Are you in the process of preparing important legal documents for your beneficiaries? It can feel overwhelming, but having a well-structured letter template can simplify the task significantly. This guide will provide you with essential tips and a clear layout to ensure your documentation is comprehensive and easy to understand. Join us as we delve deeper into effective letter writing strategies for your beneficiary legal documentation.

Clarity and Precision

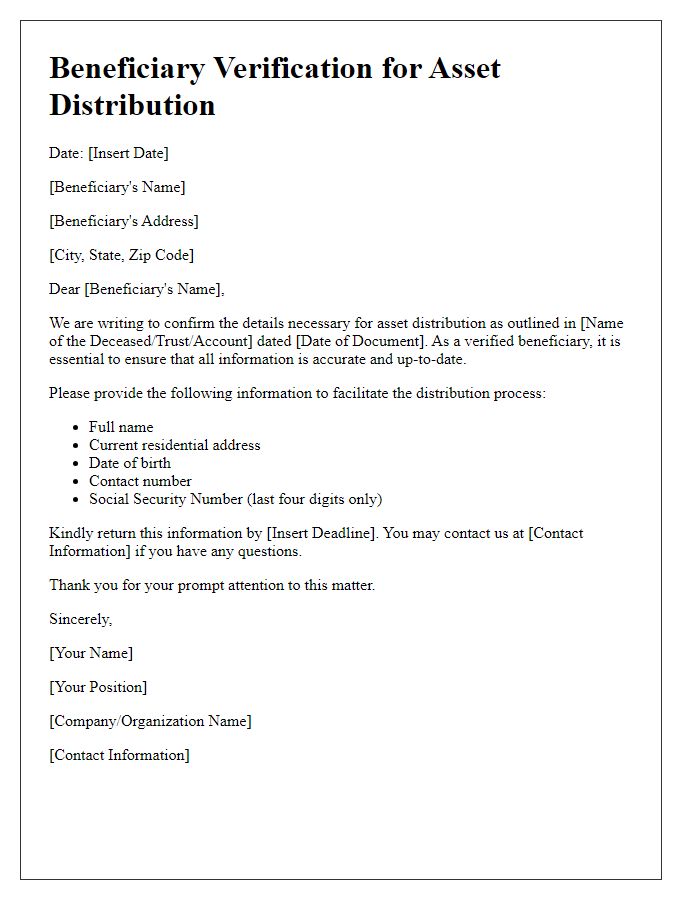

Beneficiary legal documentation requires clarity and precision to ensure all relevant details are correctly outlined and understood. Important elements include the beneficiary's full name, relationship to the deceased or grantor, and a clear description of the assets being transferred, such as a real estate property located at 1234 Elm Street, Springfield. Dates detailing when the documentation is prepared and when the assets were established are crucial, often including the date of death or the signing of the will. Legal terminology should be defined, ensuring terms like "executor" or "trustee" are clearly stated, minimizing ambiguity in roles assigned. Each document must be signed in accordance with the jurisdiction's laws, which may require witness signatures or notarization, ensuring its validity in legal proceedings.

Legal Terminology

Beneficiary legal documentation encompasses critical components in estate planning, trust management, and inheritance laws. Beneficiaries, individuals designated to receive assets or benefits (such as financial accounts, properties, or insurance payouts), must understand their rights and responsibilities under the law. Legal documents, including wills (legal declarations regarding asset distribution), trusts (establishing asset control and management), and power of attorney (authorizing another person to act on behalf), play vital roles in safeguarding beneficiary interests. Moreover, understanding terms like intestate (dying without a will), probate (legal process of validating a will), and fiduciary duty (obligation to act in another party's best interest) is essential for navigating these legal frameworks effectively. Clear communication and thorough documentation are necessary to prevent disputes and ensure seamless asset transfer to designated beneficiaries.

Jurisdictional Compliance

Jurisdictional compliance refers to the adherence to specific legal requirements and regulations established by local, state, and federal authorities applicable to a jurisdiction. This encompasses timely submission of legal documents, such as beneficiary designations and trust agreements, ensuring they meet the legal standards set forth by the relevant governing body, such as the state's probate court in California or federal IRS regulations. Compliance often necessitates thorough documentation, requiring exact legal terminology and verification, along with updates about changes in beneficiary information in accordance with laws, such as the Uniform Probate Code. Non-compliance with these requirements can result in legal disputes, challenges in asset distribution, or potential penalties, emphasizing the importance of understanding the legal landscape upon which these documents are built.

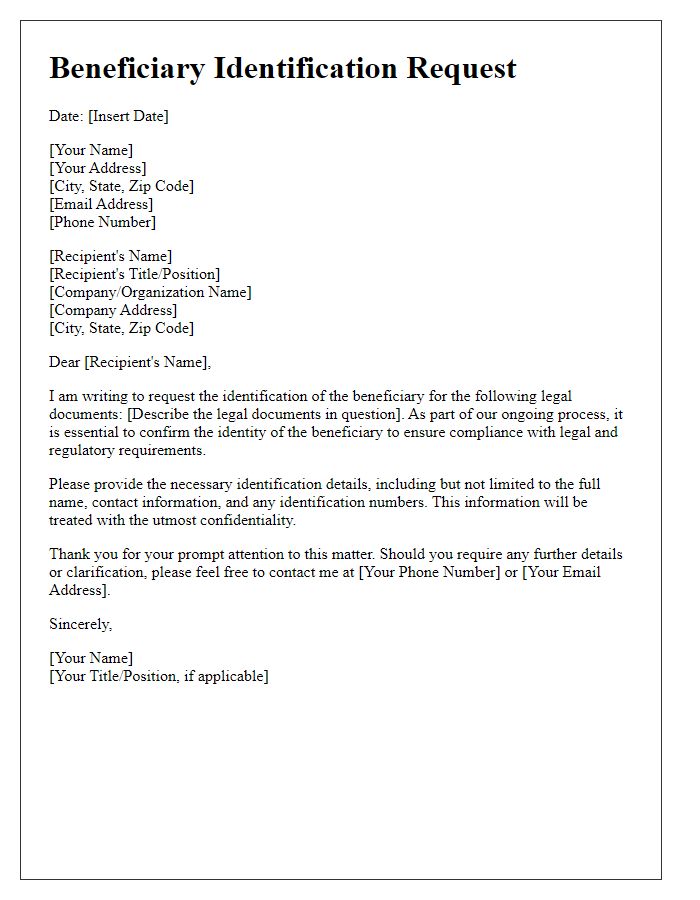

Beneficiary Identification

The Beneficiary Identification process is crucial for ensuring compliance and accurate allocation of funds. Essential documents include government-issued identification, such as a driver's license or passport, to verify the identity of the beneficiary. In addition, proof of address needs to be provided, typically in the form of utility bills or bank statements dated within the last three months. For individuals, social security numbers (SSN) or tax identification numbers (TIN) are also necessary to confirm eligibility and avoid fraudulent claims. This documentation is vital for entities such as financial institutions or insurance companies, adhering to regulatory requirements to prevent identity theft and money laundering. All information must be submitted securely and kept confidential, in accordance with privacy laws outlined in regulations like the General Data Protection Regulation (GDPR) or the Health Insurance Portability and Accountability Act (HIPAA).

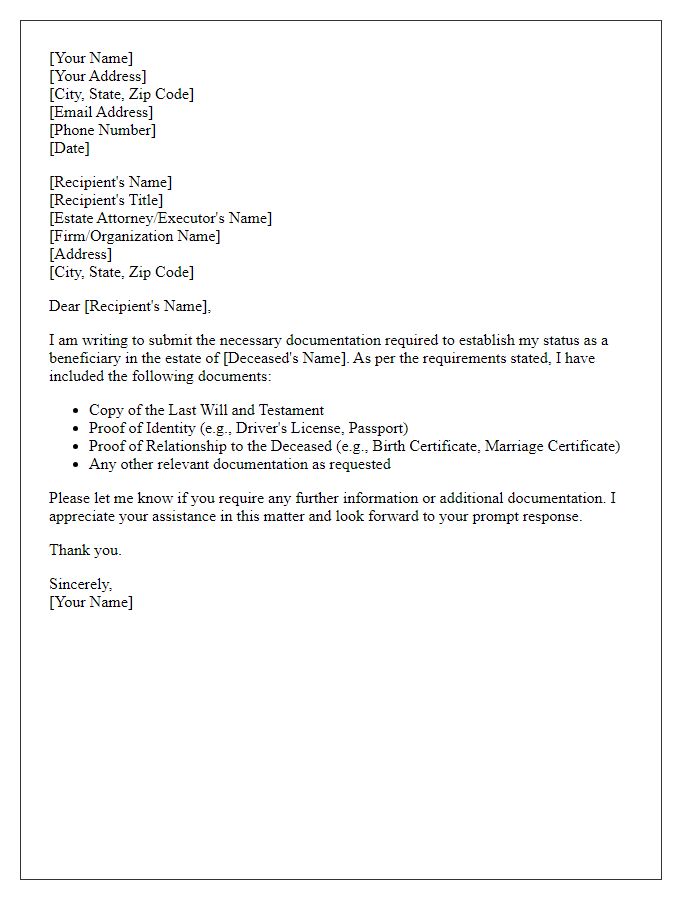

Document Authentication

Legal documentation provision for beneficiaries requires meticulous document authentication to ensure compliance with regulatory standards. Essential documents include identity verification materials such as government-issued photo identification (e.g., passport, driver's license) and residence proof (utility bills, bank statements dated within the last three months). The authentication process must involve a recognized authority, like a Notary Public, who verifies the legitimacy of the documents. Additionally, any supporting documentation related to the beneficiary's claims, such as wills or trust agreements, must be reviewed for proper execution and adherence to local laws. In jurisdictions with specific requirements, it is crucial to follow guidelines set by agencies like the Internal Revenue Service (IRS) or state probate courts to avoid legal complications.

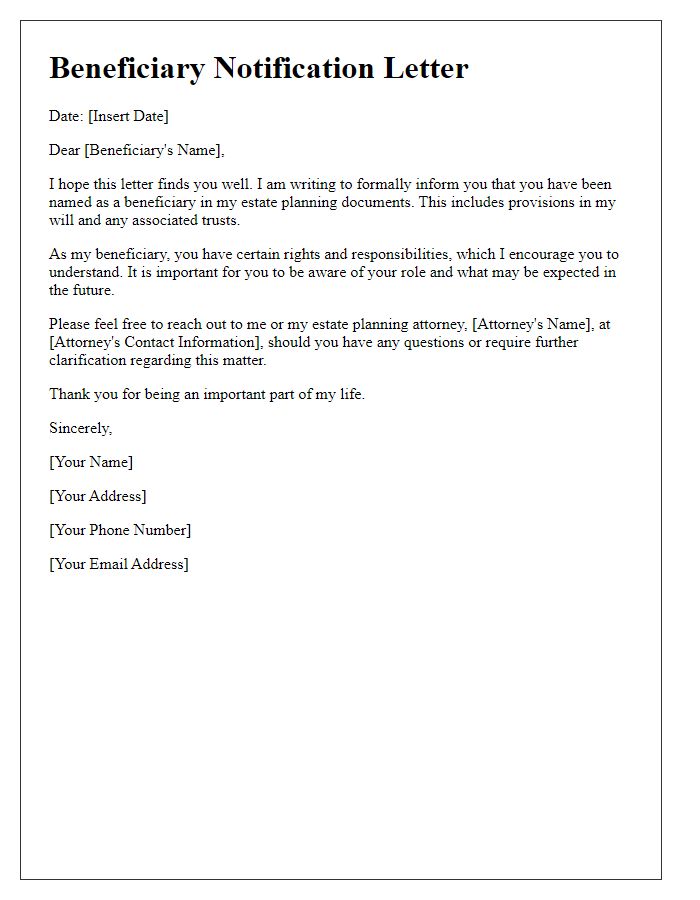

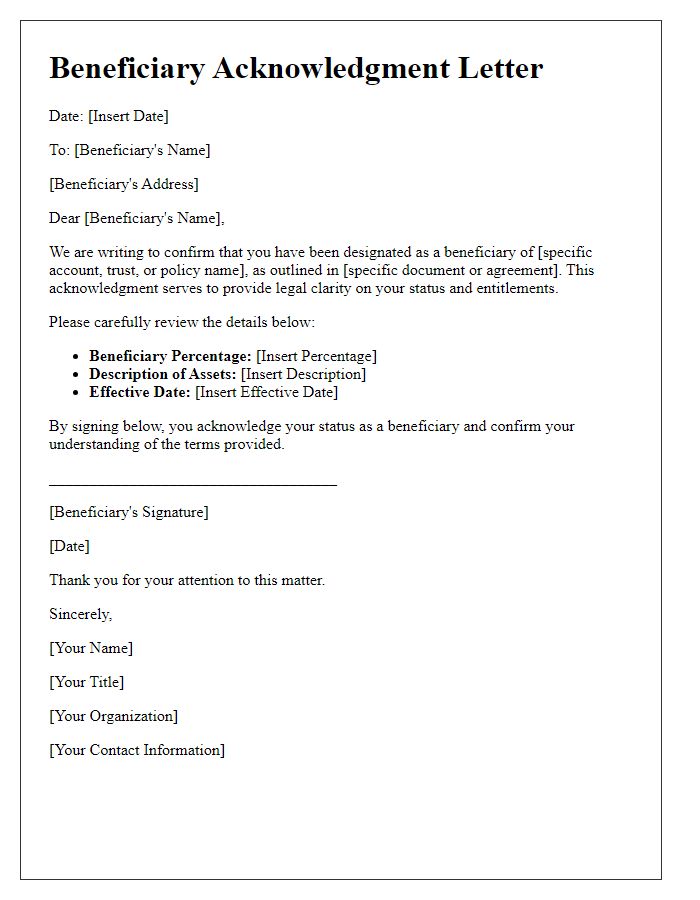

Letter Template For Beneficiary Legal Documentation Provision Samples

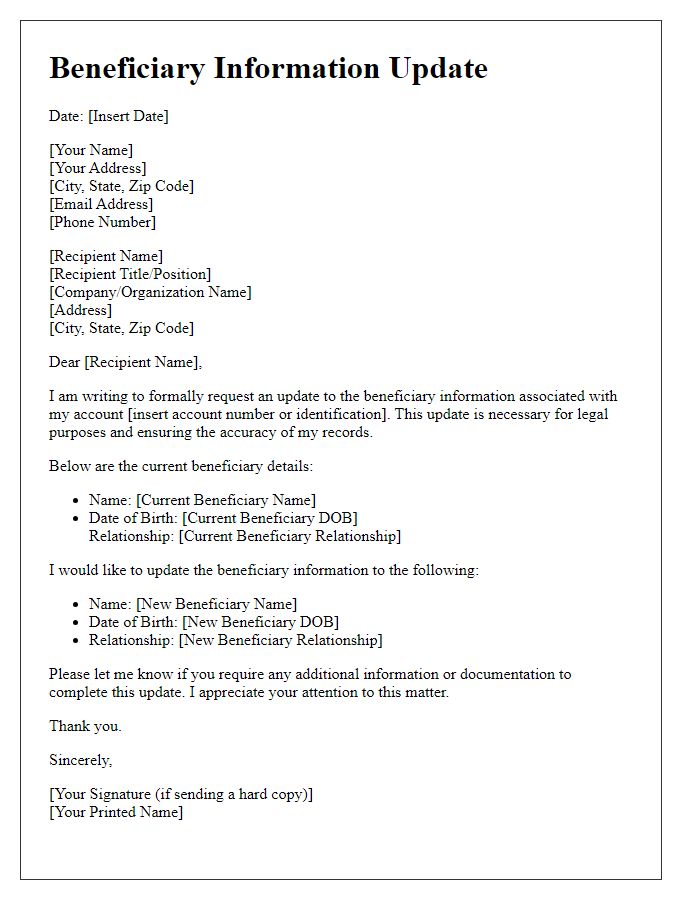

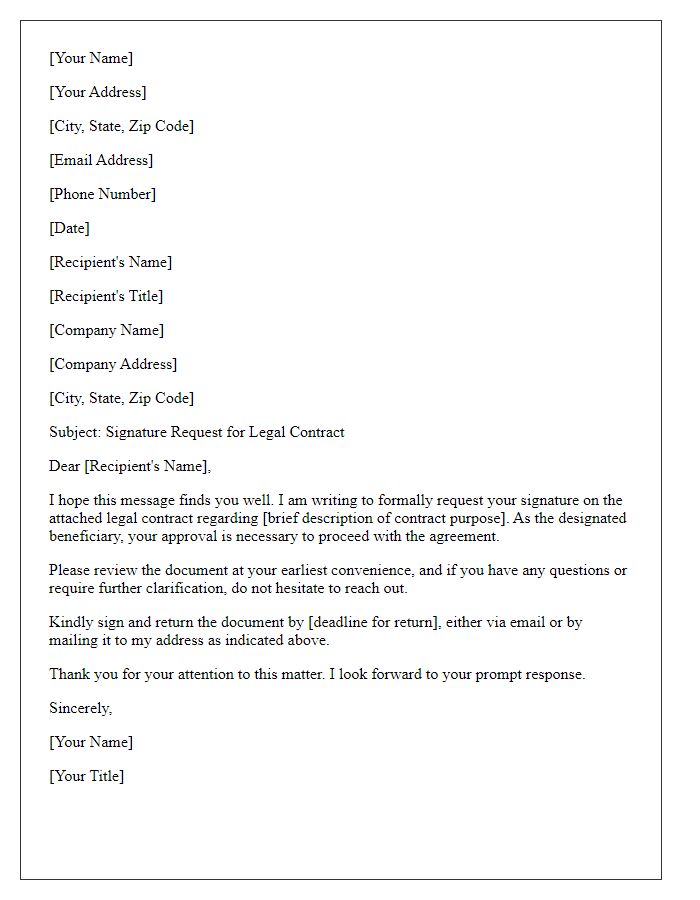

Letter template of beneficiary identification request for legal documents.

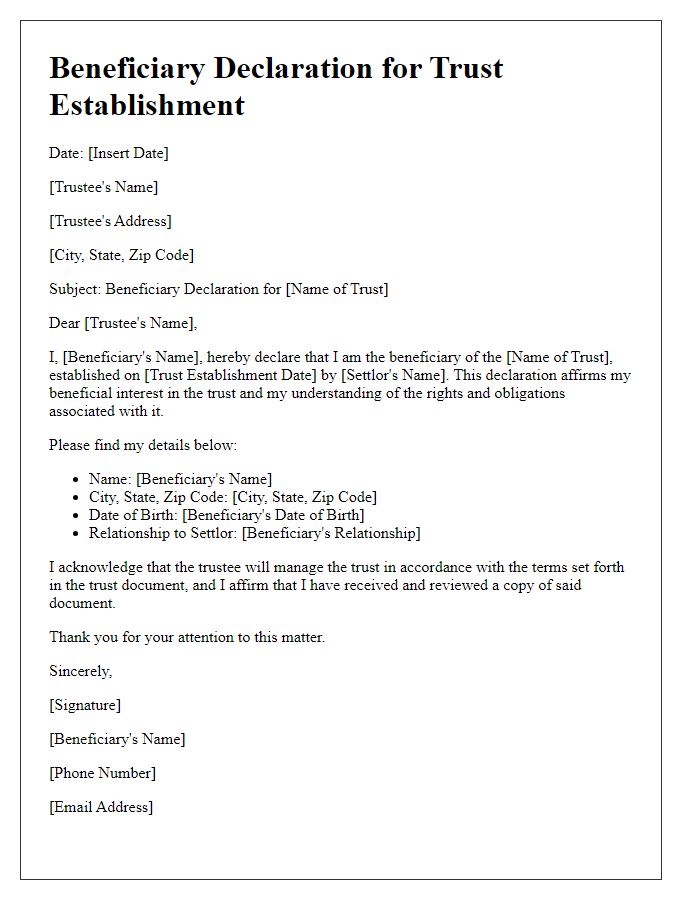

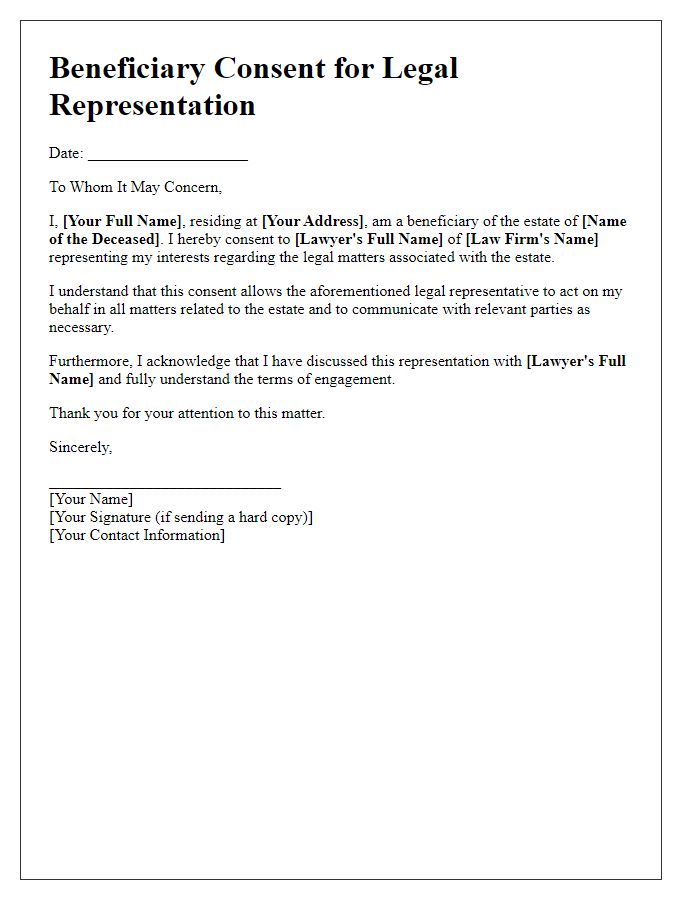

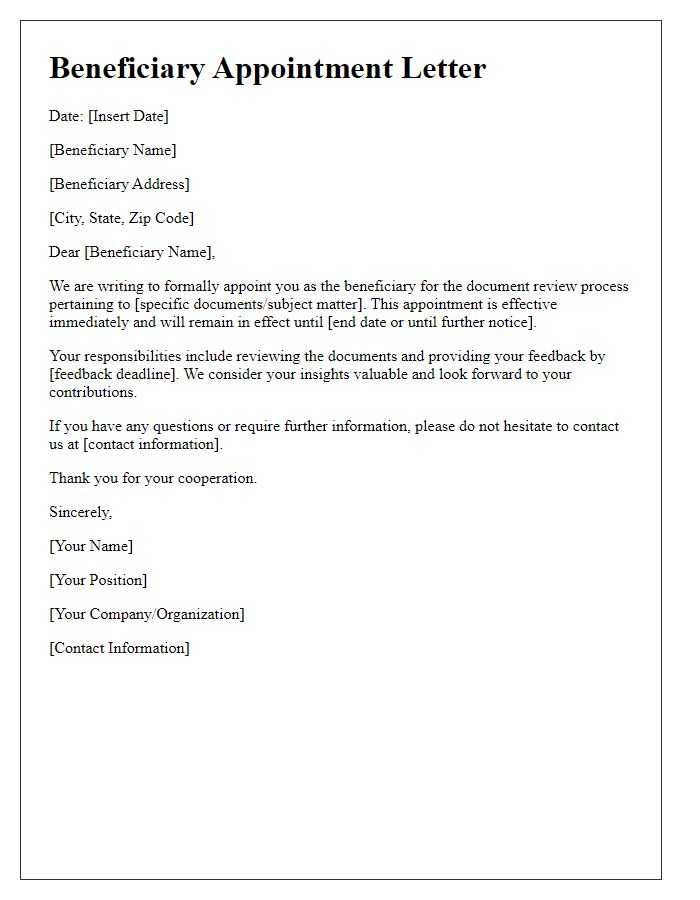

Letter template of beneficiary documentation submission for estate matters.

Comments