Welcome to our guide on crafting an effective pre-audit meeting agenda! Whether you're a seasoned auditor or new to the process, organizing a clear and concise agenda is key to a successful meeting. It helps ensure that all necessary topics are covered and that everyone involved is on the same page, ultimately making the audit process smoother and more efficient. Curious about how to structure your agenda for the best results? Let's dive in!

Meeting Objectives

A well-structured pre-audit meeting agenda can facilitate clear communication and ensure that all necessary topics are addressed prior to the audit. Key objectives might include defining specific goals, distributing roles and responsibilities among participants, addressing any outstanding questions, outlining the audit process, establishing timelines for document submission, and identifying key contacts for various departments involved in the audit. Additionally, reviewing compliance requirements and previous audit findings can help to set benchmarks for evaluation. The meeting should also aim to foster collaboration among team members to ensure a thorough preparation and understanding of expectations, minimizing potential disruptions during the actual audit.

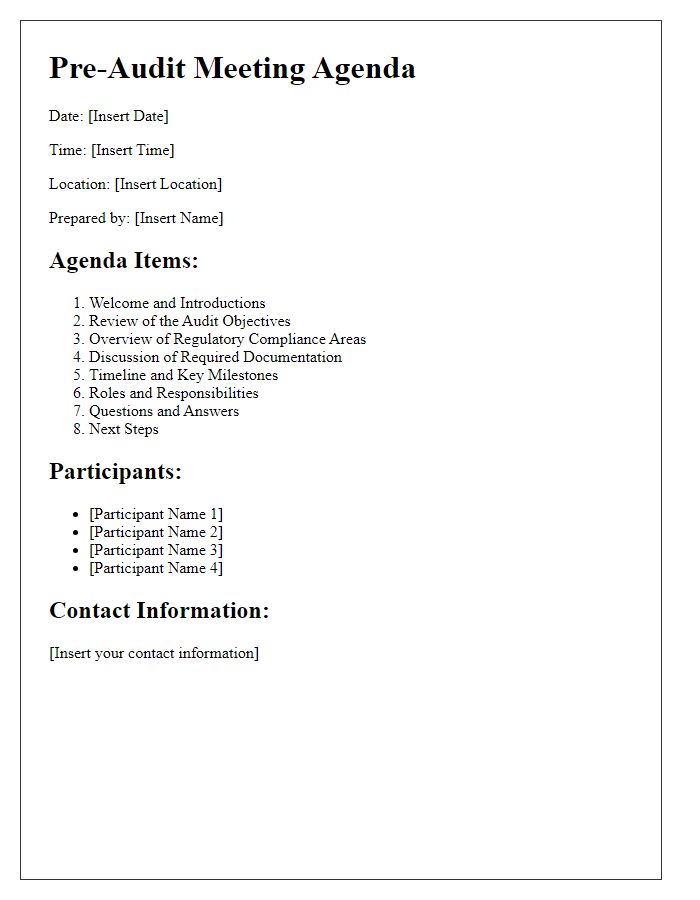

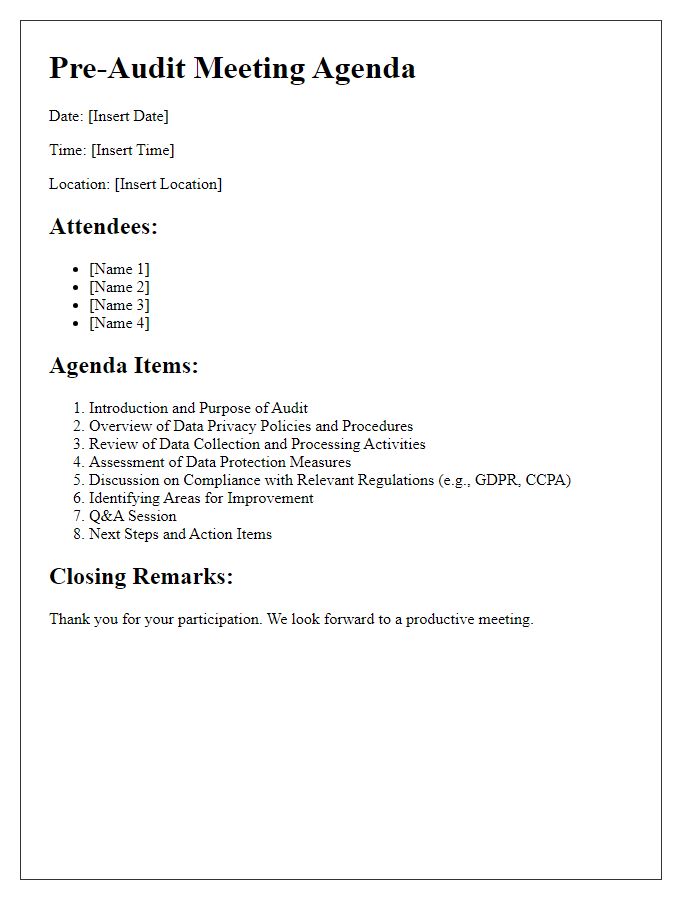

Agenda Items

The pre-audit meeting agenda plays a crucial role in setting the stage for a successful audit process. Key topics for discussion often include review of audit objectives, clarification of the scope as outlined in the audit plan (typically assessed in accordance with guidelines from standards like ISO 9001 or GAAP for accuracy), and identification of stakeholders involved (including senior management and operational team members). Preparations for documentation review are typically noted, with emphasis on specific records such as financial statements, internal controls, and policy manuals that relate directly to the audit areas. Time allocations for each agenda item are usually specified, ensuring that important points such as risk assessment and compliance obligations are thoroughly addressed. Additionally, assigning action items and responsible individuals ensures accountability in the lead-up to the audit. Finally, scheduling future follow-up meetings to discuss progress strengthens transparency throughout the audit process.

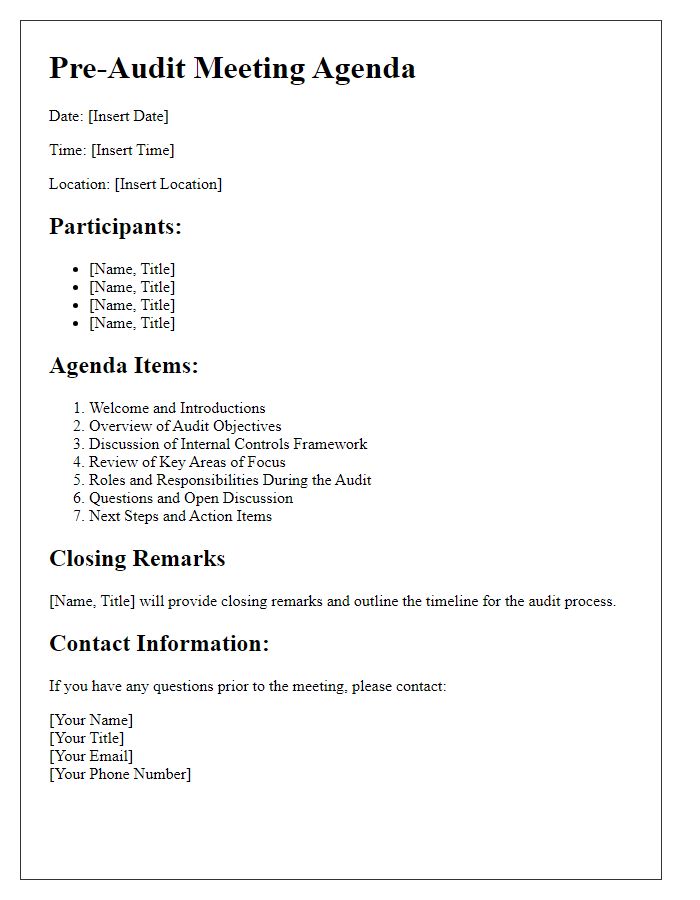

Participants and Roles

The pre-audit meeting agenda outlines key participants and their roles in preparation for the upcoming compliance review. Audit Manager, responsible for overseeing the audit process, ensures that objectives align with organizational goals. Internal Auditor will conduct assessments, presenting findings and recommendations. Department Heads provide necessary documentation related to their respective areas, facilitating review of processes. Compliance Officer ensures adherence to regulatory requirements, highlighting any potential non-conformities. Finance Representative will prepare financial data relevant to the audit scope, ensuring accuracy and transparency. Each participant's input is crucial to a successful audit, contributing to a comprehensive evaluation and identifying areas for improvement.

Time Allocation

The pre-audit meeting agenda outlines specific time allocations for various discussion topics to ensure a structured and efficient meeting process. The meeting will commence promptly at 10:00 AM, starting with introductions and purpose setting, lasting 15 minutes. Following this, a review of the previous audit findings will take 30 minutes, allowing participants to prepare for the upcoming audit. A designated 45 minutes will be allocated for the discussion of audit objectives and scope, ensuring clarity on what will be evaluated. Next, logistical considerations such as timelines and resources will be covered for 20 minutes, preparing all stakeholders for their roles in the audit process. Finally, the meeting will conclude with a 10-minute Q&A session, providing an opportunity for clarification and addressing any final concerns before the audit begins.

Supporting Documentation

A well-structured pre-audit meeting agenda can enhance the effectiveness of the audit process, specifically regarding supporting documentation. Essential documents, including previous audit reports (typically covering fiscal year 2022), financial statements (balance sheet and income statement as of December 31, 2022), corresponding invoices (dated within the last quarter), contracts (including service agreements with vendors for 2023), and compliance records (pertaining to regulations such as Sarbanes-Oxley), should be gathered in advance. The meeting location, such as the main conference room at the corporate office in New York City, scheduled for March 15, 2023, will allow auditors and department heads to discuss expectations and clarify responsibilities prior to the formal audit. Key participants include the CFO, internal audit manager, and external auditors from Deloitte, highlighting the importance of collaboration.

Letter Template For Pre-Audit Meeting Agenda Samples

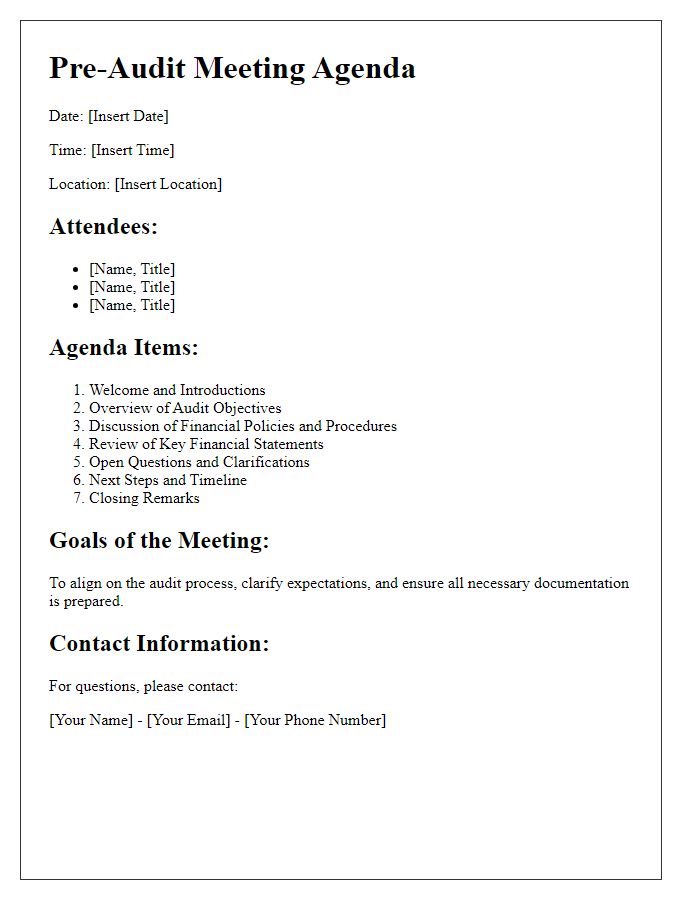

Letter template of pre-audit meeting agenda for internal controls evaluation

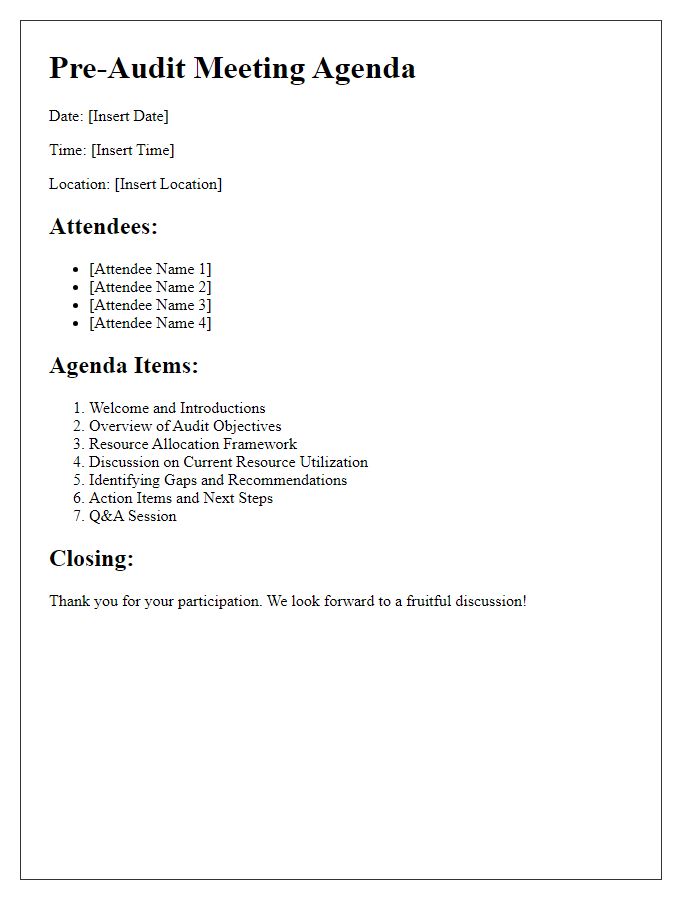

Letter template of pre-audit meeting agenda for resource allocation discussions

Comments