Navigating the complexities of beneficiary disputes can be a daunting experience, but having a clear and organized approach can make all the difference. Whether you're dealing with differences among family members or misunderstandings regarding the distribution of assets, it's crucial to communicate effectively and professionally. This letter template for a beneficiary dispute resolution notice offers a straightforward guide to help you articulate your concerns and seek a resolution that works for everyone involved. So if you're ready to tackle these sensitive matters head-on, read on to explore the essential elements of this important communication tool!

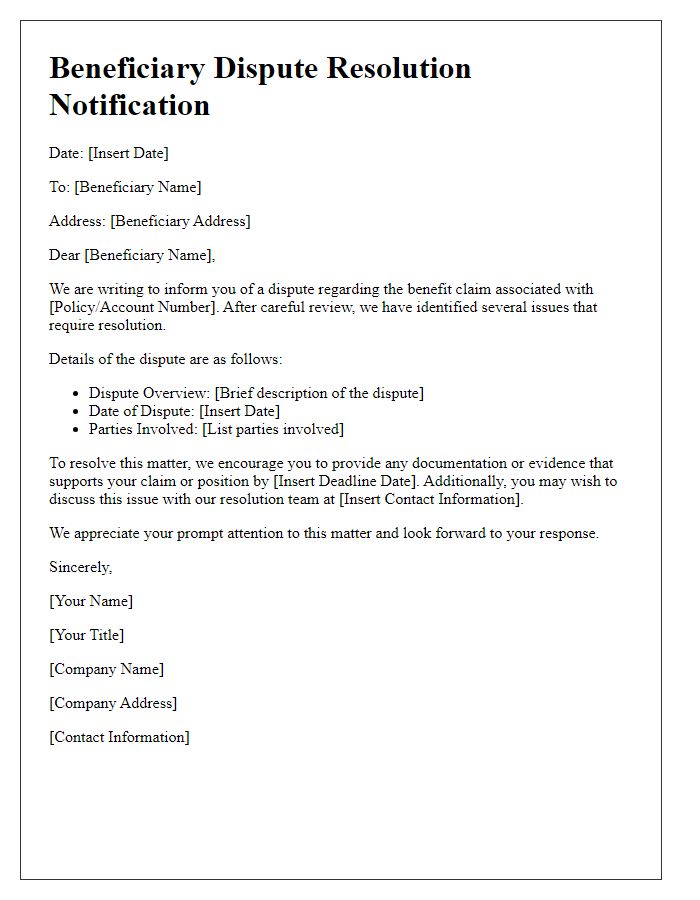

Clear subject line and heading

Dispute Resolution Notice for Beneficiary Claims This notice serves to inform the relevant parties regarding a discrepancy related to beneficiary claims associated with the designated trust fund established on January 15, 2020. The trust, located in Springfield, Illinois, administers assets exceeding $2 million, including real estate and investments. Beneficiaries named in the trust agreement, executed by the deceased on December 1, 2019, have raised questions about the distribution percentages delineated in the legal documents. All interested parties are encouraged to review the specific provisions outlined in Section 3 of the trust document and provide their feedback, ensuring clarity and equity in processing claims. An official meeting has been scheduled for March 30, 2024, to deliberate on the presented concerns and seek mutual agreement on the resolution approach.

Identification of parties involved

The beneficiary dispute resolution notice outlines the identification of parties involved in a dispute regarding a trust or estate. This document typically includes the names of primary parties such as the trustee or executor (the individual responsible for managing the trust or estate), the beneficiaries (those entitled to receive assets or benefits), and any legal representatives or attorneys involved in the case. It may specify the relationship of each beneficiary to the deceased or to the trust creator, providing context to their claims. For instance, family connections or legal beneficiaries under state probate laws, as well as contact details for communication purposes, are crucial for clarity. Additionally, details on how the dispute arose--such as disagreements over asset distribution or interpretations of the will or trust--can also be included for comprehensive understanding.

Detailed explanation of dispute

Beneficiary disputes often arise during the administration of trusts or estates, particularly regarding asset allocation and entitlement claims. Disputes typically emerge after the passing of a trustor or decedent, leading to confusion among beneficiaries regarding their rights. For instance, disagreements may arise over the interpretation of ambiguous language within a trust document, potentially affecting the distribution of valuable assets such as real estate or investments, including stocks and bonds. Key factors in these disputes include the specific provisions set forth in legal documents and variations in state laws, which can complicate resolution processes. Mediation or court proceedings are common pathways for resolution, where beneficiaries and fiduciaries present evidence to clarify intent and uphold legal obligations. Notably, trust and estate disputes can also involve third-party claims, such as creditors, adding complexity to the resolution process.

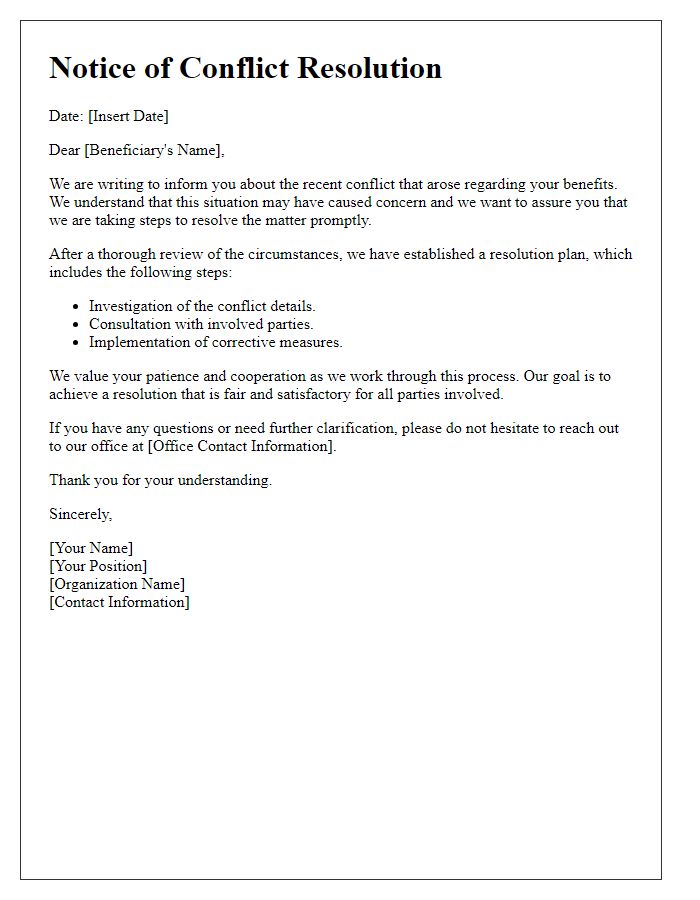

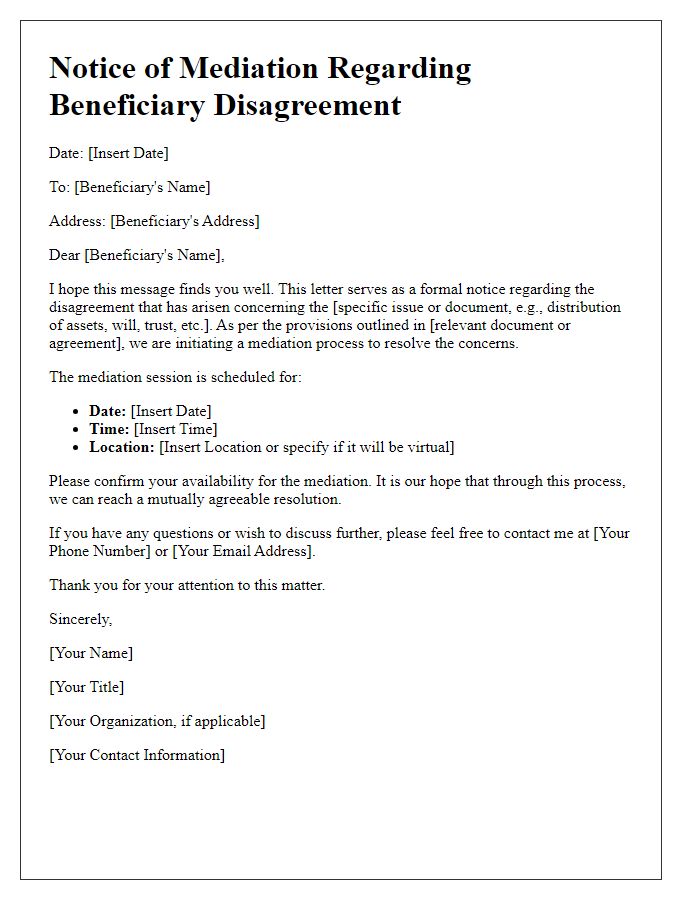

Proposed resolution steps

Beneficiary dispute resolution involves careful considerations and structured steps to address conflicts regarding the distribution of assets or benefits. Proposed resolution steps include initiating communication with all involved parties to clarify expectations and concerns. Schedule a meeting at a neutral location, such as a mediation center, to encourage open dialogue. Gather relevant documentation, including wills, trust agreements, and correspondence, to ensure all perspectives are understood. Assign a neutral mediator, preferably with experience in estate matters, to facilitate discussions and propose solutions. Establish a timeline for resolution, aiming for a final agreement within 30 days to ensure timely closure. Consider drafting a formal agreement detailing the terms reached, signed by all parties to avoid future disputes.

Contact information for follow-up queries

In the realm of beneficiary dispute resolution, providing clear and accessible contact information is essential for seamless communication. For instance, a dedicated hotline (1-800-123-4567) could assist beneficiaries seeking to resolve issues related to estate claims, inheritance disputes, or other financial concerns. Furthermore, an office location (123 Resolution Plaza, Suite 200, Cityville, State, ZIP) enables in-person consultations, allowing beneficiaries to engage directly with specialists trained in dispute mediation. An email address (disputesupport@resolutionservice.com) ensures that questions can be efficiently addressed, with a response time typically under 48 hours. These avenues foster transparency, ensuring that all parties involved can navigate the dispute process with clarity and confidence.

Comments