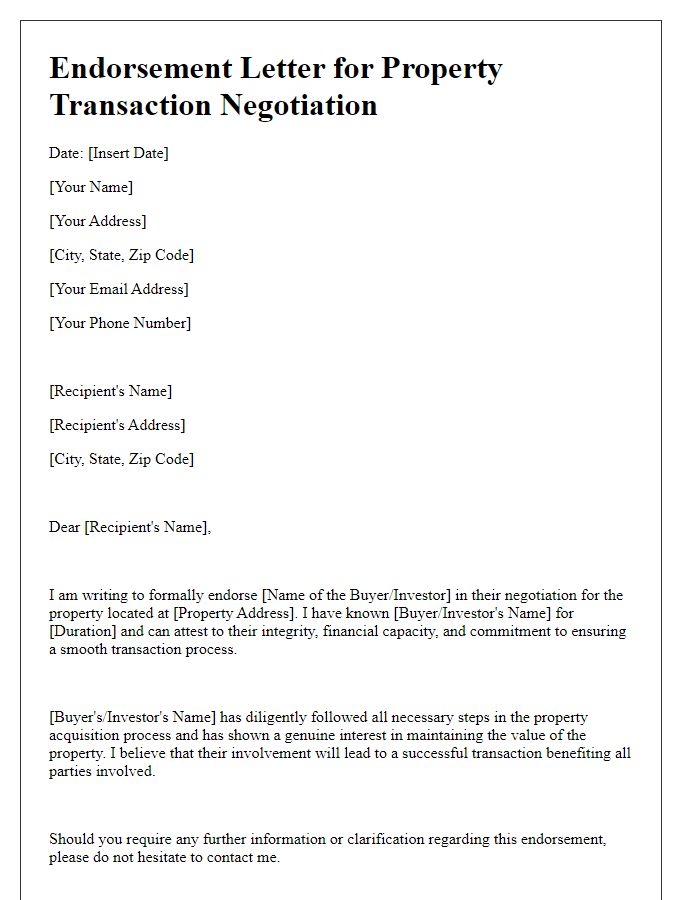

Are you navigating the world of real estate transactions and looking for a way to streamline the process? A real estate transaction authorization letter can be a game-changer, providing essential consent for your property dealings. Whether you're buying, selling, or renting, this document helps clarify roles and permissions, ensuring everything flows smoothly. Curious about how to craft the perfect authorization letter? Read on to discover a handy template that can make your transaction hassle-free!

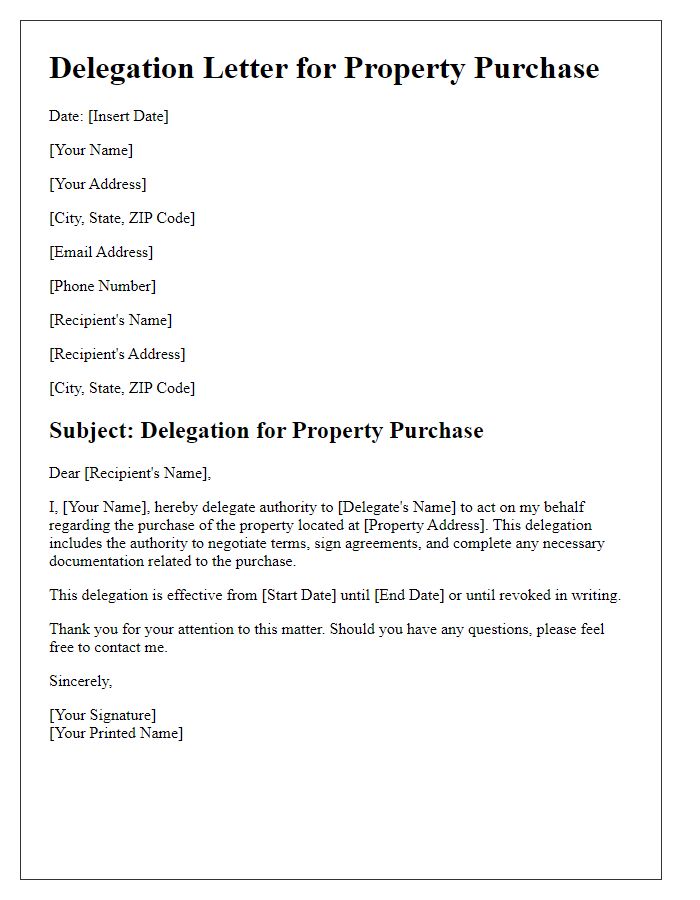

Header Information

Real estate transaction authorization requires precise details for effective processing. Full name of the primary applicant (for identification) needs to be listed alongside the property address (including street number, street name, city, and zip code). The purchase price (the agreed amount for the property) must be documented clearly. Dates (specifying the transaction initiation and expected closing date) should be accurately noted. Additional parties involved, such as co-buyers or real estate agents (including names and contact information), should be included for comprehensive communication. Any relevant transaction ID or reference number (issued by the brokerage or state) helps streamline the process and ensures all documentation is aligned.

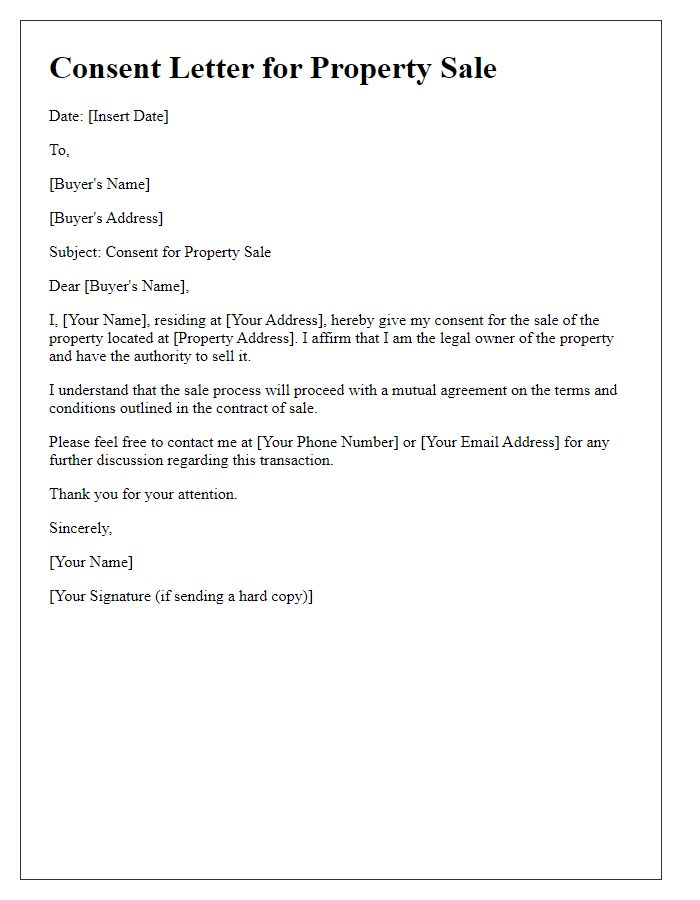

Property Details

The authorization for a real estate transaction outlines the specific details of the property located at 123 Maple Street, Springfield, with an estimated market value of $350,000. This residential property features a three-bedroom layout, two bathrooms, and a spacious 1,800 square feet floor plan, ideal for families. Notable amenities include a modern kitchen equipped with stainless steel appliances, a two-car garage, and a landscaped backyard complete with a patio area. The transaction is set to occur in November 2023, coinciding with the annual Springfield Housing Fair, where local agents will be present to assist buyers. The property is situated within proximity to top-rated schools such as Lincoln Elementary and Springfield High, enhancing its attractiveness in the real estate market.

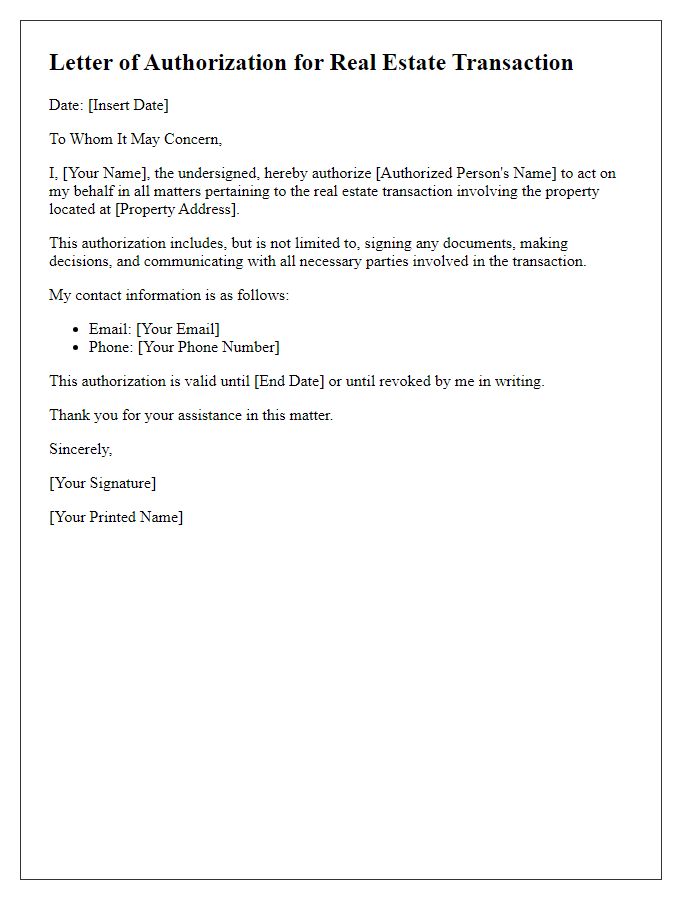

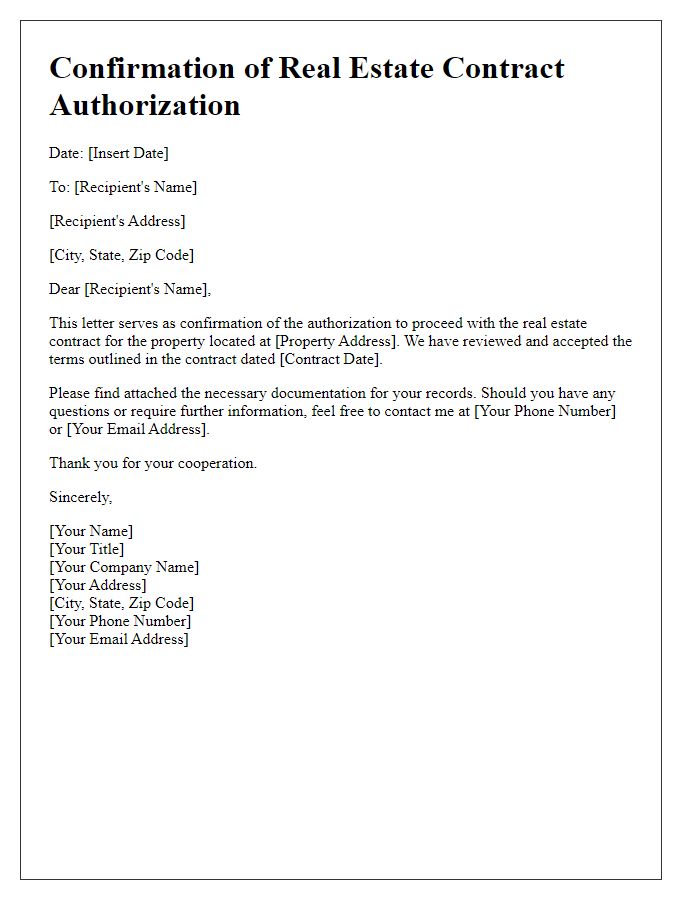

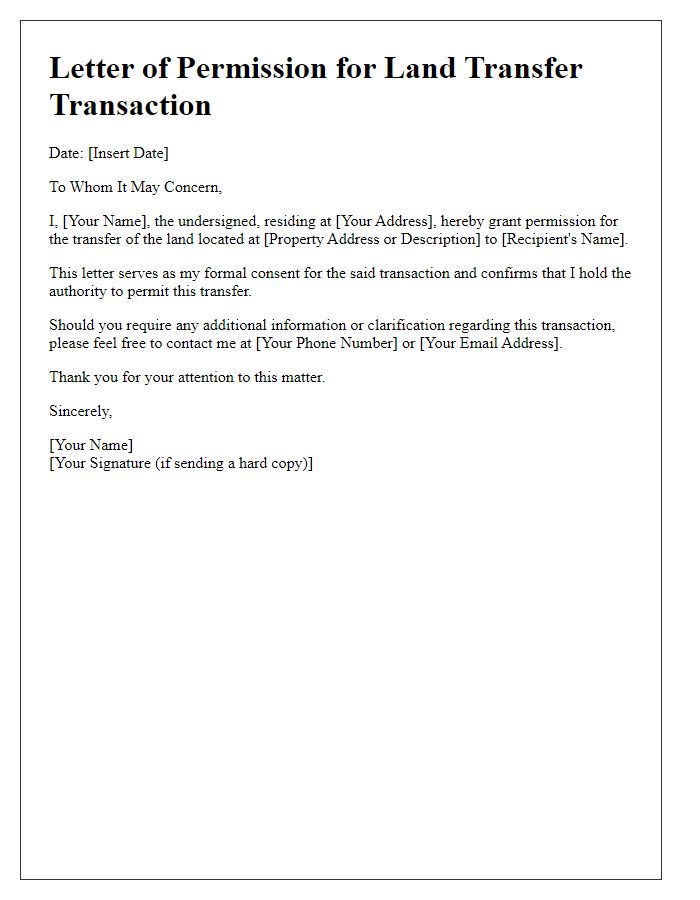

Authorization Terms

Real estate transaction authorization involves clear terms and conditions between parties involved in a property transfer. Proper documentation should include essential elements such as authorization date, names of the parties (buyer, seller), and property details (address, parcel number). A legally binding authorization agreement outlines responsibilities, including who will handle financial transactions, closing dates (typically 30-60 days post-acceptance), and specific permissions granted (e.g., inspection access). Additionally, it should address contingencies, such as financing approval and home inspection results. Notarization may be required to authenticate the agreement, ensuring compliance with local laws and protecting the interests of both buyer and seller in the transaction.

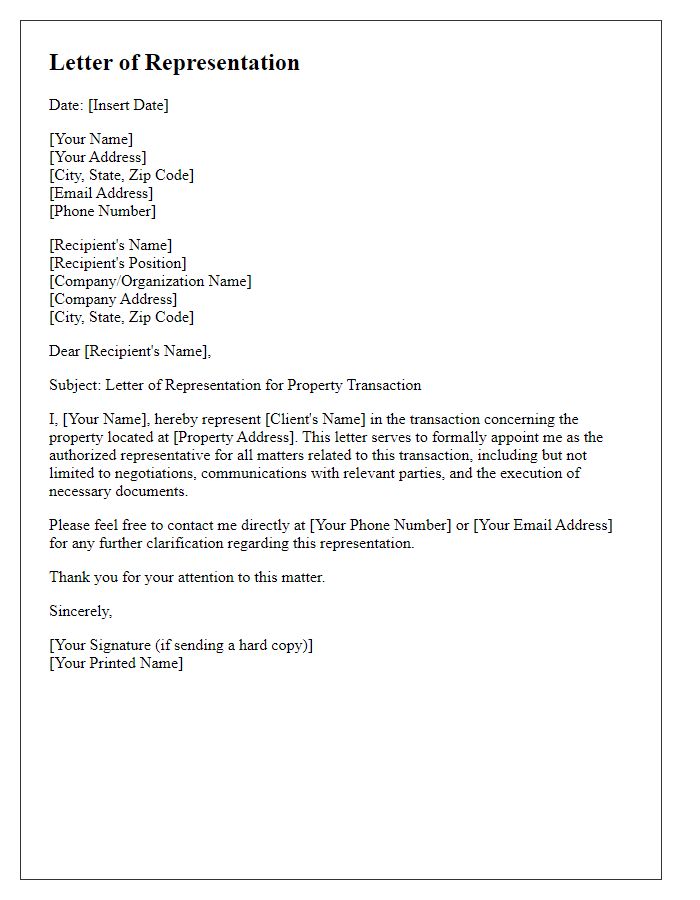

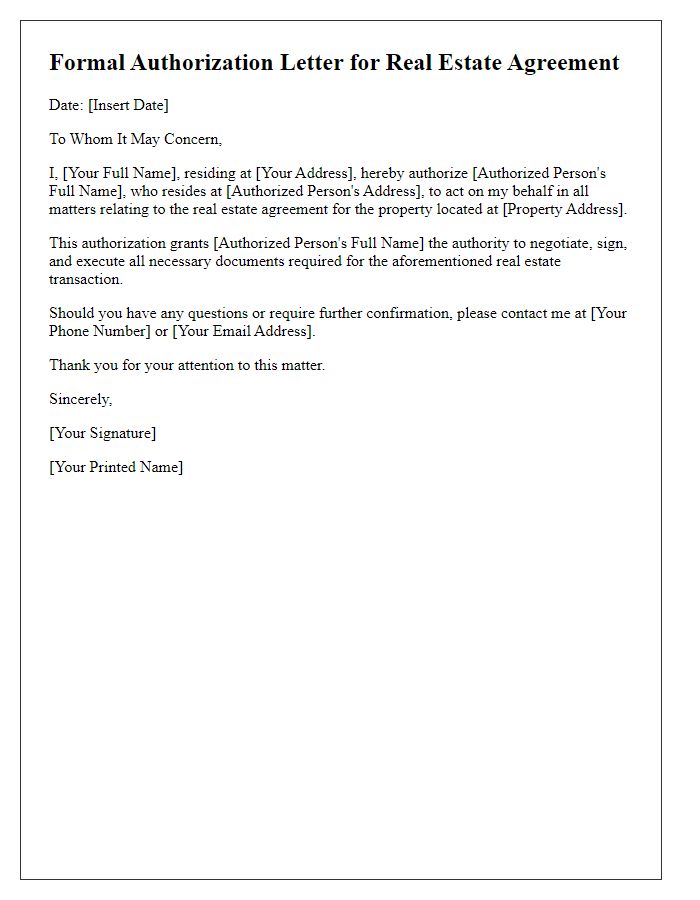

Signatory Parties

The real estate transaction authorization document outlines the signatory parties involved in the formal agreement, crucial for any property transfer process. For instance, the seller, often identified by full name (such as John Doe), alongside the buyer, possibly Jane Smith, must provide their respective signatures, signaling mutual consent. Noteworthy, the property address (e.g., 123 Maple Street, Springfield) serves to clearly identify the subject of the transaction. Additionally, any real estate agent or broker, like XYZ Realty, who facilitates the deal should also be mentioned, typically featuring their license number and contact information. Essential components include date of authorization, ensuring all parties are aware of the timeline for the transaction process, and legal disclaimers, clarifying obligations and responsibilities of each party throughout the transaction.

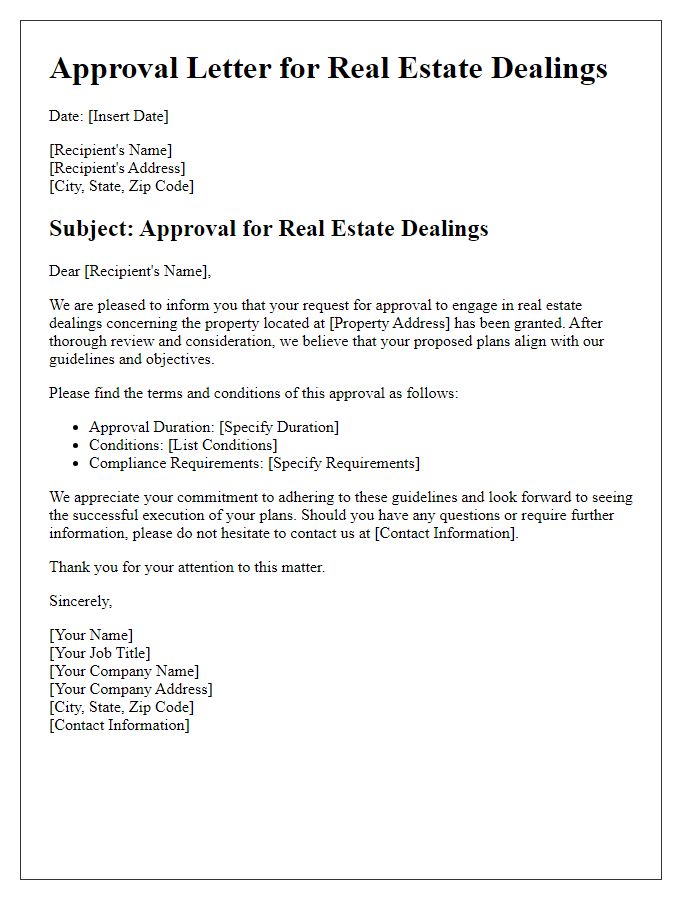

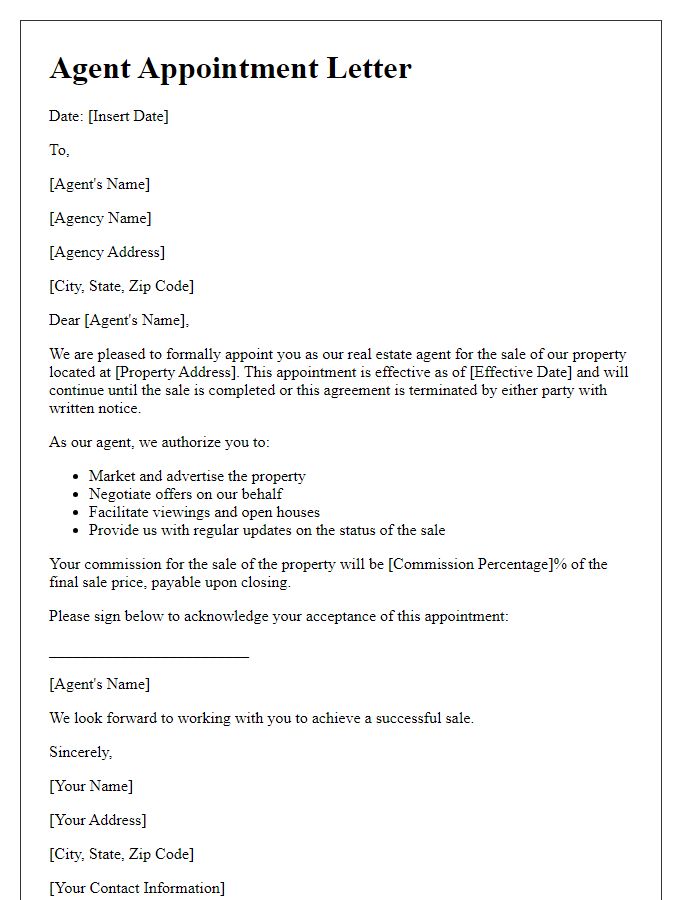

Legal Considerations

Real estate transaction authorization involves multiple legal considerations crucial for ensuring compliance and protection for all parties involved. Essential documents may include purchase agreements, disclosure statements, and title reports, each adhering to state-specific laws. License requirements must be met for real estate agents, typically mandated by local regulatory bodies like the Department of Real Estate in California. Confidentiality agreements protect sensitive information during negotiations, while disclosures regarding property condition must comply with the Seller's Disclosure Act. Notarization of signatures is often required to validate contracts legally, particularly in states like Texas, where formalities are strictly enforced. Third-party financing entities, such as banks or credit unions, necessitate adherence to the Truth in Lending Act, promoting transparency in loan terms and costs. Failing to address these legal considerations could lead to disputes, invalid transactions, or financial liabilities.

Comments