Are you looking to update the personal representative of a beneficiary in a clear and concise manner? It's important to communicate this change effectively to ensure everyone stays informed and on the same page. In this article, we'll explore a straightforward letter template that simplifies the process of notifying all parties involved. Stick around to discover tips and examples that will make your communication seamless!

Accurate identification details

Accurate identification details are crucial for updating personal representatives of beneficiaries in legal and financial matters. Full legal names, including middle names and suffixes (such as Jr., Sr., or III), should be clearly stated. Dates of birth provide essential verification, ensuring that each representative is distinctly identified. Social Security numbers serve as a unique identifier, helping to prevent confusion among individuals with similar names. Addresses must be current, including city, state, and zip codes, to ensure that all correspondence reaches the appropriate individuals without delay. Finally, contact numbers, including mobile and landline options, enhance communication efficiency, allowing for timely updates and notifications regarding beneficiary matters.

Clear designation of roles

The personal representative is crucial in administering a trust, ensuring the timely execution of estate duties. This representative manages various tasks, such as settling debts, distributing assets, and maintaining communication with beneficiaries. Clarity in their role helps prevent conflicts during the estate administration process. For example, in a large estate involving properties located in New York and California, the personal representative must navigate differing state laws effectively. They also serve as a liaison with financial institutions, ensuring that all accounts are properly handled and that tax obligations are met in accordance with Internal Revenue Service (IRS) regulations. Regular updates to beneficiaries regarding the status of the estate promote transparency and trust, essential in maintaining family relationships during potentially emotional times.

Concise purpose statement

Updating beneficiaries can ensure proper allocation of assets in estate planning processes. Personal representatives play a critical role in managing an estate's affairs, especially following significant events such as a death in the family. Changes in beneficiary designations require clear communication to avoid potential disputes or confusion among heirs. Accurate contact information is vital for timely updates regarding asset distribution, tax obligations, or any legal matters that may arise during probate. Regular reviews of these designations can help align with current wishes and legal requirements, ensuring a smooth transition of assets in accordance with the deceased's intentions.

Legal and procedural compliance

Beneficiary personal representatives play a crucial role in estate management processes, ensuring legal and procedural compliance during the execution of wills and distribution of assets. In jurisdictions such as California, representatives must adhere to the California Probate Code, which outlines responsibilities including filing the will with the court within 30 days of death. Furthermore, accurate accounting of estate assets, typically required within four months post-appointment, is mandatory to maintain transparency. In large estates, the probate process can take up to a year or more, emphasizing the importance of timely updates to beneficiaries regarding asset valuations and distribution timelines. Regular communication helps in fostering trust and ensuring all parties are informed of developments in proceedings, mitigating potential conflicts.

Contact information for follow-up

Beneficiary personal representatives often need to keep contact information updated for efficient communication regarding estate matters. The primary contact number should include an area code, typically consisting of seven digits, ensuring accessibility. Email addresses remain critical for quick correspondence; they often consist of a combination of letters and numbers, often followed by domains such as Gmail or Yahoo. Physical addresses should include street numbers, street names, city names, and postal codes for accuracy in documentation and delivery of notices. Regularly verifying this information (at least annually or after major life events) prevents delays in the administration process and fosters transparency among all parties involved.

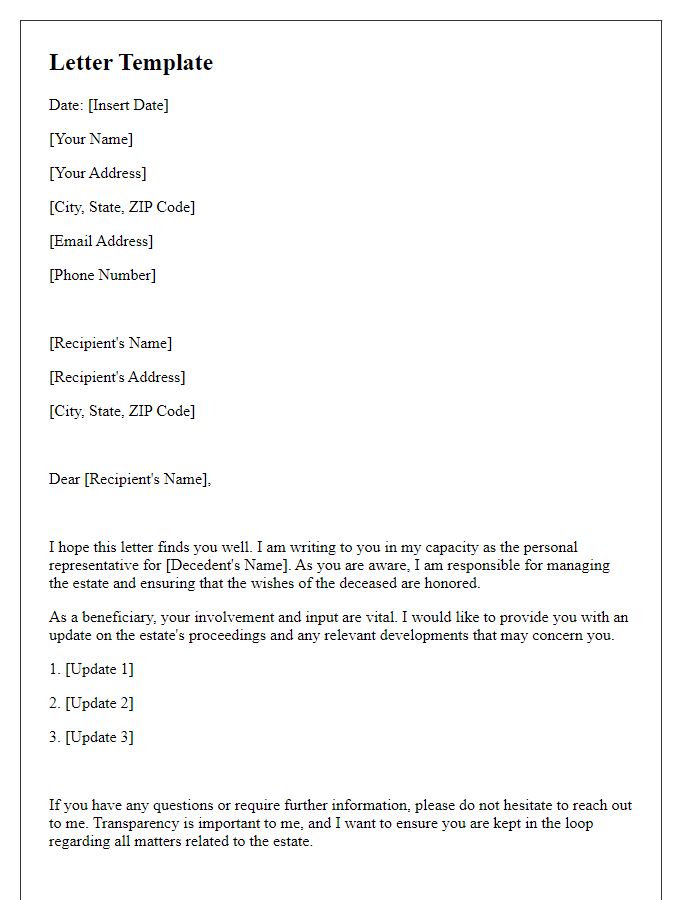

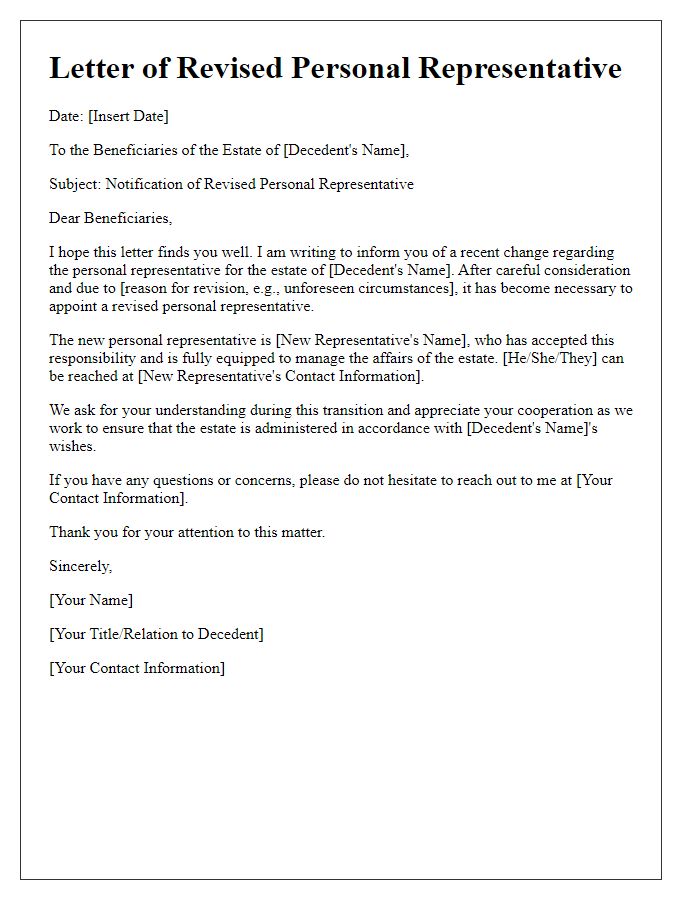

Letter Template For Beneficiary Personal Representative Update Samples

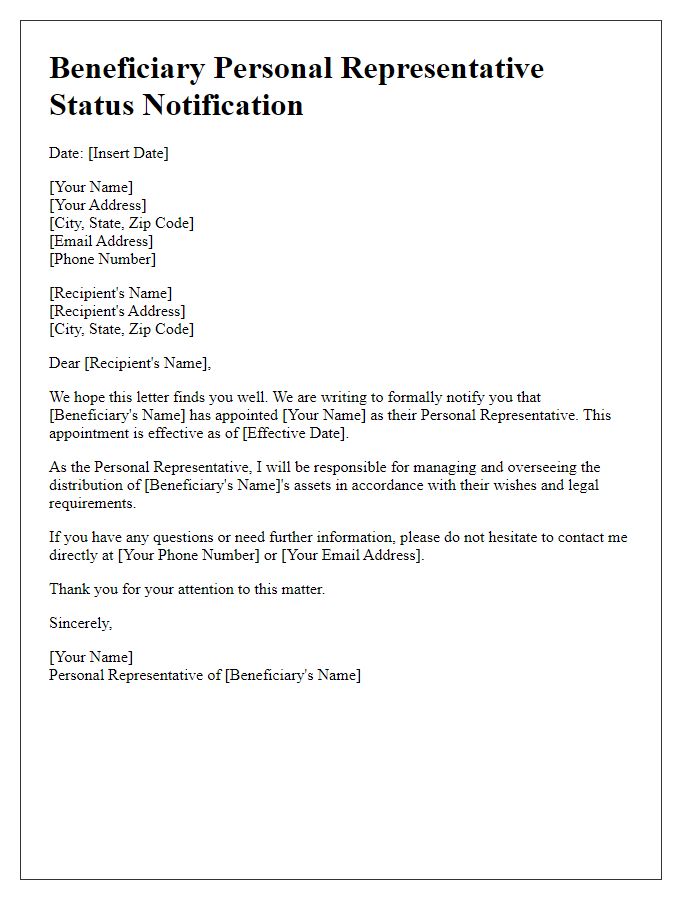

Letter template of beneficiary personal representative status notification

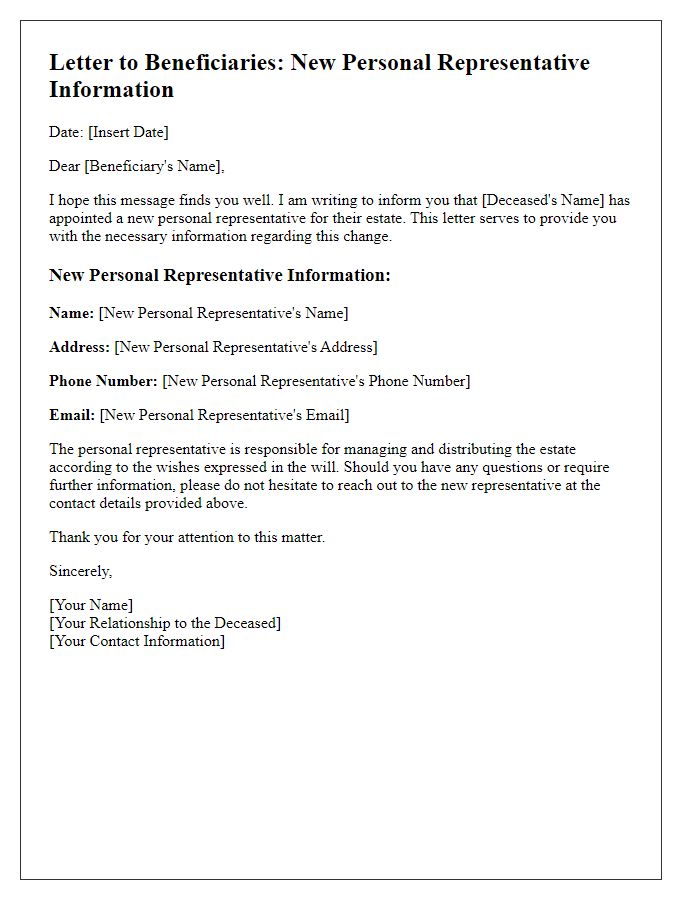

Letter template of new personal representative information for beneficiaries

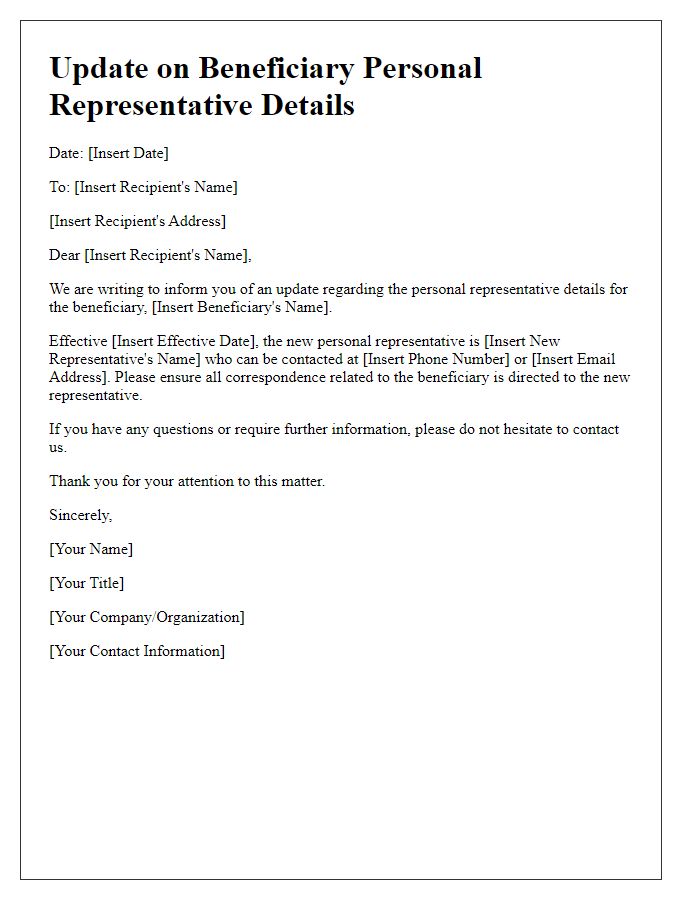

Letter template of update on beneficiary personal representative details

Letter template of notification regarding personal representative for beneficiaries

Comments