Are you gearing up for a post-audit review meeting and unsure how to draft the perfect letter? Crafting a clear and concise letter can set the tone for a productive discussion and ensure all participants are aligned on the agenda. It's important to outline the key points and provide a brief overview of the findings to guide everyone's understanding. Let's dive into how you can create an effective letter template that not only communicates vital information but also fosters collaborationâread on for tips and a sample letter!

Meeting Objective and Agenda

The post-audit review meeting aims to assess the findings from the recent financial audit conducted by XYZ Accounting Firm in October 2023. Key areas of focus include compliance with generally accepted accounting principles (GAAP), identification of discrepancies in financial statements, and evaluation of the internal control systems in place. The agenda includes a comprehensive presentation of audit results, discussion on significant observations and recommendations, followed by a Q&A session to address any concerns from stakeholders. The meeting will be held at the corporate headquarters located at 123 Business Park Drive, Suite 300, Springfield, with attendees including department heads, finance team members, and external auditors.

Summary of Audit Findings

During the post-audit review meeting, a comprehensive summary of audit findings will be presented, focusing on critical observations from the financial audit conducted for the fiscal year 2023. Notable discrepancies uncovered include a 15% variance in revenue recognition practices across departments, which raises concerns regarding compliance with the Generally Accepted Accounting Principles (GAAP). Additionally, risk assessments highlighted potential vulnerabilities in the procurement process, particularly the lack of documented vendor evaluations, affecting transparency in the vendor selection process. Recommendations from the audit suggest implementing standardized procedures for financial reporting to enhance accuracy and reliability. These findings underscore the necessity for ongoing training and development programs for staff to mitigate risks and ensure adherence to regulatory frameworks.

Key Discussion Points

The post-audit review meeting focuses on key discussion points identified during the comprehensive audit process conducted in various departments within the organization. Objectives include assessing compliance with established regulations, such as the Sarbanes-Oxley Act (SOX), and evaluating internal control effectiveness. Critical findings highlight areas like financial reporting accuracy, operational efficiency, and risk management strategies. Recommendations may address discrepancies in financial statements, improvement in workflow processes, and reinforcement of accountability measures. The meeting will also prioritize monitoring follow-up actions taken since the initial audit, alongside reviewing specific departmental audit reports, such as the Finance Department and Human Resources, for a well-rounded evaluation of organizational performance and governance.

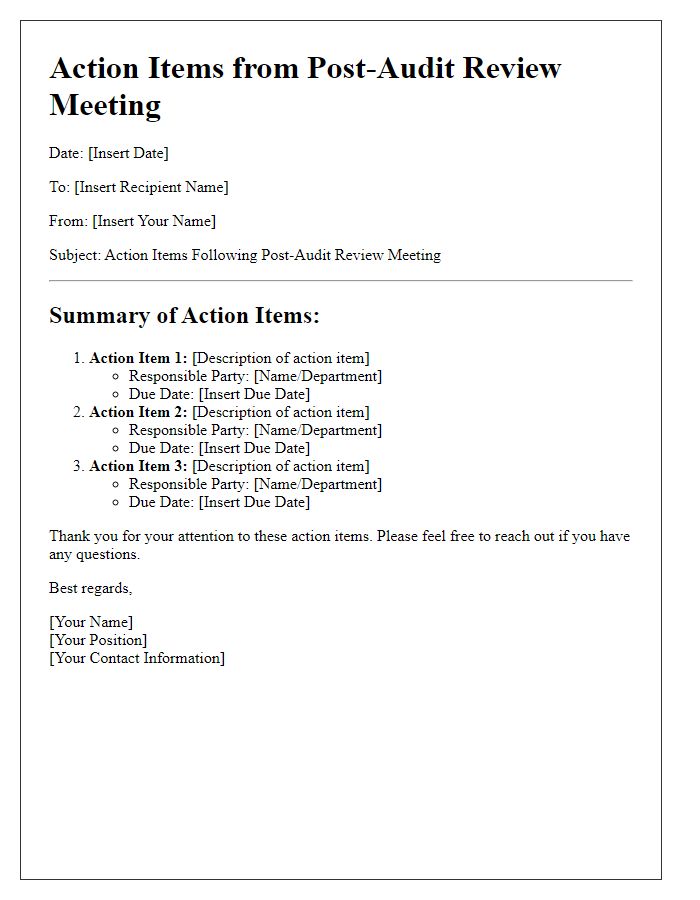

Action Items and Responsibilities

A post-audit review meeting highlights key action items and responsibilities for team members. Identified action items include resolving discrepancies found during the audit process in departments like finance and operations. Responsibilities are assigned, such as creating a corrective action plan by the finance lead by the end of the month and implementing data verification protocols in the operations department. Additionally, a follow-up meeting is scheduled for 30 days later to assess progress on these action items and ensure accountability among team members involved in the implementation. This structured approach fosters transparency and continuous improvement in organizational processes.

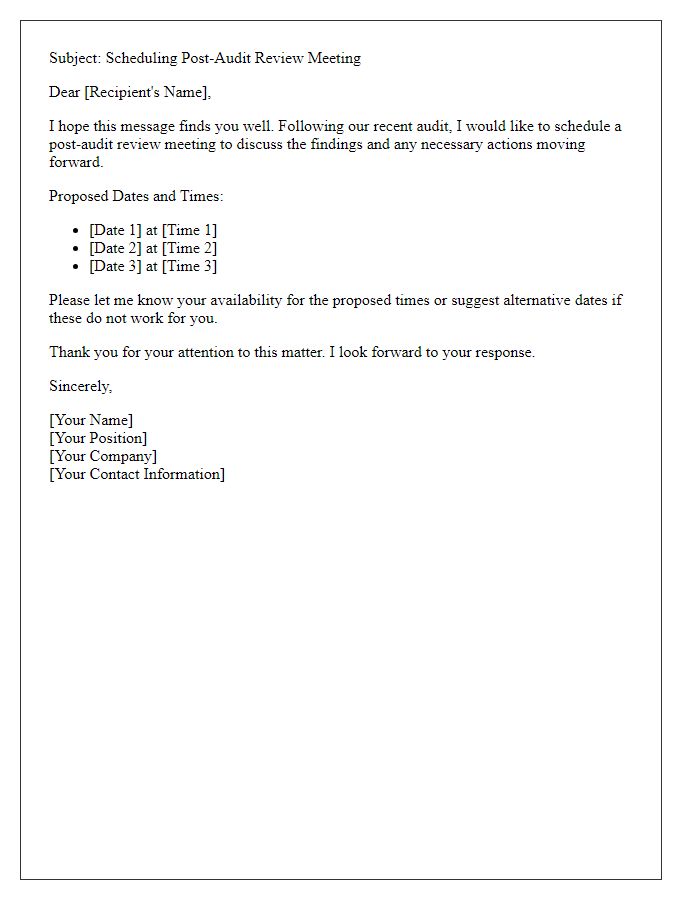

Meeting Details and Logistics

The post-audit review meeting is scheduled for November 4, 2023, at 10:00 AM, located in the Executive Conference Room on the third floor of the Corporate Headquarters, 22 Corporate Drive. Attendance is expected from key stakeholders, including the Audit Team, Senior Management, and Financial Compliance Officers. The agenda focuses on the findings from the Q3 Internal Audit Report, including compliance with regulatory standards, financial discrepancies totaling $150,000, and identified operational inefficiencies in the procurement process. Please ensure that necessary documentation, such as department reports and previous audit outcomes, is available for reference during the discussion. A video conference link will also be provided for remote participants.

Comments