Are you considering setting up a mutual fund allocation for your beneficiaries? Crafting the perfect letter can help communicate your intentions clearly and ensure that your loved ones are well taken care of. In this article, we'll guide you through essential elements to include in your letter template, making the process straightforward and efficient. So, grab a cup of coffee and let's dive into the details together!

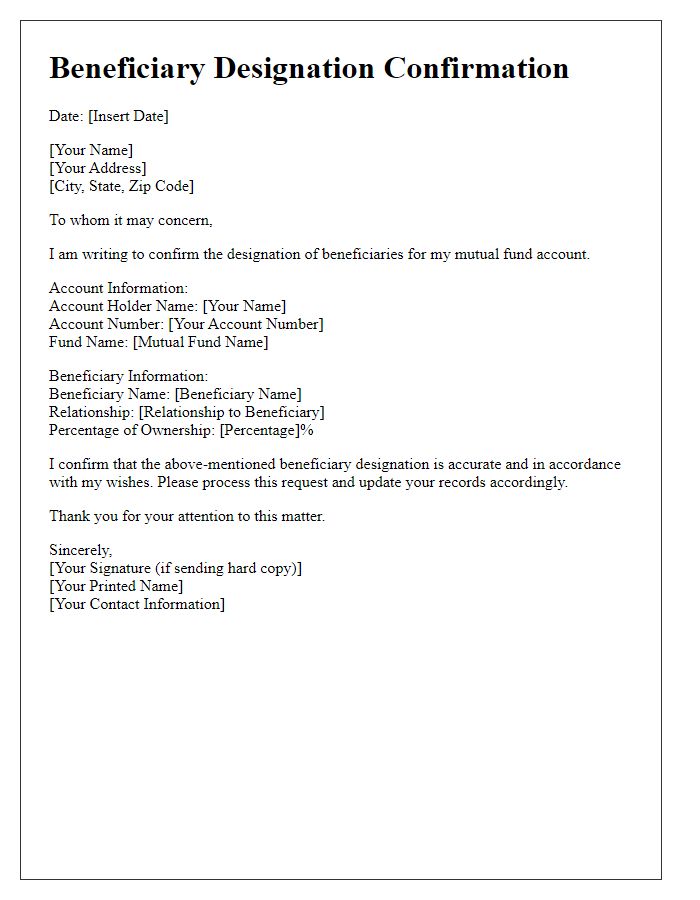

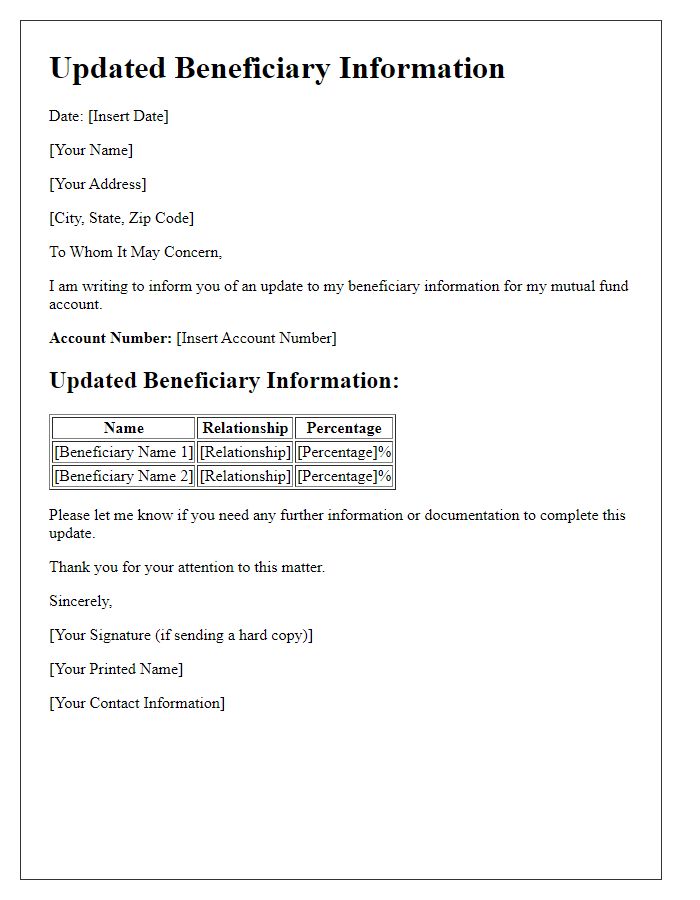

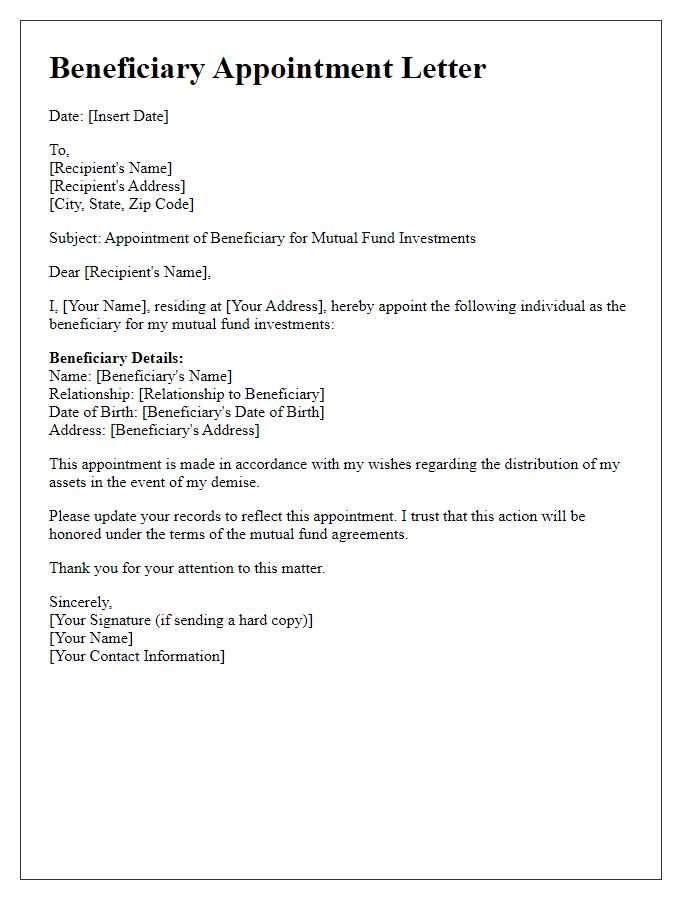

Clarity of Beneficiary Details

Beneficial ownership of mutual funds necessitates clarity in beneficiary designations, ensuring seamless asset transfer upon the account holder's demise. Key details such as full name, Social Security number, date of birth, and relationship to the account holder enhance identification accuracy. Fund providers like Vanguard and Fidelity often require this information for compliance with federal regulations. Proper documentation ensures that beneficiaries, often spouses or children, receive rightful inheritance without legal disputes. Misidentification or lack of details could delay the allocation process, causing unnecessary stress during times of loss. Timely updates and confirmations of beneficiary details safeguard against potential complications, ensuring that financial assets are efficiently transitioned.

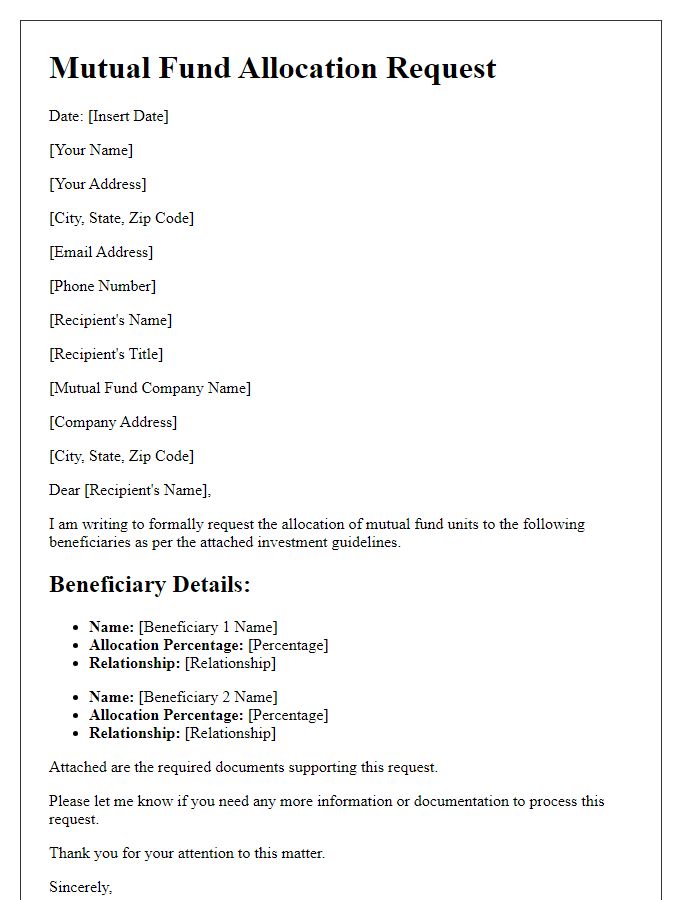

Specific Fund Allocation Information

Beneficiary mutual fund allocation involves strategic decisions regarding the distribution of investment assets within various mutual funds. Specific fund allocation can include various fund types such as equity funds that invest primarily in stocks, bond funds focused on fixed-income securities, or balanced funds that combine both equities and bonds to diversify risk. For example, a typical allocation could involve directing 60% of the total investment into a Growth Equity Fund, which targets high-return stocks, with the remaining 40% allocated to a Stable Bond Fund, aimed at preserving capital and generating steady income. This allocation strategy allows beneficiaries to align their financial goals with risk tolerance, ensuring a well-rounded investment approach that can adapt to market fluctuations and potential economic changes. The monitoring of fund performance, experienced portfolio managers, and adherence to regulations set by financial authorities like the Securities and Exchange Commission (SEC) further enhance the efficacy of these investment choices.

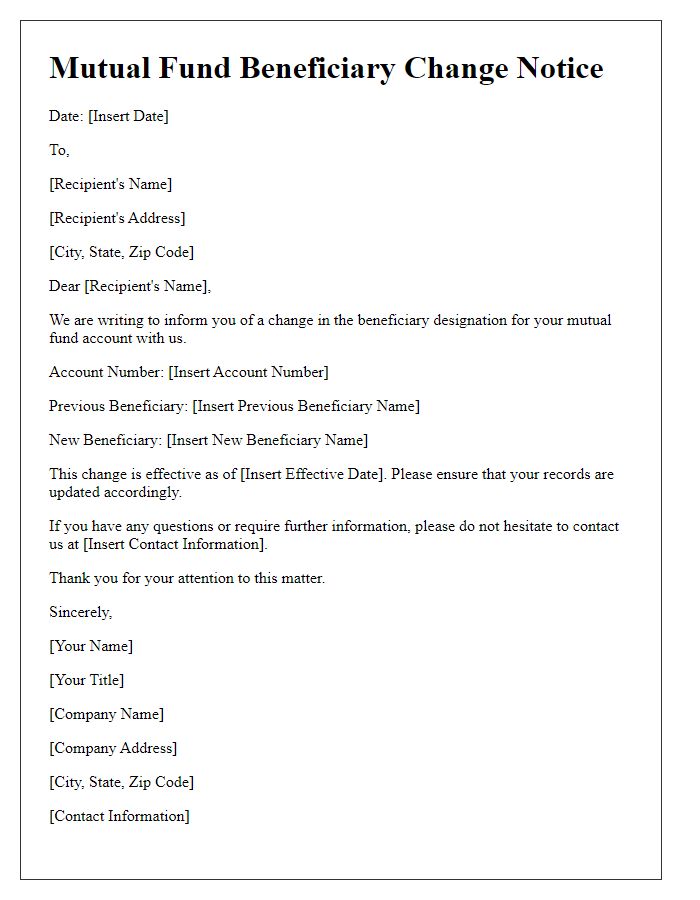

Legal Compliance and Documentation

Mutual fund allocations for beneficiaries necessitate stringent legal compliance and meticulous documentation. Financial institutions, such as asset management companies (AMCs), require detailed forms to be completed by investors for beneficiary designation, ensuring clarity in the allocation process. Key documents, including the Know Your Customer (KYC) forms, identification proof, and any trust documents, must be submitted to adhere to regulatory frameworks set by governing bodies like the Securities and Exchange Board of India (SEBI). Accurate record-keeping is fundamental, with transaction statements and communication logs retained for auditing purposes. Failure to meet compliance requirements can result in legal challenges, affecting fund disbursement and ultimately jeopardizing beneficiaries' financial interests.

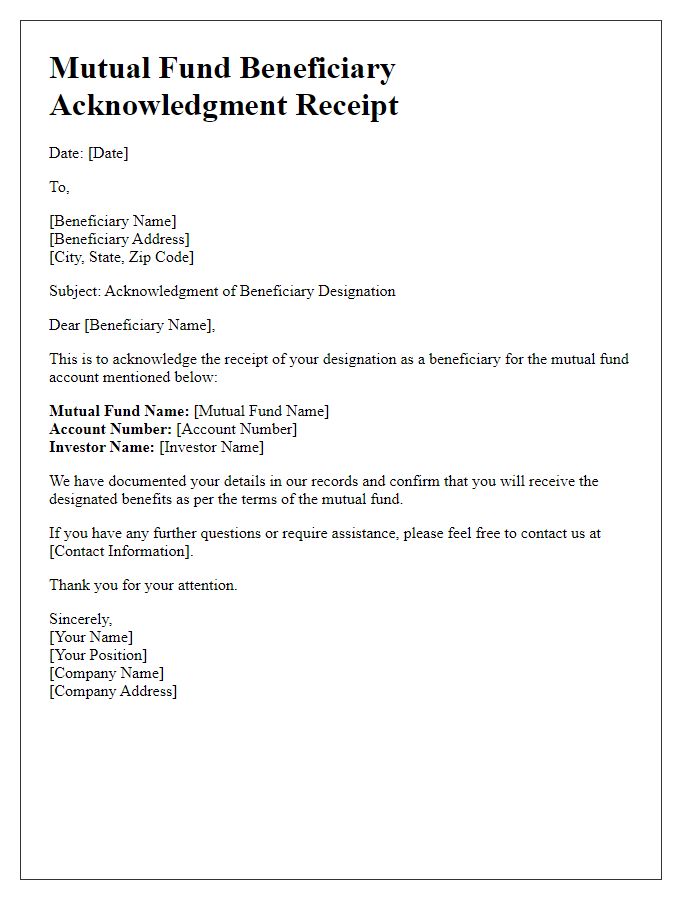

Contact Information for Queries

Beneficiary mutual fund allocation involves the distribution of investment assets to designated beneficiaries. Mutual funds contain various assets, such as stocks or bonds, managed by investment companies. In case of any inquiries regarding the allocation, individuals should contact the customer service department of the mutual fund firm. A dedicated hotline, typically operational from 9 AM to 5 PM on weekdays, can provide assistance. Additionally, official websites often feature live chat options for real-time support and email addresses for written inquiries. It is crucial to keep contact information updated to ensure beneficiaries receive timely communication regarding their investments.

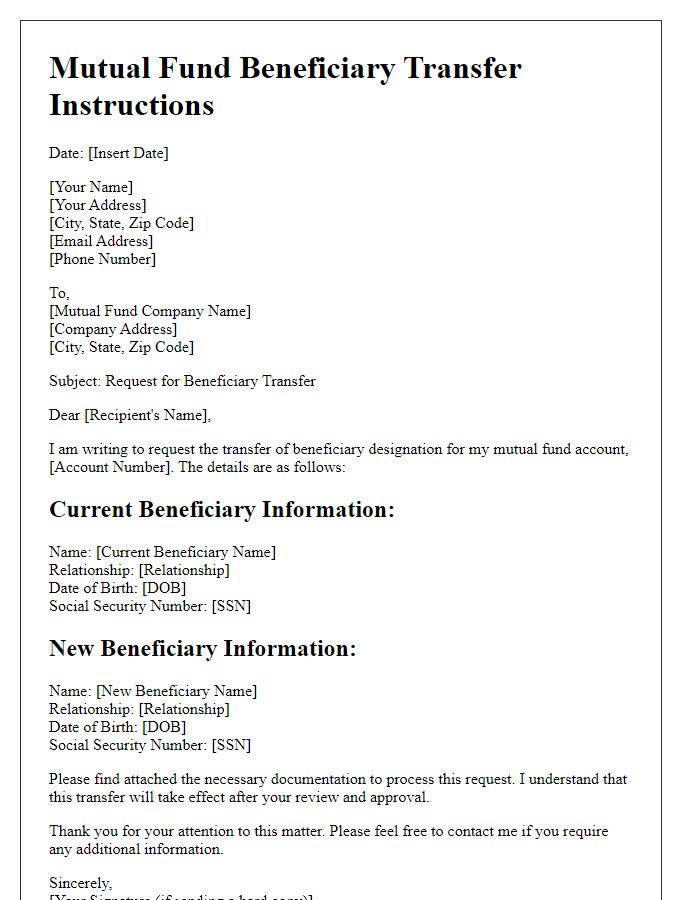

Clear Instruction for Execution

Beneficiary mutual fund allocation involves a deliberate process of designating individuals or entities to receive assets upon the account holder's passing. Proper documentation, including forms such as the beneficiary designation form, is crucial for executing these allocations seamlessly. It is essential to provide clear and precise contact information for each beneficiary, including names, Social Security numbers, and relationship to the account holder. Specific instructions regarding percentage allocations or dollar amounts must be outlined to avoid ambiguity in asset distribution. Additionally, periodic reviews of beneficiary designations are recommended, especially after significant life events such as marriage, divorce, or the birth of a child, to ensure that the mutual fund allocation reflects current wishes and circumstances.

Comments