Are you in the process of drafting an audit fee proposal and unsure where to start? Creating a clear and professional letter can set the right tone for your business relationship and ensure all necessary details are covered. In this article, we'll walk you through an effective letter template that outlines the essential elements of your proposal while maintaining a conversational tone. Ready to craft the perfect proposal? Let's dive in!

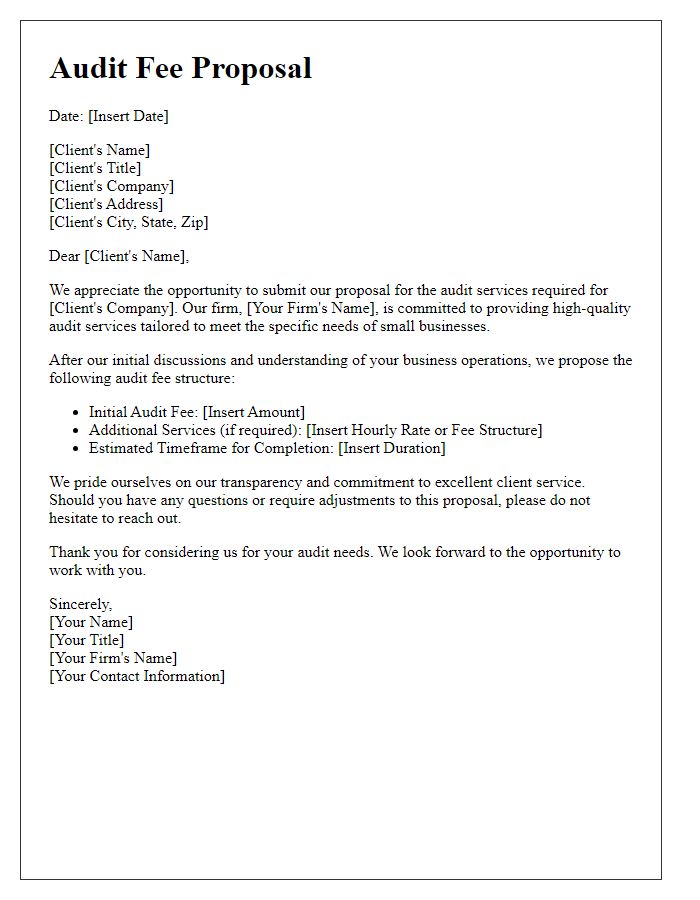

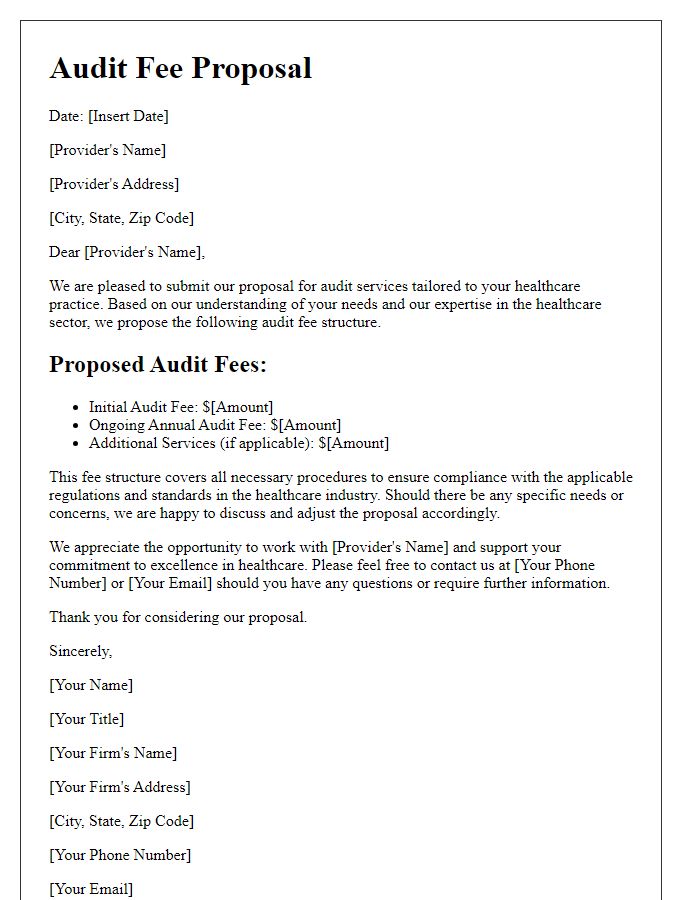

Clear subject line and professional header

A proposal detailing the audit fees for professional services can enhance budgeting and financial planning. The proposal typically includes key elements such as the firm's name, address, and contact information in the header. The subject line should be clear and direct, specifying the purpose--for example, "Audit Fee Proposal for [Client's Company Name]". The body of the proposal provides a detailed breakdown of the fees, including hourly rates, estimated hours, and any additional costs, while emphasizing the value-added services such as in-depth financial analysis or compliance guidance. An overview of the audit process timeline and expected deliverables, such as a formal audit report, adds clarity and assists in managing expectations.

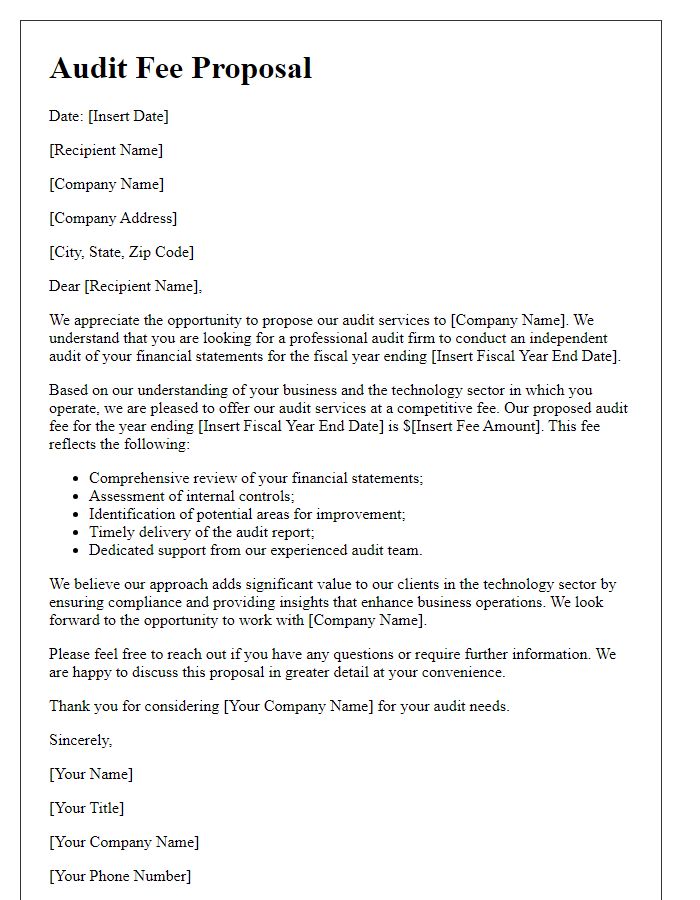

Introduction and purpose of the proposal

An audit fee proposal outlines the costs associated with conducting an audit of financial statements, which is essential for accuracy and compliance with regulations. The proposal aims to provide a clear and transparent estimate of fees based on the scope of work involved, which includes reviewing financial records, assessing internal controls, and delivering comprehensive reports. This document serves to establish expectations for both the auditing firm and the client, ensuring alignment on objectives, timelines, and budget considerations. Accurate fee proposals foster trust and facilitate a smooth auditing process, crucial especially for organizations preparing for fiscal assessments or regulatory scrutiny.

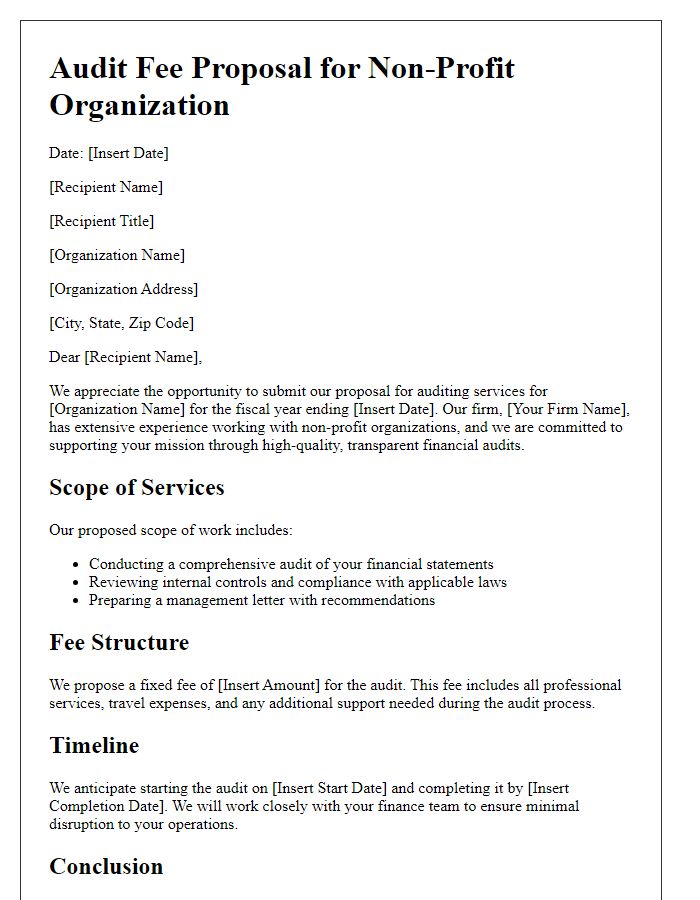

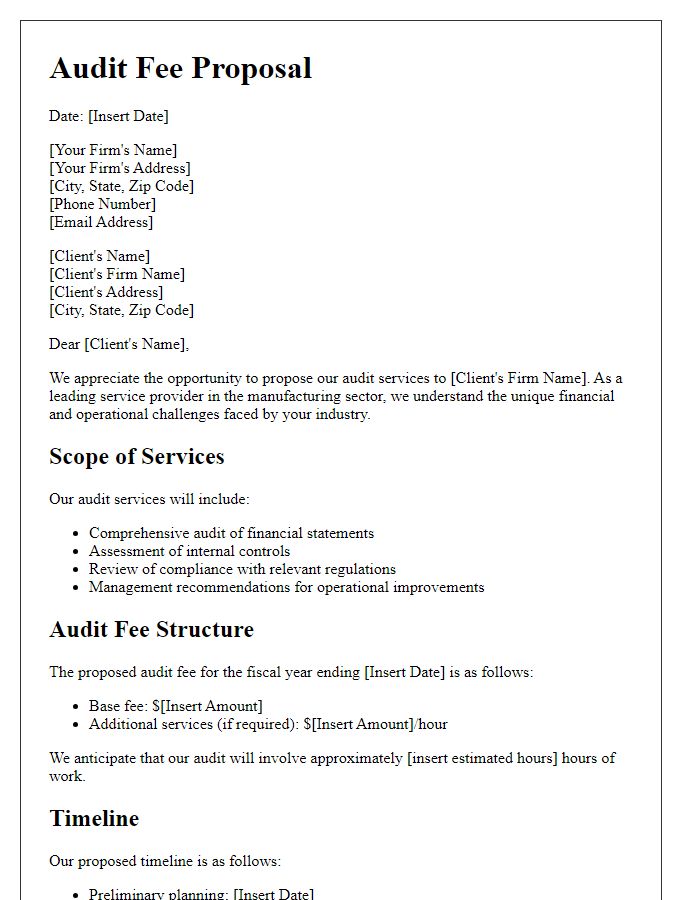

Detailed description of audit services

An audit proposal outlines comprehensive services offered by certified public accountants (CPAs) to assess financial records, compliance with laws, and operational efficiency of a company. The extensive audit process typically involves a thorough examination of financial statements, including balance sheets and income statements, conducted annually or bi-annually, depending on client needs. CPAs utilize various auditing approaches, such as substantive testing and control testing, to identify discrepancies or irregularities. The audit report produced highlights findings, recommendations for improvements, and assists in risk management strategies. Additionally, services may extend to regulatory compliance checks, leveraging expertise in standards set by the Financial Accounting Standards Board (FASB) and the International Financial Reporting Standards (IFRS), ensuring adherence to ethical practices. An essential component includes ongoing consultation for best practices in financial reporting and internal controls, fostering transparency and trust with stakeholders. The audit fee typically reflects the complexity of the engagement, duration, and size of the organization undergoing assessment.

Comprehensive fee structure and payment terms

Comprehensive audit fee structures often include several key components that reflect the complexity of services offered. Typical fees may vary based on size and nature of the organization being audited, with small businesses generally incurring fees starting around $5,000, while larger corporations could face fees exceeding $50,000. Payment terms usually stipulate a 50% upfront payment upon engagement, with the remainder due upon completion of the audit. Additional costs may arise from extra services, such as compliance assessments or specialized financial advisory tasks, with hourly rates for these typically ranging from $150 to $400 based on the expertise required. Clear communication of these fees at the outset ensures transparency and sets realistic expectations for both the auditing firm and the client.

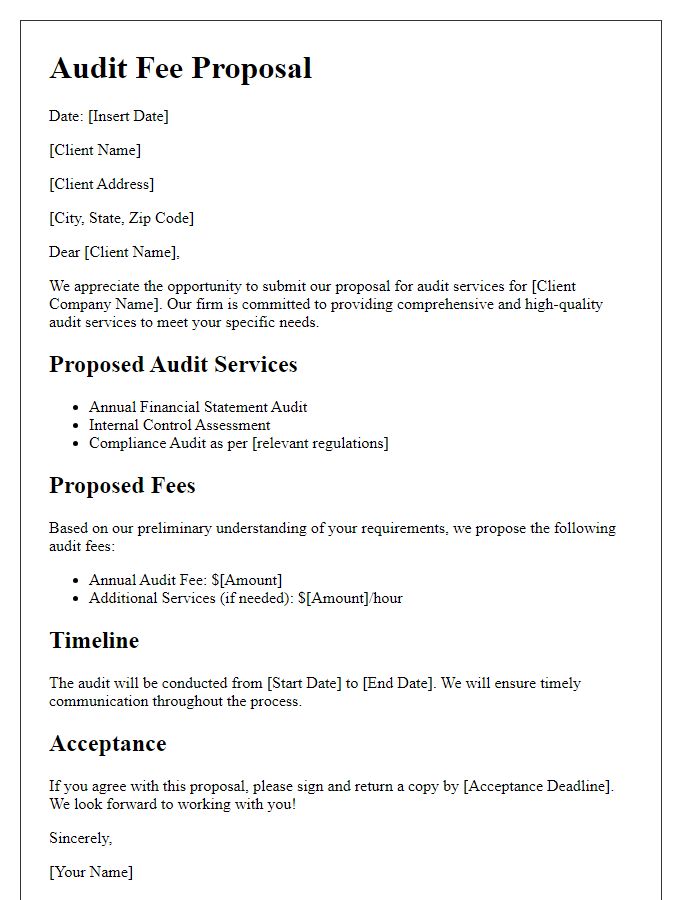

Explanation of qualifications and expertise

An audit fee proposal should highlight the qualifications and expertise relevant to the auditing industry. The firm boasts a track record of delivering high-quality audit services, with a team consisting of Certified Public Accountants (CPAs) and Chartered Accountants (CAs) who have collectively amassed over 30 years of experience. Notably, the firm has successfully conducted audits for companies across various sectors, including manufacturing, technology, and healthcare, ensuring compliance with regulations such as Generally Accepted Auditing Standards (GAAS) and International Financial Reporting Standards (IFRS). The team has participated in over 100 audits, providing detailed financial analysis and risk assessments to enhance financial reporting and internal controls. Additionally, the firm has a dedicated quality assurance program, ensuring that all audits are subject to rigorous internal reviews and adhere to industry best practices, thus establishing a reliable reputation in both the local and national markets.

Comments