Are you looking to streamline your cheque signing process? Writing a cheque signing authorization letter can simplify financial transactions and ensure that your payments are handled smoothly. This template will guide you through the essential elements to include in your letter, making it both clear and professional. Dive in to learn more about how to effectively authorize cheque signing in your organization!

Introduction and Purpose

Cheque signing authorization serves as a formal document granting specific individuals the legal authority to sign and process financial transactions on behalf of an organization. This process ensures that only designated personnel can access and manage funds, maintaining security and accountability in financial operations. Organizations, such as non-profits and corporations, often implement such measures to prevent unauthorized access and maintain proper financial oversight. In particular, the introduction of this authorization helps streamline the payment process while safeguarding against potential fraud. The note also reinforces the organization's commitment to responsible financial management and compliance with regulatory requirements.

Authorized Signatures

Authorized signatures denote the individuals granted permission to sign financial documents, including cheques. In financial institutions, this process ensures accountability and minimizes fraud. Typically, organizations require two signatures for cheques exceeding certain amounts, often $500, safeguarding against unauthorized transactions. The designation of authorized individuals usually reflects their position within the organization, such as a Chief Financial Officer or a Treasurer. Financial regulations mandate that each signature must match the recorded specimen maintained by the bank. Proper documentation should outline the scope of authority and list all authorized signatories, ensuring compliance and security in financial operations.

Terms and Conditions

A cheque signing authorization letter should clearly outline the terms and conditions of the authorization process. The letter typically includes the names of the authorized signers, details about the bank or financial institution involved, and specific instructions for signing cheques. The document must specify the limits of the authority, such as the maximum amount for which the authorized persons can sign. It should also mention the duration of the authorization, which could be permanent, temporary, or until revoked in writing. If applicable, it should include any required documentation, such as identification or accounts to which this authorization applies. Moreover, it is essential to note the process for revocation or change, to prevent unauthorized use and ensure clarity for all parties involved.

Contact Information

A cheque signing authorization form is typically used to grant permission to specific individuals, such as employees or accountants, to sign cheques on behalf of a company or organization. This document includes important details such as the names of authorized signers, their contact numbers, and the date, ensuring transparency and accountability in financial transactions. Properly designated individuals may be required to sign cheques issued by entities like banks, suppliers, or service providers, enhancing secure expenditure management. This reduces the risk of fraud and unauthorized access to company funds, especially in larger organizations with multiple financial activities.

Closure and Acknowledgment

Cheque signing authorization is an essential activity for financial transactions in businesses. Acknowledgment of receipt indicates approval and confirmation of responsibility, typically requiring specifics such as authorized signatories and their respective signing limits. Company policies often dictate the necessity for dual signatures for amounts exceeding $5,000 to mitigate fraud risks. Proper documentation must include details like the date, the cheque amount, and the purpose, ensuring transparency within the financial records. In addition, retaining a signed copy in digital formats enhances record-keeping efficiency, ensuring compliance with auditing standards that may be mandated by financial regulatory bodies like the Securities and Exchange Commission (SEC).

Letter Template For Cheque Signing Authorization Samples

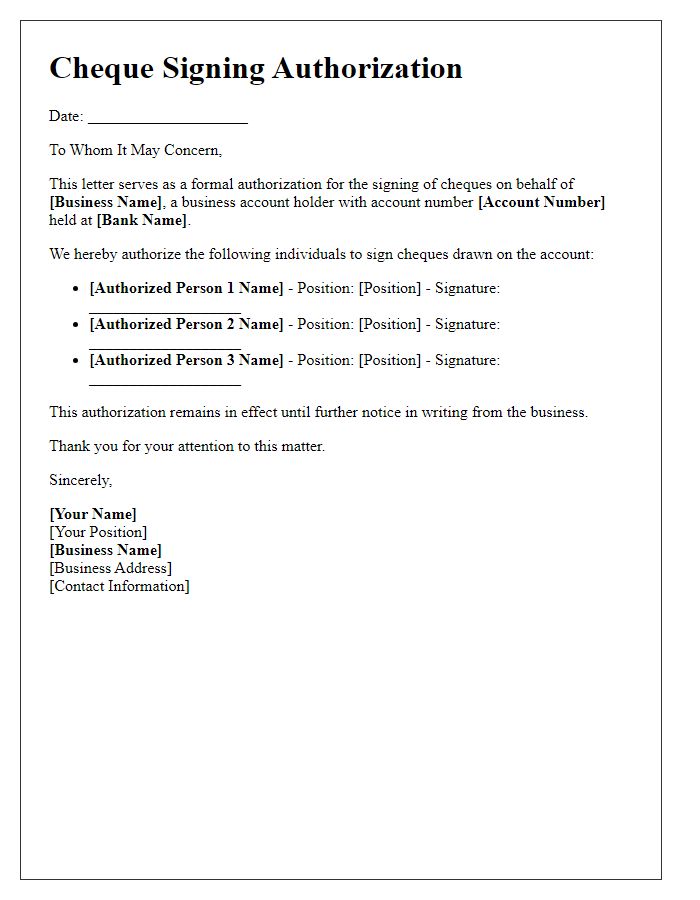

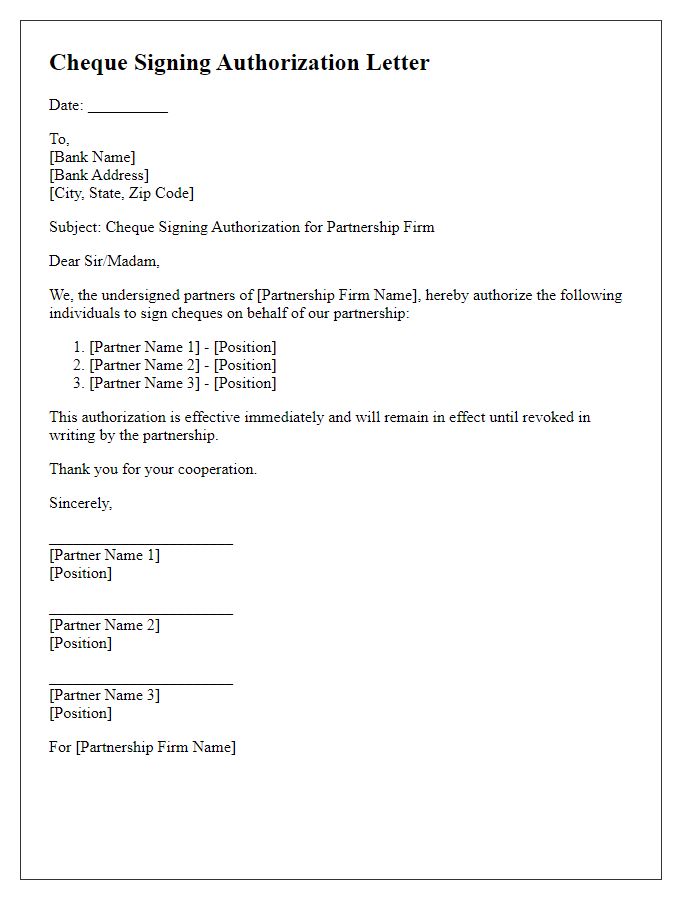

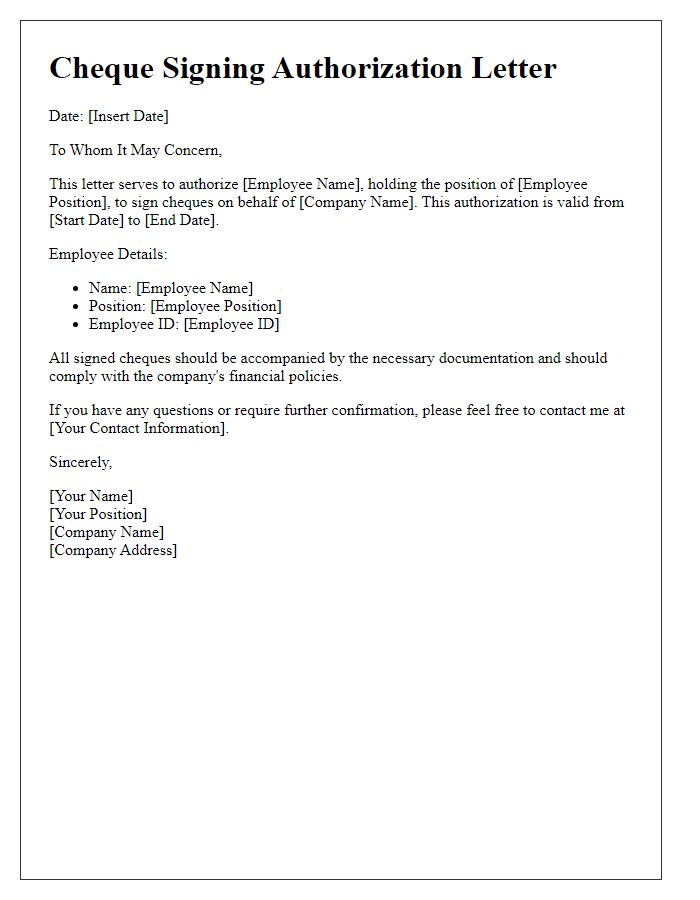

Letter template of cheque signing authorization for business account holders.

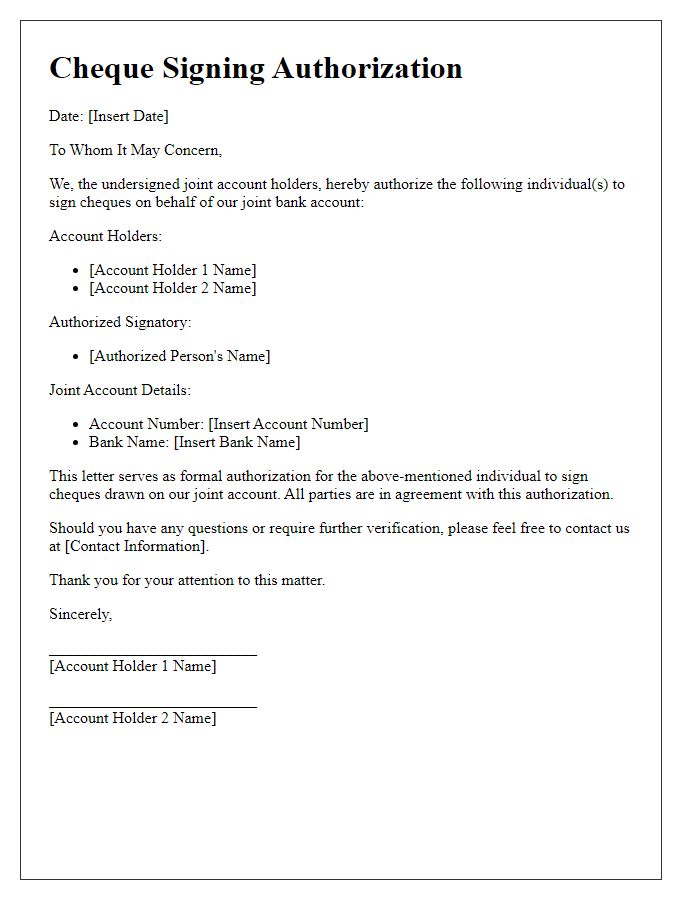

Letter template of cheque signing authorization for joint bank accounts.

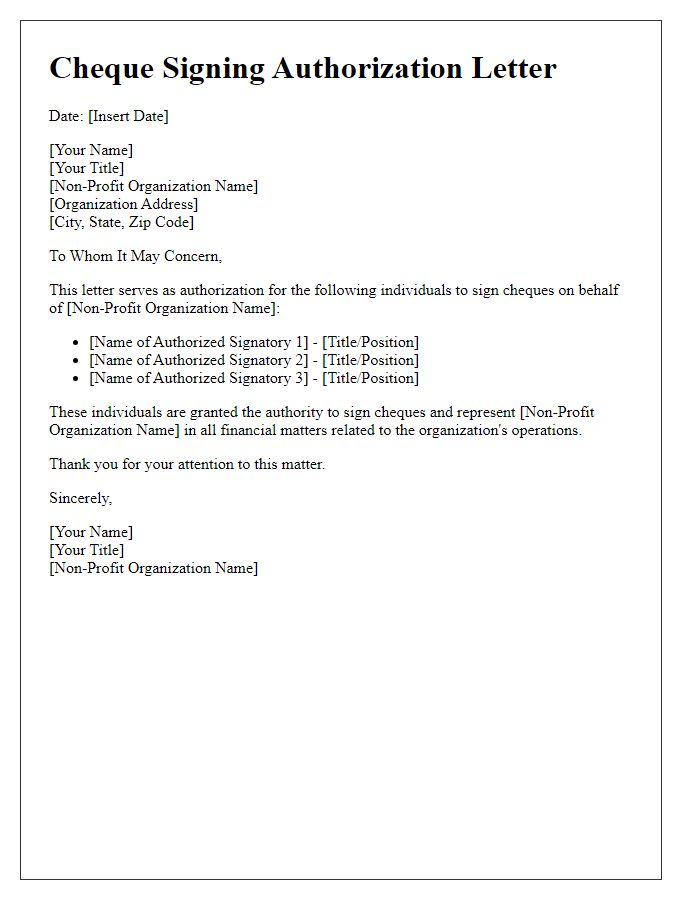

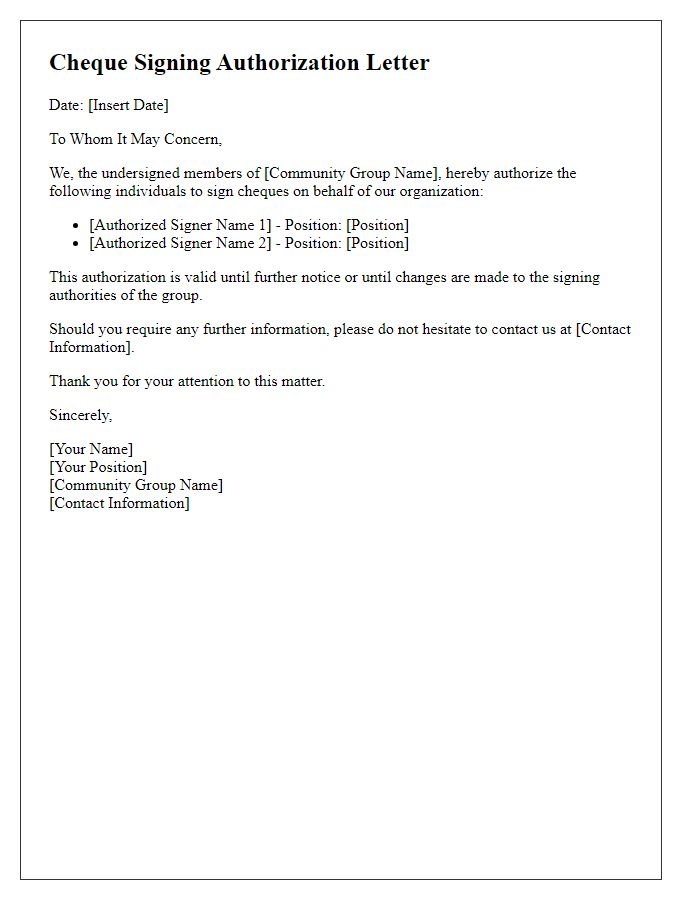

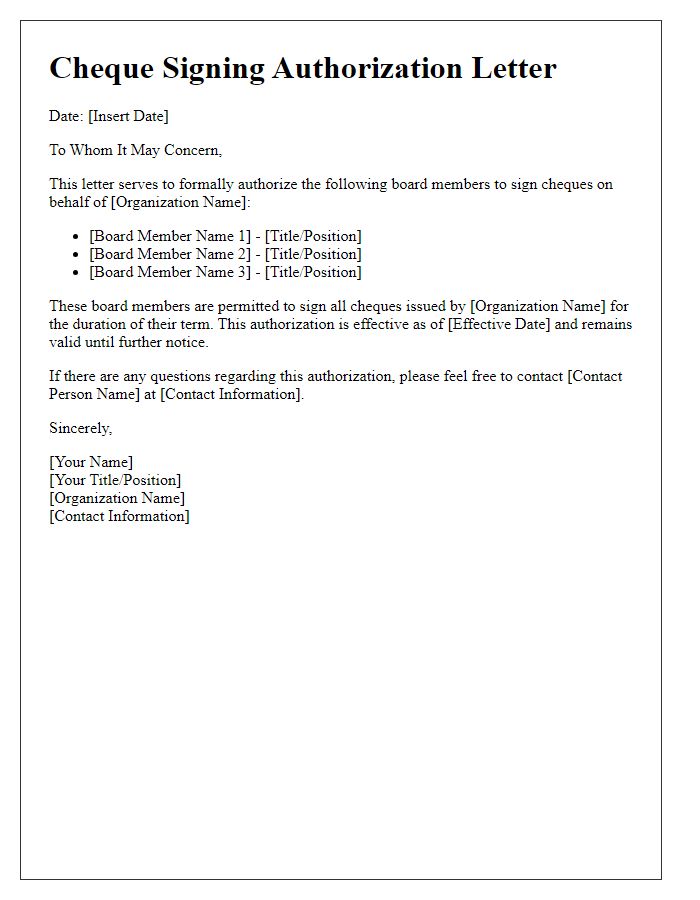

Letter template of cheque signing authorization for non-profit organizations.

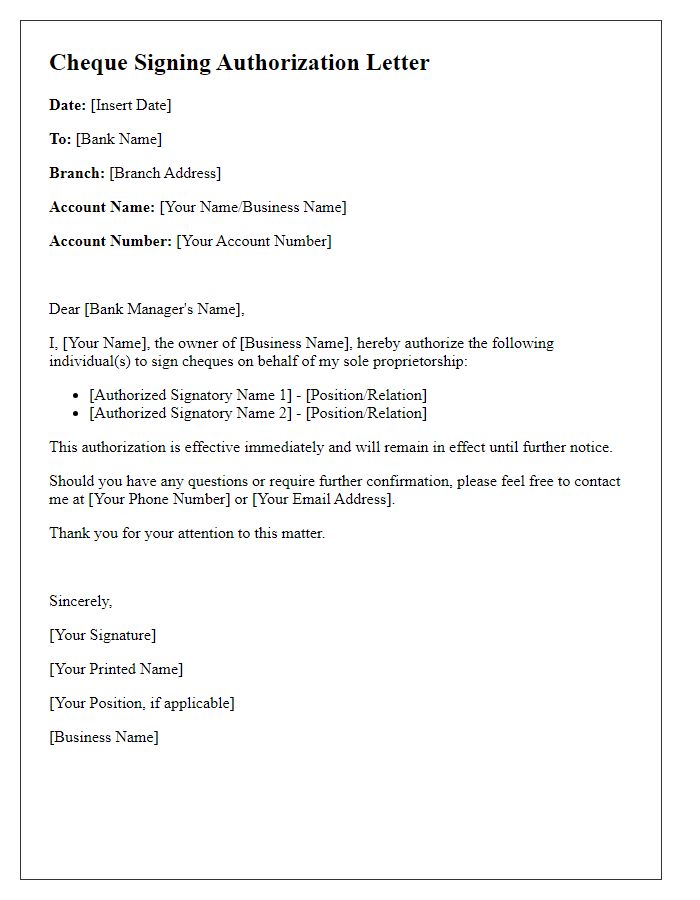

Letter template of cheque signing authorization for sole proprietorships.

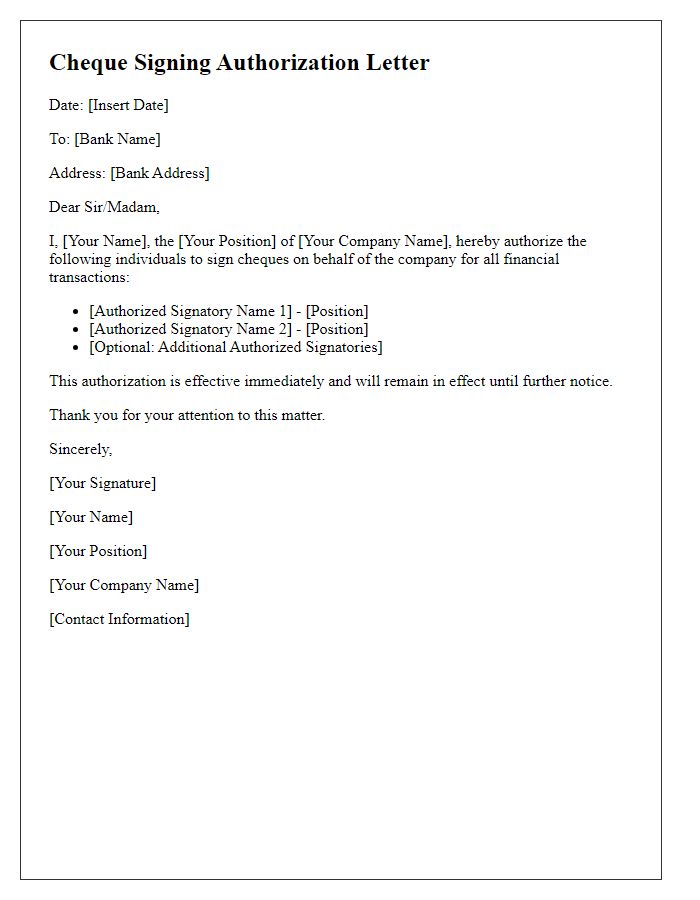

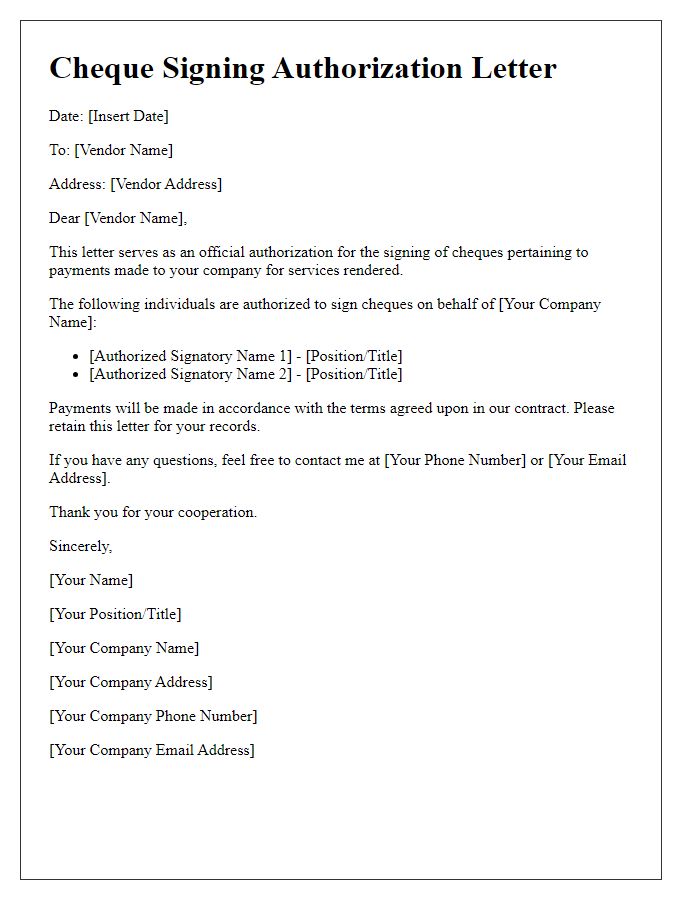

Letter template of cheque signing authorization for financial transactions.

Comments