Are you looking for the perfect way to inform a loved one about their inheritance? Writing a letter can feel daunting, but it's actually a wonderful opportunity to express your care and share important news. In this letter, you can provide clear details about the inheritance while also conveying a sense of warmth and support. If you're curious about how to craft the ideal notification, keep reading for tips and a helpful template!

Correct legal language

The legal notification of inheritance typically involves notifying a beneficiary about their rights and entitlements under a will or estate plan. Important details such as the decedent's name, date of death, and the specific assets or amounts assigned to the beneficiary would be included. The notification often references relevant laws, such as probate law, and may require signature or acknowledgment to confirm receipt. A legal representative, such as an attorney, may be involved in drafting this document to ensure compliance with jurisdictional requirements. Clarity and precision in terminology are essential to prevent any misunderstandings regarding the beneficiary's rights.

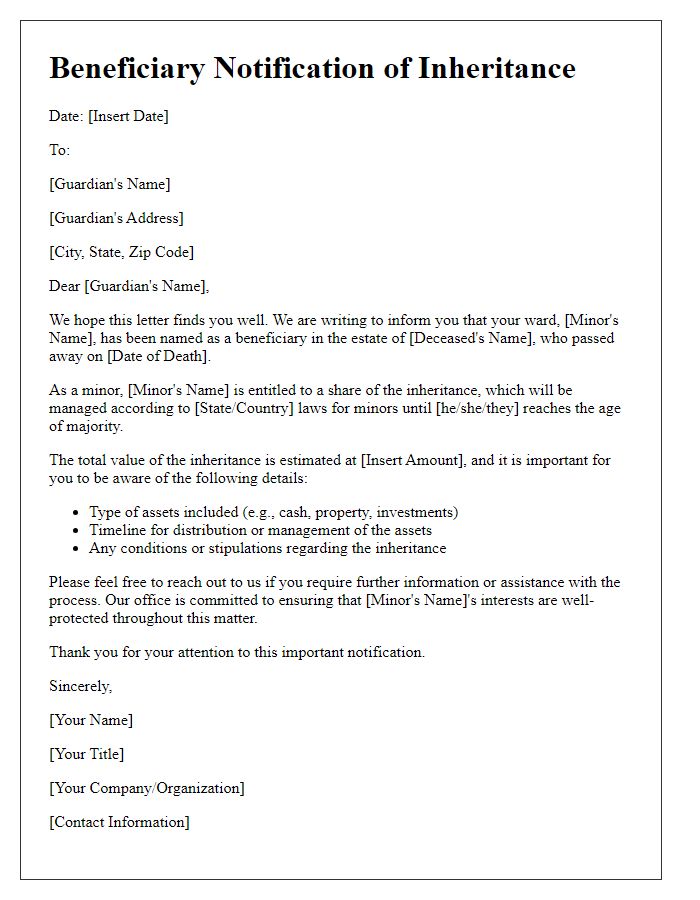

Recipient's full name and address

A beneficiary notification of inheritance typically includes essential details about the deceased estate and the rights of the recipient. For example, the letter formally addresses the recipient, providing their full name and address to ensure clarity and proper identification. The document details the name of the deceased (like John Smith), the date of passing (such as January 15, 2023), and information about the estate's executor (name and contact details). Furthermore, it outlines the beneficiaries' entitlements, specific assets (such as property located at 123 Maple Street), and any legal implications regarding taxes or estate settlements that may apply. This notification serves as an official communication that can significantly impact the recipient's financial future and responsibilities.

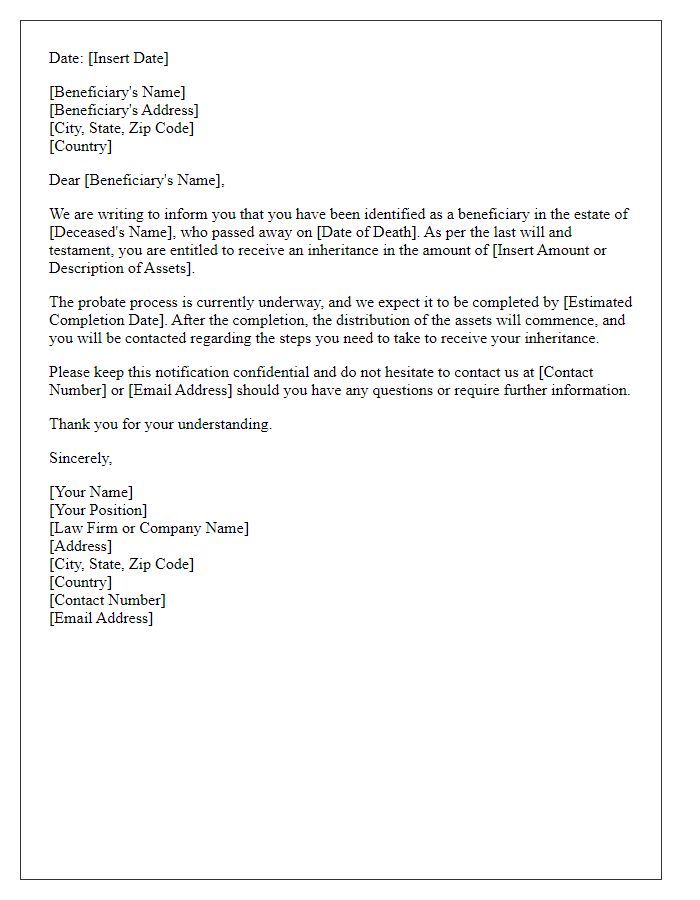

Details of the inheritance

The notification of inheritance typically conveys important information regarding the assets left by a deceased individual. This includes significant items such as real estate properties, bank accounts, valuable personal belongings, and financial securities. For instance, a residential property in New York City may be valued at several million dollars, while a collection of antique jewelry could be appraised at tens of thousands of dollars. Beneficiaries will also receive details about any outstanding debts or taxes related to the estate, potentially impacting the final distribution. Additional details such as the executor's contact information and deadlines for claims are vital for beneficiaries to understand their rights and responsibilities fully. Each inheritance case can vary greatly based on the deceased's estate plan, location, and applicable local laws, making precise information crucial for the beneficiaries involved.

Executor's contact information

When notifying beneficiaries about their inheritance, it is essential to include clear and concise specifics about the executor's contact information. For instance, an estate executor, appointed by the court, may have details including the executor's full name (e.g., John Smith) managing the estate of a deceased individual, contact number (e.g., (555) 123-4567) for inquiries, and official email address (e.g., johnsmith@email.com). The executor handles asset distribution as mandated by the will while ensuring compliance with local regulations. Additionally, including the estate's address (e.g., 123 Main Street, Springfield) may facilitate correspondence regarding the inheritance process and administrative duties involved. Timely communication by the executor will assist beneficiaries in understanding their rights and claims under the will.

Instructions for next steps

Beneficiaries receiving an inheritance should follow specific steps to ensure a smooth transition and management of their assets. Upon notification of inheritance, the individual should first consult legal documents, such as a Last Will and Testament, to understand the distribution of assets and specific provisions. Next, it is crucial to gather relevant financial records, including bank statements, property deeds, and investment accounts, to assess the total value of the estate, which may involve appraisals for real estate or valuables. Beneficiaries should also contact an estate attorney, particularly if the estate is complex or subject to probate process in jurisdictions like California or New York, where laws vary significantly. Navigating tax implications is essential, considering factors such as estate tax and inheritance tax, which may differ based on local regulations. Lastly, beneficiaries should make a plan for managing or liquidating assets, ensuring compliance with any obligations outlined in the will.

Letter Template For Beneficiary Notification Of Inheritance Samples

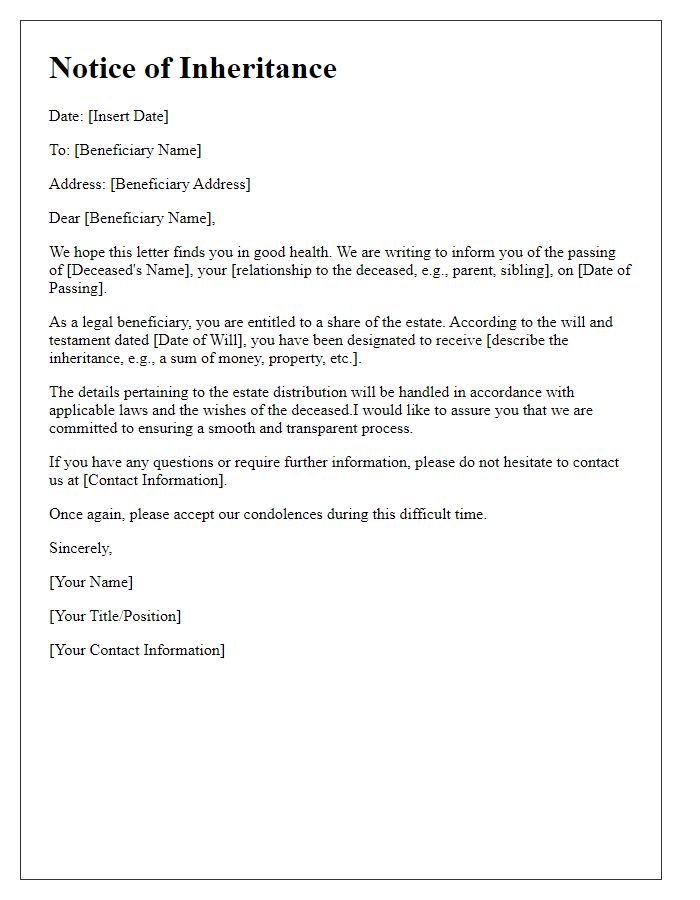

Letter template of beneficiary notification of inheritance for immediate family members.

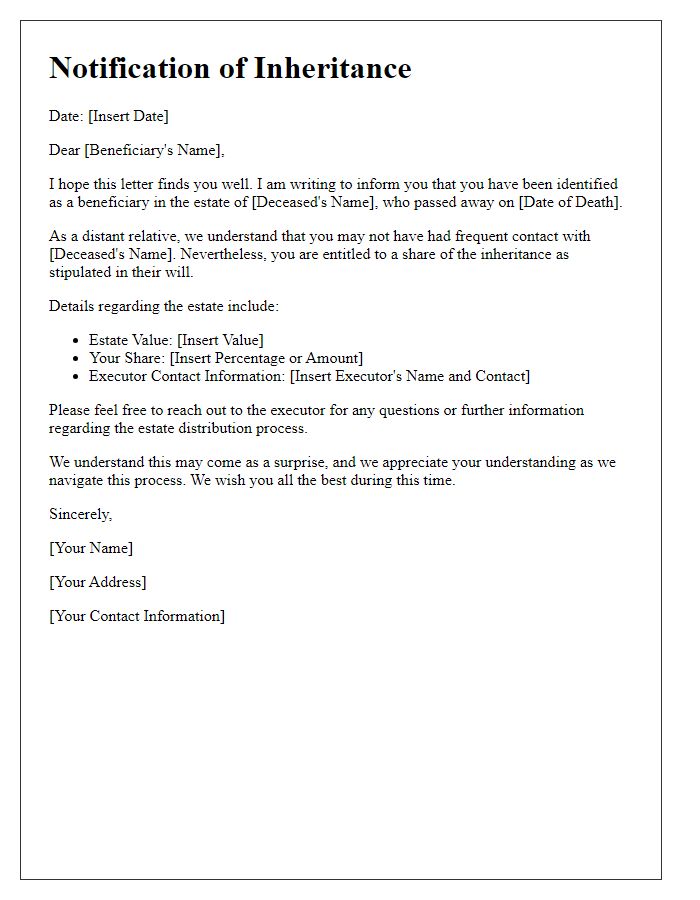

Letter template of beneficiary notification of inheritance for distant relatives.

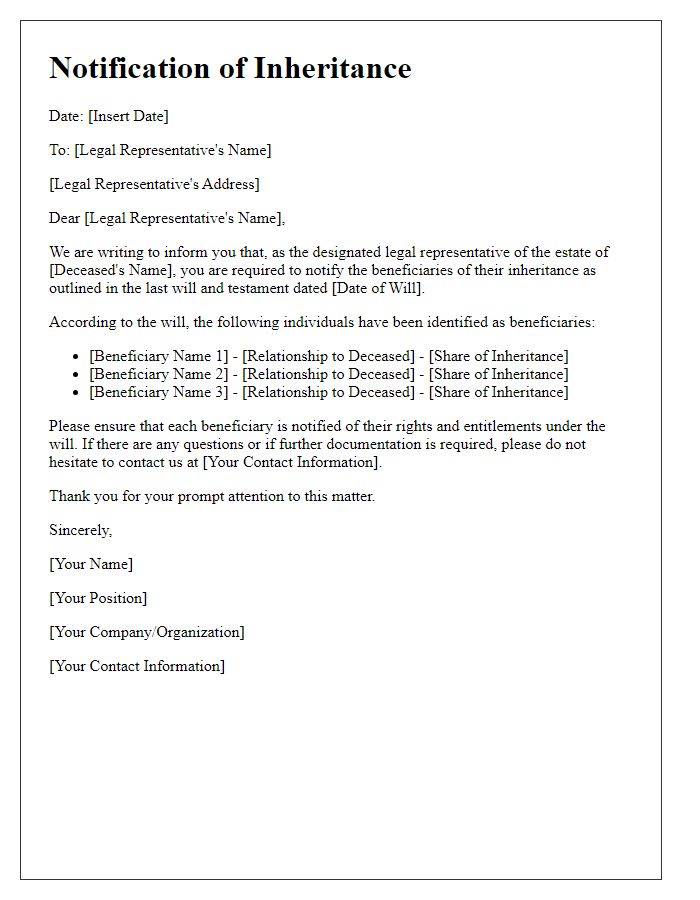

Letter template of beneficiary notification of inheritance for legal representatives.

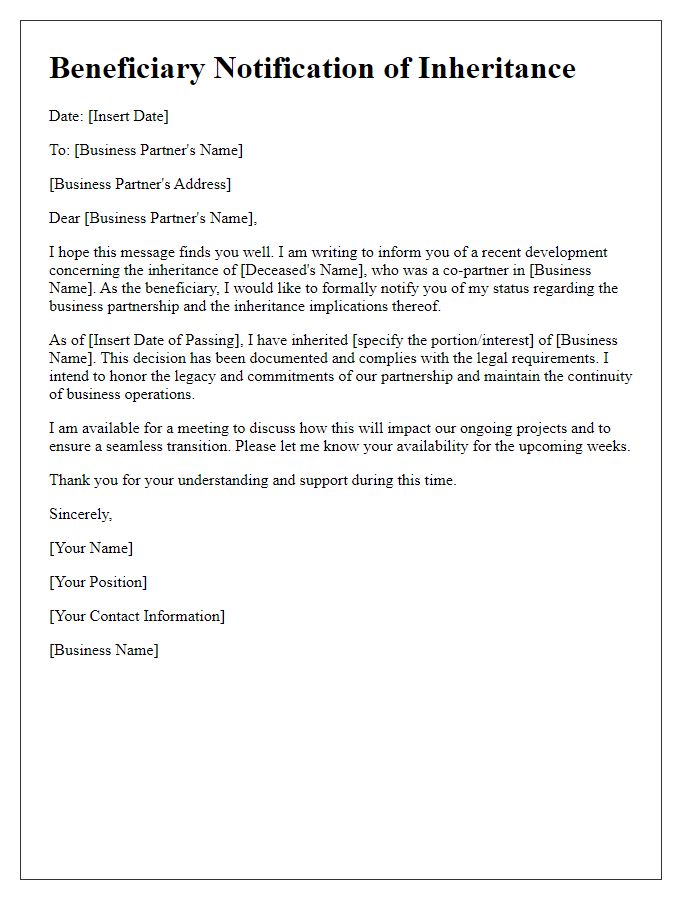

Letter template of beneficiary notification of inheritance for business partners.

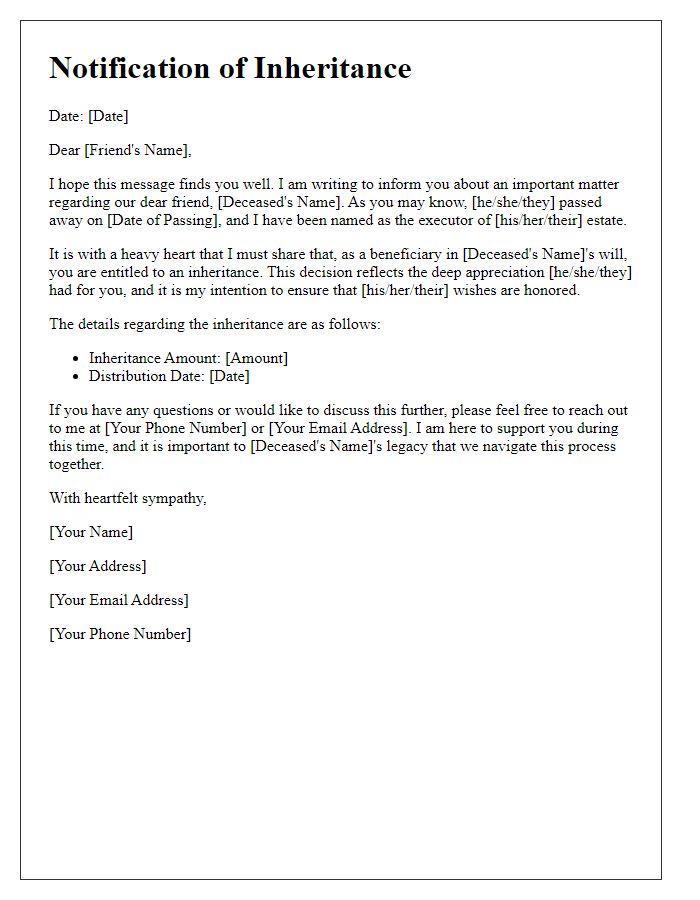

Letter template of beneficiary notification of inheritance for close friends.

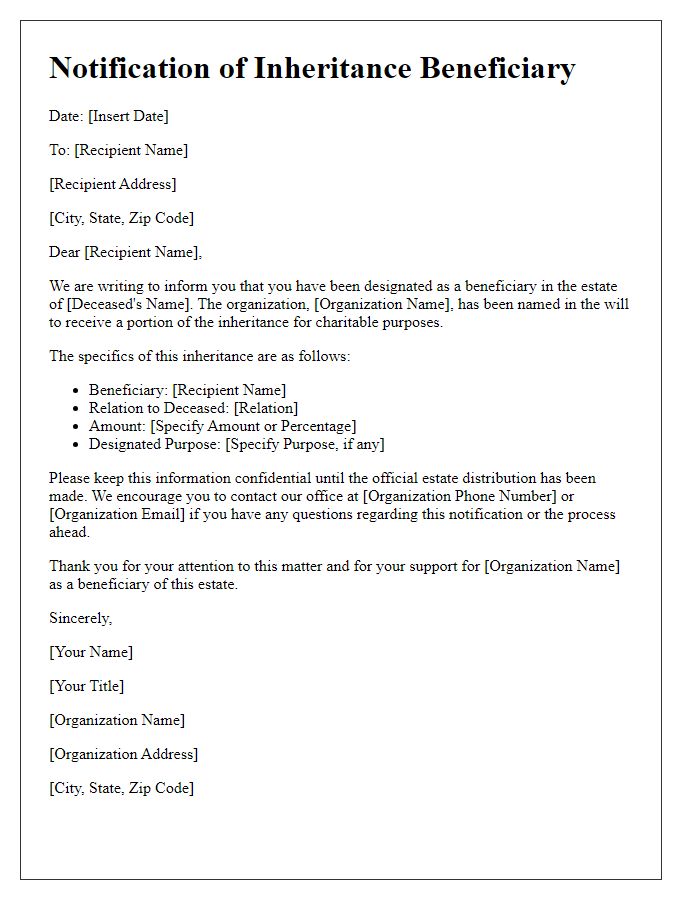

Letter template of beneficiary notification of inheritance for charities or organizations.

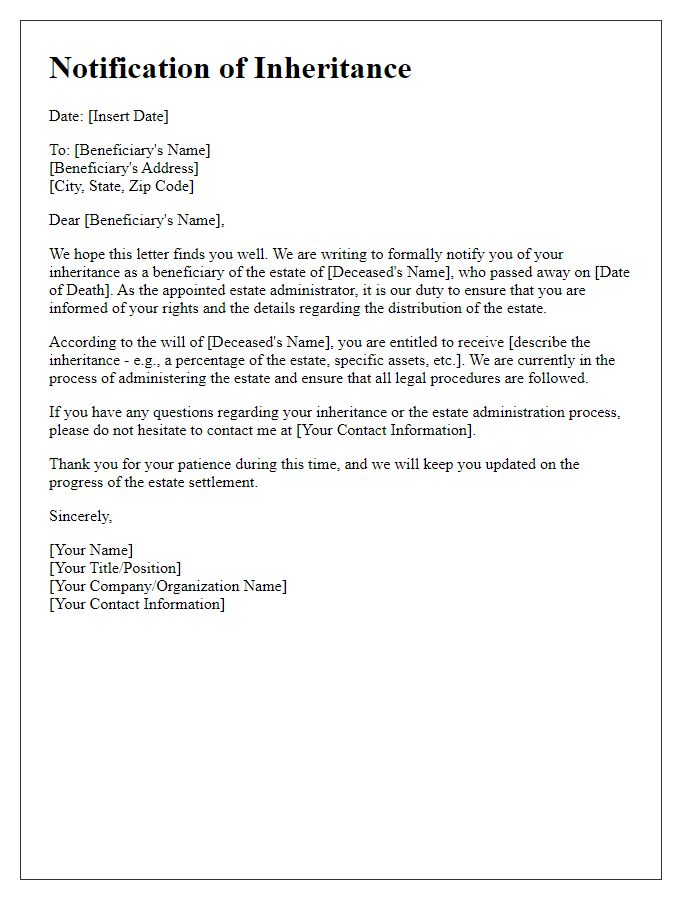

Letter template of beneficiary notification of inheritance for estate administrators.

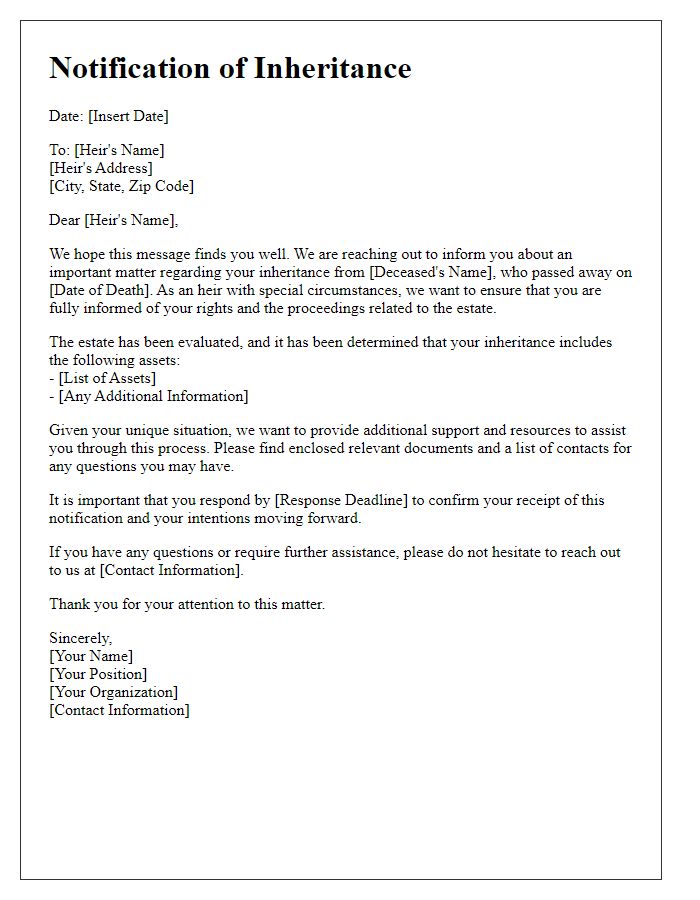

Letter template of beneficiary notification of inheritance for heirs with special circumstances.

Comments