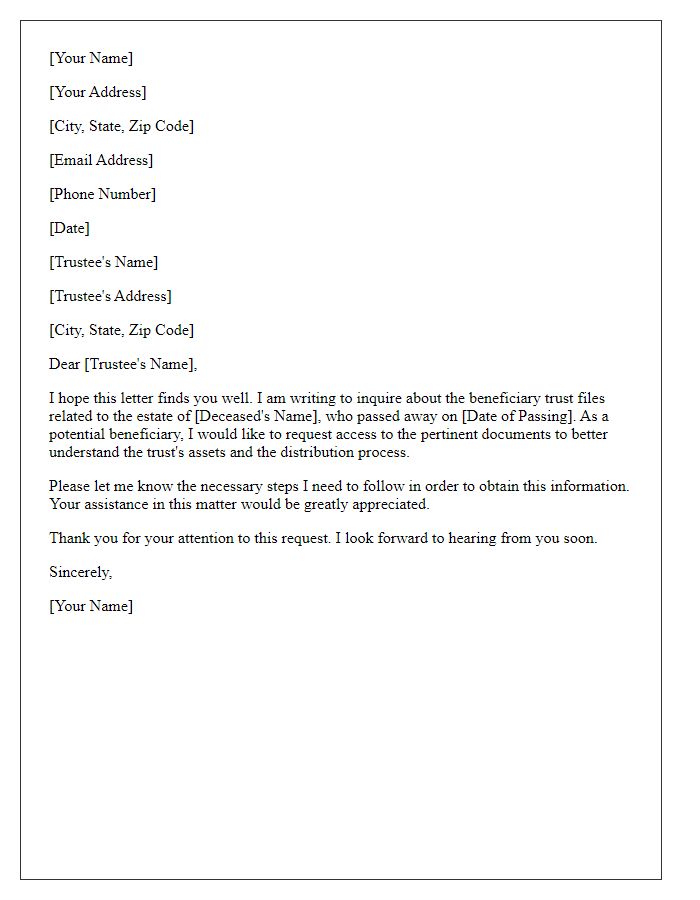

Letter template of request for beneficiary trust documentation for estate planning.

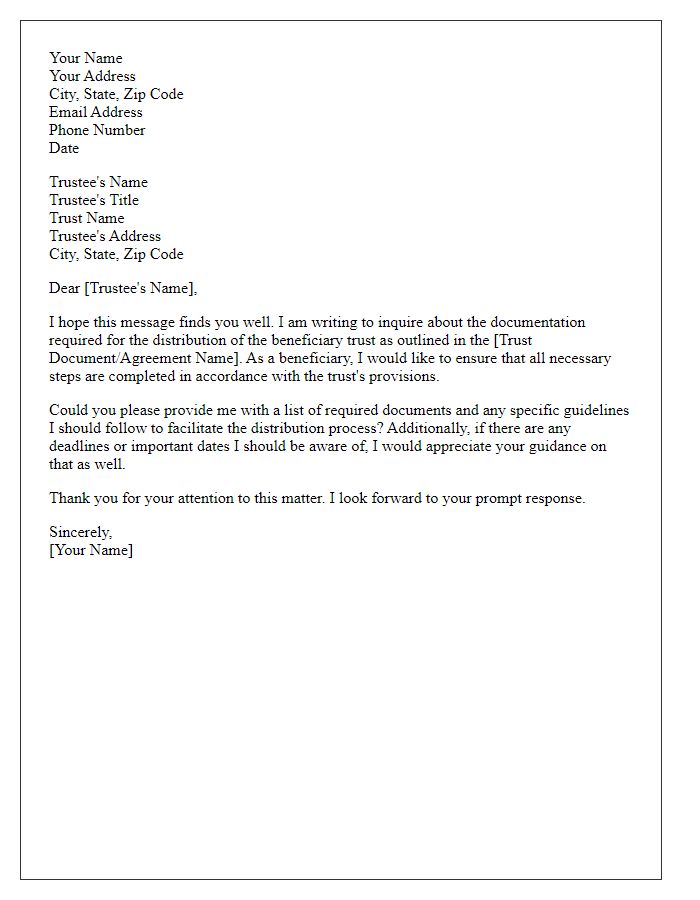

Letter template of inquiry regarding documentation for beneficiary trust distribution.

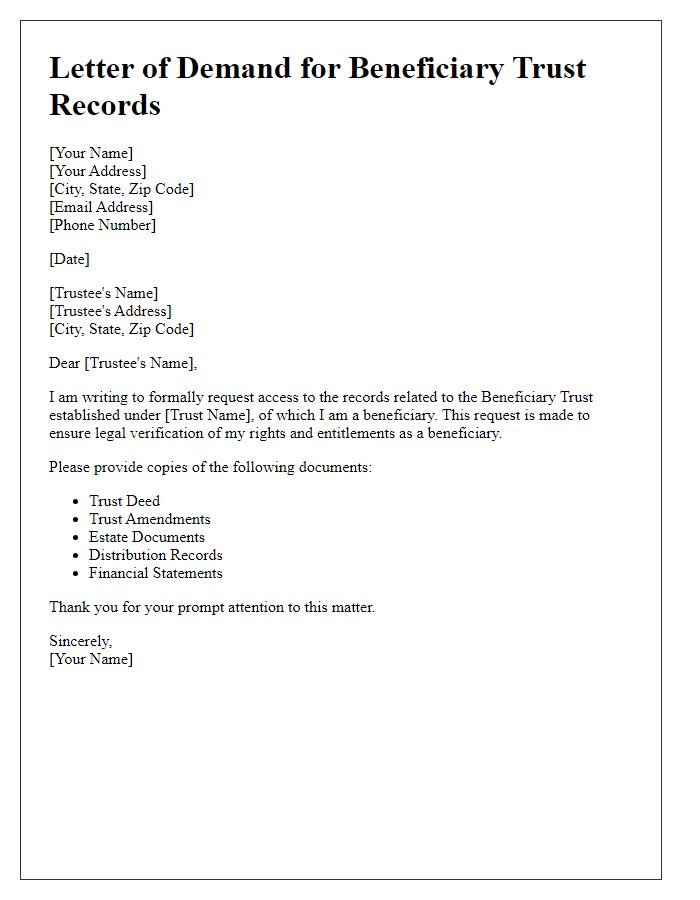

Letter template of demand for beneficiary trust records for legal verification.

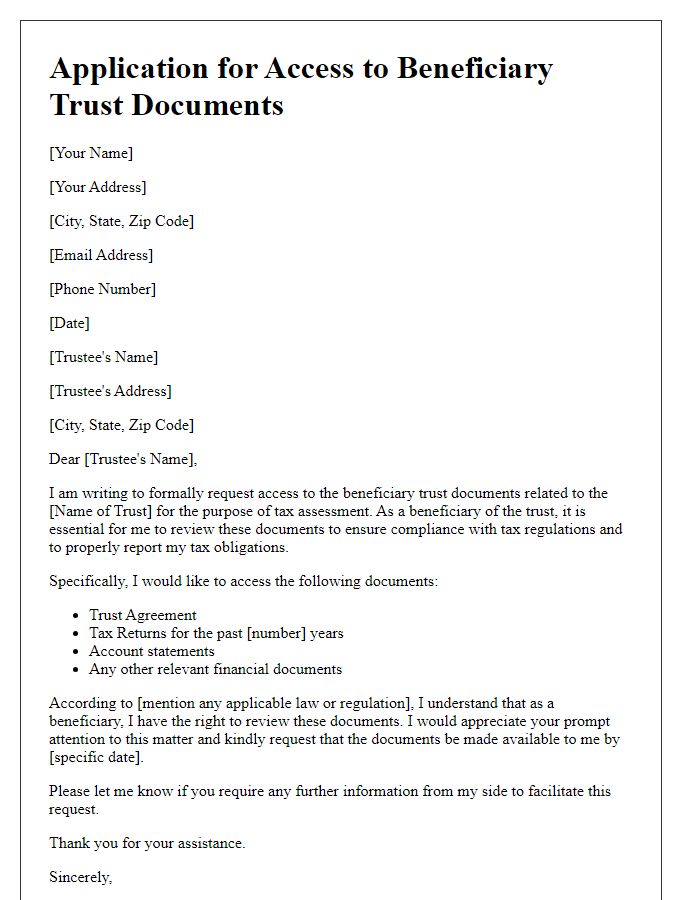

Letter template of application for access to beneficiary trust documents for tax assessment.

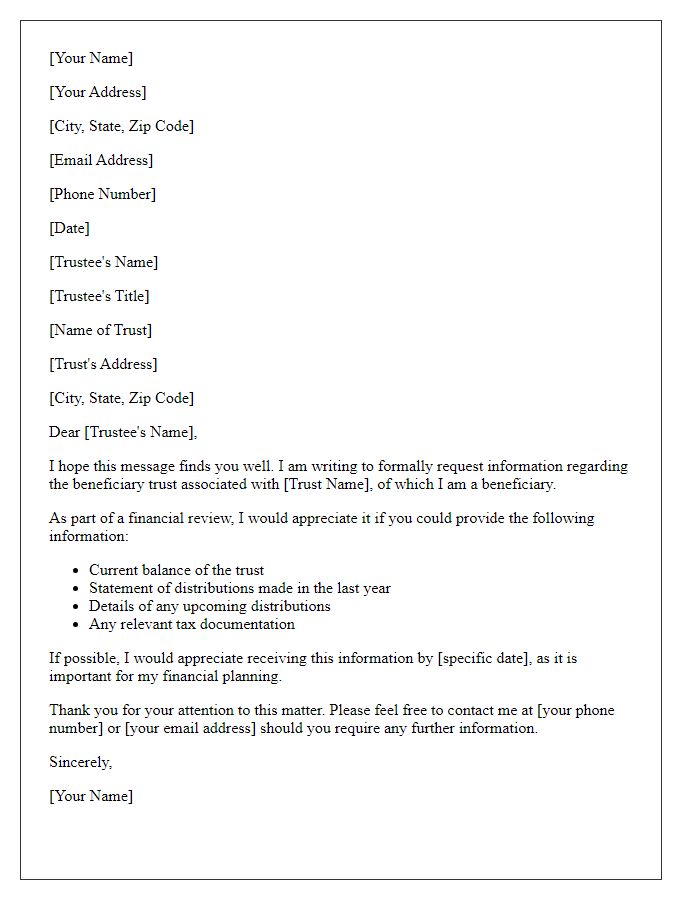

Letter template of formal request for beneficiary trust information for financial review.

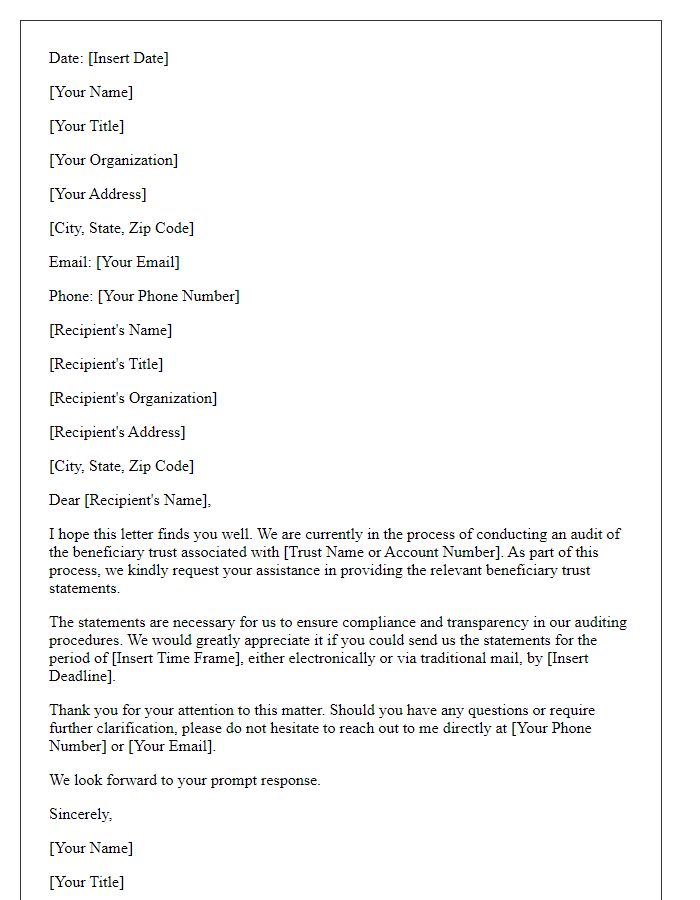

Letter template of solicitation for beneficiary trust statements for auditing purposes.

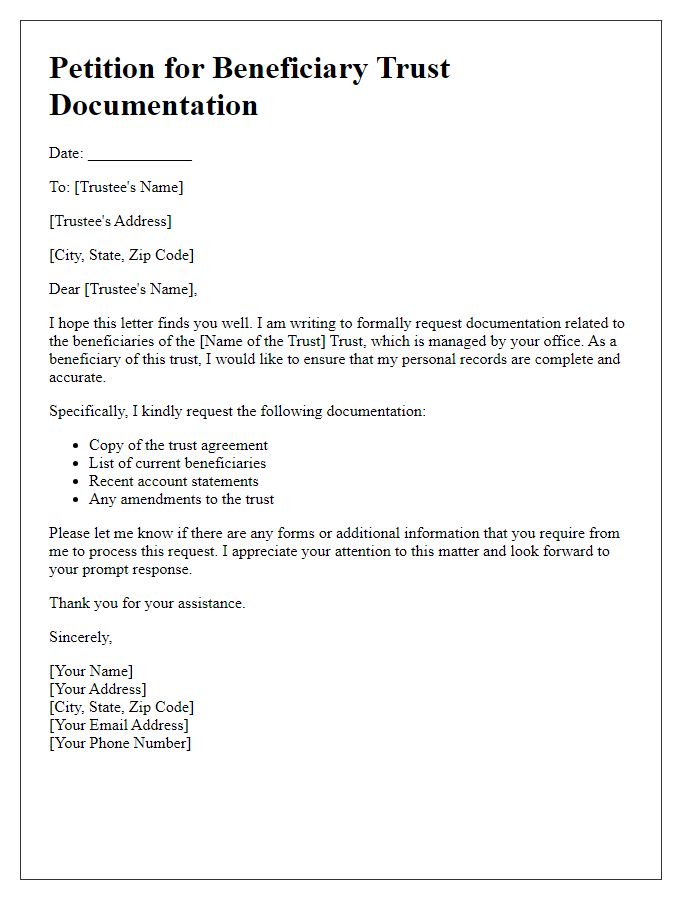

Letter template of petition for beneficiary trust documentation for personal records.

Letter template of inquiry for beneficiary trust files for inheritance purposes.

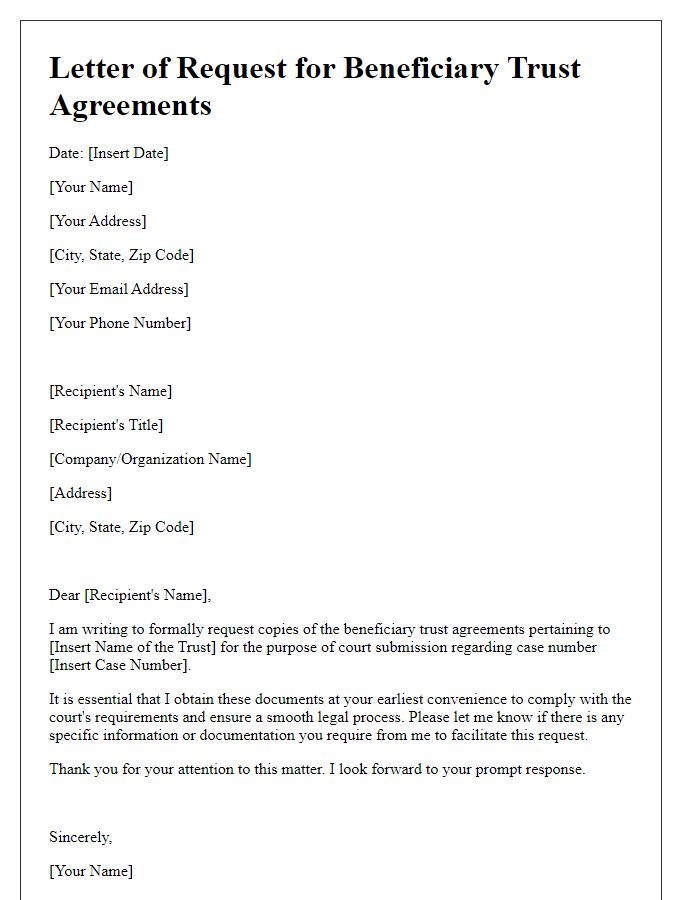

Letter template of request for beneficiary trust agreements for court submission.

Comments