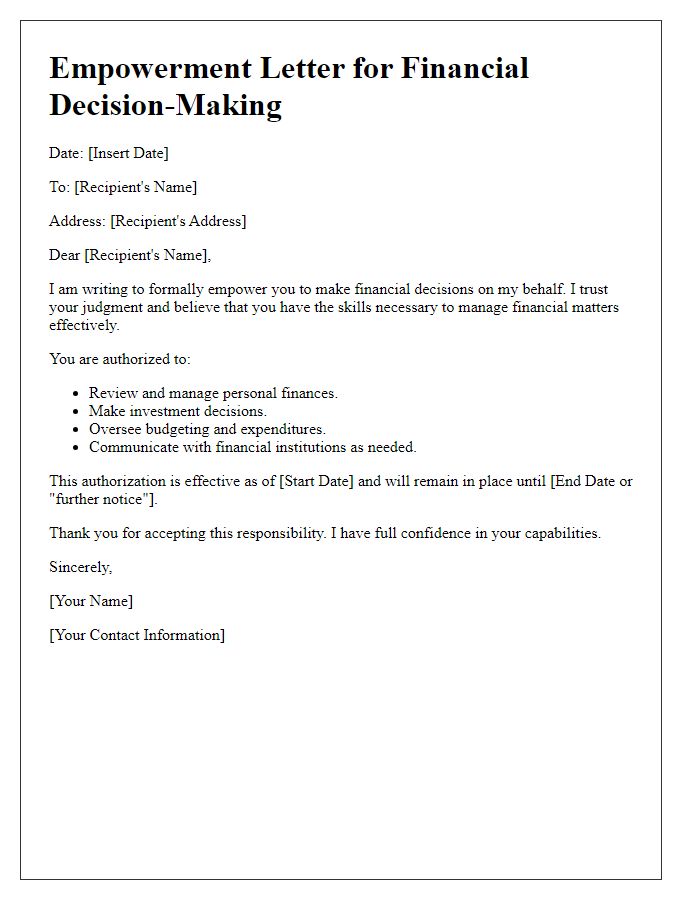

Are you looking to streamline your financial decision-making process? A well-crafted letter template can make all the difference in ensuring that your financial intentions are clearly communicated and effectively authorized. By establishing a structured approach, you can minimize the chances of confusion and enhance accountability within your organization. Keep reading to discover how a simple letter can empower you in making informed financial decisions!

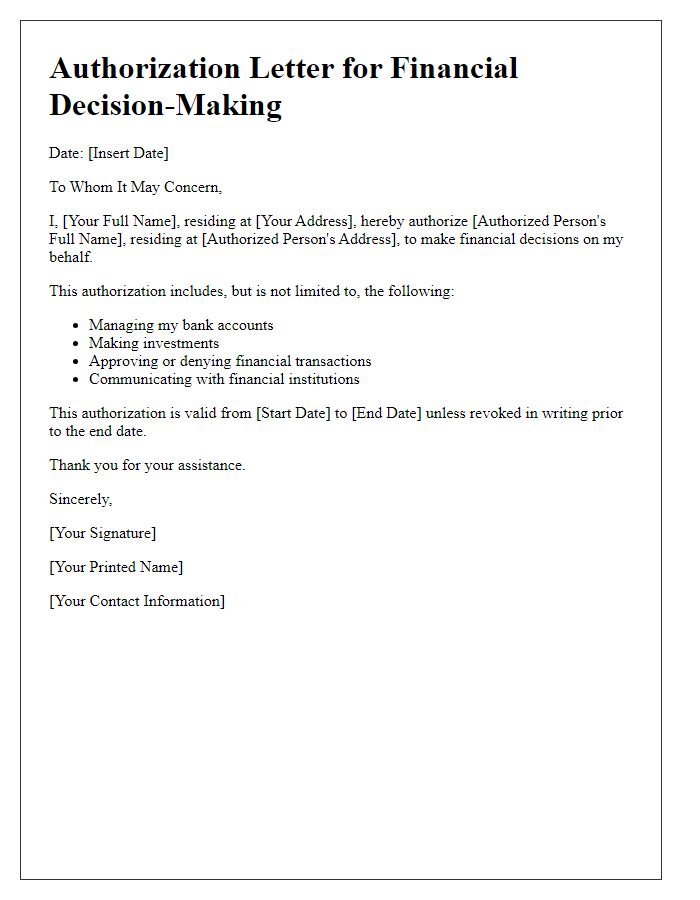

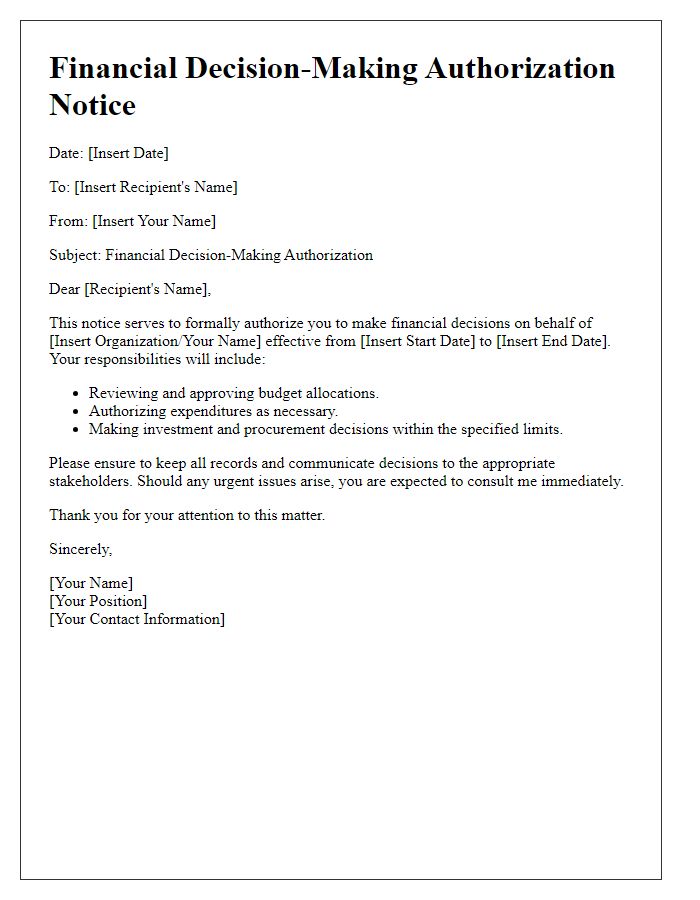

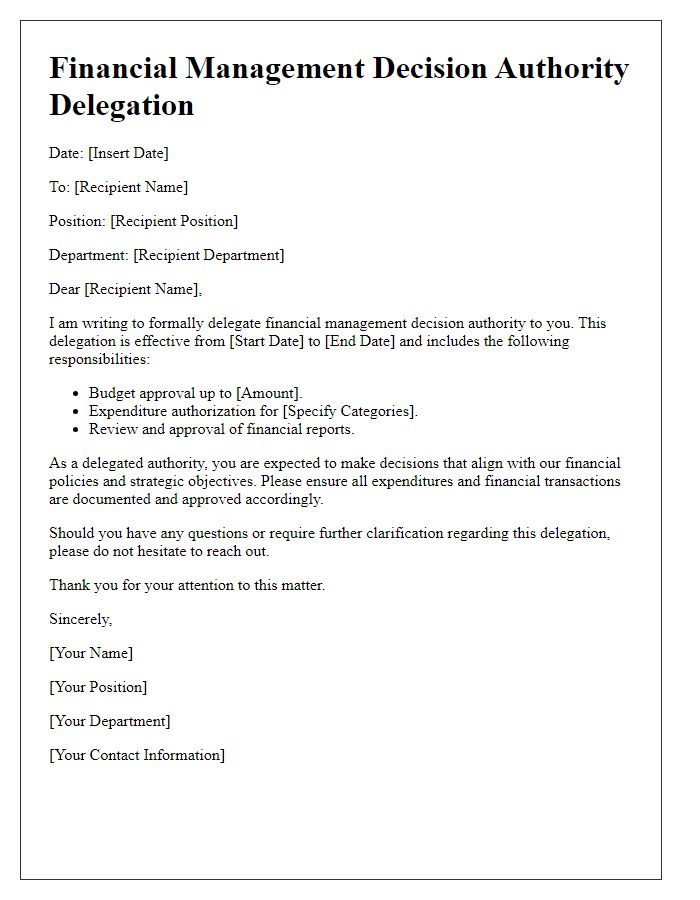

Clear identification of involved parties

In financial decision-making processes, clear identification of involved parties is crucial to maintain accountability and transparency. Typically, key stakeholders include the authorization entity, often represented by a Finance Director or CFO, and the requesting party, which may be a project manager or department head seeking budget approval. For instance, in a corporate setting, the Finance Director of Company X, located in New York, may be evaluating a funding request from the Marketing Department for an advertising campaign projected to cost $50,000. Furthermore, external parties such as financial auditors or legal advisors may also need to be mentioned to ensure compliance with regulations. Proper delineation of these roles and responsibilities helps streamline the authorization process, ensuring that all transactions align with the organization's financial policies.

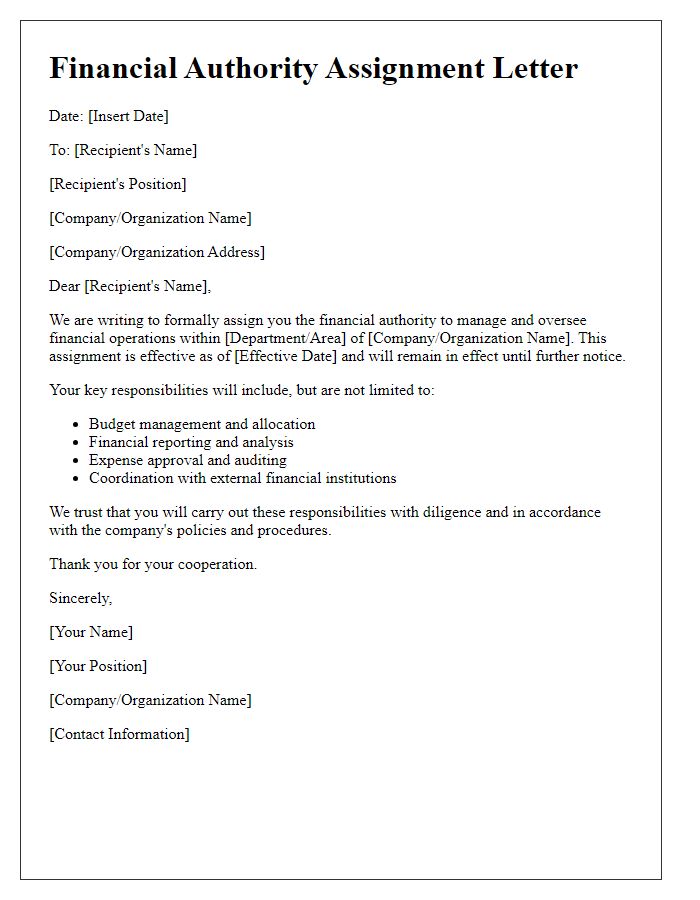

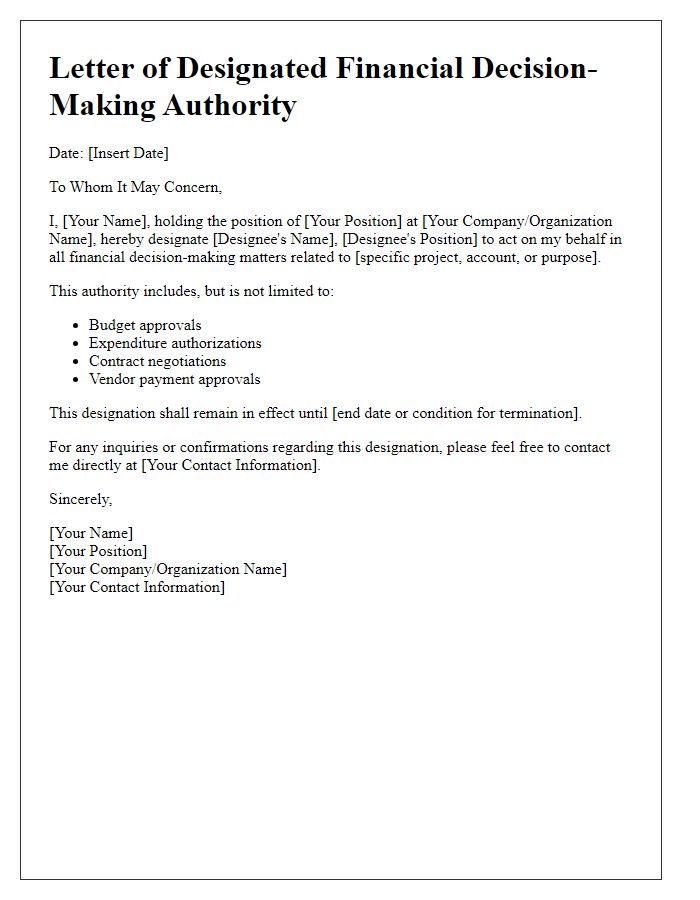

Detailed scope of authorization

Financial decision-making authorization encompasses a range of critical activities within organizational management. This includes budget approvals exceeding $50,000 for departmental expenditures, capital investments over $100,000 requiring board review, and expense reimbursements for employees amounting to $5,000 or more necessitating supervisory consent. Specific financial reports must be reviewed quarterly, focusing on key performance indicators, such as net profit margins and cash flow projections, ensuring alignment with the organization's strategic objectives. Additionally, any contracts exceeding $75,000 must undergo legal validation prior to commitment, while grant applications for funding must include a comprehensive review process to evaluate eligibility and compliance with issuance protocols. This framework aims to mitigate financial risks while promoting transparency and accountability in all financial dealings.

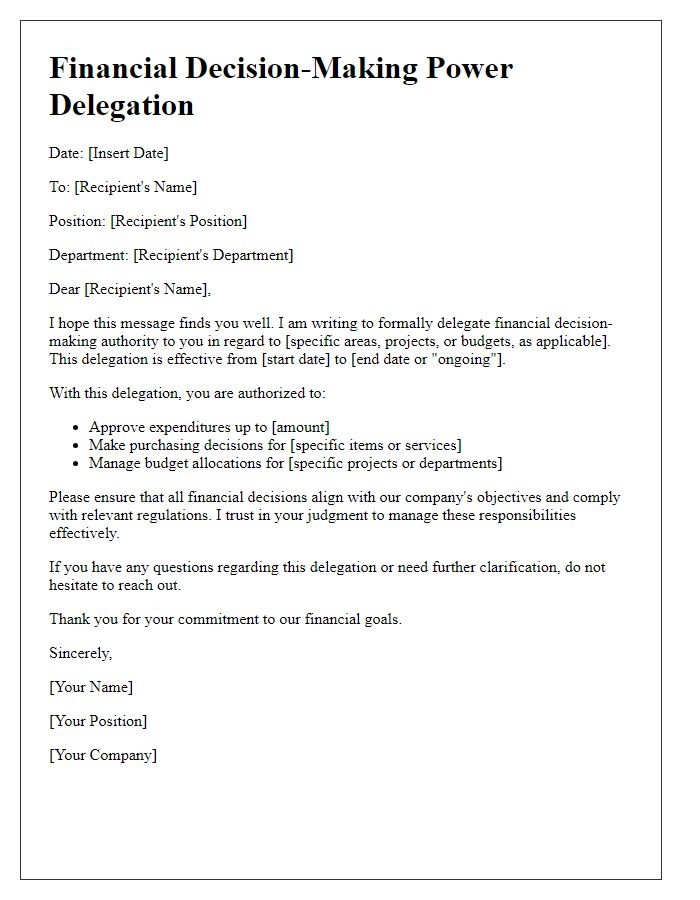

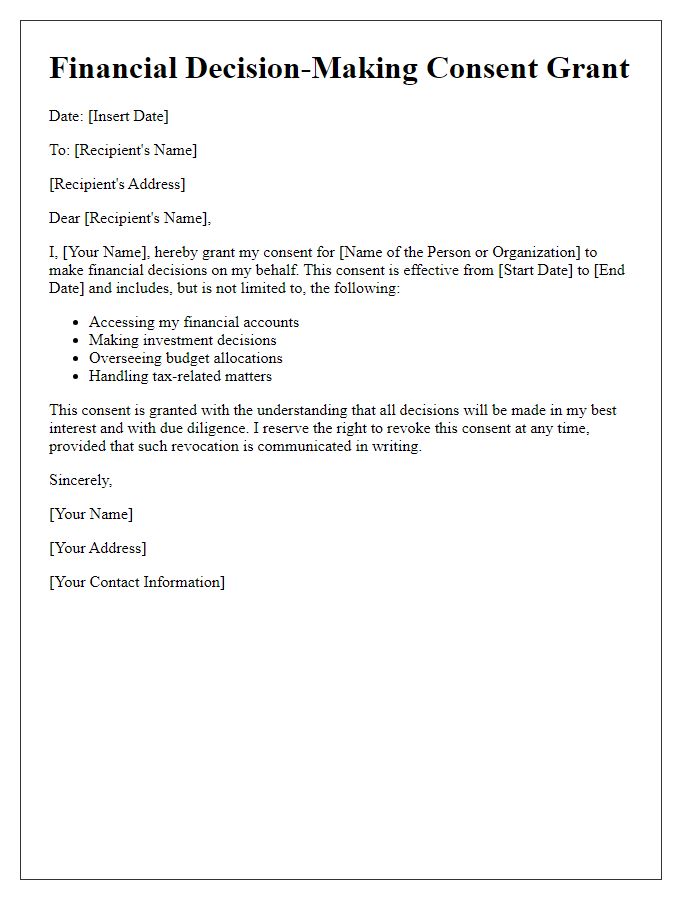

Specific financial actions and decisions permitted

A financial decision-making authorization outlines specific financial actions and decisions permitted within an organization. It typically includes approvals for budget allocations, expense reimbursements, and contract signings. For instance, a project manager may be granted authority to approve expenses up to $5,000 for project-related costs. Higher amounts, such as $25,000 or more, might require board approval. Additionally, it can specify limits on procuring goods and services, outlining thresholds that trigger additional scrutiny. Organizations often implement this framework to ensure accountability and transparency in fiscal activities, demonstrating a clear delineation of responsibilities among team members.

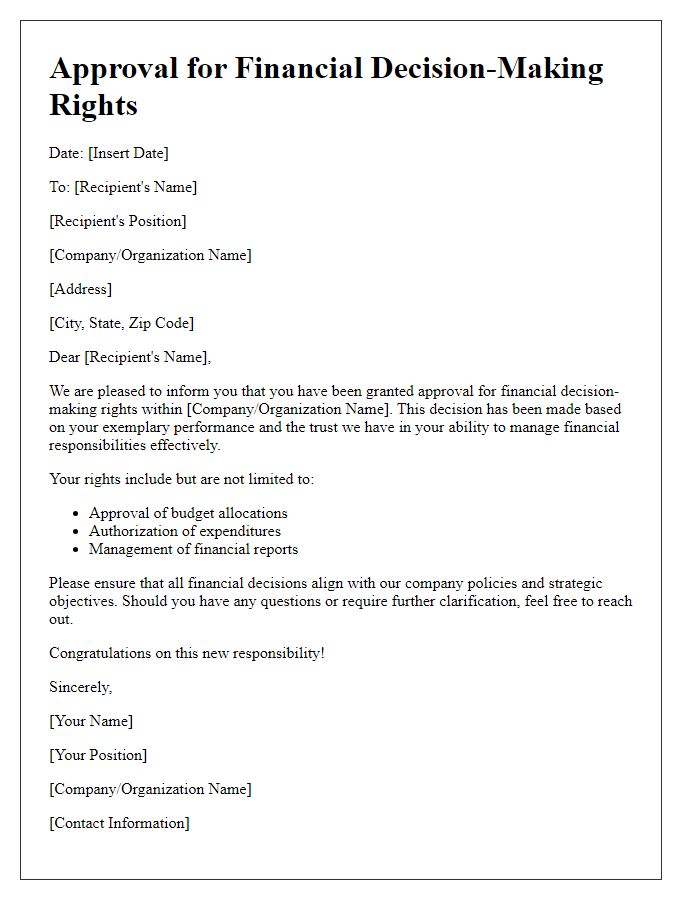

Duration and limitations of authorization

Financial decision-making authorization can streamline operations for organizations, providing designated individuals clear parameters for spending authority. Typically, the duration of such authorization may span from six months to one year, depending on the organization's policies. Limitations should be explicitly defined, including monetary thresholds, specific categories of expenses (such as travel, supplies, or capital expenditures), and conditions under which additional approvals are necessary. For example, an authorization may permit up to $10,000 for office equipment purchases but require additional review for expenditures exceeding that amount or for projects exceeding a defined budget limit. Such guidelines ensure financial accountability and mitigate risks associated with unauthorized spending.

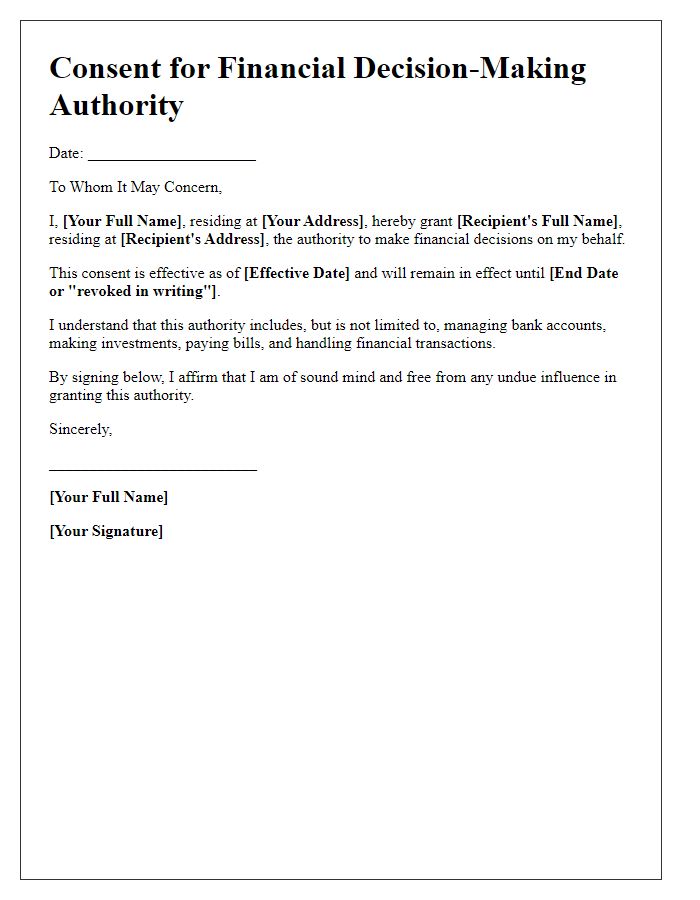

Signatures and contact information of all parties

Financial decision-making authorization requires clear documentation, ensuring each party's agreement and accountability. Key participants include signatories such as the Chief Financial Officer (CFO) and department heads, whose names and titles must be clearly printed. Contact information, including email addresses and phone numbers, should accompany the signatures to facilitate communication regarding financial transactions. The document must outline specific financial thresholds, authorizing limits, allowing traceability for every financial commitment made. Date of authorization should be included, guaranteeing that the approval reflects timely consent in financial operations. This structured approach ensures accountability in all fiscal decisions.

Comments