Are you looking to enhance your investment strategy and secure your financial future? Diversifying your investment portfolio can be a game-changer, helping you mitigate risks while maximizing returns. By spreading your investments across various asset classes, you can achieve a more balanced approach that withstands market volatility. If you're curious about how to effectively diversify your portfolio, stick around as we delve into valuable tips and insights!

Purpose and Goals

Investment portfolio diversification aims to mitigate risk by spreading investments across various asset classes and industries. The primary purpose involves reducing the potential negative impact of any single investment's poor performance. Key investment goals include achieving a balanced return over time, safeguarding capital against market volatility, and enhancing the potential for long-term capital appreciation. By incorporating a mix of stocks, bonds, real estate, and alternative investments, investors can target strategic risk levels while aligning with individual financial objectives and timelines. A diversified portfolio can be tailored to accommodate different risk appetites, from conservative to aggressive strategies, ensuring alignment with personal or institutional financial goals.

Risk Assessment

Investment portfolio diversification is essential for mitigating risk in financial markets. By spreading investments across various asset classes such as equities, bonds, and real estate, investors can minimize exposure to volatility. Historical data shows that portfolios with at least 20 different assets reported lower fluctuations during economic downturns. For instance, the 2008 financial crisis highlighted the importance of diversification when the S&P 500 Index fell by approximately 37%. Additionally, sector-specific investments, like technology versus healthcare, can further balance risk. Investors should also consider geographic diversification, with emerging markets potentially offering higher returns despite increased risk. Consistent risk assessment, incorporating metrics like standard deviation and beta, is crucial for maintaining a balanced and resilient investment portfolio.

Asset Allocation

Diversifying an investment portfolio involves strategic asset allocation to mitigate risk and enhance potential returns. Diversification spreads investments across various asset classes, such as equities, bonds, and real estate. For instance, an ideal allocation might consist of 60% stocks (including large cap, small cap, and international equities), 30% bonds (covering government and corporate bonds), and 10% alternative investments (such as real estate investment trusts or commodities). This mix aims to balance risk and reward, especially during market volatility where certain asset classes, like equities, can fluctuate rapidly. By adjusting allocations based on personal risk tolerance, investment goals, and market conditions, investors can create a resilient portfolio capable of navigating economic downturns while capitalizing on growth opportunities.

Diversification Strategy

Investment portfolio diversification is a strategic approach aimed at reducing risk by allocating resources across a variety of financial vehicles. This method involves spreading investments among different asset classes such as equities, fixed income, real estate, and commodities to minimize exposure to any single investment. Historical data shows that balanced portfolios can withstand market volatility; for instance, during the 2008 financial crisis, diversified portfolios experienced significantly lower losses compared to those concentrated in stocks. Geographical diversification, such as investing in emerging markets in Asia, Europe, and Latin America, can also enhance portfolio resilience. Regular rebalancing, which involves adjusting the proportion of various investments to maintain an intended asset allocation, is essential to capitalize on changing market conditions. Overall, a well-structured diversification strategy can contribute to achieving long-term financial goals while managing risk effectively.

Regular Monitoring and Review

Regular monitoring and review of an investment portfolio is essential for maintaining optimal asset allocation. Diversification involves spreading investments across various asset classes, such as equities, bonds, and real estate, to mitigate risk and enhance potential returns. Financial experts recommend reviewing the portfolio at least quarterly, taking into account factors such as market performance, changing economic conditions, and individual investment goals. For instance, during significant market events like the 2008 financial crisis, investors observed substantial fluctuations in asset values, emphasizing the importance of timely adjustments. Utilizing tools like performance tracking software and consulting with a certified financial advisor can provide invaluable insights, ensuring that the portfolio aligns with the investor's risk tolerance and long-term objectives. Regular adjustments and strategic rebalancing can help capitalize on emerging opportunities while minimizing exposure to underperforming assets.

Letter Template For Investment Portfolio Diversification Samples

Letter template of comprehensive investment portfolio diversification strategy

Letter template of tailored investment portfolio diversification for risk management

Letter template of optimal investment portfolio diversification for growth potential

Letter template of strategic investment portfolio diversification for market resilience

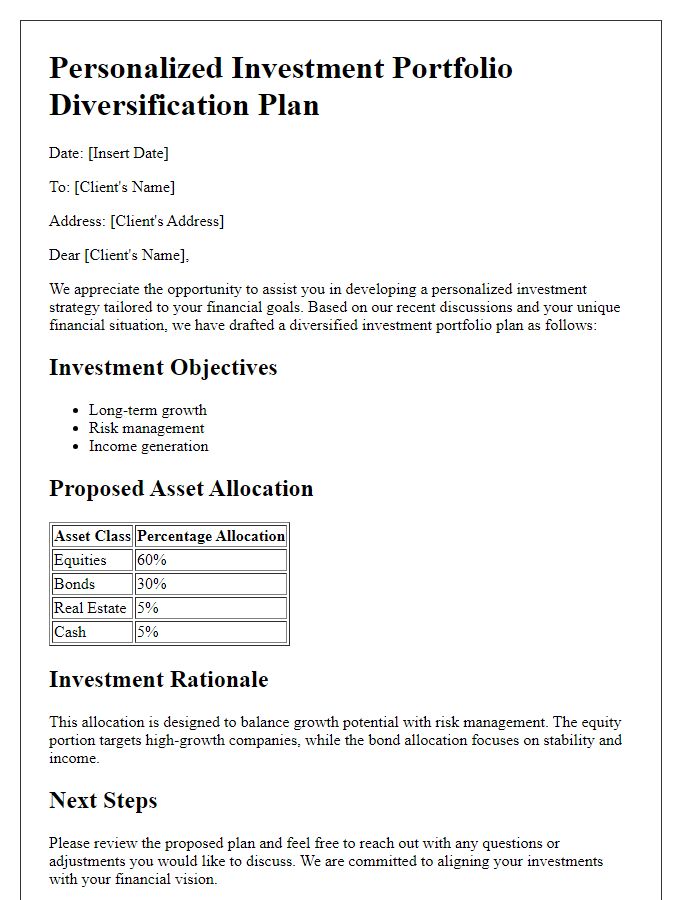

Letter template of personalized investment portfolio diversification plan

Letter template of proactive investment portfolio diversification to enhance returns

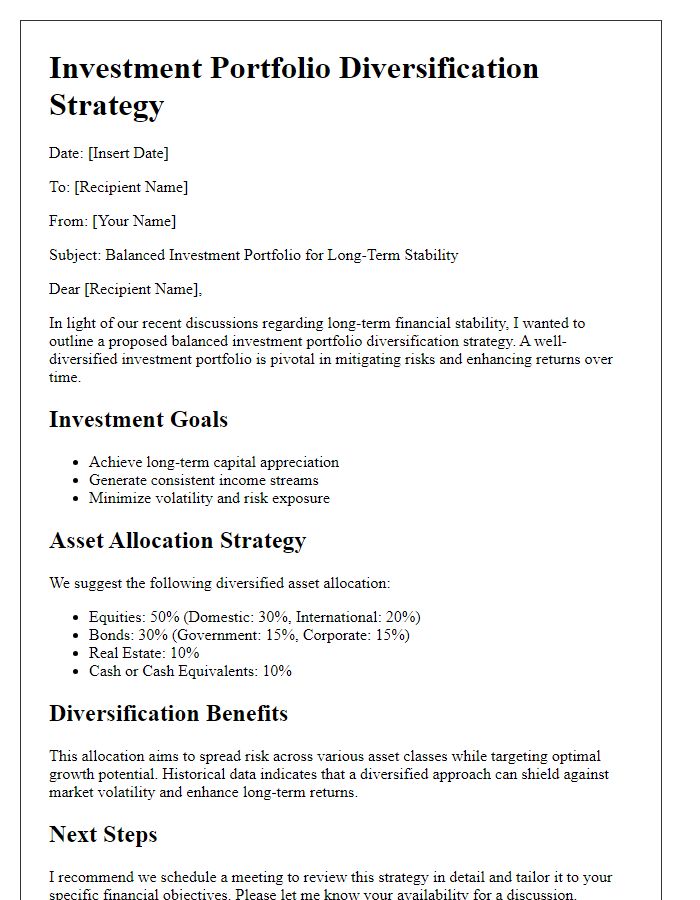

Letter template of balanced investment portfolio diversification for long-term stability

Letter template of dynamic investment portfolio diversification in response to market changes

Letter template of efficient investment portfolio diversification for asset allocation

Comments