Preparing for a client audit can often feel overwhelming, but with the right approach, it can also be an opportunity for growth and improvement. A well-structured audit preparation not only helps in showcasing your organization's strengths but also addresses any potential weaknesses proactively. By creating a thoughtful plan and engaging with your team, you can navigate the process with confidence and ease. Ready to dive deeper into effective audit preparation strategies? Let's explore more!

Clear Objective Statement

The client audit preparation process requires a precise objective statement to guide the audit team. This objective statement should articulate the specific goals of the audit, including compliance verification with regulations such as Sarbanes-Oxley Act and identification of areas for operational improvement. The statement must also address the audit timeframe, typically spanning a fiscal quarter or fiscal year, and outline stakeholder expectations, including insights from senior management and board members. Engaging key personnel from departments like finance, operations, and compliance ensures comprehensive input and focused assessment of risks and controls. The ultimate aim is to provide actionable recommendations, enhancing overall business performance and mitigating future risks.

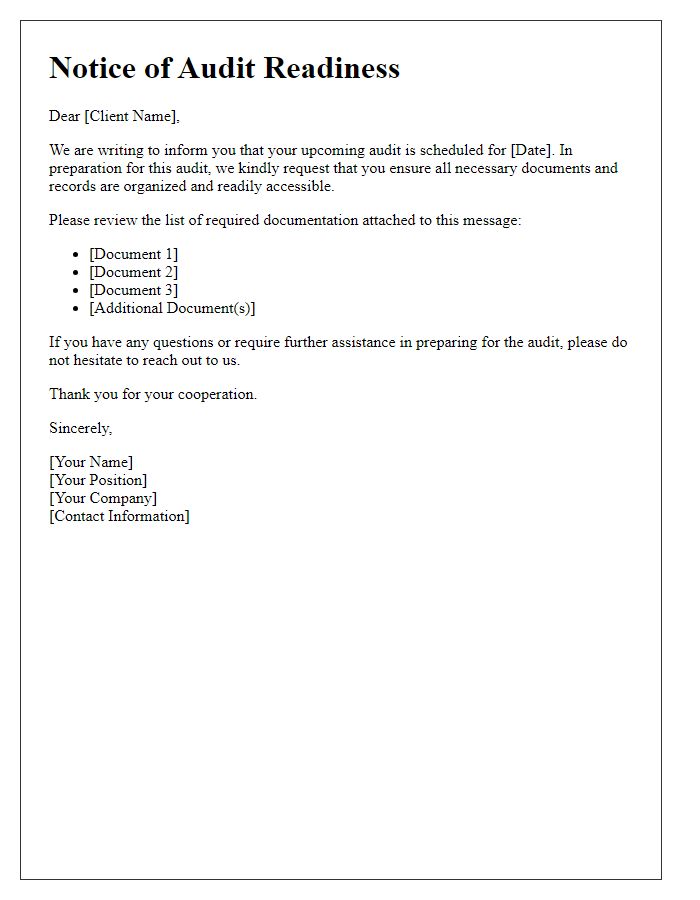

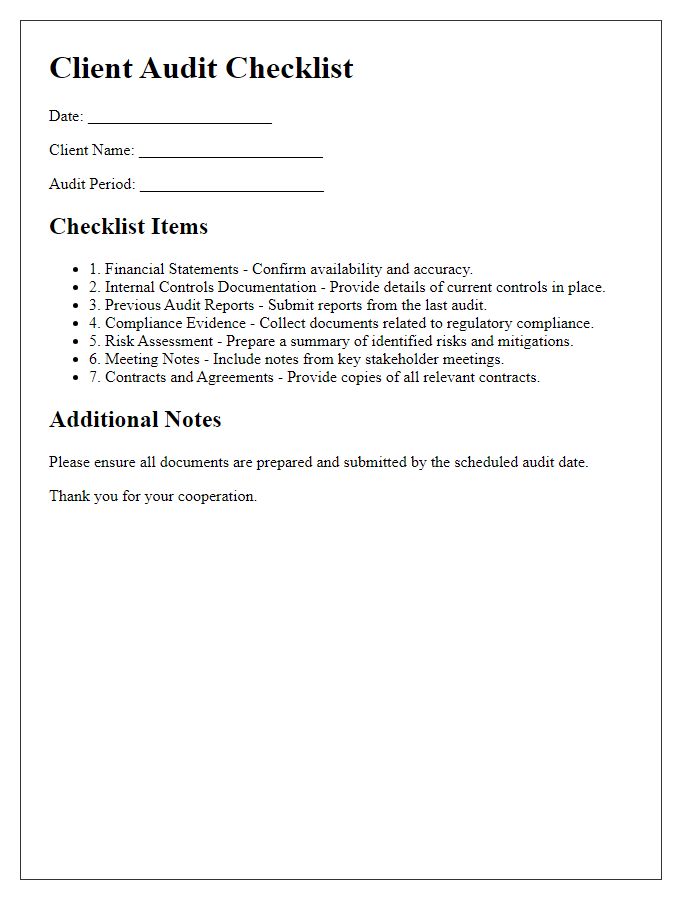

Required Documentation List

For an efficient client audit preparation, a comprehensive documentation list is essential. This list typically includes financial statements such as balance sheets and income statements (covering the fiscal year 2022) to provide an overview of the organization's financial health. Additionally, tax returns, particularly the Federal Form 1040 and any relevant state tax documents, should be included to verify compliance with government regulations. Contracts and agreements, including client contracts and vendor agreements, provide necessary insights into business operations and relationships. Records of significant transactions, including invoices and receipts dating from January to December 2022, are crucial for transparency and accuracy in financial reporting. Furthermore, internal policies and procedures, particularly those related to finance and compliance, help auditors understand operational controls in place. Lastly, any correspondence with regulatory bodies, such as the IRS or local tax authorities, should be compiled to ensure all interactions regarding compliance are documented and readily available for review.

Audit Schedule and Timelines

A comprehensive audit schedule for the financial year 2023-2024 consists of a series of critical deadlines and activities necessary for a successful audit process. Preparation starts with a kick-off meeting on March 15, 2023, involving key stakeholders from the finance department of XYZ Corp, ensuring everyone is aligned on objectives. Preliminary fieldwork occurs from April 10 to April 21, focusing on key areas such as accounts receivable and inventory valuation, followed by a mid-audit review on May 5, 2023, to address any initial findings. The final fieldwork phase occurs between June 1 and June 15, encompassing thorough testing of financial controls and compliance with GAAP (Generally Accepted Accounting Principles). Draft reports are scheduled for distribution by July 1, 2023, with feedback sessions planned by July 10. The final audit report is anticipated for completion by July 31, allowing for any necessary corrections before the September 30, 2023, submission to the regulatory bodies.

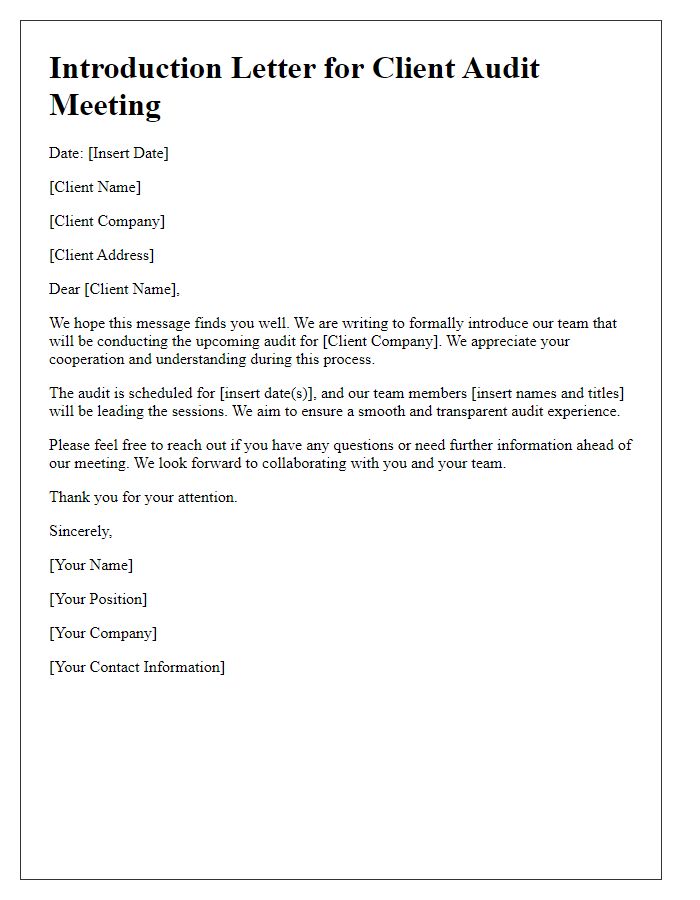

Contact Information for Queries

For client audit preparation, clear communication is essential. Designate a primary contact person, such as Kathleen Jones, Audit Manager, reachable at (555) 123-4567 or via email at kathleen.jones@auditfirm.com. Additionally, include support staff, like Robert Smith, Auditor, who can be contacted at (555) 987-6543 or robert.smith@auditfirm.com, for specific inquiries. Ensure that response times are prompt, ideally within 24 hours, to facilitate a smooth audit process. Include office hours (Monday to Friday, 9 AM to 5 PM) for scheduling appointments or discussions to address any concerns related to the audit documentation or procedures required.

Confidentiality Assurance

Confidentiality assurance in client audit preparation is crucial for maintaining trust and compliance with regulations. Organizations must implement strict protocols to safeguard sensitive information, particularly during audits involving financial statements, internal controls, and operational processes. A key component includes non-disclosure agreements (NDAs) that establish legal obligations for auditors, preventing unauthorized access to confidential data. Additionally, policies should incorporate data encryption methods and secure communication channels, ensuring that information remains protected throughout the audit process. Regular training sessions for staff can enhance awareness about confidentiality measures and the importance of safeguarding client information, particularly within industries such as finance or healthcare, where breaches can have significant legal and reputational repercussions. Auditors should clearly document all processes and safeguards in place to reinforce trust and transparency with clients.

Comments