Are you feeling overwhelmed by the complexities of tax season? You're not alone! Many people grapple with the intricacies of filing their taxes, especially when it involves granting someone else the authority to handle it on their behalf. In this article, we're going to simplify the process and provide you with essential tips on creating a tax filing authorization letter that meets all the necessary requirementsâso let's dive in!

Accurate taxpayer information

Accurate taxpayer information is crucial for the successful processing of tax filings. It includes key elements such as the taxpayer's full name, Social Security Number (SSN), filing status (e.g., single, married filing jointly), and current address. Incorrect or incomplete information can lead to delays in processing, potential audits, or discrepancies in tax returns. Furthermore, providing authorization to an accountant or tax professional requires combining the taxpayer's information with the representative's details, including their Tax Identification Number (TIN) or PTIN. This ensures the tax authority recognizes the tax professional's ability to access relevant financial records on the taxpayer's behalf. Adhering to the guidelines set by the Internal Revenue Service (IRS) is essential to avoid penalties and ensure compliant processing of tax obligations.

Legal tax filing authority

Legal tax filing authority provides individuals with the power to manage tax-related matters on behalf of another person or entity. This important document enables authorized representatives, such as Certified Public Accountants (CPAs) or tax attorneys, to file federal and state tax returns, respond to IRS inquiries, and negotiate on behalf of the taxpayer. In the United States, individuals typically utilize Form 2848 for this purpose, allowing for the designation of a specific representative for specific tax years. This grants access to sensitive information, ensuring compliance with Internal Revenue Service regulations while streamlining the tax filing process and potentially alleviating the burden of intricate tax code navigation.

Detailed scope of authorization

The tax filing authorization grants permission to a designated agent to act on behalf of an individual or entity in matters relating to tax compliance. This includes the preparation and submission of tax returns, such as the Form 1040 for individuals or the Form 1120 for corporations, to the Internal Revenue Service (IRS) in the United States. The agent is authorized to represent the taxpayer in communications with tax authorities, including audits and inquiries, ensuring accurate reporting of income, deductions, and credits. Furthermore, the authorization encompasses access to tax documents, including past tax returns, W-2 forms, and 1099s, as well as the ability to make tax payments electronically. Additionally, the agent may receive copies of notices, letters, or other communications from the IRS, allowing for timely responses and compliance with filing deadlines, such as April 15, which marks the standard due date for personal income tax returns.

Tax advisor/agent details

Tax advisors play a crucial role in facilitating efficient tax filing processes. Agents, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs), possess specialized knowledge in tax laws and regulations, enabling them to assist clients in navigating complex tax codes. These professionals typically hold licenses or certifications recognized by regulatory bodies, such as the American Institute of CPAs or the Internal Revenue Service. Tax advisors often require authorization to represent clients before the IRS, which may involve submitting Form 2848, the Power of Attorney and Declaration of Representative. This formal document grants the advisor legal authority to discuss sensitive tax matters, access confidential information, and make decisions on behalf of the client. Effective communication between clients and their tax advisors is essential to ensure compliance with deadlines, such as the April 15th filing date for individual tax returns, while maximizing potential deductions and minimizing liabilities.

Compliance and signature sections

Tax filing authorization requires well-defined compliance and signature sections to ensure legitimacy and accountability. The compliance section outlines responsibilities, affirming that the taxpayer consents to allowing a designated individual, such as a tax preparer, to file tax documents on their behalf. It includes essential information like taxpayer identification number (TIN), filing years, and specific authorizations granted. The signature section demands the signatures of both the taxpayer and the authorized representative, often requiring date stamps for clarity. States like California or New York may have additional requirements regarding notarization. Proper formatting and adherence to IRS guidelines, particularly Form 2848 for power of attorney, are crucial for valid submission and processing of tax filings.

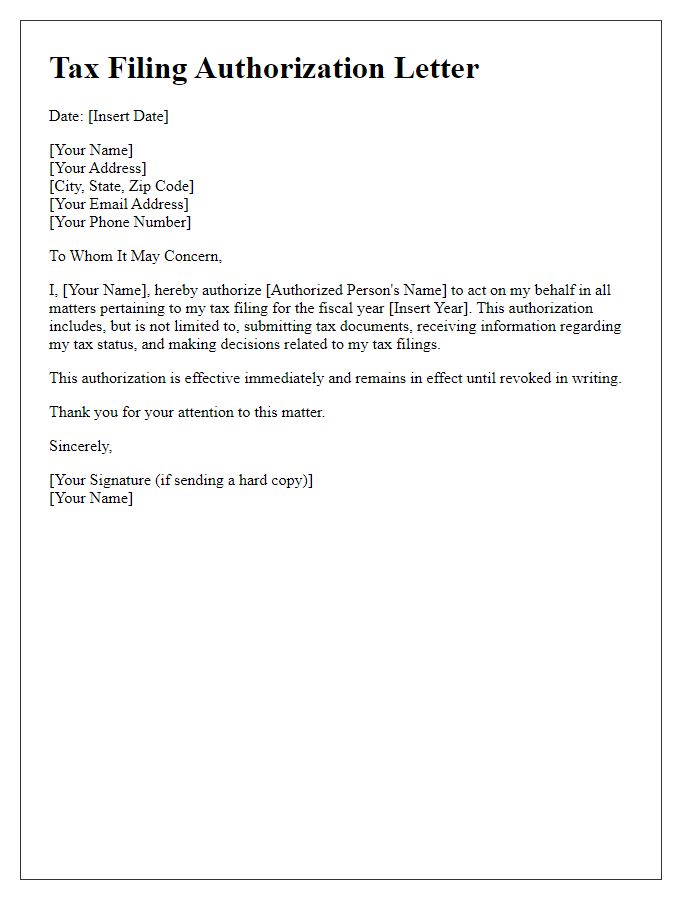

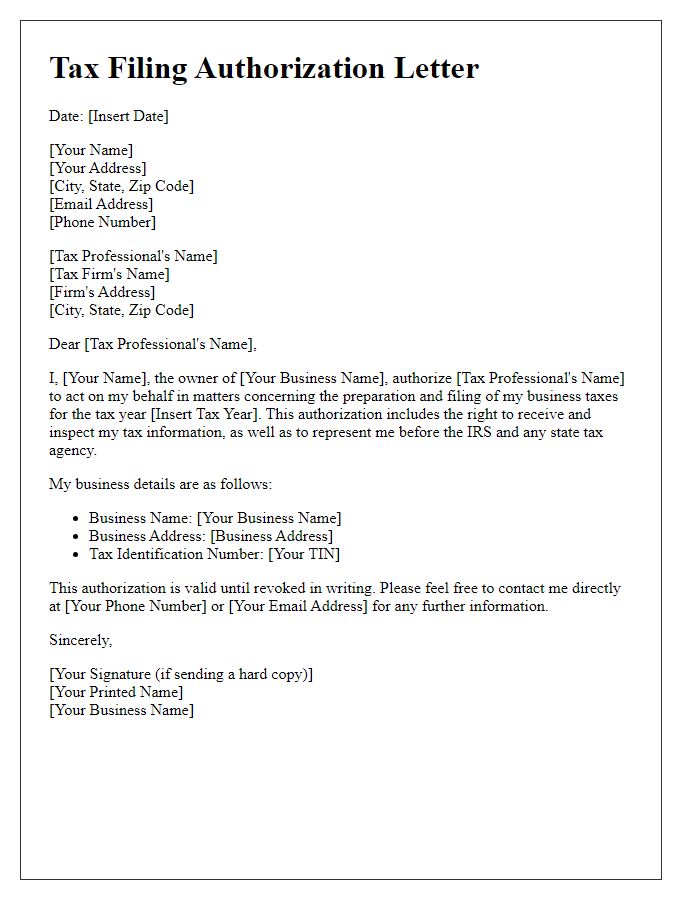

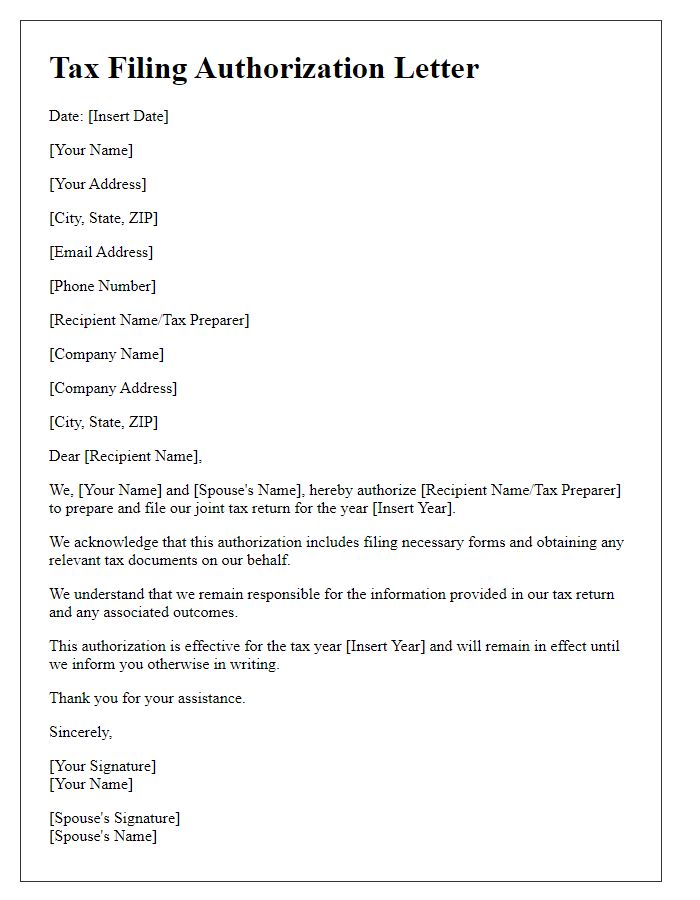

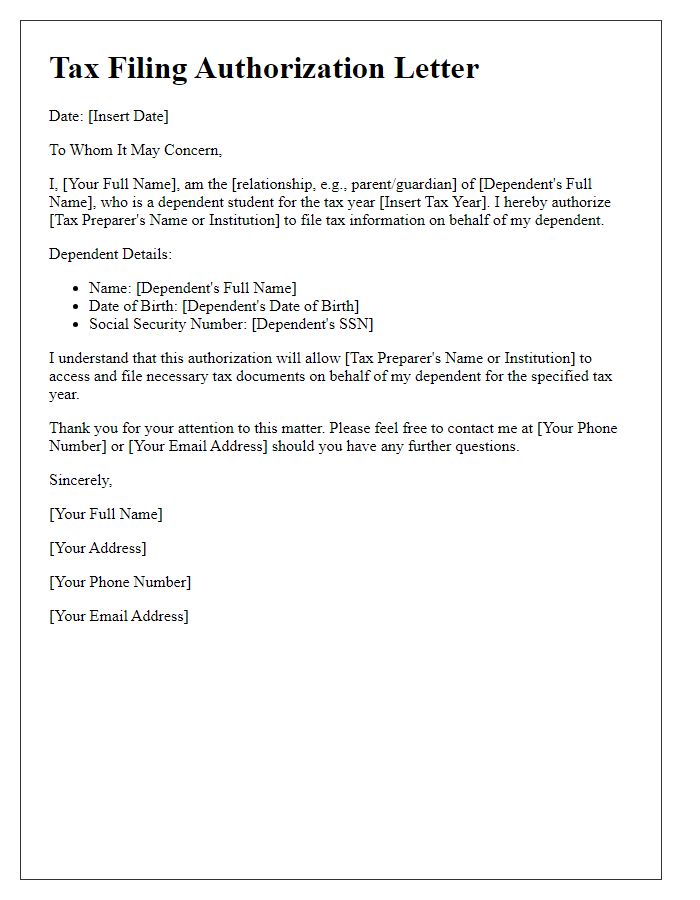

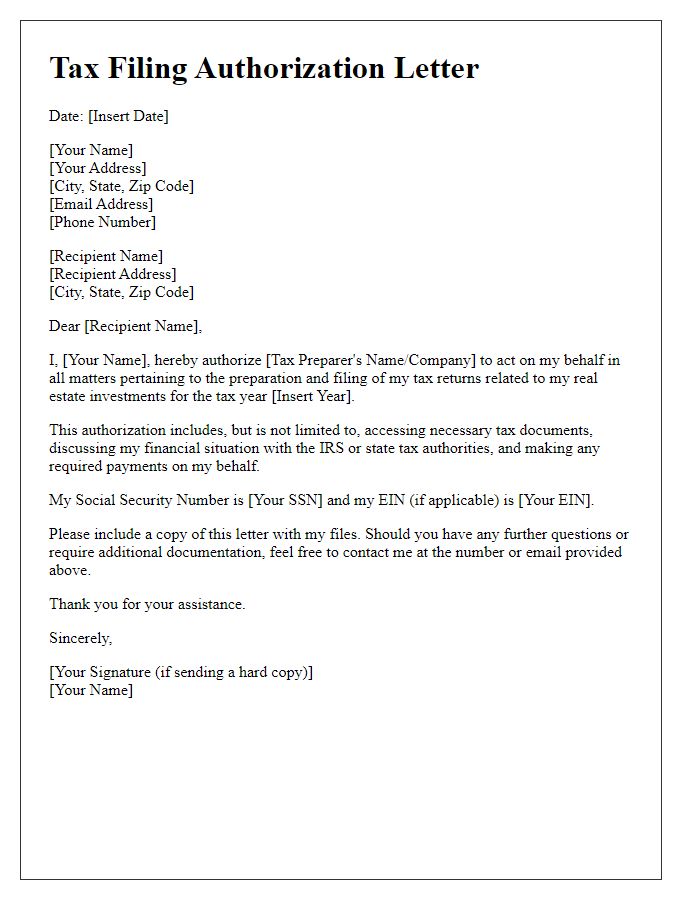

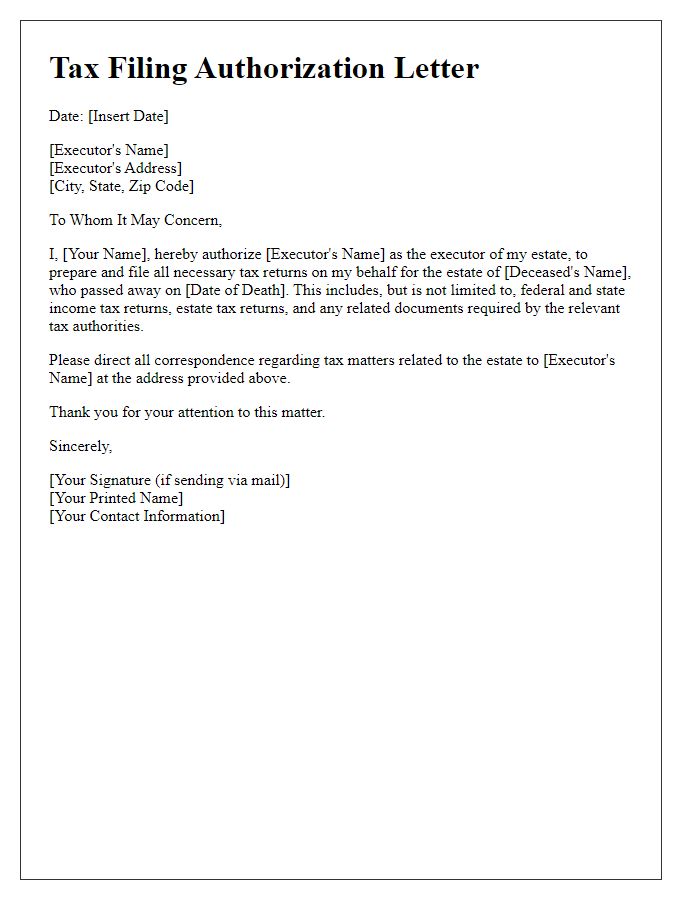

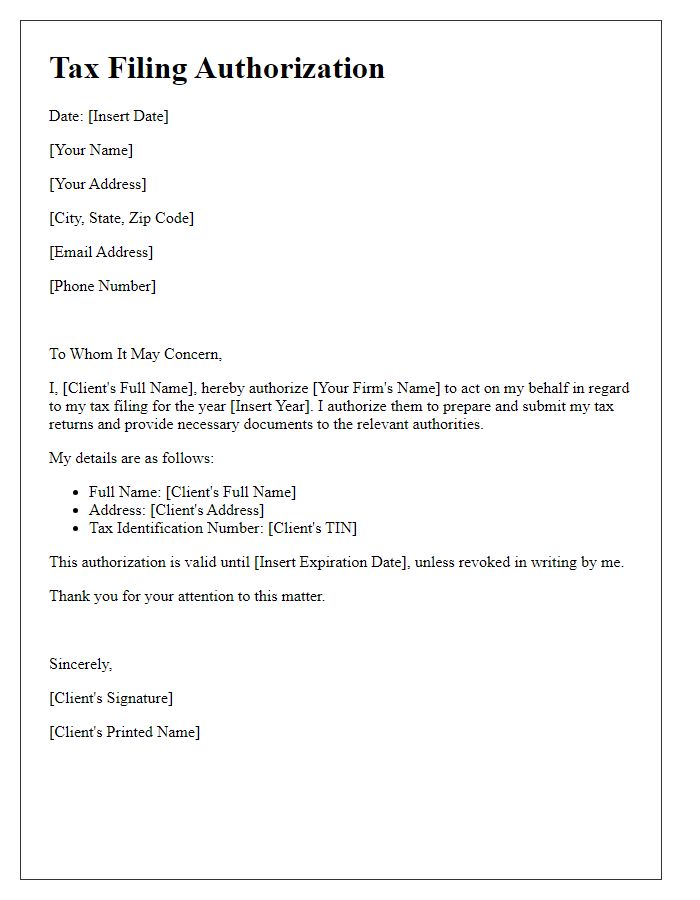

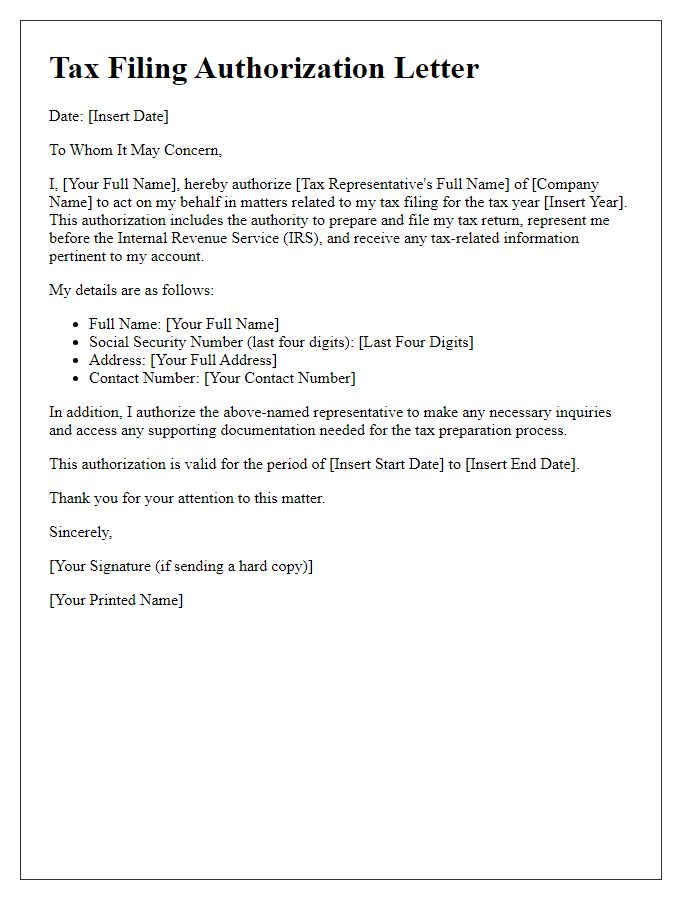

Letter Template For Tax Filing Authorization Samples

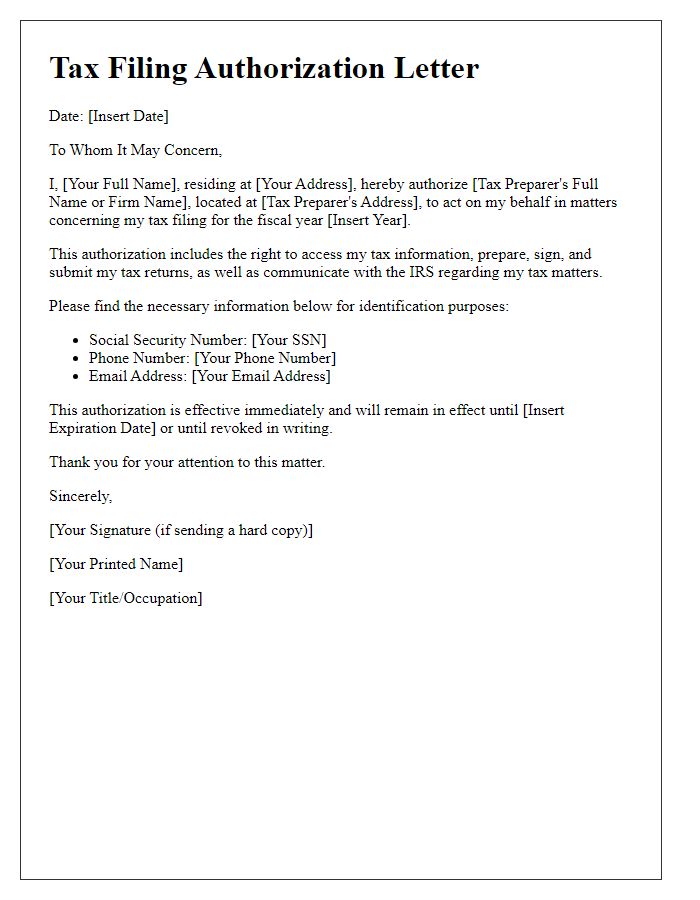

Letter template of tax filing authorization for freelancers and independent contractors.

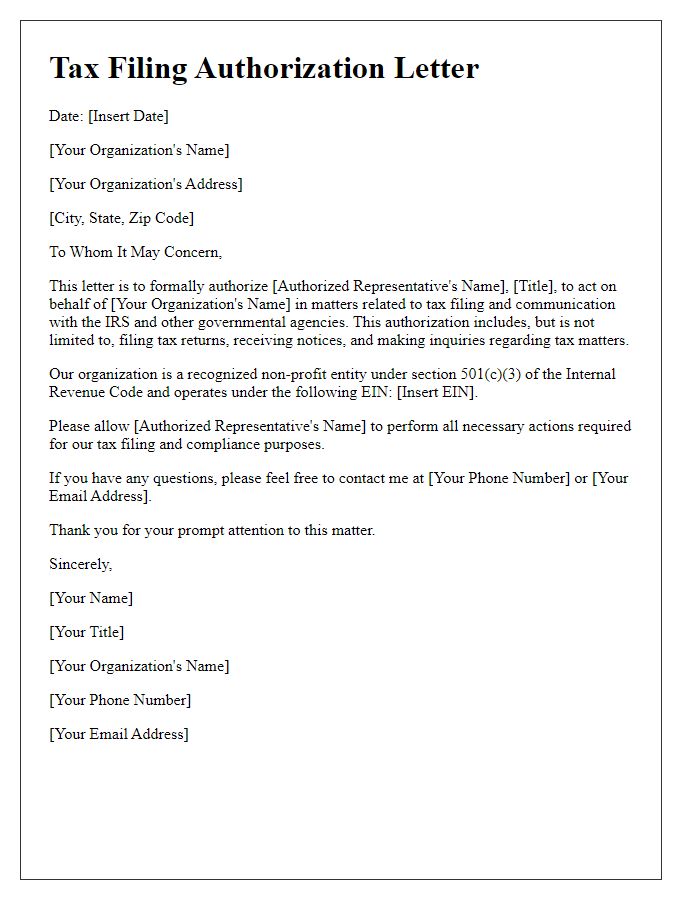

Letter template of tax filing authorization for non-profit organizations.

Comments