Are you feeling overwhelmed by the intricacies of inheritance tax as a beneficiary? You're not alone! Navigating the complexities of tax obligations related to inheritances can be quite challenging, and understanding your responsibilities is crucial. If you're eager to learn how to tackle your inheritance tax inquiries effectively, stick around for more insights in the article ahead!

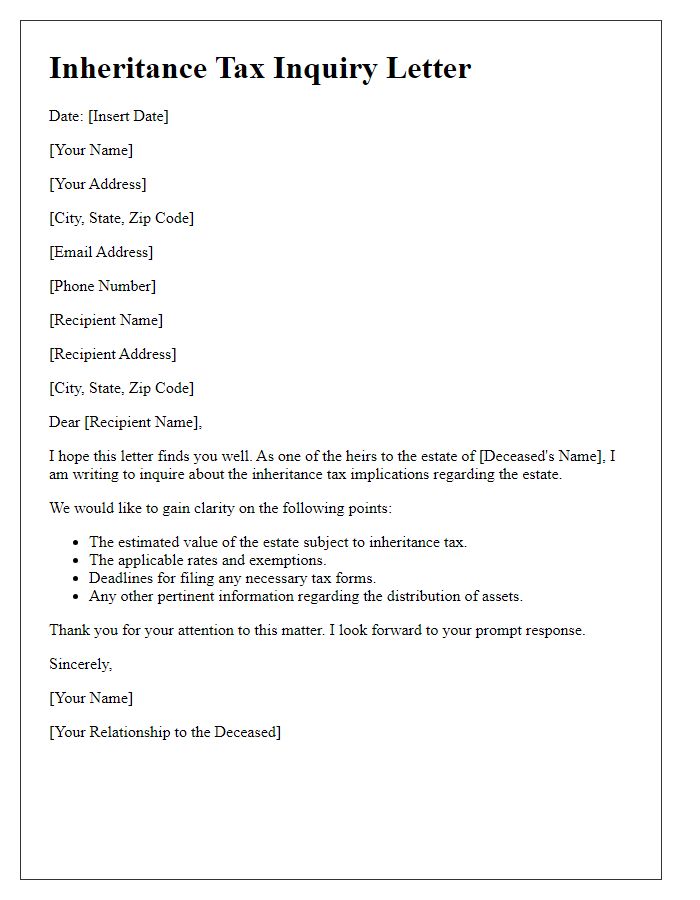

Precise Beneficiary Identification

The precise identification of beneficiaries is crucial in the context of inheritance tax inquiries within estate management. Each beneficiary, ranging from children of the deceased to extended family members, must be clearly documented with full names, birth dates, and relationship to the deceased to comply with regulations. This meticulous record-keeping ensures transparency and accuracy in assessing potential tax liabilities, which may involve varying percentages depending on jurisdiction, such as up to 40% in some cases. Additionally, the legal framework surrounding inheritance tax varies significantly between countries, making it essential to consult local laws, such as the U.S. Internal Revenue Code or the UK Inheritance Tax Act of 1984, for specific guidelines on exemption thresholds and allowable deductions. Accurate identification ultimately facilitates the smooth processing of tax obligations and the equitable distribution of the estate.

Detailed Estate Composition

Beneficiary inheritance tax inquiries often revolve around the detailed composition of an estate, comprising various asset classes. These assets may include real property, such as residential properties located in urban areas (e.g., a four-bedroom house in New York City valued at $1.2 million), investment portfolios containing stocks and bonds (e.g., a diversified portfolio worth $500,000 with holdings in technology and healthcare sectors), personal property including vehicles (e.g., a classic 1967 Ford Mustang valued at $30,000), and liquid cash reserves maintained in bank accounts (e.g., $100,000 in a high-yield savings account). Furthermore, liabilities such as outstanding mortgages (e.g., a $300,000 mortgage on the primary residence) and personal loans must also be calculated. The executor should meticulously catalog each asset and liability with corresponding values as of the date of death, necessary for accurate tax assessments and to determine the taxable estate's net value, ultimately impacting the inheritance tax obligations for beneficiaries.

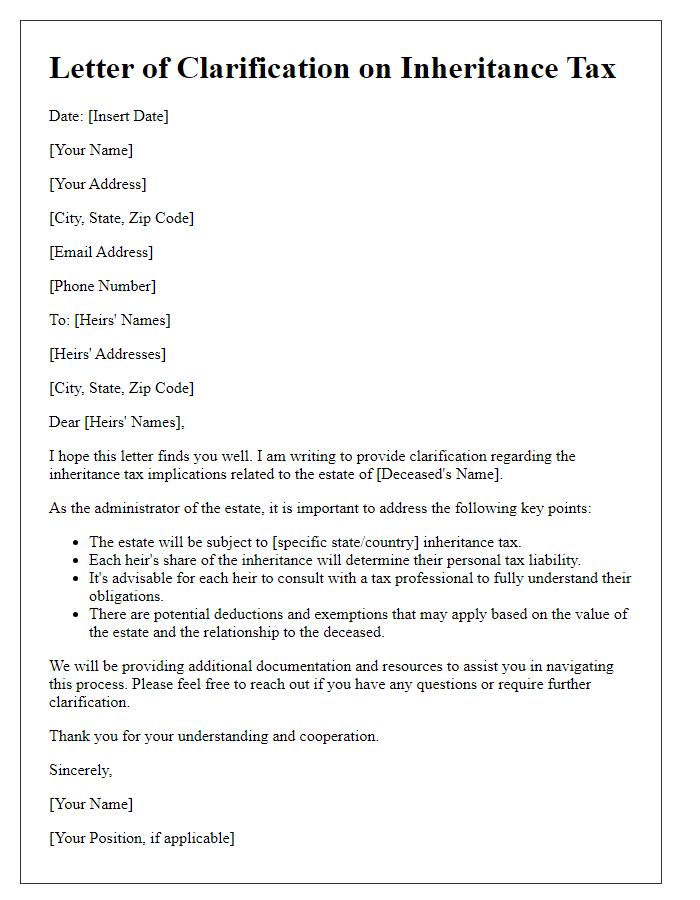

Relevant Tax Regulations

Beneficiary inheritance tax regulations vary significantly across jurisdictions. In the United States, for instance, the federal government imposes an estate tax with a threshold of $12.92 million for individuals (2023 figure) while states such as California and Texas have no inheritance tax. The United Kingdom applies a flat rate of 40% on estates valued above PS325,000. In Australia, no inheritance tax exists, but certain assets may incur capital gains tax upon sale. Understanding these local tax laws is essential for beneficiaries to accurately report inheritance and fulfill tax obligations. Consulting with tax professionals can provide clarity on applicable rates, exemptions, and filing requirements specific to the estate involved.

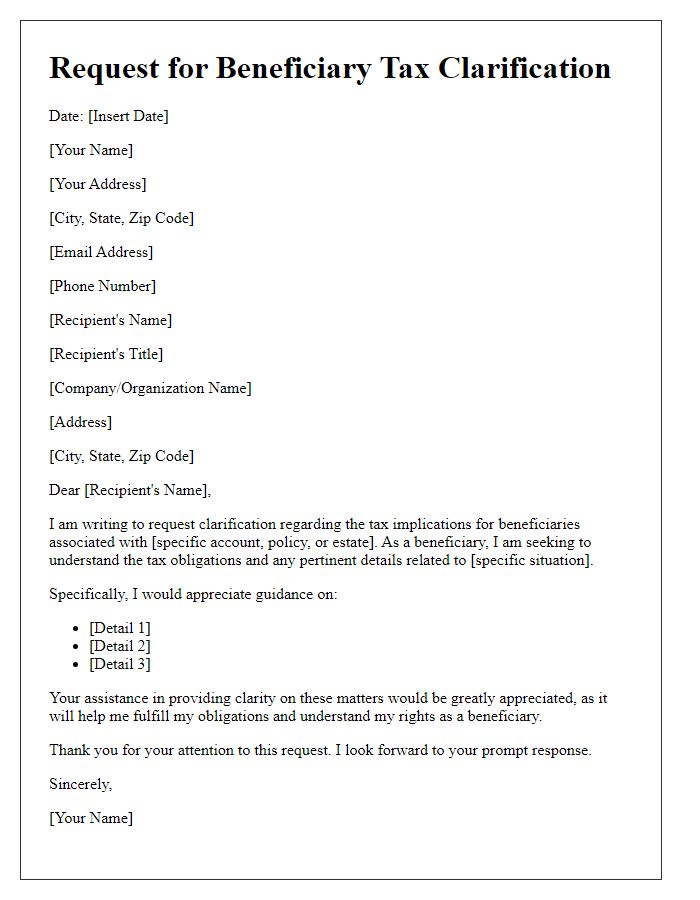

Required Documentation and Evidence

Beneficiary inheritance tax inquiries involve complex documentation requirements that may include various key documents. An official death certificate serves as the foundational proof of the decedent's death. A will, particularly if contested or probated, provides insight into the decedent's intentions regarding asset distribution. Financial statements from institutions, such as bank accounts or investment portfolios, establish the value of the estate at the time of death, crucial for tax calculation. Property deeds, especially for real estate assets, detail ownership and value, further impacting tax assessments. Additionally, any previous tax returns or estate tax filings may be necessary for historical context, showing how assets were previously reported and valued. In some cases, legal identification of all beneficiaries is essential for processing, ensuring that tax obligations are appropriately directed.

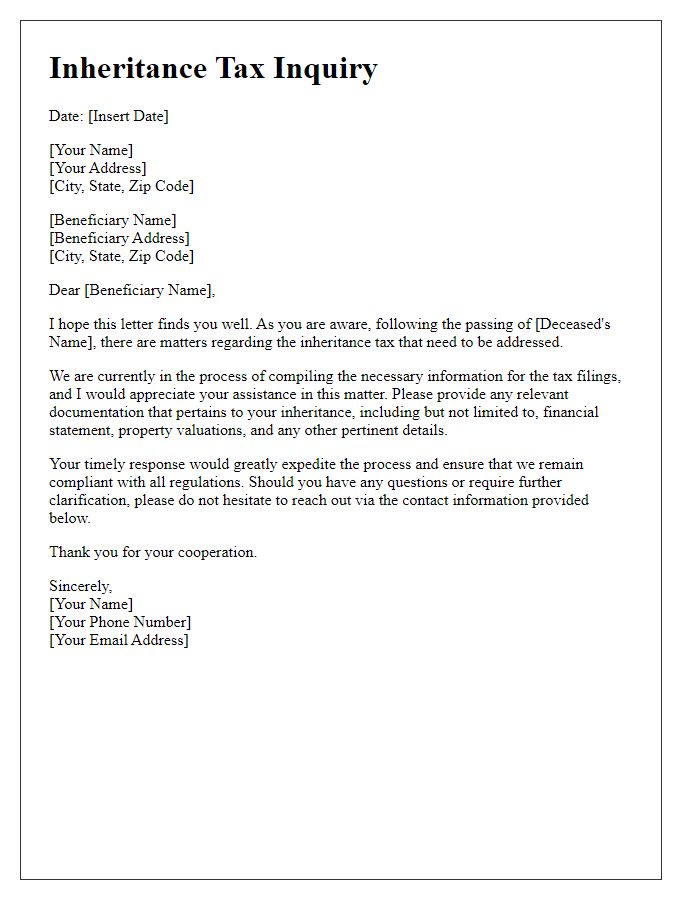

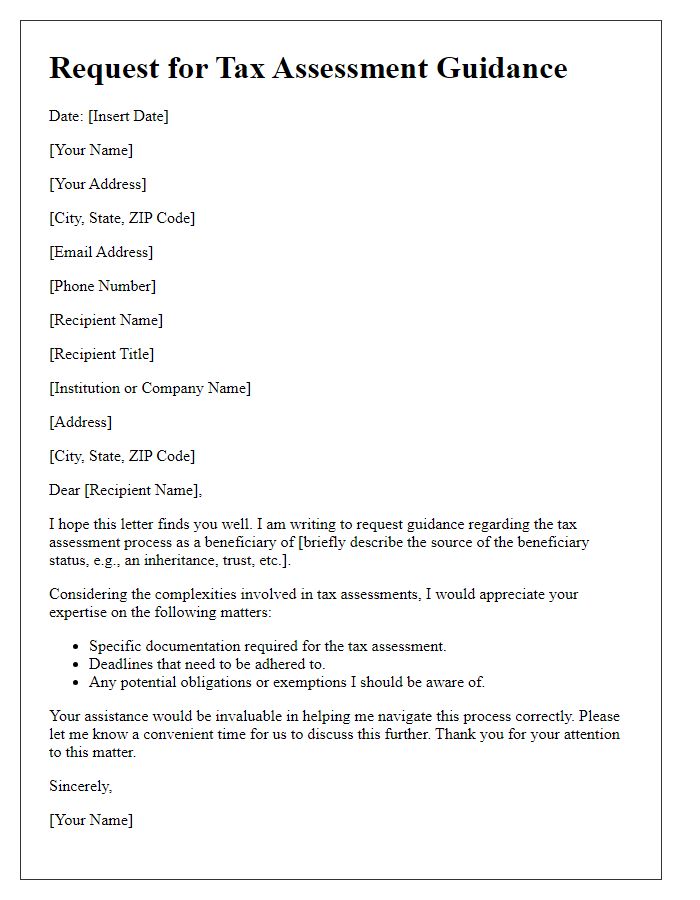

Clear Inquiry Questions and Purpose

An inheritance tax inquiry aims to clarify the obligations and processes for beneficiaries regarding taxes owed on inherited assets. Key questions might include: What is the current inheritance tax rate applicable in [specific jurisdiction, e.g., California, USA]? What exemptions or deductions are available for inherited properties, such as primary residences or family businesses? Are there timelines for filing tax returns related to inherited assets? What documentation is required to prove the value of the estate, such as appraisals or financial statements? Understanding these elements is crucial for beneficiaries to ensure compliance with tax laws while maximizing potential benefits from the inheritance.

Comments