Are you preparing for an upcoming audit and need to request evidence from your team? Crafting a well-structured letter can streamline the process and ensure you gather all necessary documentation effectively. In this article, we'll provide a handy template to help you communicate your audit evidence requests clearly and professionally. So, let's dive in and enhance your audit readiness together!

Clear Subject Line

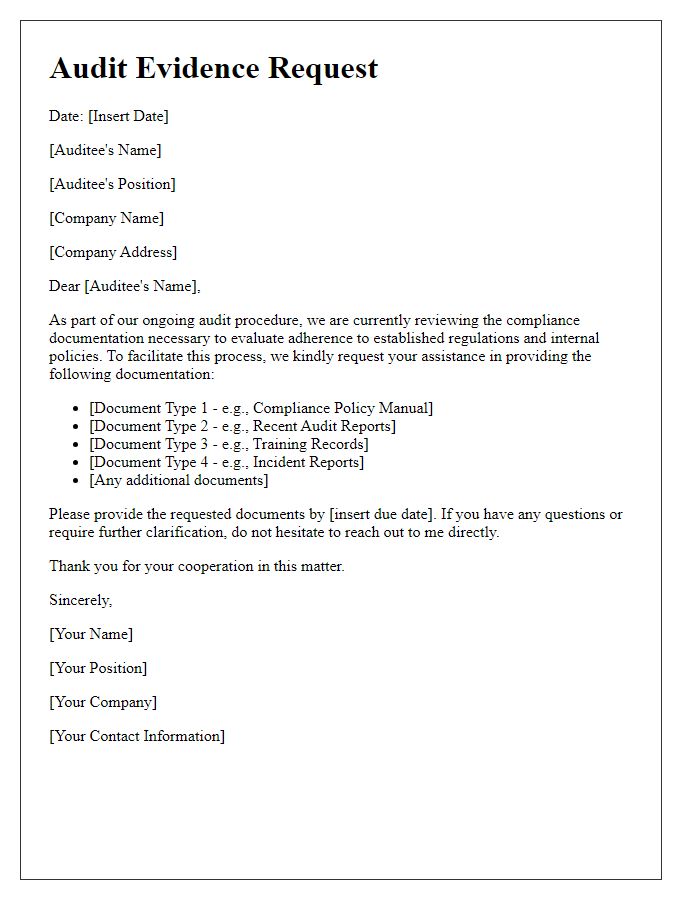

An audit evidence request typically seeks information needed to support the findings of an audit. This involves obtaining documentation such as financial statements, contracts, or other records from organizations like corporations or nonprofits. A clear subject line indicates the purpose of the request, ensuring recipients understand its importance. For instance, "Request for Financial Statements and Supporting Documents for Fiscal Year 2022 Audit" serves to clarify the specific documents sought and the time period relevant to the audit. This efficiency speeds up response times and enhances overall audit quality. Additionally, organizational entities might include stakeholder details, deadlines for submission, and any relevant guidelines to follow for compliance purposes.

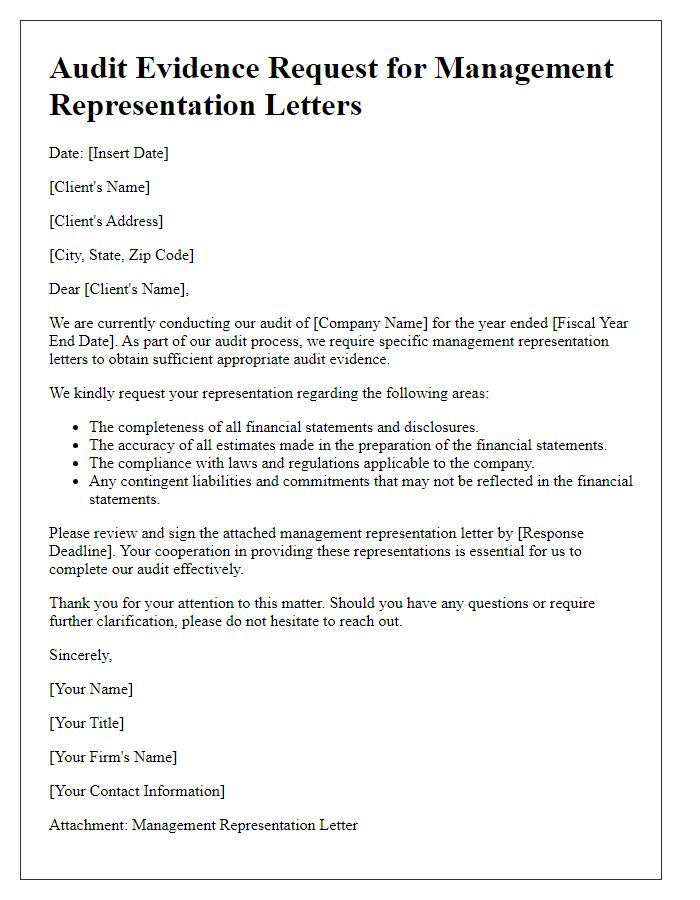

Request Details and Purpose

Audit evidence requests are critical during the audit process, particularly in financial settings, to ensure compliance with regulations and accuracy in financial reporting. Accurate documentation, such as invoices, bank statements, and contracts, provides verification of transactions. Timely responses from the accounting department are essential for adhering to audit schedules, typically set by external auditors, like the Big Four firms (Deloitte, PwC, EY, and KPMG). Clarification of specific data needed, including dates, amounts, and involved parties, can enhance the effectiveness of the request. Effective communication with stakeholders, such as department heads and financial analysts, streamlines the gathering of necessary information, ultimately ensuring transparency and integrity in the audit findings.

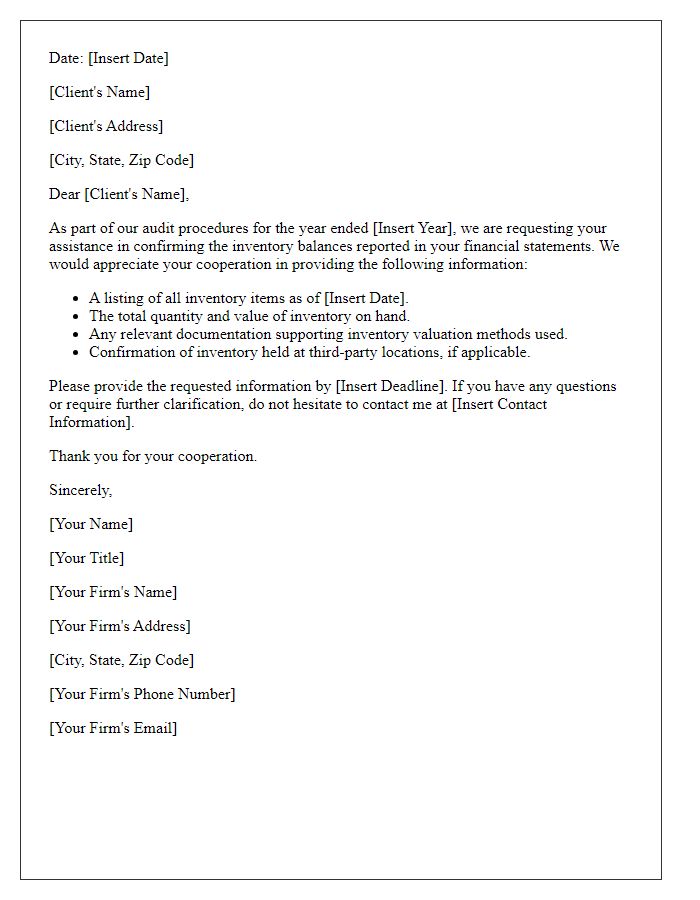

Specific Information Needed

Audit requests for specific information are critical in ensuring transparency and accuracy during financial reviews. Examples include documents such as bank statements, invoices, contracts, and receipts related to fiscal years, typically ranging from January 1 to December 31. Detailed records from departments like Accounts Payable and Receivable, alongside inventory reports from logistics centers, are often required. Specific information may include expense reports from significant projects or transactions exceeding a certain threshold, usually around $10,000. This process aids auditors in validating financial statements and compliance with regulatory mandates. Key entities: - Fiscal years (January 1 to December 31) - Accounts Payable and Receivable departments - Transactions greater than $10,000 - Regulatory compliance (financial statements validation)

Submission Deadline

In the field of auditing, the submission deadline for evidence request holds significant importance. This date, often specified in the engagement letter, establishes a framework for auditors to receive necessary documentation, such as financial statements, invoices, and contracts, timely to conduct a thorough review. Typically set within a range of two to four weeks from the date of the request, this deadline ensures adequate time for the auditors to analyze the information before the upcoming audit report deadline. Failure to adhere to this timeline may result in audit delays, incomplete assessments, or potential compliance issues under regulatory standards, such as the Sarbanes-Oxley Act for public companies.

Contact Information for Queries

During an audit process, a well-organized request for evidence is crucial for effective communication and thorough examination of records. Contact information for queries serves as a pivotal resource, ensuring that auditors can address any uncertainties or seek clarification regarding specific documents. Essential components include the name of the primary contact person, job title, direct phone number, and email address, facilitating swift responses. Providing this information helps maintain clear communication channels during the audit, supporting efficient collaboration between parties involved. Accurate and readily available contact details can greatly enhance the overall audit experience, ensuring that all necessary evidence is compiled seamlessly.

Letter Template For Audit Evidence Request Samples

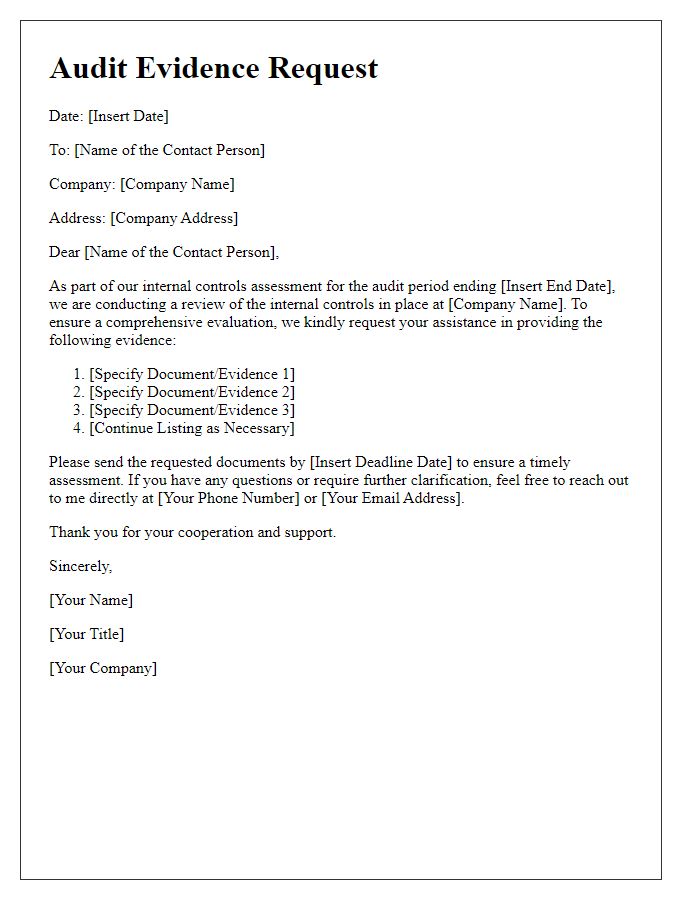

Letter template of audit evidence request for internal controls assessment.

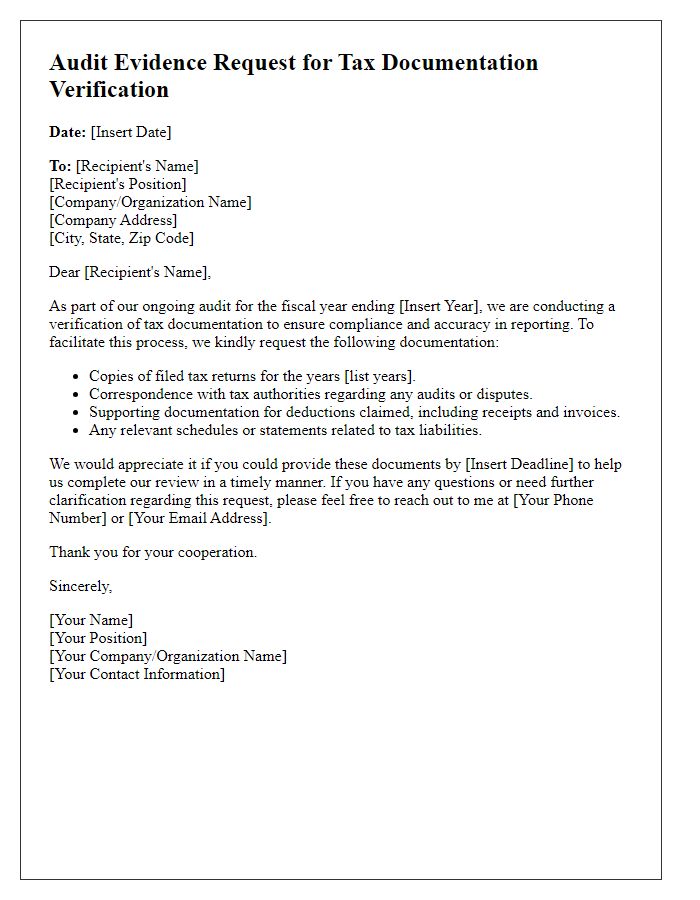

Letter template of audit evidence request for tax documentation verification.

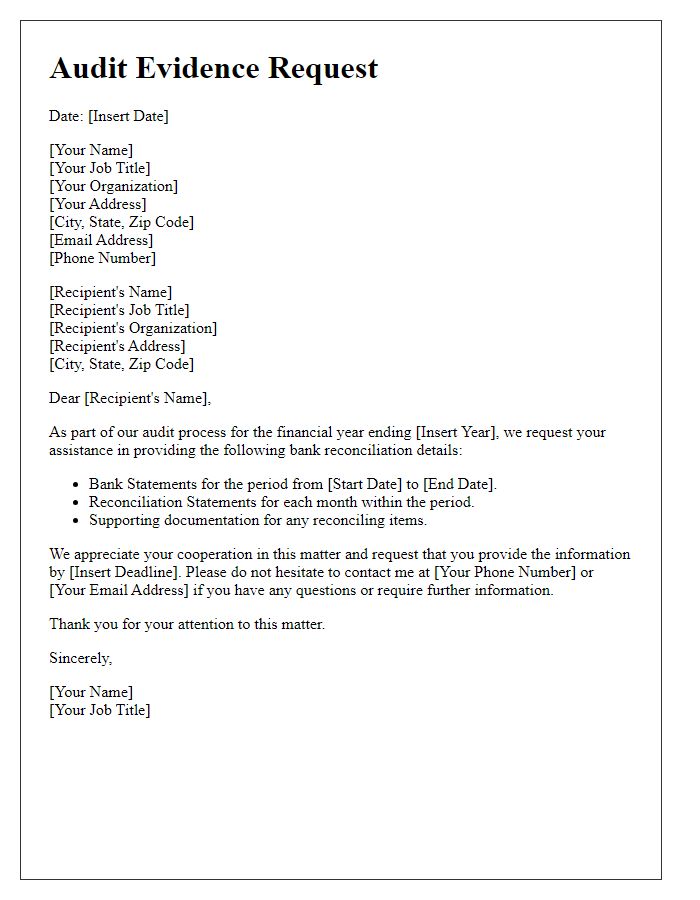

Letter template of audit evidence request for bank reconciliation details.

Letter template of audit evidence request for contractual agreements review.

Letter template of audit evidence request for expense report verification.

Letter template of audit evidence request for payroll information analysis.

Comments