When it comes to ensuring fair and transparent compensation for beneficiaries, a well-crafted beneficiary compensation agreement is essential. This document not only outlines the terms and conditions but also protects the interests of all parties involved. It's important to understand the key elements that should be included, such as the compensation structure, responsibilities, and timelines. So, if you're ready to dive deeper into crafting the perfect agreement, keep reading to unravel more details!

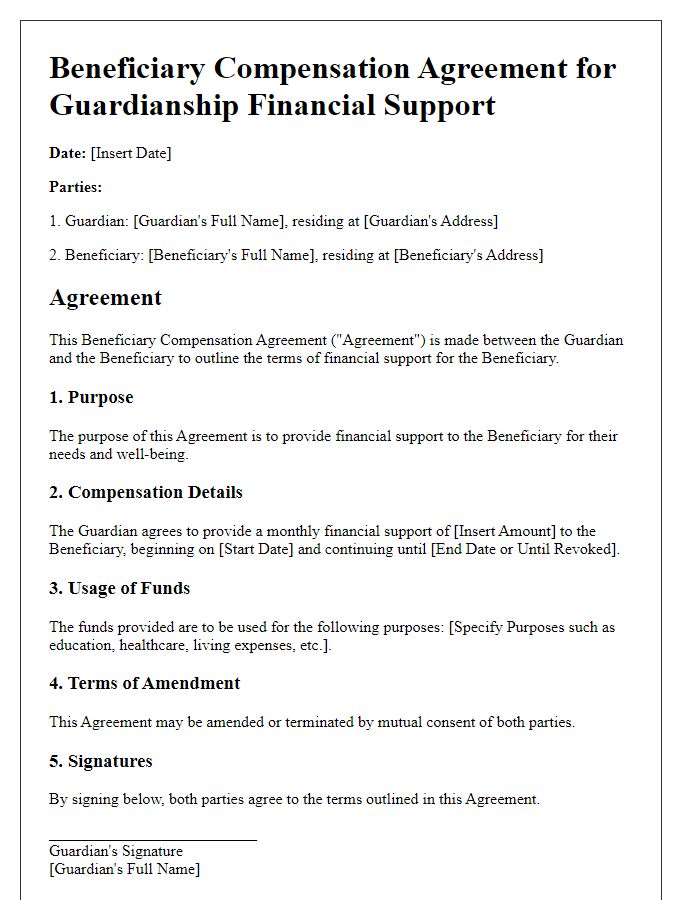

Clear Identification of Parties

The Clear Identification of Parties section establishes the identities of individuals or entities involved in the beneficiary compensation agreement. This typically includes the full legal names, addresses, and contact information of both the benefactor and the beneficiary. In legal documentation, clarity is crucial; therefore, specifying the relationship, such as "John Doe, residing at 123 Elm Street, Springfield, IL, as the Benefactor" and "Jane Smith, residing at 456 Oak Avenue, Springfield, IL, as the Beneficiary," helps avoid ambiguity. Additionally, including pertinent identifiers like Social Security numbers or business registration numbers can strengthen the identification process. Accurate and complete identification of parties ensures that all obligations can be enforced under the terms of the agreement, minimizing potential disputes.

Detailed Description of Compensation

The beneficiary compensation agreement outlines the financial restitution provided to individuals who have suffered losses due to specific events, such as natural disasters, accidents, or corporate malfeasance. For instance, in the case of a hurricane like Hurricane Katrina in 2005, beneficiaries may receive compensation for property damage, medical expenses, and lost wages, totaling up to $100,000 depending on the extent of loss and applicable insurance coverage. The agreement typically stipulates payment timelines, which could range from immediate disbursement within 30 days to structured payments over several years, ensuring beneficiaries receive financial relief in a timely manner. Additionally, detailed calculations must accompany the compensation amount, clearly itemizing factors such as estimated repair costs, medical bills, and psychological counseling expenses, thereby ensuring transparency and accountability throughout the compensation process. Legal frameworks governing compensation agreements, such as state statutes or federal regulations like the Stafford Act, provide essential guidelines for equitable distribution, protecting the rights of beneficiaries while minimizing disputes.

Terms and Conditions

Beneficiary compensation agreements establish clear terms and conditions for financial compensation in various contexts such as insurance settlements or trusts. These legal documents typically outline critical components including the beneficiary's name, financial amount designated for compensation, and any pertinent conditions governing the release of funds. Specific clauses often address the timeline for payment, conditions under which compensation may be modified, and stipulations for resolving disputes, such as arbitration requirements. Additionally, tax implications related to the compensation may be highlighted to inform beneficiaries of potential obligations. Signing such agreements usually requires notarization to authenticate the identities of the involved parties and ensure legal compliance.

Confidentiality Clause

A beneficiary compensation agreement outlines terms and conditions under which a party will receive compensation for services or assets. Confidentiality clauses within such agreements ensure that sensitive information related to the agreement remains private. Typically, these clauses prohibit the disclosure of any details concerning the compensation amount, the identity of involved parties, or the circumstances surrounding the agreement. Breaching the confidentiality clause can lead to legal ramifications, including potential penalties. Organizations commonly utilize these clauses to protect trade secrets, personal data, or proprietary information, thereby fostering a sense of trust and security between the beneficiaries and the compensating party.

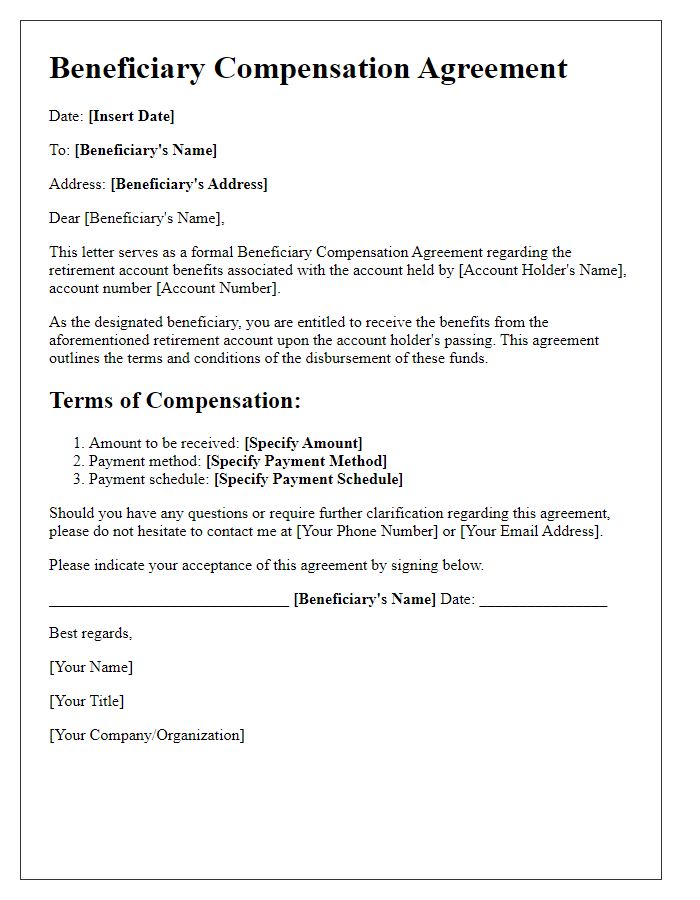

Signature and Date Lines

A beneficiary compensation agreement outlines terms of compensation among parties involved. Essential components include clear identification of beneficiaries, precise compensation amounts, and the conditions under which these payments are made. Important details such as payment methods (e.g. bank transfer, check), payment schedule (e.g. monthly, annually), and potential tax implications should be included. A signature line for each party enhances legal validity, while a date line ensures the agreement is recognized from a specific point in time. Notarization may further strengthen authenticity, especially in formal arrangements.

Letter Template For Beneficiary Compensation Agreement Samples

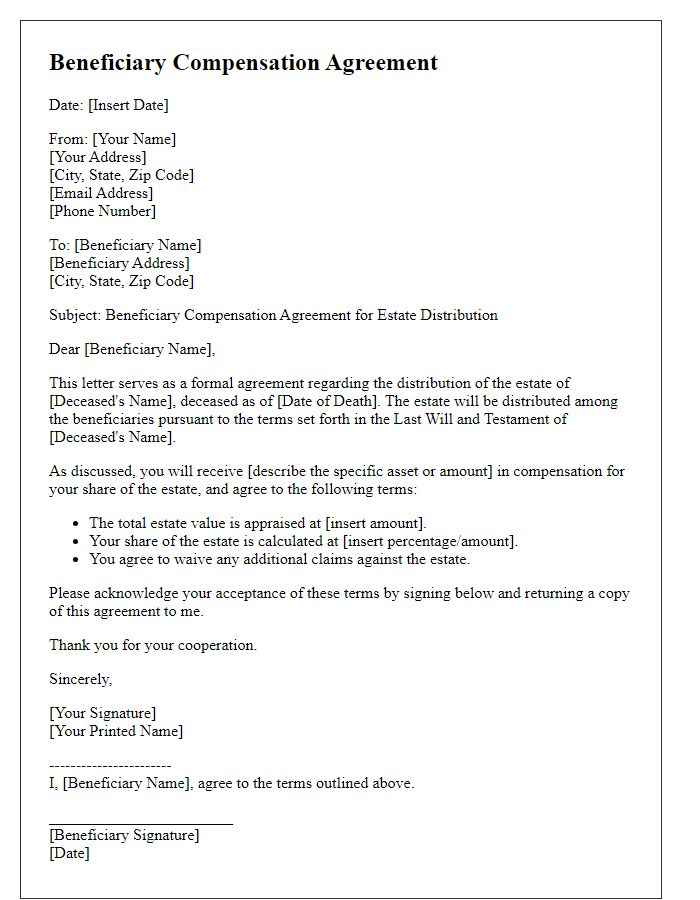

Letter template of beneficiary compensation agreement for estate distribution.

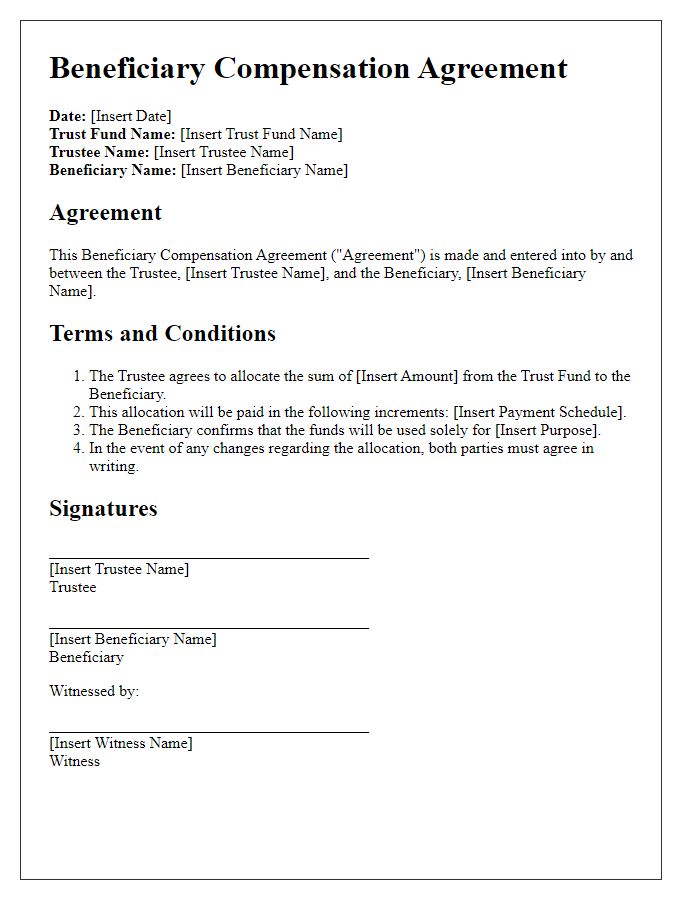

Letter template of beneficiary compensation agreement for trust fund allocation.

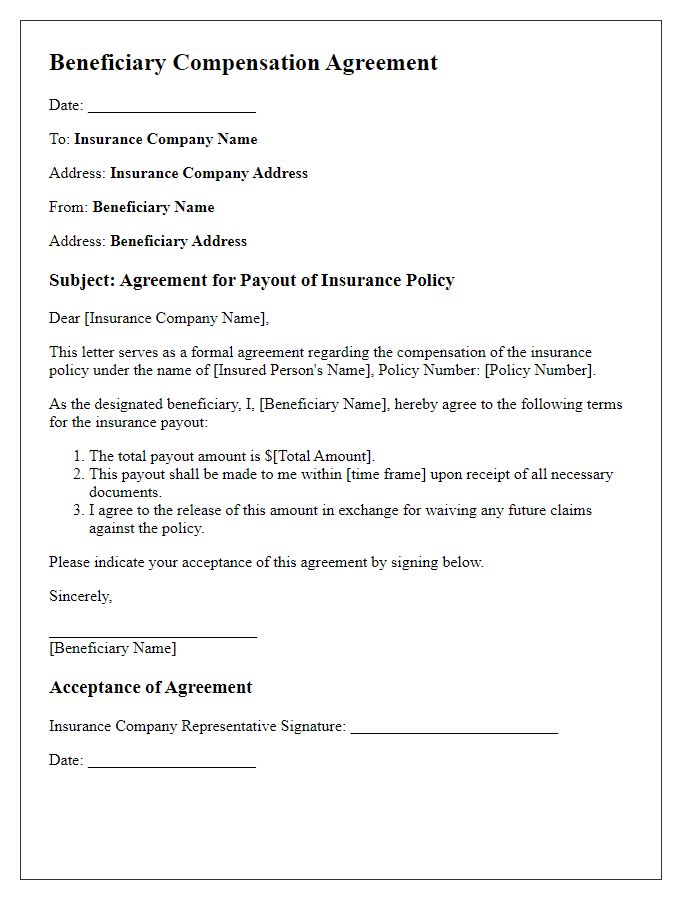

Letter template of beneficiary compensation agreement for insurance policy payout.

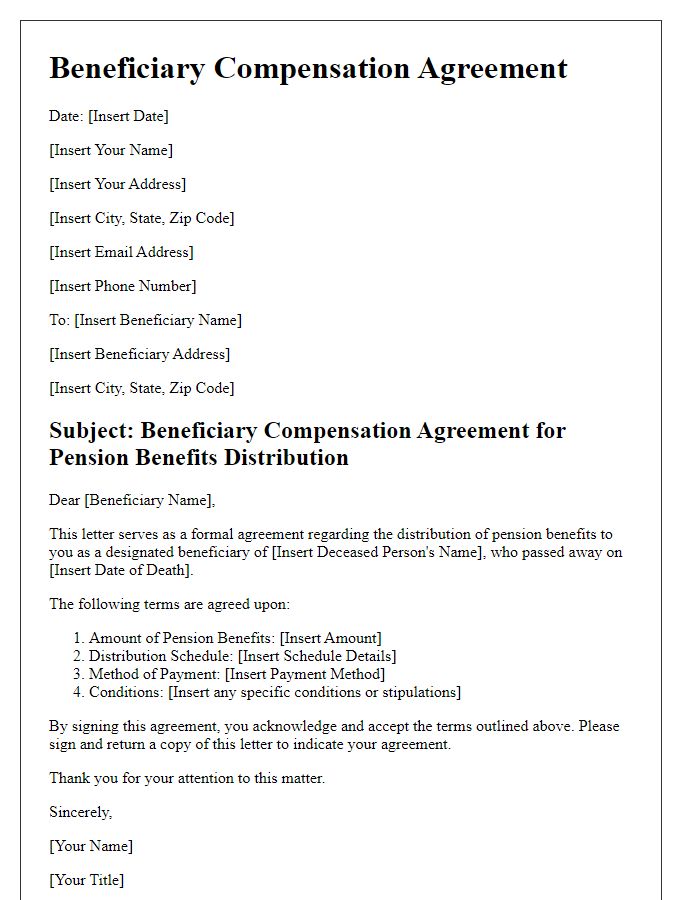

Letter template of beneficiary compensation agreement for pension benefits distribution.

Letter template of beneficiary compensation agreement for legal settlement disbursement.

Letter template of beneficiary compensation agreement for real estate inheritance.

Letter template of beneficiary compensation agreement for bank account proceeds.

Letter template of beneficiary compensation agreement for royalties and intellectual property.

Letter template of beneficiary compensation agreement for retirement account benefits.

Comments