Are you ready to take control of your financial future? Understanding your beneficiary retirement account can seem overwhelming, but it doesn't have to be. In this article, we'll break down everything you need to know about statement letters for retirement accounts, including what to expect and how to interpret the details. So, grab a cup of coffee and let's dive deeper into this essential financial topic!

Account Information Keywords

Beneficiary retirement account statements provide essential details regarding account balances and distributions for individuals designated to receive assets upon the account holder's passing. Key information includes the account balance, which represents the total value of funds accumulated (often influenced by contributions and market fluctuations). The statement also outlines the type of account (e.g., Traditional IRA, Roth IRA), along with any upcoming required minimum distributions (RMDs) for account owners aged 72 and older, a significant aspect of tax planning. Contact information for the financial institution providing the account, such as Vanguard or Fidelity, ensures beneficiaries can access support for managing these assets. Transaction history sections detail contributions, withdrawals, and fees incurred, providing clarity on the account's performance over time. Finally, the statement specifies any tax implications associated with the distributions, crucial for informed financial decision-making.

Beneficiary Name and Details

The retirement account statement provides essential information regarding the financial assets designated to the named beneficiary, typically a family member or trusted individual. Details include the beneficiary's full name, social security number, postal address, and contact information. The account's current balance shows the total amount available at the date of the statement, which might be subject to change due to market fluctuations. Additionally, the statement outlines recent transactions, including contributions, withdrawals, and any distributions made, providing insight into the account's activity over a specified period. Important notes about tax implications related to the inherited funds are also included, ensuring the beneficiary understands their obligations.

Retirement Account Performance Metrics

Retirement account performance metrics reveal valuable insights into the growth and health of individual savings plans, such as 401(k) or IRA accounts, which are popular among U.S. workers. For the fiscal year ending in December 2023, the average annual return for diversified portfolios stood at approximately 8%, influenced heavily by market variations in the S&P 500 index, which saw a rebound of 15% after a challenging previous year. Contributions, typically ranging from 3% to 15% of the participant's salary based on employer program guidelines, significantly affect the total balance. The compound interest aspect, which can accumulate an additional growth layer over time, underscores the importance of early investments. Detailed breakdowns of asset allocation across stocks (about 60% to 70%), bonds (20% to 30%), and cash equivalents (10% or less) illuminate strategic choices affecting overall performance. Regular reviews of these metrics empower account holders to adjust contributions, thereby optimizing retirement readiness.

Tax Implications and Regulations

Clear communication regarding tax implications and regulations associated with beneficiary retirement account statements is crucial for financial planning. Beneficiaries, such as spouses or children, need to understand the tax treatment of inherited accounts, particularly in light of the SECURE Act that came into effect in 2020. This federal law mandates that non-spousal beneficiaries must fully withdraw the account balance within ten years, potentially increasing their taxable income. Specific retirement accounts like Individual Retirement Accounts (IRAs) and 401(k)s have distinct tax rules; for instance, distributions from traditional IRAs are taxable as ordinary income, while Roth IRAs may provide tax-free withdrawals under certain conditions. State tax regulations may also vary, impacting overall tax liability. Staying informed about these factors enables beneficiaries to make sound financial decisions regarding withdrawals and investment strategies, ultimately optimizing their retirement funds and tax situation.

Instructions for Accessing Account Details

Beneficiary retirement account statements provide essential information regarding the status and performance of retirement funds, typically associated with Individual Retirement Accounts (IRAs) or 401(k) plans. To access account details, beneficiaries must visit the financial institution's official website, such as Fidelity or Vanguard, where they can securely log in using their assigned access credentials. Once logged in, beneficiaries can navigate to the "Account Summary" section, where they will find current balances, transaction histories, and investment performance reports. Additionally, important documents such as beneficiary forms and tax-related statements may also be available for download in PDF format. For assistance, contact customer service through the institution's dedicated helpline, where representatives can provide guidance on account management and address any queries regarding the retirement account.

Letter Template For Beneficiary Retirement Account Statement Samples

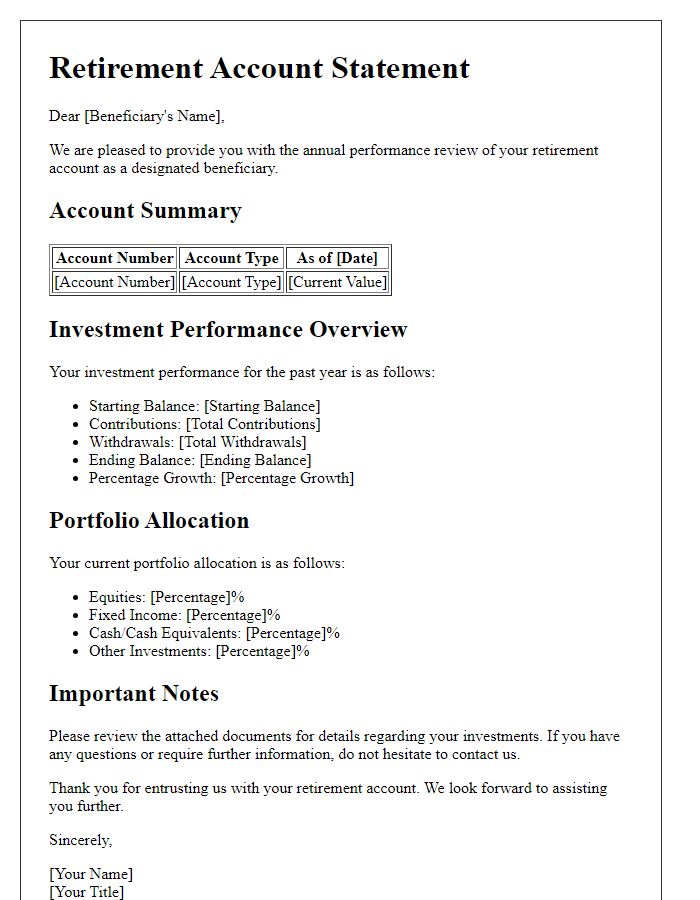

Letter template of beneficiary retirement account statement for account review.

Letter template of beneficiary retirement account statement for tax preparation.

Letter template of beneficiary retirement account statement for financial planning.

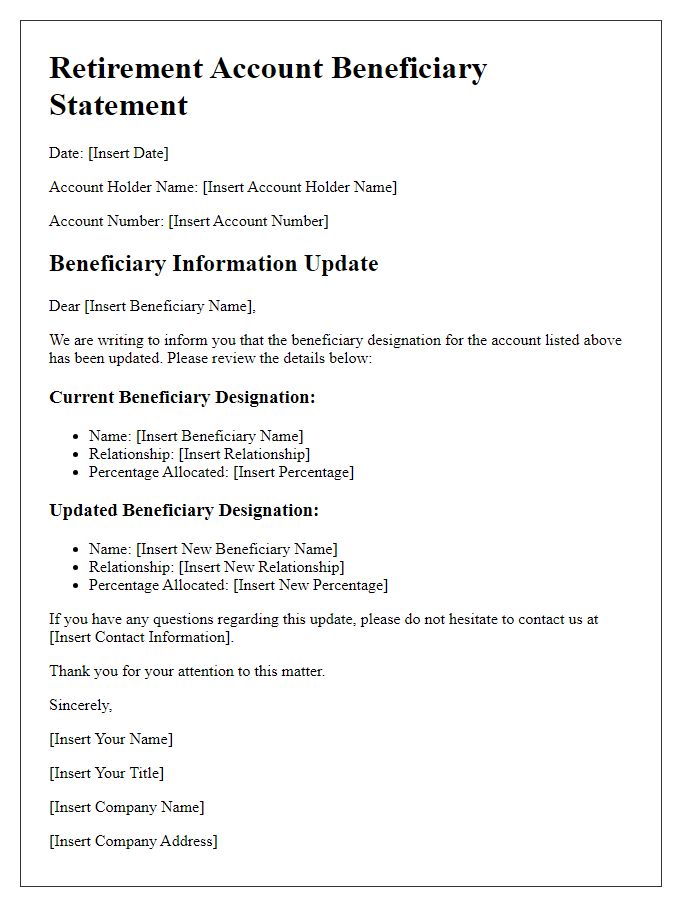

Letter template of beneficiary retirement account statement for inheritance clarification.

Letter template of beneficiary retirement account statement for estate settlement.

Letter template of beneficiary retirement account statement for withdrawal request.

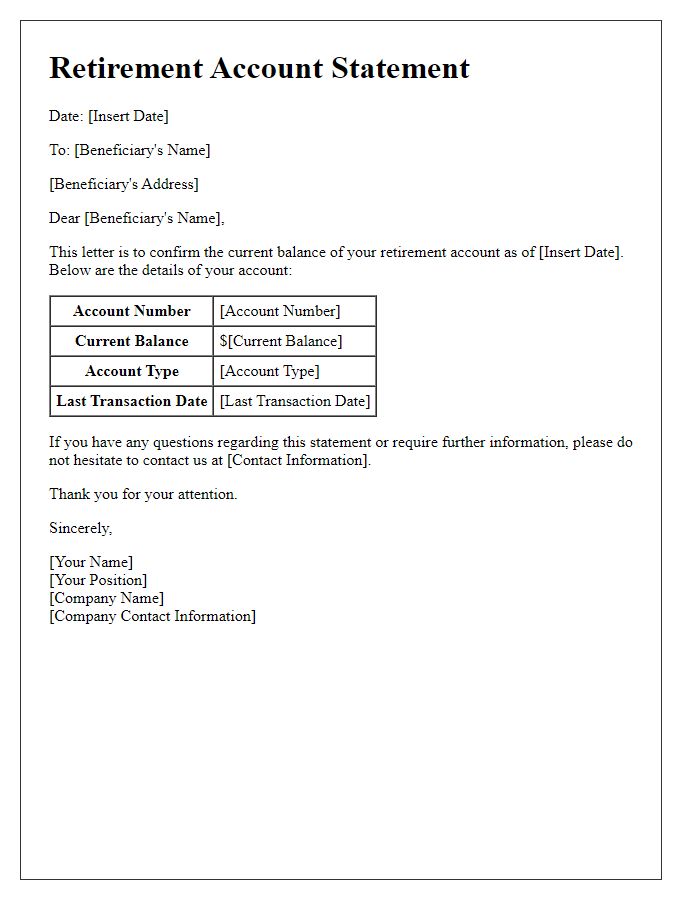

Letter template of beneficiary retirement account statement for balance inquiry.

Letter template of beneficiary retirement account statement for investment performance review.

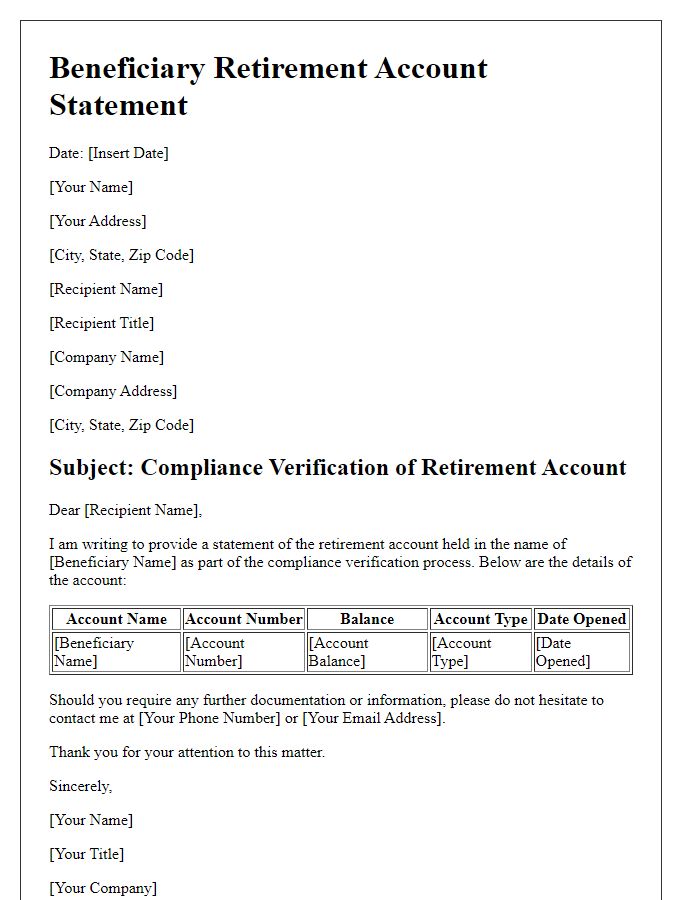

Letter template of beneficiary retirement account statement for compliance verification.

Comments