Hey there! If you're looking to update your account insurance policy, you're in the right place. These updates are crucial to ensure you're fully protected and aware of any changes in your coverage. Stick around as we delve into the key elements of updating your policy and what you should keep in mind to make this process smooth and hassle-free!

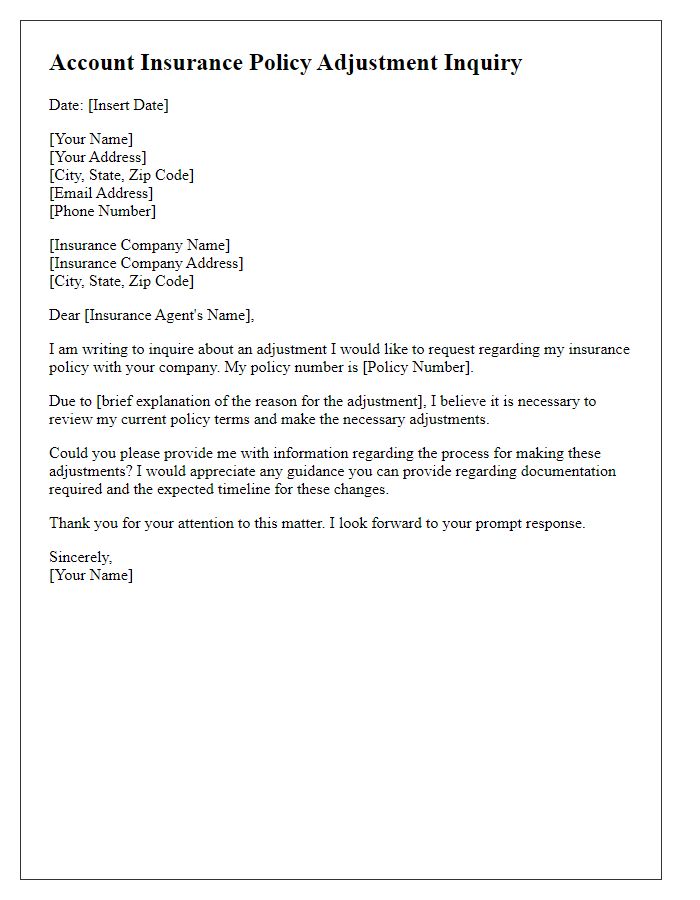

Salutation and Greeting

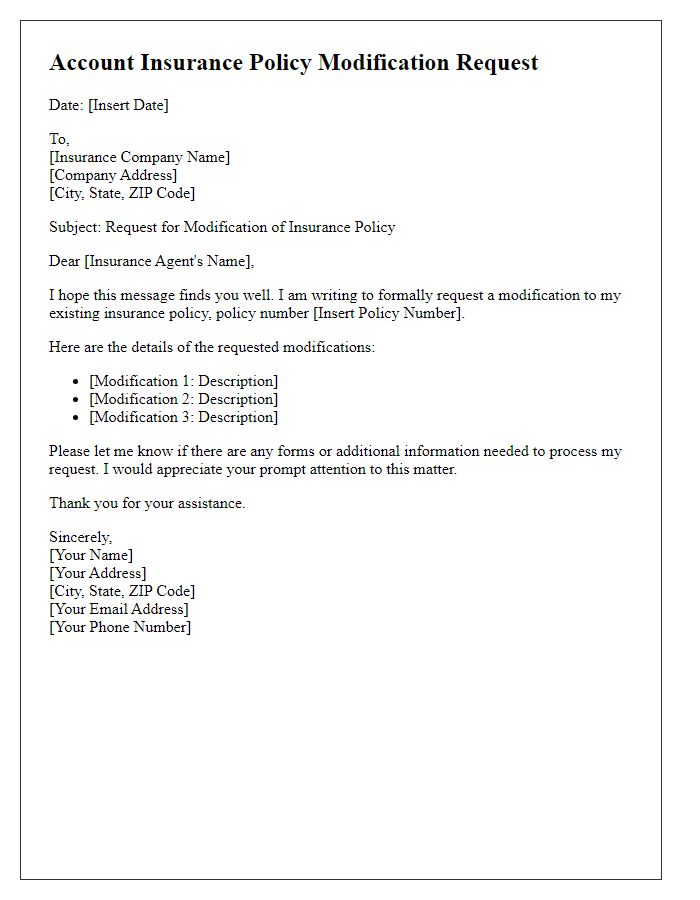

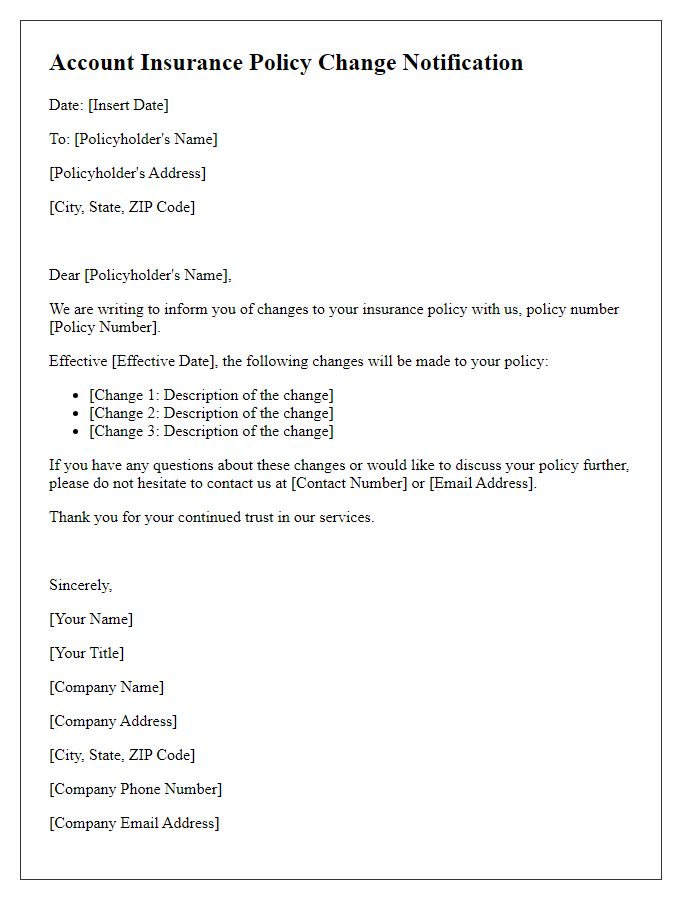

The account insurance policy update notification requires careful attention to detail and clarity. Typically, it begins with a formal salutation addressing the recipient by name, followed by a polite greeting that expresses the intention to provide important updates. This greeting emphasizes the importance of the information and encourages the recipient to review the changes attentively. Note: Using the recipient's full name or title adds a personal touch and reinforces professionalism. A general greeting phrase can create a warm atmosphere while maintaining formality. Specific references to the policy number or account details may also follow to enhance clarity.

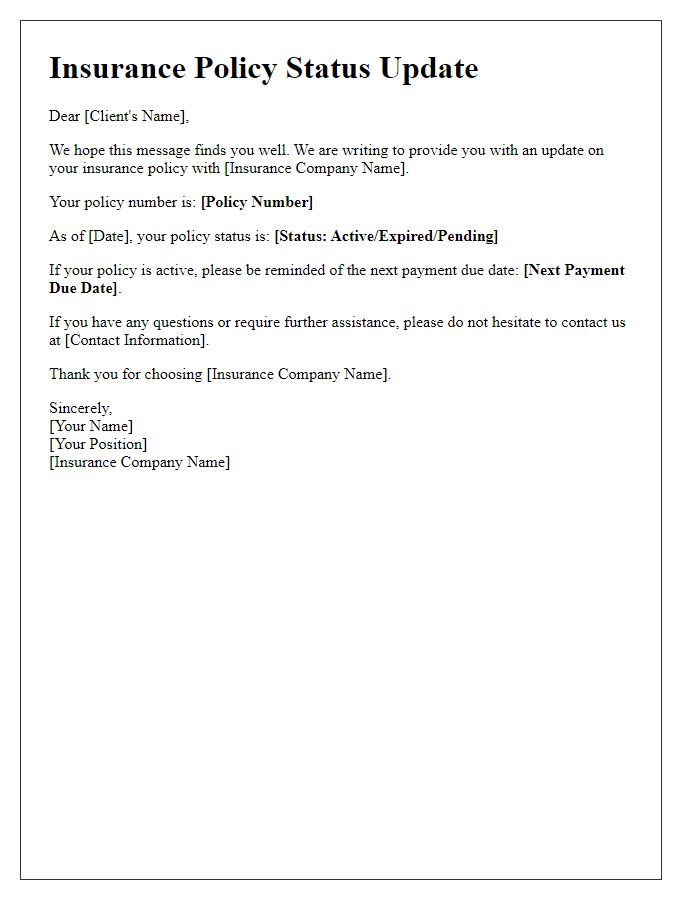

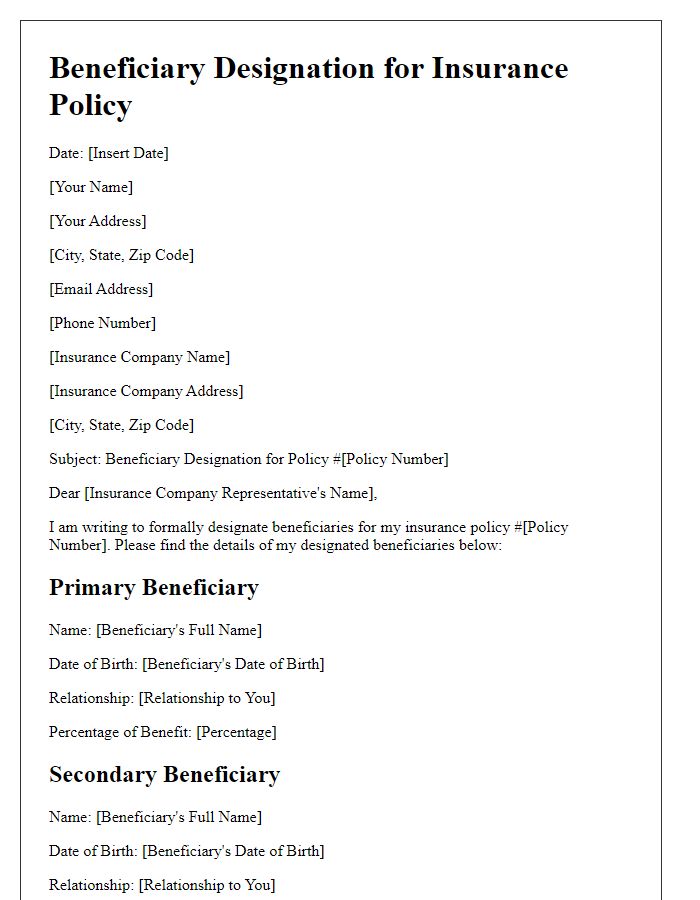

Policyholder Identification

Policyholders' identification is crucial for managing account insurance policies effectively. This includes details such as the policyholder's full name, date of birth (commonly formatted as MM/DD/YYYY), and unique identification number (often a Social Security Number for individuals in the United States). The current address, including street, city, state, and ZIP code, allows insurers to communicate updates efficiently. Contact information such as email addresses and phone numbers are also vital for immediate correspondence. These elements ensure accurate records, enabling quick access to vital policy details concerning coverage, claims, and benefits.

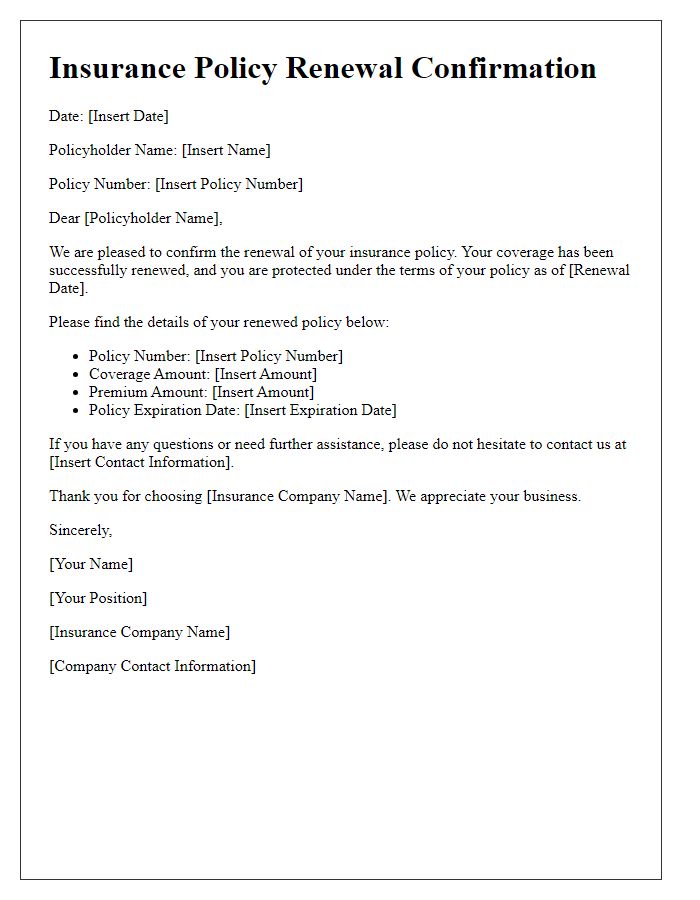

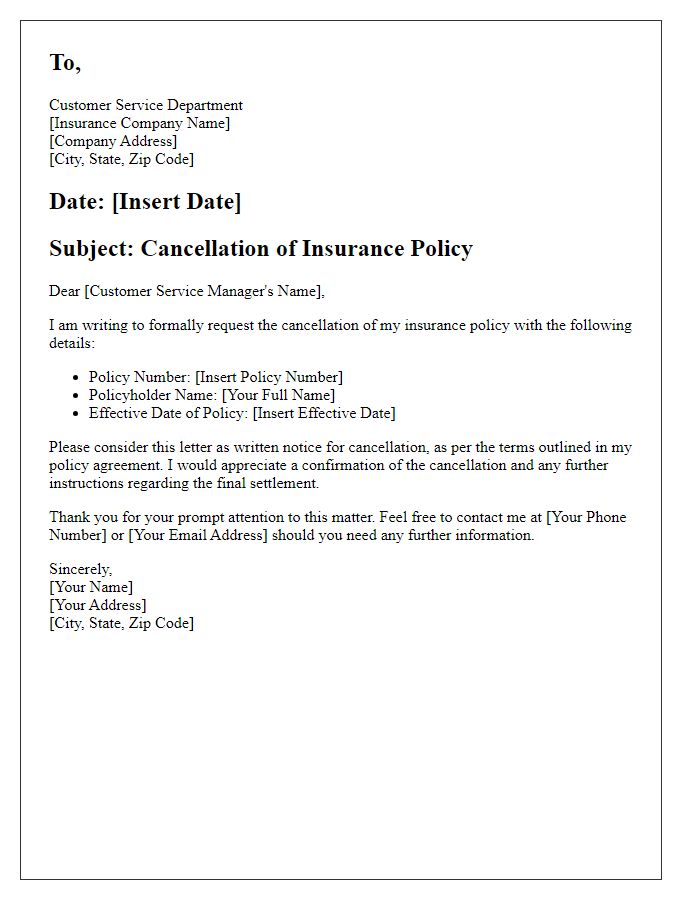

Policy Details and Changes Summary

Insurance policy updates are crucial for ensuring adequate coverage and compliance with regulations. Policy number, such as #123456789, indicates specific agreements between the insured and the provider, which may be an established company like AllState or State Farm. Coverage types may include liability, collision, or comprehensive, each with distinct terms, limits, and deductibles affecting claims. Changes might involve adjustments to premium rates, beneficiary designations, or coverage limits, especially if there are changes in personal circumstances such as home address or marital status. Annual review periods, often around the policy anniversary date, allow both parties to discuss benefits, risks, and the impact of claims history on future rates.

Effective Date and Coverage Terms

Reviewing an account insurance policy update requires attention to effective dates and coverage terms. The effective date (often pivotal in policy documents) indicates when the new coverage begins. Standard practices across major insurance companies (like State Farm, Geico) incorporate clauses detailing coverage limits (maximum amounts for claims) and deductibles (out-of-pocket costs before insurance kicks in). Policyholders in the United States should note specific conditions (such as natural disasters or theft) that might influence claims. Understanding these nuances (like exclusions and endorsements) is crucial for ensuring adequate protection. Please reference your original policy for details regarding changes, as well as state regulations affecting your coverage.

Contact Information for Further Assistance

For account insurance policy updates, clients can reach customer service at the dedicated hotline (1-800-555-1234) available Monday to Friday from 8 AM to 6 PM Eastern Standard Time. Additionally, clients may send inquiries via email to support@insurancecompany.com for assistance with policy changes or coverage questions. The official website, www.insurancecompany.com, provides further resources, including FAQs, online chat support, and downloadable forms. Clients are encouraged to have their policy numbers ready for quicker assistance.

Comments